The benefits of financial statements go beyond compliance. Preparing them is a fundamental business process for companies to monitor and sustain strong financial health. They consist of multiple reports that supply stakeholders with valuable insights, influencing their financial planning and management.

Two key reports within a financial statement are the balance sheet and income statement. Each report provides unique information critical to guiding the board of directors and C-suite executives in making data-driven financial decisions.

Looking to gain a deeper understanding of your company’s financial health? This article provides an in-depth guide on what a balance sheet is and what is an income statement. Continue reading and learn about the difference between income statements and balance sheets, their key components, and types.

What is a balance sheet?

A balance sheet reports on the assets, liabilities, and shareholder equity of a company at a specific point in time. It highlights developing risks and opportunities, which the boards of directors, executives, and shareholders consider for asset optimization and debt handling. For external stakeholders, balance sheets help investors assess a company’s value, becoming a significant factor in their investment decisions.

At its core, a balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Shareholder Equity

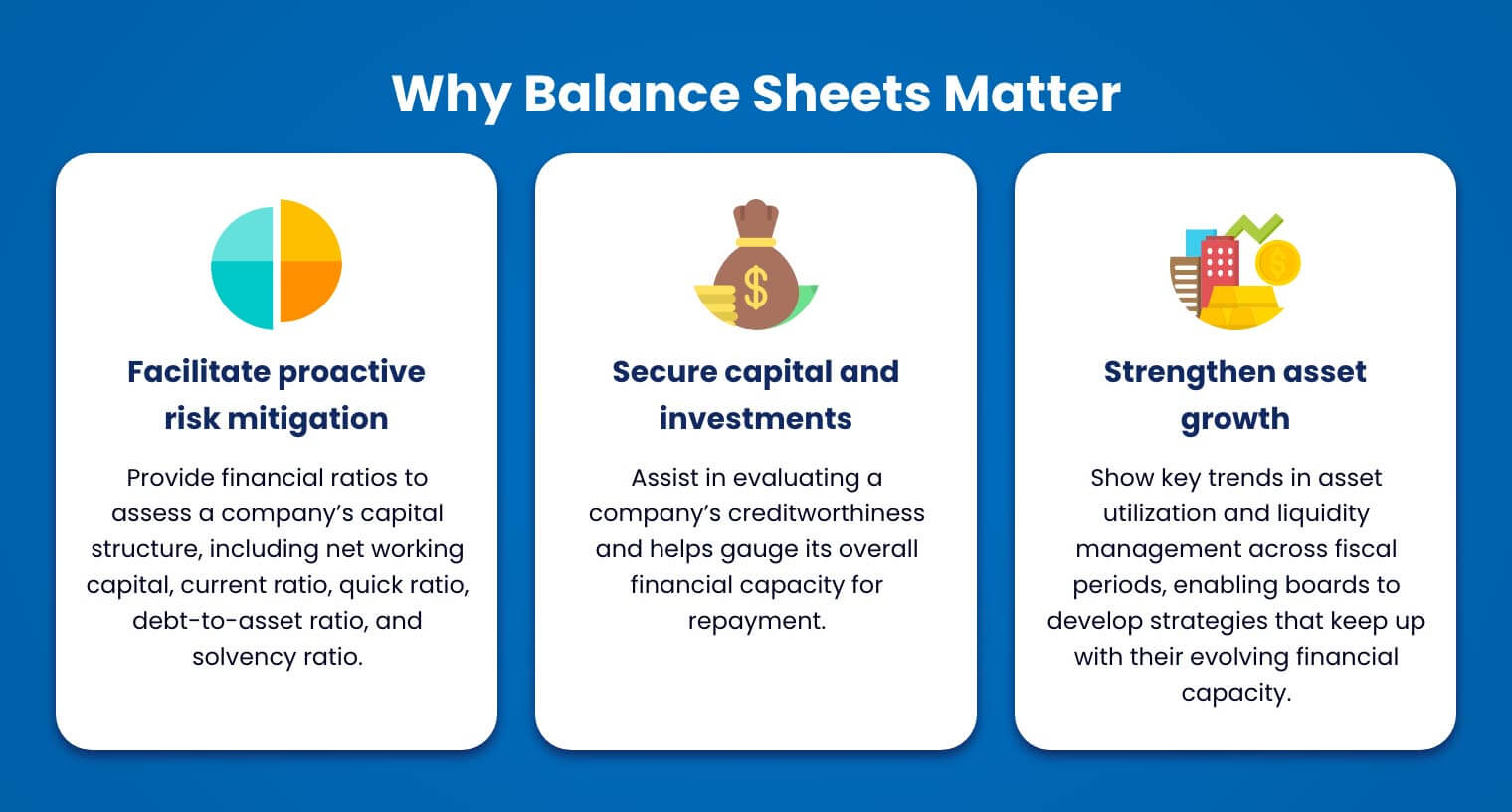

Why Balance Sheets Matter

Effective use of the balance sheet enhances directors’ visibility on overall resources. It provides more than just numbers — it offers actionable insights that drive stakeholders to:

1. Facilitate proactive risk mitigation

Boards and executives derive financial ratios from balance sheets, such as net working capital, current ratio, quick ratio, debt-to-asset ratio, and solvency ratio. Together, these values assist in understanding a company’s capital structure. It shows the proportion of assets funded by debt versus equity, informing stakeholders of its liquidity and solvency.

2. Secure capital and investments

Creditors review balance sheets to evaluate a company’s creditworthiness. It helps gauge the overall financial capacity for repayment, preventing potential losses and legal disputes. Beyond financing, producing balance sheets signals a commitment to cultivating trust and credibility among investors. This fosters stronger relationships and boosts appeal to potential funders.

3. Strengthen asset growth

Comparing balance sheets from different fiscal periods helps boards identify key trends in asset utilization and liquidity management. This encourages a forward-thinking mindset, enabling boards to develop strategies that keep up with their evolving financial capacity.

What is on a balance sheet?

A balance sheet consists of three major components:

1. Assets

This section refers to the physical and non-physical resources companies use to generate value. The audit committee typically categorizes these as current and non-current assets, listed in descending liquidity.

Current Assets

- Highly liquid assets: These refer to cash or cash equivalents that are easily convertible into funds, such as bank deposits, Treasury bills, and foreign currency reserves.

- Accounts receivable: The amount the company needs to receive from customers for services or goods delivered.

- Prepaid expenses: Costs companies pay in advance for services they will receive in the future.

Non-Current Assets

- Property, Plant, and Equipment (PP&E): This pertains to big and tangible assets companies use for operations. Examples include real estate and heavy equipment.

- Intangible assets: High-valued resources related to intellectual properties such as copyright and trademark.

- Long-term investments: Larger-scale bonds or stocks with a maturity period exceeding one year.

2. Liabilities

Liabilities are pending payments to external parties: suppliers, customers, government agencies, and insurance companies. This section is sorted by payment priority.

Current Liabilities

- Accounts payable: Dues to suppliers and vendors for fulfilled goods or services received.

- Payroll: The total unpaid salaries and benefits to employees.

- Short-term loans: Low-value credits due within the year.

- Customer prepayments: Advanced payments received from customers for goods or services with pending fulfillment.

Non-Current Liabilities

- Long-term loans and bonds: Debt obligations payable for more than a year.

- Healthcare and pension plans: Post-employment benefits after retirement.

- Deferred tax liabilities (DTLs): Outstanding tax payments of a company to be paid in the future.

3. Shareholder Equity

Shareholder equity is the difference between total liabilities and total assets. It represents investors’ ownership stake in a company for each share of stock.

This value is impacted by the following metrics:

- Share capital: This refers to the total value of direct investments shareholders contributed in exchange for ownership stakes.

- Retained earnings: These are accumulated profits the company retains after paying dividends to shareholders.

- Net income: The final profit value after deducting total expenses from the total revenue.

Types of Balance Sheets

Understanding the different formats of balance sheets is crucial for effective financial planning. Here are its different types to guide you in choosing the correct format for your business:

1. Comparative Balance Sheets

Stakeholders opt for this format to compare side-by-side financial data from two or more reporting periods. This shows a clear view of financial position change over time, equipping boards with actionable insights.

2. Vertical Balance Sheets

This format organizes financial data in a top-down structure, arranged based on liquidity, priority of payment, and residual interests. Listing items vertically facilitates faster comparison between sections, enabling stakeholders to analyze capital structure and liquidity more accurately.

3. Horizontal Balance Sheets

A horizontal balance sheet is commonly used to compare extended periods, often spanning several years. This enables stakeholders to track consistent improvements and emerging risks, supporting strategic planning and financial forecasting.

What is an income statement?

An income statement reports on the revenue, expenses, profit, and losses of a company over a specific period. Known by other names, such as profit-and-loss statement (P&L) or earnings statement, this document provides a comprehensive overview of financial performance. Similar to balance sheets, stakeholders refer to this to inform their strategies for enhancing profit margins and growth rates.

