Unlike commercial banks, credit unions operate on a cooperative model, where members are both owners and customers. This unique structure influences their approach to risk management. Because the risk is shared among member-owners, credit unions often prioritize their members’ financial well-being and stability rather than focusing solely on profit maximization.

This article delves into credit union risk management, including the benefits, risk factors, and how they manage them effectively. If you’re curious about how risk management strategies work, read on.

Understanding Risk Management for Credit Unions

Risk management is a strategic and collaborative process that involves identifying, analyzing, and responding to risk factors in business decisions. For credit unions, an effective risk management system means monitoring and proactively addressing the financial risks, both internal and external, to safeguard the institution’s stability and the members’ interests.

It should include policies, processes, and controls to identify, assess, measure, monitor, manage, and report risks from its activities and the external environment. More importantly, the system must document its risk tolerance, or the level of risk the organization can take, so that it aligns with strategic objectives. This ensures that risks are managed in line with the credit union’s operations, financial strength, and goals.

Credit Unions’ Internal and External Risk Factors

Every financial institution, like banks and credit unions, faces two risk factors: internal and external. The difference lies in the level of control credit union managers can exert. Managers have some control over internal risks, whereas they have no control over external ones.

Internal Risks

- Operational Risks: These are risks of loss, whether financial or otherwise, resulting from inefficiencies in internal processes, human errors, system failures, or external events such as natural disasters.

- Credit Risks: This is the risk of potential loss arising from a borrower, issuer, or guarantor’s failure to meet its obligations, which could impact the credit union’s financial health.

- Compliance Risks: This type of risk stems from failures to adhere to regulatory requirements, leading to legal penalties and reputational damage.

- Liquidity Risks: A credit union’s inability to have sufficient liquid assets to fund its current and future expected and unexpected credit obligations may be detrimental.

- Capital Risks: Capital is a cushion to absorb losses and keep a credit union solvent. Capital risk comes from the quality and amount of capital, sensitivity to external shocks, and capital management. High capital risk can make it hard for a credit union to meet obligations during tough times.

- Strategic Risks: This risk is associated with the credit union’s business decisions, such as expansions and product launches.

- Reputation Risks: This risk comes from negative publicity, which could damage the credit union’s reputation.

