With cooperatives like credit unions, success relies upon the effectiveness and dedication of its board of directors. Unlike traditional banks, credit unions operate with a core mission – providing competitive loan rates, financial education, and serving their members. To achieve this, the credit union board of directors has to demonstrate strong leadership and clear strategic direction to ensure the institution stays true to its goal.

This article explores the nature of credit union boards’ responsibilities and the qualities that the position requires, to give insight into how vital their leadership is in credit unions.

What is a credit union board?

A credit union is a nonprofit guided and governed by its board of directors – a group of volunteers elected to serve members’ interests. They focus on developing financial systems, setting loan rates, and enforcing policies to enhance their member’s economic well-being. Using their authority and influence over the organization, they are capable of executing high-level activities such as strategic planning and policy creation.

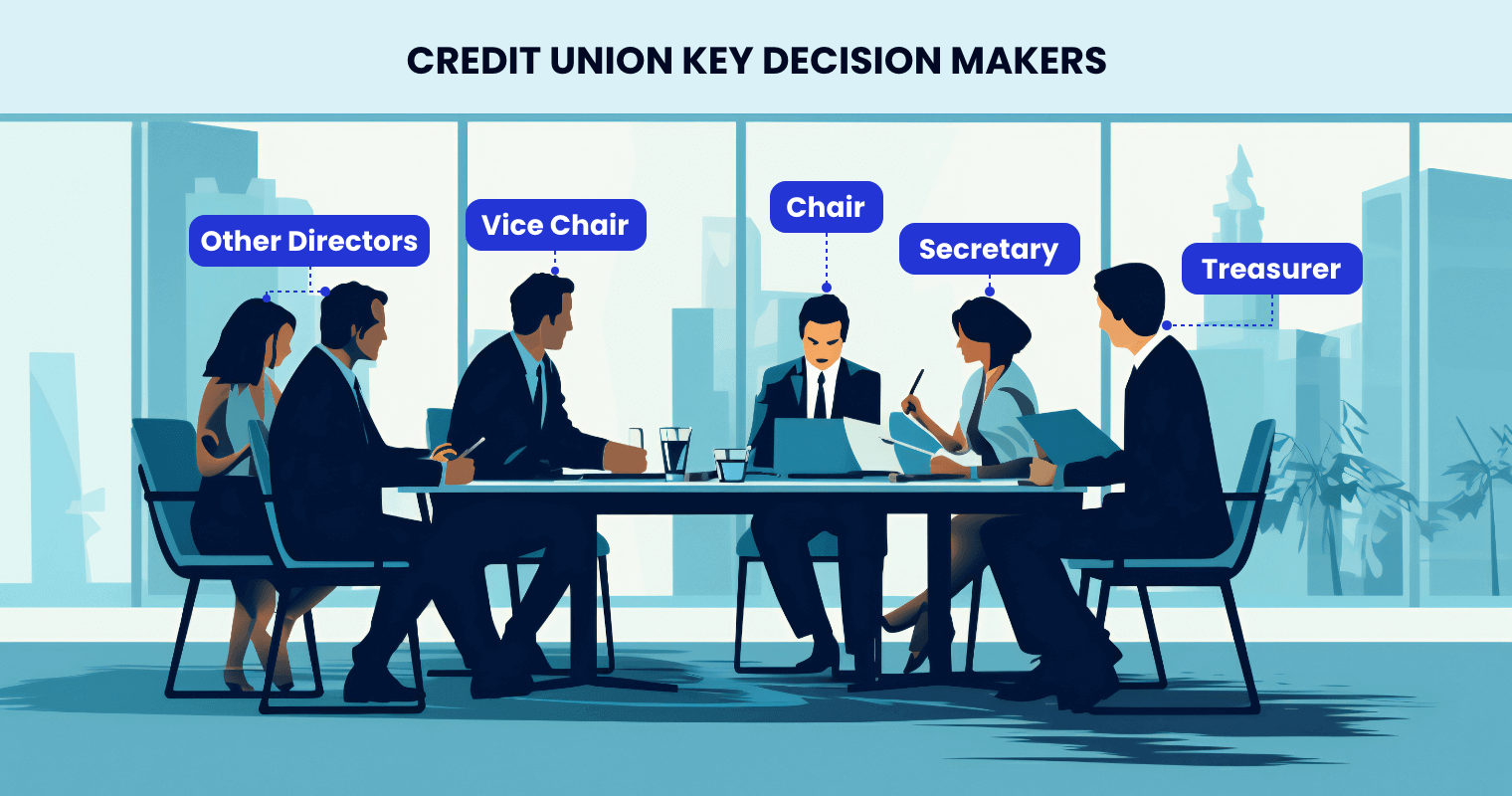

Who are the members of the credit union board of directors?

