Starting a nonprofit is not just simply acting on your vision, but also about executing concrete requirements, especially in legal and administrative aspects. This includes understanding federal and state regulations and efficiently handling organizational paperwork.

One way to achieve better financial sustainability for your nonprofit is by getting a tax-exempt designation from the US Internal Revenue Service (IRS). Read further to explore the 501(c)(3) meaning, including its tax advantages and eligibility requirements.

What is a 501(c)(3)?

A 501(c)(3) designation exempts qualified nonprofit organizations to pay federal tax income. The IRS grants this status following Section 501(c)(3) of the Internal Revenue Code (IRC). To become eligible, an organization must operate exclusively for a charitable purpose and provide service for the public good.

These organizations commonly focus on areas including, education, poverty alleviation, scientific research, environment, and religion. The IRS offers a total of 29 tax-exempt statuses for organizations. In 2022, 501(c)(3) had the most with 1,480,565 recognized charitable organizations.

What are the requirements to gain 501(c)(3) tax-exempt status?

Being granted the 501(c)(3) status comes with considerable tax benefits. Review the key requirements below and see if your organization qualifies to apply for 501(c)(3).

Qualified entities

Even though most qualified 501(c)(3) are nonprofits, application for it is open to other entities, such as corporations, trusts, community chests, and unincorporated associations. A Limited Liability Company (LLC) is allowed to apply but under a strict requirement: They must ensure all members/partners are recognized 501(c)(3) organizations. An LLC may only apply for 501(c)(3) after fulfilling this condition.

Exempt Purposes

Having a charitable purpose is a primary condition nonprofit organizations should have when seeking 501(c)(3). They must only act per their exempt purpose and share all proceeds with the public. Any asset should not be taken advantage of to serve the personal interests of its founders and directors. Additionally, all remaining assets must go to the public in the event of ceasing operations.

Here is the list of exempt purposes as outlined in Publication 557 of the IRS:

- Religious – Organizations that promote religion, beliefs, and good deeds for the public.

- Charitable – These cover other charitable groups that do not fit into the categories defined by the IRS.

- Scientific – Organizations that conduct and publish scientific research to help the wider society. Typical topics are health, environment, and technology.

- Testing for public safety – Organizations that quality checks products, services, and materials to ensure the safety of target users when it becomes widely available.

- Literary – Organizations that produce and sell literary content to advance their purpose.

- Educational – Organizations that educate, empower, and train individuals from communities to develop their competencies and reach their maximum potential.

- Fostering national or international amateur sports – Organizations that host large-scale regional and national sports competitions.

- Prevention of cruelty to animals and children – Organizations protect the welfare of children and animals.

Political Activity Restriction

Engaging in political activity is restricted for 501(c)(3) organizations. They must not be involved in endorsements/anti-endorsements of candidates, campaigns, and partisan propaganda. To expand the reach of their organization’s mission, they are only allowed to focus on doing programs for the community. This regulation protects 501(c)(3) organizations from breaking public trust in the long run.

501(c)(3) vs 501(c)(4): How do they differ?