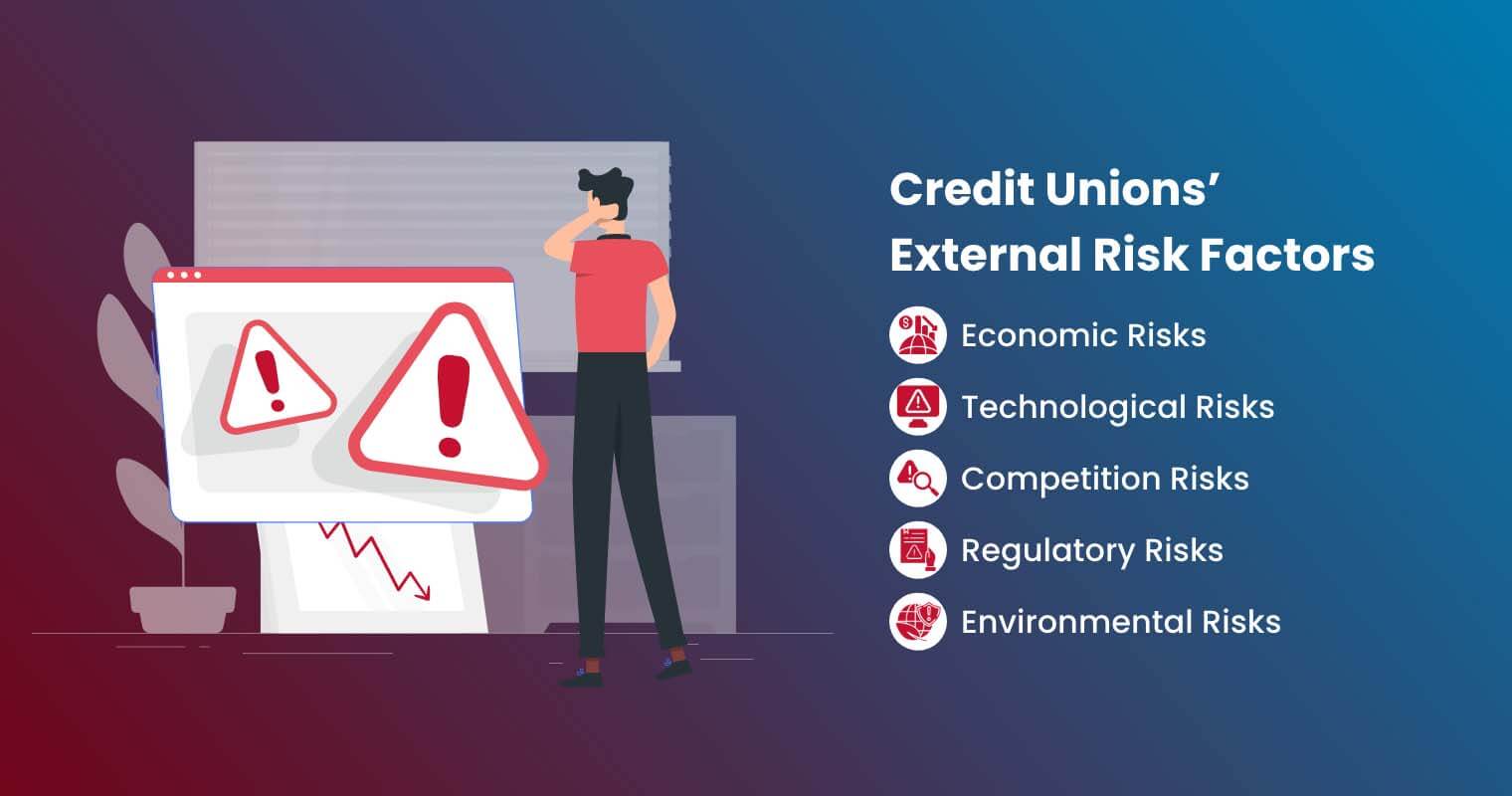

External Risks

- Economic Risks: Credit unions have many assets and liabilities linked to interest rates. Changes in interest rates, economic downturns, inflation, and recession can impact both profitability and the value of these assets and liabilities.

- Technological Risks: Rapid technological advancements pose challenges in keeping systems updated and secure. At the same time, they introduce new threats and vulnerabilities.

- Competition Risks: Increasing competition from other financial institutions and fintech companies can affect market share and member acquisition.

- Regulatory Risks: This risk comes from regulation changes that require constant adaptation and compliance efforts, affecting the credit union’s operations and profitability.

- Environmental Risks: Natural disasters are risks to the credit union as they can put everything on hold, disrupt operations, damage assets, and hinder the credit union’s ability to serve its members.

Key Elements of the Credit Union Risk Management Process

Effective risk management is vital to the credit union’s longevity and success. This process typically involves:

1. Risk Identification

As with any organization, credit unions must perform thorough assessments to identify risks that could jeopardize their goals. These assessments should adhere to a standardized risk management system to ensure consistency and accuracy and must factor in the scope of the entire enterprise. Additionally, the evaluation should cover potential issues that might arise from the credit union’s day-to-day operations. You must look into factors that could lead to workplace incidents and injuries beyond financial and operational risks.

A crucial part of this process involves identifying and monitoring Key Risk Indicators (KRIs). KRIs are metrics used to consistently track potential problems in the organization’s operations. By doing so, the credit union can proactively address risks before they escalate.

2. Risk Assessment and Measurement

When assessing risks, ask yourself: How likely is this risk to occur, and how will it impact the credit union? The answer to these questions determines the risk rating or severity of the risk. Moreover, you should consider the type of risk you’re dealing with, distinguishing between inherent risk (the risk before implementing controls) and residual risk (the risk after controls are in place).

For instance, in the financial sector, the risk of a borrower defaulting on a loan is inherent. Before implementing any controls, such as credit checks or collateral requirements, the potential for default is high and represents the inherent risk of lending. Using the same example, after a bank has conducted thorough credit checks, the risk of loan default is reduced, but not entirely gone. Some risk remains that the borrower might default due to unforeseen circumstances like economic downturns or personal financial issues. This remaining risk is the residual risk.

This approach gives the credit union a better view and understanding of the risk landscape and helps implement effective risk management strategies.