Each board member brings a unique perspective and expertise to board meetings, enriching discussions and resolutions. The key decision-makers that make up a credit union board are:

Chair

The chair is the highest officer in the group and acts as the board’s spokesperson within and outside the credit union. In collaboration with the CEO, the chair leads the development of the credit union’s strategic direction. This involves guiding discussions around long-term goals, analyzing market trends, and formulating growth strategies.

Vice Chair

The vice chair supports the chair in all its initiatives and takes over in their absence. They are the right hand of the chair in regulating the whole board when navigating issues, forming resolutions, and developing plans.

At meetings, the vice chairs are strategic advisors to the board, providing significant insights during discussions that influence the group’s decisions. Some organizations assign their vice chair to handle specific committees. This grants them greater access to first-hand operational processes, providing valuable insights to share with the chair and the rest of the board.

Secretary

Coordination is one of the key aspects of a secretary’s job. They notify the directors before meetings and ensure discussions are well-recorded and compliant with the bylaws. The secretary safeguards and organizes official organizational documents including, founding papers, board meeting minutes, and financial reports. This way, records become more accessible to the board and management. Aside from their core responsibilities, the secretary may also provide administrative support to the board and credit union.

Treasurer

The treasurer is in charge of sustaining the credit union’s financial stability for the long term. They regulate financial processes such as budget approvals and analysis of financial reports. To equip credit unions when navigating market uncertainties, the treasurer analyzes trends and risks to deliver factual financial projections that the board can refer to when developing plans.

As an expert in finance, the treasurer plays a vital role on the financial committee, often serving as its head. They provide insights and guidance to the committee, ensuring sound financial practices are implemented.

Other Directors

Credit union board directors support the officers in achieving the board’s collective goals for the organization. They contribute by participating in board meetings, reviewing and approving policies, and heading specific projects as assigned by the board. Directors are representatives of the board to the member body in helping sustain democracy and cooperative culture and values.

Credit Union Board of Directors Duties and Responsibilities

The board of directors credit union is an integral unit in a nonprofit that helps organizations navigate the changes in market landscapes. They are the backbone of credit unions and are responsible for the following:

- Make strategic decisions – The credit union board has the last say on crucial matters such as policy approval, budget allocation, and services. As the highest authority in the organization, the board exercises its power by defining the operational framework and setting the tempo for the management team to follow in execution.

- Develop policies – The credit union board is the primary policy maker shaping the systems within the organization. These include establishing their services, deciding interest rates, and outlining membership eligibility. Their clear and well-defined policies ensure that the credit union complies with state and federal laws to operate efficiently and remain financially sound.

- Enhance member engagement – Keeping members engaged is one of the core responsibilities of credit union boards. They need to ensure that the financial services they offer are what their members seek. Tracking metrics such as member satisfaction and participation rates helps the board assess the effectiveness of their strategies. They nurture members by arranging regular feedback sessions using surveys, interviews, and town hall meetings. This way, the board can understand what products would best resonate with their need, enabling them to offer more appropriate financial services.

- Hire and oversee CEO – Credit union boards are in charge of appointing and overseeing their CEOs. Their closeness with the CEO lets them align on high-level matters, streamlining the decision-making process. Acting as supervisors to the CEO, the board schedules periodic performance evaluations throughout its tenure to evaluate their work on aspects including, operations, member management, and risk management.

- Financial controller – The credit union board controls the financial resources, making the final investment decisions, addressing financial risks, approving financial policies, and allocating funds. With their foresight and financial expertise, they act as stewards and make informed decisions to keep the credit union financially healthy for the sake of its members.

Key Qualifications for Credit Union Board Members

Credit unions need a competitive and reliable board of directors to guide them. Effective directors should have leadership qualities and skill sets, including:

Governance

A big part of a credit union board’s responsibility is ensuring they ethically govern their members. For the board to achieve this, they should have a strong foundation in these areas: legal compliance, ethical principles, corporate governance best practices, risk management strategies, and emerging trends in financial technology. This knowledge would help them establish effective policies regulating the credit union’s activities and promoting financial security.

