The fast-paced digital transformation is challenging financial companies of today. As the world continues to battle a pandemic, customers are opting to avail online services straight from their mobile devices, while most workplaces have transformed into a hybrid arrangement. Financial service institutions must turn to innovation to keep up with the continuous, monumental shift, while addressing the specific needs of their customers, strengthening operations and compliance with security regulations, and remaining competitive within the financial industry.

Given this challenge, how can a board management software for financial institutions help adapt to the accelerated pace of digitalization?

Pandemic’s Challenge to the Financial Sector

The COVID-19 crisis escalated the role of technology in daily life. As lockdowns and restrictions to physical contact were implemented, people are forced to pursue typical activities online. Hence, technology-driven innovation became an even more crucial arena of competition within the financial services sector. It was not only vital for financial institutions and banks to continue their operations during the pandemic — they were also required to widely digitalize their services to consumers.

Digitalization also needed to be enforced internally in financial institutions so employees could work from home and ensure business continuity. Executives had to discuss and implement business decisions without traveling and meeting physically. This involves digitizing documents needed for decision-making, such as board packs and meeting minutes. Consequently, it required an additional effort from meeting organizers in preparing the board meeting requirements. Documents needed to be scanned and sent electronically to participants so they can make informed decisions while meeting virtually. It also entailed putting secure applications in place that can ensure compliance with electronic signing regulations.

The shift of financial companies to work from home arrangements also brought concerns about employee productivity and accessibility. A survey conducted by PricewaterhouseCoopers revealed that employees who identified having decreased productivity while working from home faced challenges in ‘collaborating and acquiring the information they needed.’ This highlights the need for digital tools that can facilitate collaboration and manage company information and document access.

To smoothly execute this, applications should be able to let employees communicate in real-time. As cited by the Economic Times, tailor-fit digital solutions can serve as a foundation in ensuring that employees remain accessible even while working remotely.

Lastly, adapting to a digital workplace also heightened threats to cybersecurity. This issue is especially alarming for financial and banking companies that manage highly sensitive client data. Security measures need to be oriented for compliance with regulations and to defend against cyberattacks, such as identity theft and phishing.

To successfully and securely navigate the digital workspace, and ultimately satisfy the evolving needs of their customers, financial institutions must follow smart trends for effective digital boardrooms. Utilizing a board meeting management software is one way for financial companies to address the urgent need to shift to virtual and paperless meetings so business operations can continue.

Why do financial companies need an all-in-one platform for their meetings?

The shift to a digital workplace required financial companies to utilize various tools and applications for specific tasks.

For instance, before remote board meetings can be conducted, organizers will need to check the availability of participants, either through email or group chat applications. Once settled, the meeting will be scheduled on the company’s preferred video-conferencing platform, such as Zoom, Google Meet, or WebEx. The platform will send the meeting invitation to participants using their registered email addresses, but distributing the meeting packs will require another tool.

Storage devices such as Google Drive and Dropbox are highly accessible repositories where organizers can instantly upload meeting documents. However, to access the files, organizers must first share and send out the links through email or chat, then manage access permissions. The organizer will have opened over three separate applications for this pre-meeting process alone, excluding the applications used to prepare and seek approval for the agenda and meeting pack.

One of the primary problems brought by this adjustment is the quick turnaround needed for employees to learn to accomplish their tasks using multiple technologies. This also brings challenges to security and compliance with certain regulations as company information and activities are entered into various platforms. Thus, adopting a board meeting management software to implement end-to-end board meeting activities can signify a board’s commitment to innovation, security, and efficiency.

Board management software eliminates the need to adopt multiple tools while recognizing that all tasks can be accomplished in just a single software. It puts value on technology as an enabling tool to ensure business continuity while keeping employees safe at home. It reflects the flexibility of a company to explore an all-in-one platform that keeps business operations sustainable and efficient in the long run, despite the uncertain times. Here are some ways that an all-in-one board meeting management software can help financial institutions:

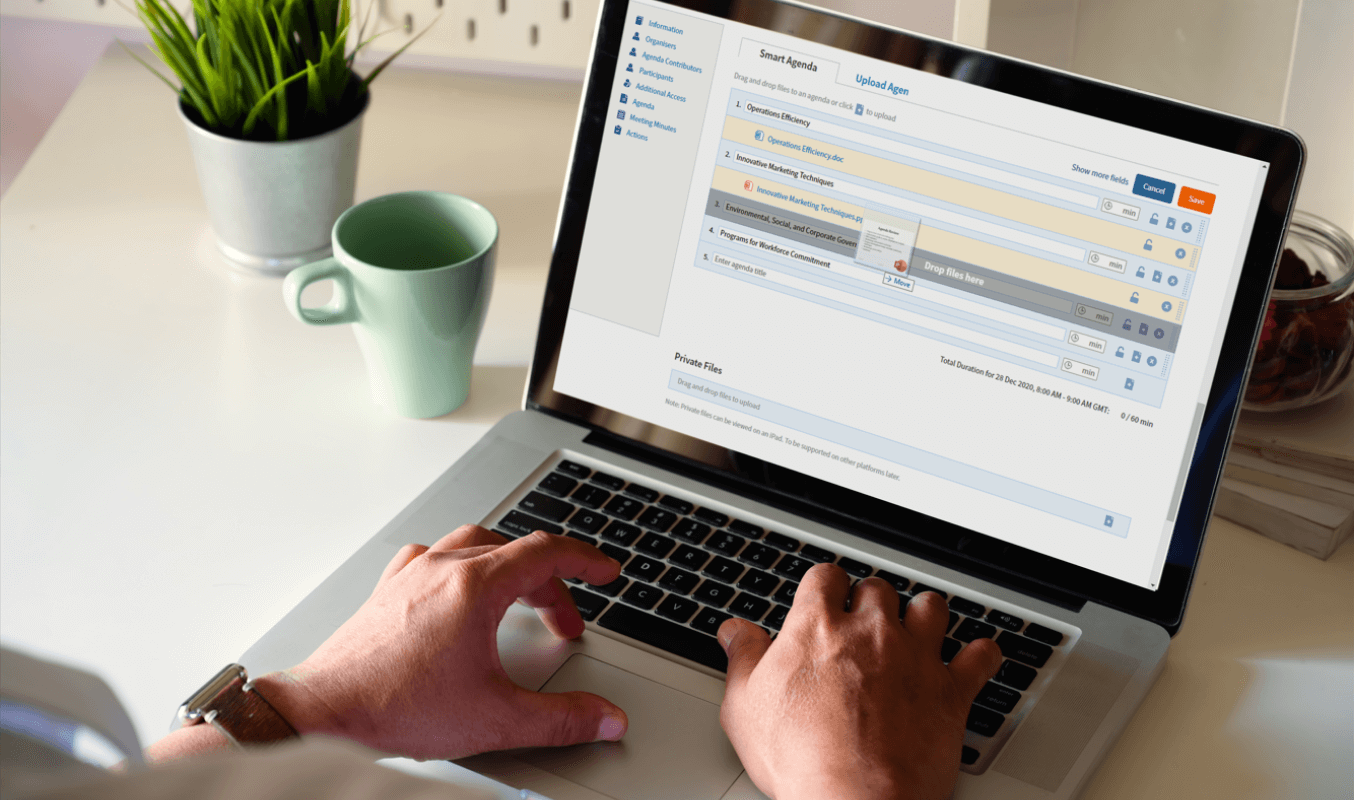

- Centralization and Efficiency. A board meeting management software increases efficiency as it keeps all company and meeting documents in just one location — providing ready access for employees and executives. Meeting participants will not need to access their email to find a link to a document that may have been uploaded in Google Drive or Dropbox. Organizers can just upload the meeting files directly in the document repository within the board meeting management software. After setting the access permissions, participants can instantly view the files shared with them. In this way, distributing documents is fast and secure, as it also decreases the need to store and retrieve documents from local devices. Additionally, organizers can arrange board meetings and finish post-meeting follow-up activities without the need to utilize other applications.

- Governance. With the growing demands of consumers to financial and banking companies, boards should be able to generate decisions to improve services and execute them fluently. Board meeting management software became a digital board solution that provides top management a means to implement corporate governance in the new workplace. It also serves as a tool to smoothly transition from face-to-face to virtual meetings, and securely accomplish decision-making outside the physical board room.

- Transparency and Accountability. A board meeting management software acts as a central system in which company information is stored and document actions are logged. By providing a mechanism to log user activities within the system, board portals provide readily accessible documentation, such as an audit trail, which can monitor the activities of the board and other users. It helps ensure that governance decisions are properly tracked and the people responsible are accountable.

What to look for in board management software?

A relevant step to smoothen the shift to a digital workplace is to find and test the board meeting management software which can adapt to the measures needed for company operations and communication. Below are some things that financial institutions need to consider when choosing a board management software:

- Data Security and User Authentication — As financial companies manage confidential information, the board meeting management software must ensure strict compliance to security requirements and regulations to protect the data and documents stored within their system. Thus, it is important for financial companies to identify and define the access permissions of certain documents and securely authenticate their users.

- Flexibility — Every financial institution has its respective workflow. The board meeting management software should be able to address distinct specifications needed by the company that can accommodate user preferences, including their frequently used devices. Financial companies may also have existing applications they already use for specific activities. Hence, the board management software of your choice must be able to integrate seamlessly with these tools so users can efficiently transition to the new platform.

- Collaboration Tools — A board meeting management software can offer various features for meetings and document collaboration. Financial companies must look for a board portal that allows users to implement the company’s workflow for meetings, document review and approval, and voting activities, even in a work-from-home setup.

