Regardless of the industry or country, it is clear that technology is a business’ strategic imperative. Yet some boards still find it challenging to dissect technology into their organisations’ systems and operations. Others may not even have digital transformation as their priority.

In today’s digital era, organisations face a growing number of disruptors — including governance complexities. But what do complexities in the corporate governance landscape have to do with pursuing digital transformation?

This question is profoundly discussed in the recent webinar, The Modern Boardroom: Year in Review and 2023 Outlook — hosted by Azeus Convene and the Corporate Secretaries International Association. The esteemed panellists explored how digital transformation and ESG corporate governance are connected, and how boards can effectively respond to emerging realities in 2023.

Improving Compliance and Governance with Digital Transformation

Regulatory reforms in corporate governance are often viewed as a burden by many organisations — not to say the poorly governed firms. This also leads to the retention of non-shareholder-friendly governance practices that eventually harm the firm and its value.

Financial Economist Dr. Alejandra Medina emphasised that in order to uphold strong corporate governance regulations are continuously being reviewed and revised. She mentioned that the G20/OECD Principles of Corporate Governance are currently under proposed revisions, which are targeted to be issued in 2023.

Among the changes they are looking to deliver by 2023 are improving disclosure of related party transactions, strengthening governance practices with digital technologies, and promoting the use of high-quality international standards for sustainability disclosure.

Dr. Alejandra also noted that the G20/OECD Principles of Corporate Governance, the main standard for corporate governance, is targeted at policymakers and not companies. She stated, “The principals are targeted to policymakers. This is an instrument not targeted to companies. It’s targeted to regulate the policymakers — to help them evaluate and improve the legal regulatory institutional frame of comparison. It provides guidance for stock exchanges, investors, corporations, and any other stakeholders involved in improving corporate governance practices.”

Using Emerging Technologies to Navigate Regulatory Changes

The growing number and complexity of regulatory changes are becoming far more disruptive for many corporates to just ignore. To address certain regulations, businesses invest in modern tools and systems that can help them run their operations while managing regulatory risks.

Azeus Convene’s Global Product Marketing Manager Lovely Peligrino tipped, “an organisation can add competitive advantage by rapidly deploying mitigation processes and monitoring key regulatory risks across the business.” She added that another thing companies should think of is how to balance the rapid complexity of existing and emerging regulatory risks with cloud-based, data-led technological advancements.

Fortunately, more and more companies are investing in strategic automated technology to comply with the increasing regulatory requirements. This also helps them in attaining internal transparency that is necessary for consistent compliance, while reducing potential costs of regulatory scrutiny.

By leveraging the power of advanced technologies, companies can now reduce their regulatory burdens and focus on maintaining compliance. In addition, Lovely mentioned that, “Transformational digital technologies enable the compliance function to have the flexibility to scale up or down as needs change and create a greater capacity in the overall compliance system.”

Lovely also gave an insight into how digitalising and digital transformation is different, “Digitalising business process may be good, but digital transformation entails more than digitalisation of existing processes.” While digitalisation enables new tools and capabilities, businesses should understand how to employ these in their operations and marketing goals; hence, digital transformation.