Communication

Board members must be excellent communicators. These positions seek individuals who can communicate their opinions and insights clearly and concisely with each other, the management, and their members. By fostering open dialogues and delivering presentations with confidence, it’s easier to build trust and strong relationships.

Management Skills

Ideal board of directors are experienced leaders. Even though credit union board members don’t get involved in operations, having management skills will empower them to instill influence over their people, making it easier to steer the organization toward its strategic path. They must be strong leaders, strategic thinkers, problem-solvers, and team players.

Financial Literacy

Credit unions should seek directors with an excellent foundation in financial analysis. Candidates must possess relevant skills like mathematical proficiency, accountancy, lending, market knowledge, and financial administration. With this, directors would know how to go about finance-related tasks such as interpreting financial statements, analyzing market trends, making investment decisions, crafting financial plans, generating forecasts, and managing cash flow. This ensures that every decision by the board is grounded on skills, expertise, and experience – boosting the confidence of stakeholders.

How does a board portal support credit union management?

As technology advances, financial institutions face increasing pressure to maintain secure and efficient operations at all times. To ensure high-quality service, credit unions have begun exploring digital solutions to assist them in digitization and create more seamless and secure workflows.

Board portals are one prime example of this. These are secure digital platforms organizational leaders use for streamlining board governance, communication, and document sharing. Leveraging paperless workflows, board portals enable leaders to focus more on strategic discussions, leading to improved engagement of the board and better-informed decisions.

Convene is a leading provider of board portal solutions to companies across various industries.

The platform provides a comprehensive suite of tools designed to enhance collaboration and streamline workflows specifically for credit union boards. With the platform’s automated and smart features, credit union leaders will have less difficulty navigating the complexities of boardroom operations.

To better understand how Convene impacts companies, here’s a case study on one of Convene’s credit union clients – America First Credit Union.

Before discovering Convene, AFCU struggled with outdated paper-based meeting packs and insecure document access when they transitioned their senior managers to iPads. Convene made their meeting experiences and collaboration smoother by offering a secure platform for centralized document storage and access. The platform’s user-friendly interface empowered meeting organizers to prepare meeting packets faster with drag-and-drop functionality for building agendas.

Frequently Asked Questions on Credit Union Boards

Here are some frequently asked questions about credit union boards and their management.

How do boards acquire the required financial skills?

The most common way to acquire financial competency is to pursue a finance program and start a career related to it. However, not all board candidates start like this. Some organizations such as the Association of Federally-Insured Credit Unions (NAFCU) and Credit Union National Association (CUNA), offer formal training programs specifically designed for those who want to apply these skills to credit unions. They award Credit Union Board Financial Literacy Certificates, providing training on financial management, risk assessment, and industry-specific regulations.

Does a CEO have more authority than the board of directors?

No, credit union boards have more authority than the CEO because the latter is an employee appointed by the board. They are tasked with implementing the policies and strategies set before them. Additionally, if the CEO is deemed ineffective, the board has the right to discipline or replace them, following the process outlined in the organizational bylaws.

How does a credit union board collaborate with management?