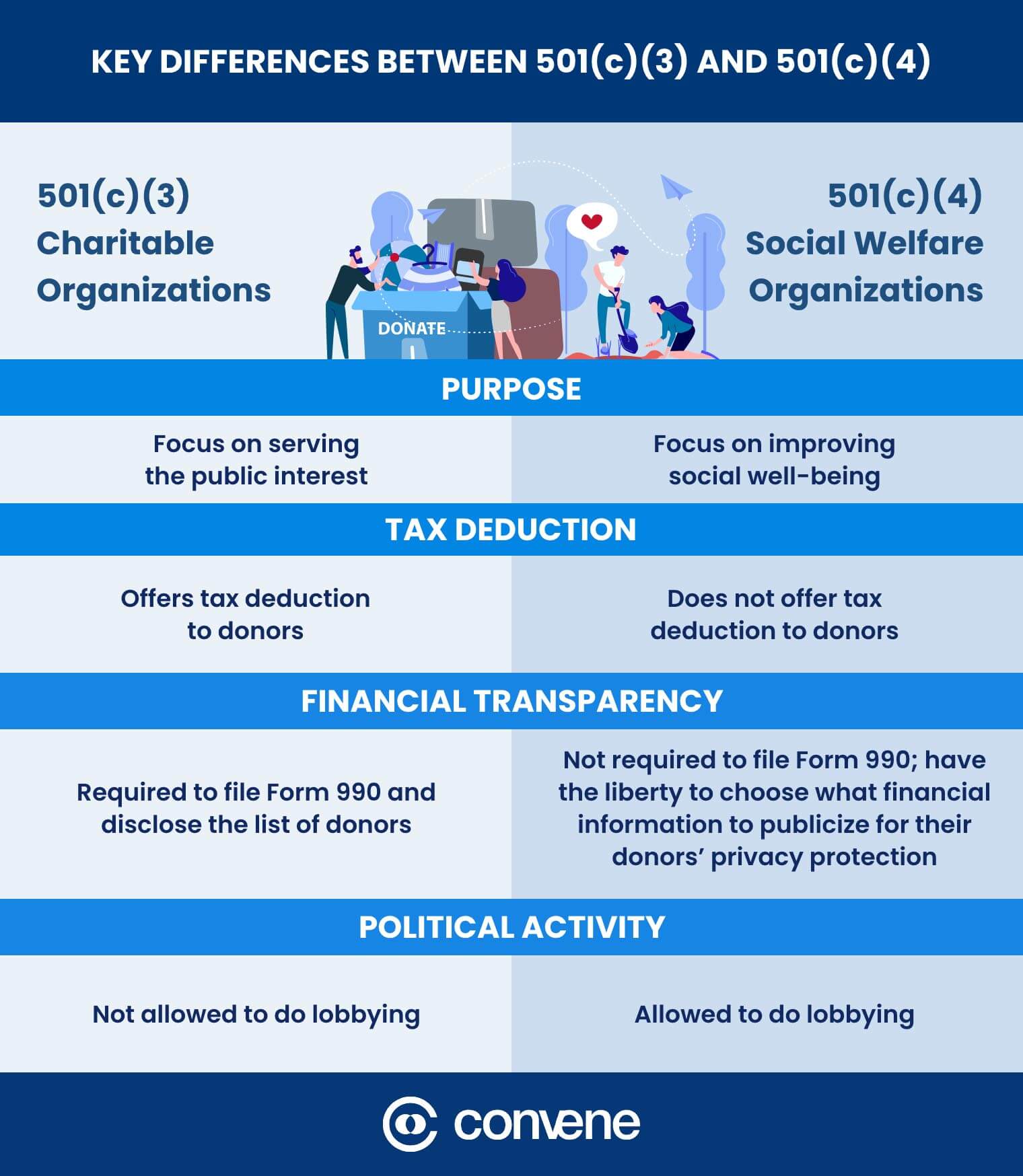

Purpose

501(c)(3) organizations work to serve the public interest. This is done by interacting with communities through charitable activities such as providing essential services, funding scientific medical research, and training the community.

501(c)(4) organizations work to address societal issues and make the society better for communities. They can organize charitable activities like 501(c)(3), but they are not limited to doing just that. Social welfare organizations are allowed to take part in political activities and influence legislation processes to form resolutions for their advocacies.

Tax Deduction

501(c)(3) incentivizes its donors with tax deductions – promoting charity giving and boosting the generation of funds. Individuals can have up to 50% tax deduction on their income tax return, while businesses can have up to 10%. The percentage depends on what type of 501(c)(3) organization they will contribute to.

On the contrary, 501(c)(4) does not incentivize its donors with tax deductions. This is because the IRS implements lenient guidelines on them. Lobbying allows them to endorse candidates that can help them advance their social welfare advocacies.

Financial Transparency

501(c)(3) has a stricter policy on financial transparency than 501(c)(4). Charity organizations are mandated to file IRS Form 990 and disclose their financial activities and donors annually. Financial transparency for 501(c)(4) organizations is quite lenient. The IRS does not require them to file IRS Form 990. Additionally, they have the liberty to choose what information to disclose to protect the privacy of their donors.