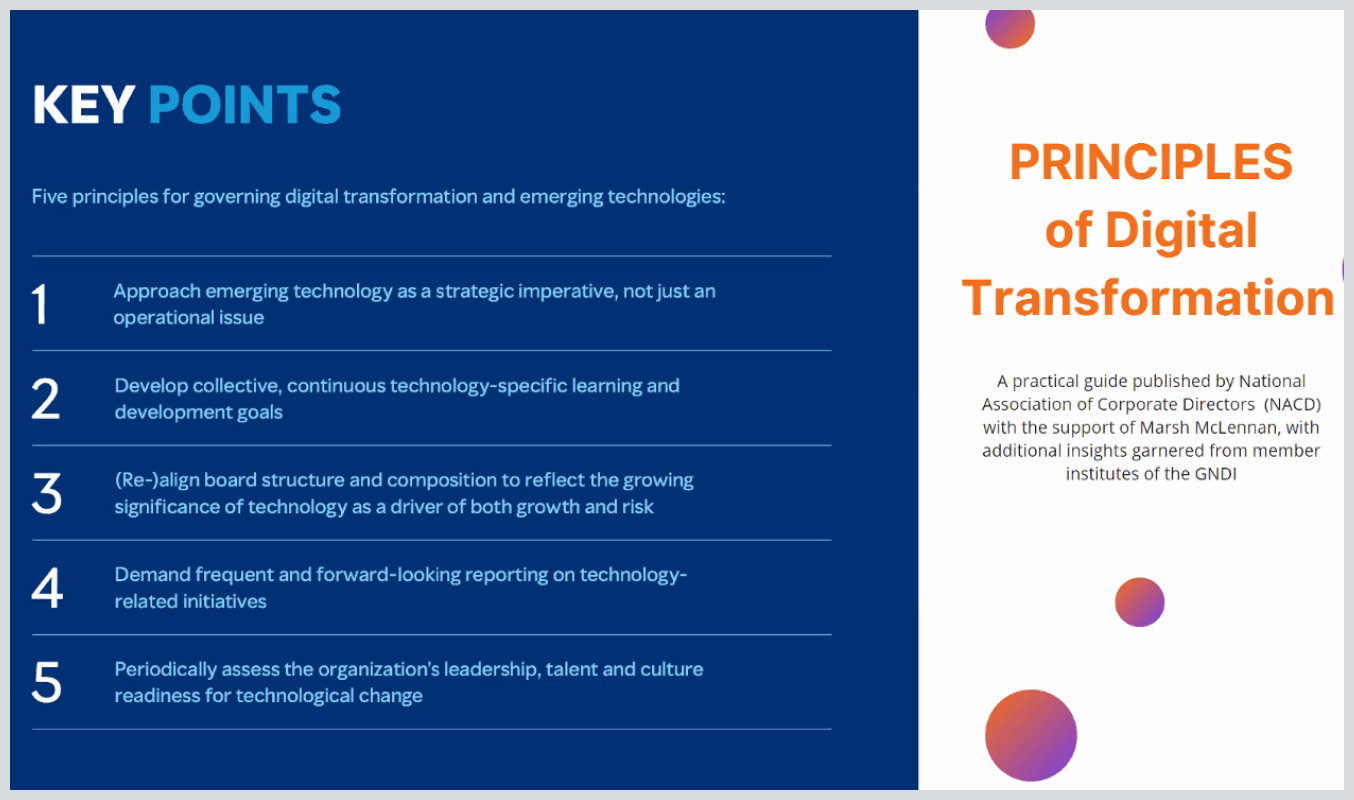

In addition, Lovely shared the five principles for governing digital transformation and emerging technologies.

On top of these principles, it is crucial to foster an organisational culture that embraces change and innovation. As Lovely mentioned, the right talent with the right mindset embedded in the right culture is fundamental to transformation. Digital transformation cannot only help companies navigate through the increasing regulations but ultimately build resilience to thrive in a sustainable future.

Approaching Transition and Reporting Risks

Transitioning to a sustainable future is widely supported by many regulators worldwide. To bring transparency and help corporates achieve their sustainability ambitions, ESG reporting standards and frameworks, such as SASB and TCFD, are imposed.

But besides adopting these standards, companies should also consider the transition risks involved. Agnes K Y Tai, Arta Asset Management Limited’s Head of Sustainability Investment and Advisory, suggested taking into account these four things: regulatory change, technology development, customer preferences, and the company’s talents and employees. Considering these can help organisations craft a transition plan that perfectly suits their corporate sustainability goals.

In terms of sustainability reporting, Agnes advised companies and leaders to look at all the risks and opportunities, understand them, and find ways to mitigate or manage them. She also emphasised the importance of the role of directors in leading the company forward, anchoring upon whether the director has the competency, accountability, or knows what they are doing.