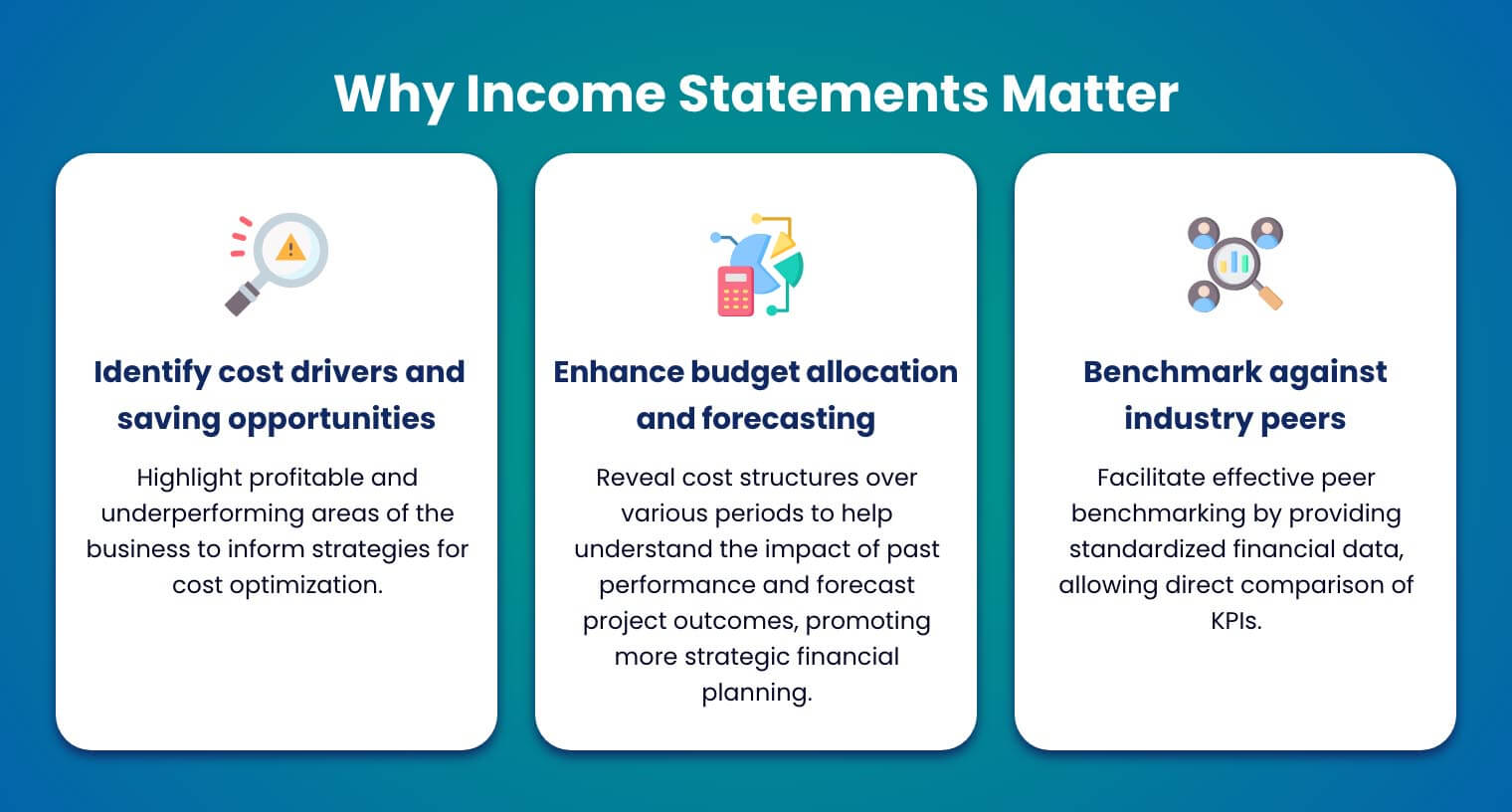

Why Income Statements Matter

Income statements hold valuable data on revenue and expenses for businesses to develop adaptable financial strategies and attain sustainability. When analyzed correctly, directors can leverage them to:

1. Identify cost drivers and saving opportunities

Income statements highlight profitable and underperforming areas of the business. By analyzing profit margins and expense trends, stakeholders can pinpoint areas for cost optimization, enhancing operational efficiency and profitability.