Political Activity

The IRS prohibits 501(c)(3) organizations from joining political activities. They should only focus on conducting charitable activities to generate donations and fulfill their purpose. On the other hand, 501(c)(4) was given more flexibility. Social welfare groups are allowed to participate in political activities that are favorable for the organization.

Types of 501(c)(3) Organizations

Charitable organizations are further classified into different types: public charities, private foundations, and private operating foundations. Here are examples of 501(c)(3) organizations and how they differ.

Public Charity

Public charities are the most popular type of 501(c)(3) because they can openly generate funds from multiple sources including, individuals, companies, governments, and other nonprofits. They regularly conduct active programs in churches, animal welfare agencies, benevolent societies, and educational institutions, to engage communities, build public trust, and drive donations.

Public charities offer higher tax deductibility to donors compared to other types of 501(c)(3). Donors can have up to 60% tax deductions on their income tax returns, while corporate donors can have up to 10%. They must be governed by unrelated individuals to avoid conflicts of interest that may damage the organization’s reputation over time.

An example of a public charity is the American Society for the Prevention of Cruelty to Animals (ASPCA). The organization was founded in 1866 and is the first animal welfare organization in North America.

Private Foundation

Private foundations are usually funded and managed by a single benefactor, which can be an individual, an entire family, or a business. Notable examples would be private foundations established by influential business tycoons like the Bill & Melinda Gates Foundation.

Unlike a public charity, a private foundation is non-operating with no active programs. To fund grants and other charities, they grow their seed donations through investments for long-term income generation. Individual donors to private foundations are eligible for up to 30% tax deduction in their income tax return.

The governance structure of private foundations is flexible compared to public charities. The founder can appoint closely related individuals for the board of directors – making their governance more independent and away from public scrutiny.

Private Operating Foundation

Private operating foundations are the least common type among 501(c)(3) organizations. They are considered a hybrid of private organizations and public charities. They can maintain active programs but employ a governance strategy similar to private foundations. Donors to private operating foundations are capped at 50% of the donor’s adjusted gross income (AGI).

J. Paul Getty Trust is an example of a private operating foundation. It is a global arts organization based in Los Angeles that funds projects worldwide to understand the history of art and its conservation.

Advantages and Disadvantages of Starting a 501(c)(3) Organization

Advantages

- Tax Privileges – One major benefit of the 501(c)(3) status is its federal income tax exemption. These significantly reduce tax spending and give organizations more funds for their charitable activities.

- Grant Eligibility – Sponsorship and grants from private foundations and government agencies are often limited to nonprofit organizations. Getting a 501(c)(3) status helps an organization boost its attractiveness to benefactors and make it easier to gain public trust and get funding.

- Formalized Governance – 501(c)(3) are legal entities having a formal nonprofit governance structure. This increases an organization’s competitiveness, making it easier for decision-makers to collaborate.

- Limited Liability – Individuals who work for a nonprofit organization will be protected from any debts in the event of financial difficulties. Limited liability provides safety to employees. However, this corporate veil should not be abused to conceal illegal transactions and activities of individuals.

Disadvantages

- Stricter Requirements – Organizations with 501(c)(3) status face stricter financial reporting requirements versus other tax-exempt statuses. They are obliged to accomplish Form 990 annually. Failure to comply can lead the IRS to review and potentially revoke the organization’s tax-exempt status.

- Shared Control – A nonprofit organization is compelled to obey the laws and regulations of their state and nation because of their public pursuits. 501(c)(3) organizations must consider these national and state guidelines when writing their bylaws, creating organizational charts, and decision-making processes.

- Public Scrutiny – Charitable nonprofits exist to fulfill their core responsibility of serving the public interest. Securing funds from public donations gives power to the general public to demand transparency on their financial transactions, earnings, and activities.

Step-By-Step Guide on How to Form a 501(c)(3)

Applying for 501(c)(3) designation is a commitment that requires time and involves heavy paperwork. Here’s a step-by-step guide on forming a 501(c)(3) organization.