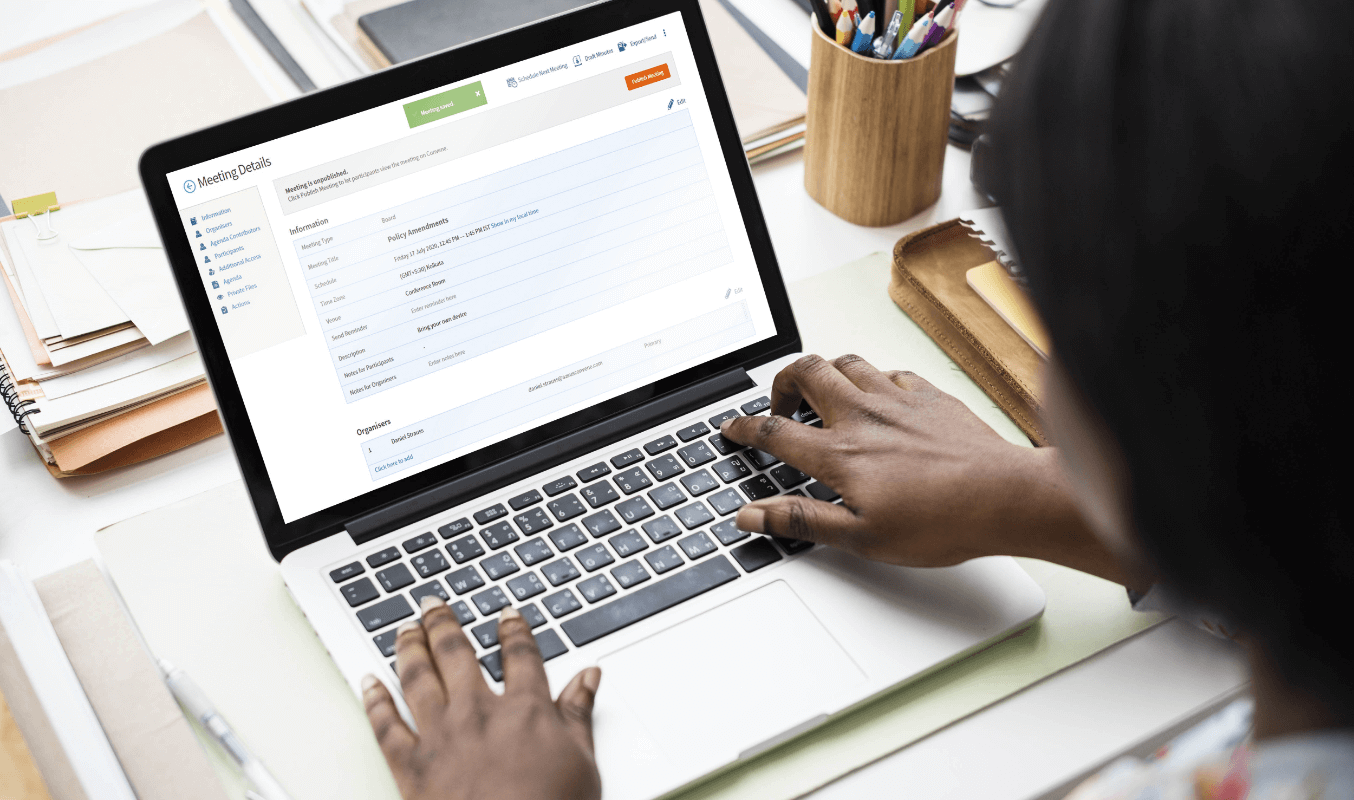

Steering the Corporate Governance Landscape with Convene

Having a clear governance structure and vision is a must for every business looking to thrive in the market. To better navigate the pressure in the corporate governance landscape, Convene aims to help companies create that digital environment perfect for flexible agendas and flexible boards.

Convene is a meeting management software designed for better governance in ESG through its advanced functions and features — giving you the tools you need for a proactive and functional modern boardroom. Discover what Convene has in store for you and your board.

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.