2. Enhance budget allocation and forecasting

Income statements reveal cost structures over various periods. Companies refer to them to understand the impacts of past performances and forecast project outcomes. This practice promotes more strategic financial planning and realistic budget allocation, allowing stakeholders to maximize resources and avoid financial strains.

3. Benchmark against industry peers

Reviewing competitors’ income statements uncovers how peers allocate budgets and set their priorities. This drives companies to keep up with market trends by adopting similar practices to enhance their operations.

For example, income statements from manufacturing companies would reveal a strong focus on research and development. A company looking to expand its product offerings can also adopt the same budget strategy to accelerate production and develop more innovative products.

What is on an income statement?

Income statements are composed of the following:

1. Revenue

This reflects goods and services sold. Companies typically have multiple revenue streams, all of which they must declare in their income statement. Types of revenue are:

- Operating Revenue: Sales from core business activities.

- Non-operating Revenue: Sales from non-core business activities (e.g., rentals, royalty payments, or advertisements)

2. Cost of Goods Sold (COGS)

COGS are the direct expenses, such as labor and materials, that companies spend to fulfill services or goods. Depending on the industry, COGS can be called other names. Retailers or wholesalers refer to it as the cost of sales, while service-based companies use the term cost of services.

3. Gross Profit

The amount of profit from goods or services after accounting for the cost of goods.

4. Operating Income

This is profit from core business activities, calculated by subtracting operating expenses from the total revenue. Investors use this to analyze the impact of operational performance on business sustainability.

5. Earnings Per Share (EPS)

EPS is a financial metric for measuring profitability. It refers to the profit value of every outstanding share of common stock. Companies need this value to benchmark profitability against industry peers.

6. Net Income

This is the final value in income sheets amounting to the overall profit after deducting the total revenue from operating and non-operating expenses.

Types of Income Statements

Income statements can be presented in various ways, depending on the size and reporting needs of companies. The two most common types are:

1. Single-Step Income Statement

This format is used by smaller-scale businesses because of its straightforward approach. It calculates net income by directly subtracting the total expenses from total revenues. By arranging revenue and expenses vertically, stakeholders can quickly have a clear summary of their financial performance.

2. Multi-Step Income Statement

A multi-step income statement provides a more in-depth view of a company’s financial performance by separating operational and non-operational components. It breaks down revenue and expenses into detailed categories, helping stakeholders analyze core business operations more effectively.