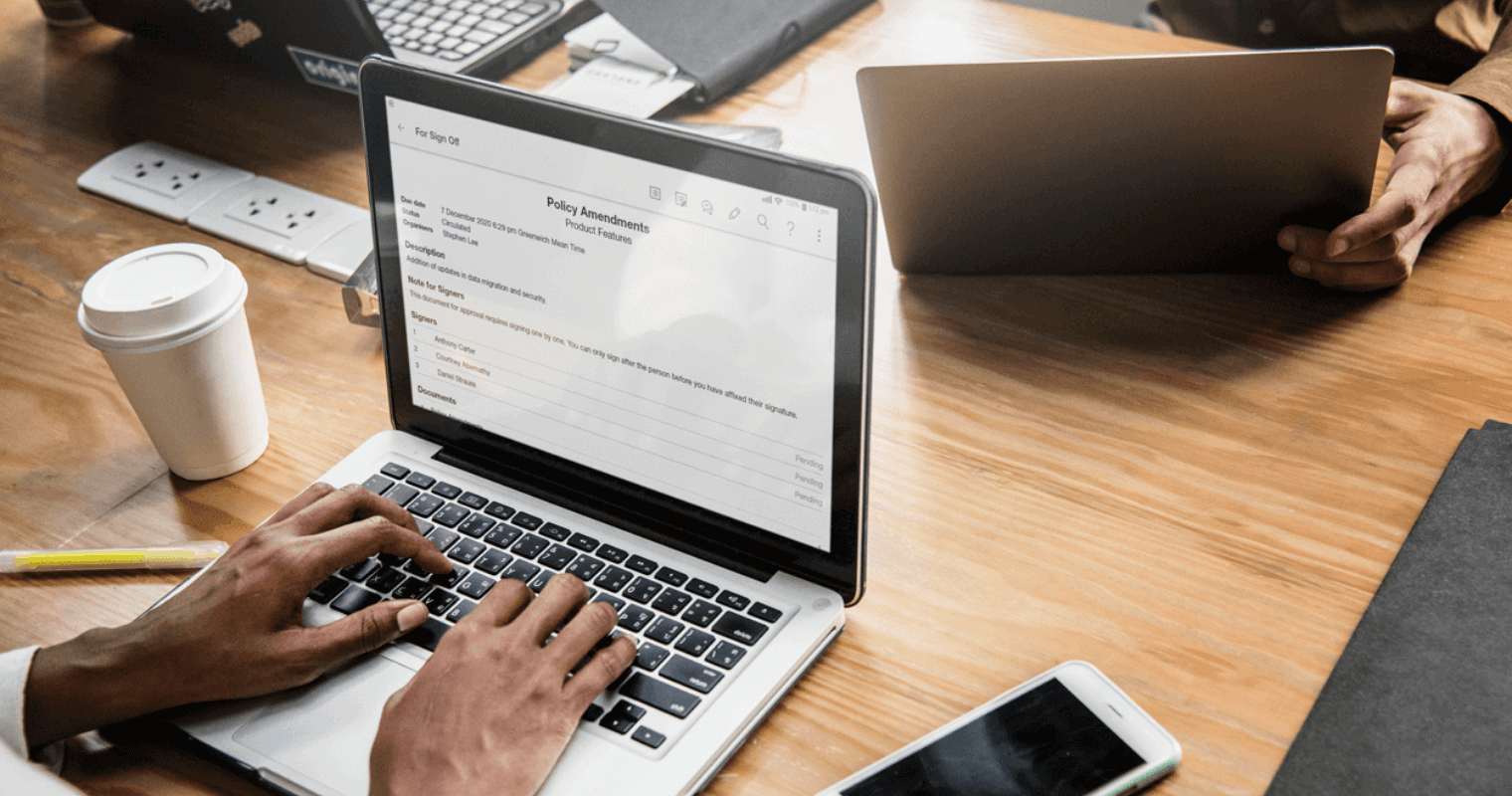

The board of directors and its management team perform complementary responsibilities critical to meeting the overarching goals of the credit union. To maintain effective collaboration and avoid conflict, the board should define the roles of both parties. Leveraging technological solutions such as board portal for credit unions can greatly help streamline the distribution of meeting notifications, document approvals, and announcements for both parties.

For instance, the CEO can utilize the board portal to submit sign-off requests with supporting documents to the credit union boards. Then, using the app, the board can review the documents and provide their electronic signatures, saving time and unnecessary consultations. Another example is when the board needs certain documents from the management team, instead of issuing requests, the board may go directly to its document repository and retrieve the files with less fuss and delay.

Empower Credit Union Board Members to Champion Modern Management Practices

The board of directors crafts the strategic direction of credit unions. To increase their chances for success, the board must leverage digital tools to help solve issues of slow decision-making, disorganized communication, and compliance gaps.

For credit unions and financial institutions, Convene’s board portal software is a trusted digital solution that empowers boards to achieve greater efficiency. It offers features for streamlining collaboration, including voting and polling tools for faster decision-making, an encrypted document repository for secure document sharing, and a 24/7 audit log for guaranteed transparency.

Is your credit union ready to unlock the potential of digital board operations? Schedule a free demo to explore how Convene can help your credit union achieve modern management practices.

Jean is a Content Marketing Specialist at Convene, with over four years of experience driving brand authority and influence growth through effective B2B content strategies. Eager to deliver impactful results, Jean is a data-driven marketer who combines creativity with analytics. In her downtime, Jean relaxes by watching documentaries and mystery thrillers.

![How to Create a Board Skill Matrix + Template [Free Download]](https://cdn.azeusconvene.com/wp-content/uploads/2024Q3_Jul_Board-of-Directors-Skills-Matrix-Whitepaper-C-Dark.png)