1. Define goal and purpose

An organization must define its mission through a purpose statement. Purpose statements should have:

- Categorization: State the type of service/s the organization plans to offer. The most common charity types are humanitarian, religious, and educational services.</

- Description: Write an overview of the organization’s purpose, mission, and unique services. Use this section to define specifics, such as the services offered, location, and target community.

- Length: An ideal purpose statement should be longer than 50 words.

2. Name the organization

The organization’s name should reflect its purpose statement. To avoid trademark infringement, you may check if the prospect name has usage with the US Patent and Trademark Office (USPTO) before finalizing it.

3. Appoint board of directors

The IRS indicates that 501(c)(3) organizations need to have at least three directors. To find the right candidate, list the skills you are looking for while considering the charitable purpose and industry of the organization. Some of the most common expertise needed for this position are in business finance, nonprofit law, fundraising, and marketing.

4. Write bylaws

Well-crafted and compliant bylaws follow the guidelines set forth by the IRS and the state law. For instance, the Florida Not-for-Profit Corporations Act stipulates that a director should be allowed to do proxy voting. This condition may not be available for other state nonprofit laws, so checking it first is a good practice.

It is best to consult with a nonprofit lawyer when drafting a bylaw to ensure that it will contain all the necessary provisions and serve the interest of the organization.

5. Complete state organizational paperwork

A nonprofit must accomplish several state organizational paperwork before applying for 501(c)(3). This includes filing Articles of Incorporation and creating the Employer Identification Number (EIN).

6. Apply for 501(c)(3) status

The 501(c)(3) application process starts with filing Form 1023-EZ or Form 1023 online with the IRS.

Form 1023-EZ is typically recommended for smaller organizations. The determination letter may take about four weeks to process with a fee of 275 USD. To be eligible to file Form 1023-EZ, your organization must meet the following requirements:

- Gross income of under 50,000 USD in the past three years

- Projected gross income under 50,000 USD in the next three years

- Less than 250,000 USD total fair market value

- Founded in the United States with a domestic mailing address

- Organized as either a corporation, unincorporated association, or trust

- Must not be a successor to a for-profit entity

Form 1023 is for larger organizations. It is more comprehensive and goes between 50 to 100 pages long. The determination letter for Form 1023 takes longer for up to six months with a fee of 600 USD. To be eligible to file Form 1023, your organization must have the following documents:

- Accomplished Form 1023 checklist

- Articles of Incorporation and Employer Identification Number

- Revision history of the organization documents

- Bylaws

- Financial data, printed materials, and explanations

- Verified payment of the 600 USD fee to the Department of the Treasury

7. Accept the determination letter

A determination letter is the IRS’s response to the application and will indicate whether an organization qualified for 501(c)(3) or not. An organization will receive a favorable determination letter if the IRS accepts the application. Included in the letter are details about the organization’s rights and responsibilities, effective date of exemption, accounting period, and annual reporting requirements.

On the contrary, an organization will receive an adverse determination letter, if the IRS denies the application. The letter will explain why the organization did not qualify for tax-exempt status. It typically offers three options to the organization: appeal the application, submit a new application, or reconsider whether tax-exempt status is right for the organization.

Optimize Nonprofit Workflows with an All-In-One Board Portal Software

Establishing a nonprofit and applying for 501(c)(3) status requires a collaborative effort. To achieve synergy, a well-organized system for document management, meetings, and approvals is crucial. Having this helps everyone complete tasks on time and contribute to the bigger goals of the organization.

Empower your decision-makers and team members with Convene’s board portal – a management software designed to automate, secure, and streamline the workflows of nonprofits.

With Convene you can:

- Securely store, share, and sign documents – Convene is a secure cloud-based document management platform powered by Amazon Web Services (AWS). It enables users to store files, streamline approvals with review rooms, and secure sign-offs using e-signatures.

- Simplify meeting preparation and execution – It makes meeting workflows smoother with its easy-to-use features – draft agendas faster, automate meeting pack distribution, and capture important decisions instantly.

- Enhance board engagement – Keep everyone in the loop through Convene’s Review Rooms, announcement boards, and automated meeting notifications.

Implement better nonprofit governance and workflows with Convene. Schedule a free demo with us today!

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.