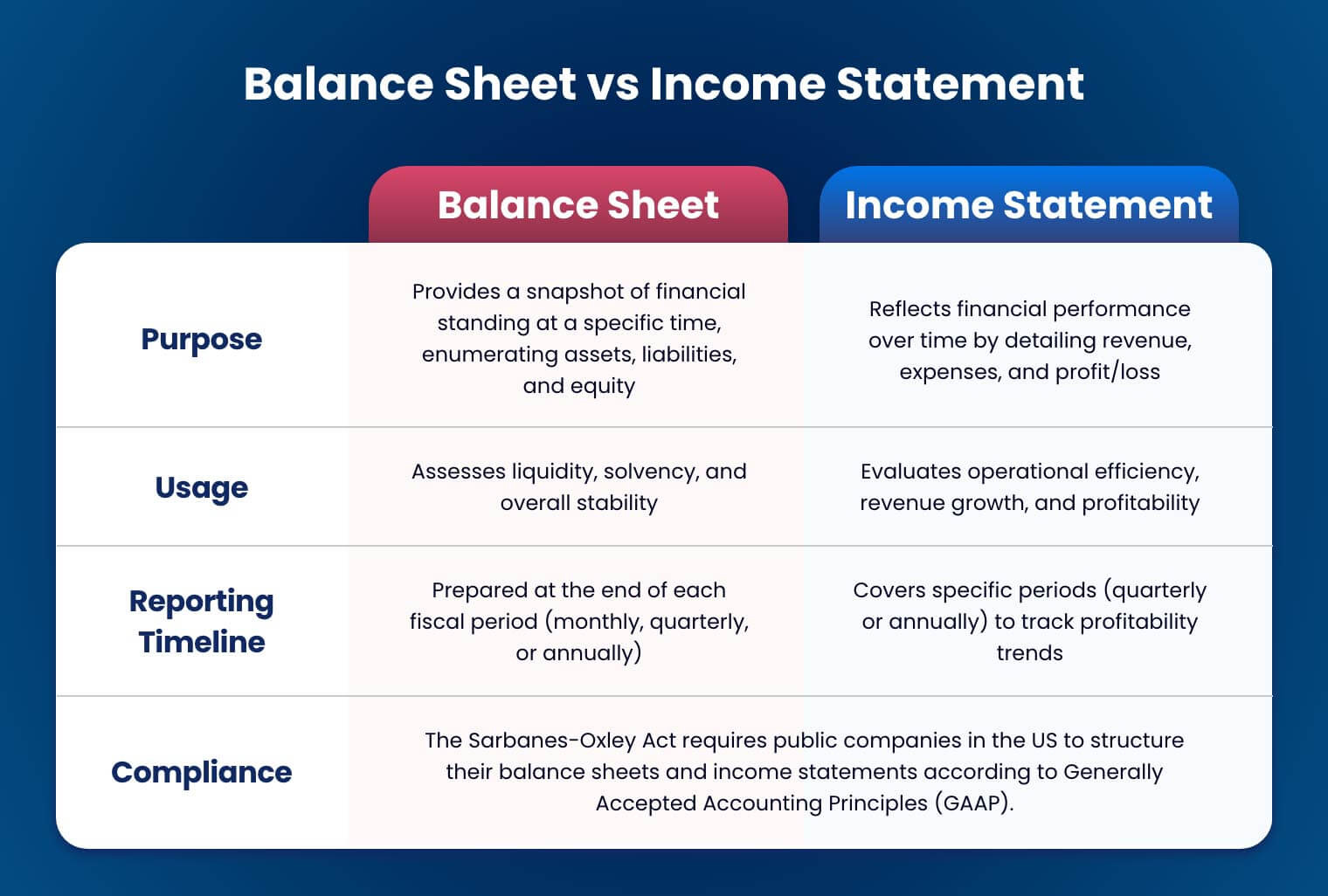

Difference Between Balance Sheet and Income Statement

The balance sheet and the income statement are both useful for providing insights to stakeholders, but they serve different purposes. Here’s a brief comparison of balance sheet accounts vs. income statement accounts.

1. Purpose and Usage

A balance sheet provides a snapshot of financial standing at a specific time, enumerating assets, liabilities, and equity. It is effective for assessing liquidity, solvency, and overall stability. On the other hand, income statements reflect financial performance over a quarter or a year by detailing revenue, expenses, and profit/loss. They assist stakeholders in evaluating operational efficiency, revenue growth, and profitability.

2. Reporting Timeline

Balance sheet and income statement have distinct reporting timelines. Companies prepare balance sheets at the end of each fiscal period, which could be monthly or quarterly. On the other hand, income statements typically cover specific periods, effectively reflecting changes in profitability.

3. Compliance

The Sarbanes-Oxley Act in the United States mandates public companies to align their financial statements, including income statements, balance sheets, and cash flows, to the Generally Accepted Accounting Principles (GAAP). The Securities and Exchange Commission (SEC) enforces this law and ensures financial reporting is transparent, consistent, and accurate. Outside the US, countries typically require balance sheets and income statements to follow the International Financial Reporting Standards (IFRS).

Frequently Asked Questions on Balance Sheets and Income Statements

Gain more insights about balance sheet and income statement with these FAQs.

Which comes first: balance sheet or income statement?

Ideally, income statements are prepared first before balance sheets and cash flow statements, as they provide the value for net income. While this sequence is common practice, it is not strictly enforced among companies.

What appears in both the income statement and the balance sheet?

Although income statements and balance sheets follow different formats, both show net income. The net income from the income statement is copied into the balance sheet as retained earnings.

A balance sheet measures assets and liabilities. What two items does an income statement measure?

An income statement measures a company’s revenue and expenses. These are values essential for boards, investors, and creditors to assess whether the business is generating profit or incurring loss.

Simplify Board Oversight and Management with Convene Board Portal

Financial statements involve data gathering, collection, and storage. To ensure compliant and accurate outcomes, boards see the need to enforce strong and precise workflows, which they can achieve faster with advanced digital tools.

Convene is a multi-awarded board portal solution committed to helping global organizations modernize and streamline their board governance. The smart software is built to enhance the overall integrity of board management by simplifying administrative burdens and centralizing operations in one secure platform.

Experience seamless collaboration and decision-making in and out of meetings, from agenda creation to project approval and document sharing. Convene eliminates the hassle of scattered files, endless email threads, and version control issues, giving board members a single, secure source of truth.

Take control of your board’s document management and ensure seamless collaboration. Schedule a demo of Convene today and discover the transformative impact of a board portal solution.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.