- Ease of Use — Since there are still those who are unwilling to adopt digital technologies in the workplace, solutions must provide users with an intuitive interface. This can lighten the burden of shifting to a new platform by reducing the needed time of users to learn and get acquainted with the board meeting management software. It also ensures that even the least tech-savvy employees will not get overwhelmed upon recommencing their work.

- Vendor — Much attention must also be given to the meeting management solution provider in choosing a board meeting management software. Financial companies should look into the provider’s background and the standards they follow in providing their services and maintaining security. As the supplier, vendors must also have an excellent track record in implementing the solution for their clients. It is also important that vendors will take the time to study the needs of the organization, so they can enlist the customizations to meet the requirements.

Sketching the Ideal Board Management Software for Financial Companies

A suitable board meeting management software is equipped with functional features relevant to the specific workflow of the organization. As one of the leading board portal solutions, Convene is packed with powerful tools, which is why it is trusted by top organizations and has achieved several recognitions worldwide. It is designed for efficiency that allows board members and administrators to perform their roles effectively.

As an ideal board portal software, it combines the following characteristics to serve the specific needs of financial institutions:

Flexible

A highly flexible board meeting management software can adapt to the process and user organization needed by financial companies, even those operating on a large scale. It can also be hosted on-premise or on the cloud depending on the preference and existing infrastructure of the client.

Moreover, administrators can customize the platform according to the preference of the users and to the branding of the organization. It can also support integration with the existing applications used by the company to ease the transition. For instance, Convene supports integrations for functions such as storage, video-conferencing, and calendar, which eliminate the need for users to switch applications.

Secure

Recognizing the sensitive nature of information and documents, especially of financial companies, an ideal meeting management software should employ robust security measures for compliance with regulations, especially in protecting its clients’ data. It implements end-to-end encryption and a multi-layered approach, thus the integrity of user data is maintained.

In addition, the software improves compliance with application security needs by allowing administrators to set user accounts and system security preferences. Designated administrators can manage user accounts and their permissions, password policies, session timeouts, and authentication. Systematized documentation of meetings and portal activities can also add another layer of security. In Convene, audit trails can be generated directly to track user activities.

The solution also has well-defined security policies that guide its employees in ensuring that the system remains available and protected. Measures for business continuity, incident management, and vulnerability management are also in place to guarantee that its services remain uninterrupted.

Sustainable

In navigating the digital workplace, financial companies must invest in smart solutions that remain efficient in the long run. The board management software must be able to help address this challenge. To illustrate, with the limitation on conducting physical boardroom meetings, boards had to do away with printing meeting packs and instead, access materials digitally. Convene helped facilitate paperless meetings by offering a facility for boards to access the agenda and documents in just one digital platform.

Moreover, Convene’s services are continuously expanded, and its tools refined. During the onset of the pandemic, annual general meetings (AGMs) of companies needed to explore hybrid and virtual setups. Thus, ConveneAGM was offered to facilitate the entire AGM meeting process. It supports live broadcast, voting, and Q&A so companies and their shareholders can still complete a comprehensive AGM on a digital platform.

Constant innovation must be employed in the board meeting management software, keeping in mind that the needs of financial companies also evolve over time. The solution must be enhanced so users can continuously rely on the software even if it involves addressing additional requirements in the future.

Trusted

A track record serves as a testament to the experience and reliability of a board management software and its vendor. An ideal board portal has acquired recognition not just in a local scene. Most importantly, its competence is most validated by the users who have tested the functionalities and other services it offers.

With the huge number of customers worldwide, Convene has satisfied clients from private and public institutions. Convene has also achieved numerous accreditations and awards from established bodies, especially in the IT industry. In 2018, Convene won the Software as a Service (Saas) Enterprise Solution of Year Award at the European IT & Software Excellence Awards. The same year, it was hailed as a silver winner in the Asia-Pacific Stevie Awards for Innovation in Business Utility Apps.

Read: A Beginner’s Guide to Board Management Software

Digitalizing Financial Boards with Convene

Given the tougher movement of digitalization in the financial and banking industries, it is important for companies within the sector to explore innovative technology, so they can adapt in the face of changing times. Services must be improved and digitalized, while decisions must also be generated and trickled down within the new normal work arrangements so companies remain relevant in the competition.

A board meeting management software can serve a crucial role in ensuring the boardroom members and other teams conduct sufficient discussions, access the right documents, and make informed decisions all in one platform. Convene is a flexible and secure board meeting management software that is trusted worldwide in over 100 countries. It helps financial institutions streamline the entire board meeting process for decision-making and execution, so improved services can reach the customers swiftly.

See how Convene can boost digitalization in your company, request a Convene demo today.

Mikaela joined the Convene team as a Proposal Writer which exposes her to the evolving and specific board meeting management needs of organizations worldwide. She utilizes her experience in writing about technology and working with various stakeholders to provide tailored content that helps promote productivity and efficiency. She graduated with a bachelor's degree in Development Communication from the University of the Philippines - Los Baños.