3. Risk Management

To manage risks effectively, the credit union must collect comprehensive information on the inherent risks and develop and maintain controls to mitigate them. This includes establishing robust internal controls, enhancing cybersecurity measures, and diversifying the credit portfolio to spread risk. Regarding residual risks, you must ensure their level is consistent with the credit union’s risk tolerance. A risk register is a standardized tool for managing and monitoring identified organizational risks.

Typically, this responsibility falls to the dedicated risk manager, supported by risk management officers. Together, the Risk Management Team develops systems and processes to monitor and address risks in real-time and provides timely reports to senior management.

4. Risk Monitoring and Reporting

Once the systems and controls are in place, you must then prioritize ongoing monitoring and evaluation. The credit union should continuously assess the effectiveness of these measures to see how well the controls perform in practice and identify any gaps or areas needing improvement. You should also monitor external factors, including regulatory changes and updates.

To ensure that risk management remains a priority, regular reporting (preferably every month) to the board and senior management is necessary. There is no strict format for what the risk report should look like but generally, it should cover:

- Detailed information on identified risks and the effectiveness of existing systems and controls;

- Updates on recent risk events and the actions taken or proposed to mitigate or reduce the impact;

- Notifications on deviations from risk tolerance levels or established systems and controls, including the status and timeline for addressing these issues;

- Identification of negative trends in higher-risk areas and any recommended changes for adjusting risk management activities;

- New risk assessments, risk rating, and systems and controls;

- Alerts regarding emerging risks and recommended course of action;

- Updates on risk management actions previously approved by the board or risk committee;

- And recommendations for any necessary remedial actions.

Leveraging modern solutions such as board portals for financial services can enhance the efficiency and effectiveness of risk monitoring and reporting. They provide a centralized platform for securely sharing reports, tracking progress, and ensuring that board members and senior management have up-to-date information. This helps make informed decisions and maintain a proactive risk management approach.

Tips to Build an Effective Risk Management Plan

If you’re just in the first stages of building a risk management plan that suits your credit union needs, here are some tips to help kickstart the journey:

1. Utilize data insights

By analyzing past financial, operational, and member data, organizations can identify trends and potential risks. From there, you can create data-driven strategies that mitigate risks effectively, such as reallocating resources or implementing preventive measures tailored to specific vulnerabilities.

2. Create a disaster recovery plan

When creating this plan, consider response strategies to various disaster scenarios, including immediate actions to mitigate damage and long-term recovery efforts. It should also include provisions for the credit union’s business continuity, ensuring critical functions continue without interruption. This involves setting up backup systems for crucial data and operations and establishing recovery locations to minimize downtime.

3. Leverage technology

The digital age calls for employing advanced software solutions to enhance security and ensure regulatory compliance–and credit unions are no exception. This means safeguarding against potential risks with encryption and firewalls and simplifying tasks with tailored credit union risk management software. To ensure seamless integration, select technology that matches the existing systems and is user-friendly. This facilitates effective implementation and continuous management of risk mitigation strategies.

What are the benefits of credit union software in risk management planning?

Using credit union risk management software like Convene might seem like an unnecessary cost on top of the expenses credit unions have to settle regularly. It can also be daunting for some credit union boards that are not very tech-savvy and will need to learn how to navigate a new solution. But all these worries can be set aside if you fully realize its benefits—it will become more of an asset rather than a liability in the long run.

Streamline the risk management process

Identifying probable risks, managing threats of these risks, and keeping track of changes in regulations can be a lot of responsibilities for one person. Acquiring credit union board software can ease the trouble of manually doing all these tasks. With a centralized document library, you can ensure that all members have instant access to updated regulatory information and risk management protocols.

Moreover, automating processes through credit union risk management software offers boards a platform to organize data efficiently. The software includes live meeting tools and secure polling and voting systems to speed up decision-making for progress. This promotes transparency and collaboration and improves not only the reporting process but also the quality of plans implemented afterward.

Provide digital and comprehensive risk assessment

Credit union boards should always aim to provide digital and comprehensive risk assessments since these are integral to risk management plans. Risk assessments analyze the likelihood of threats and their impacts on the business. By understanding the severity of each risk, credit union boards can closely monitor risks depending on the organization’s priority level. Credit union board software lets you design and conduct board self-evaluations to ensure ongoing effectiveness and alignment with strategic objectives.

Create risk reports efficiently

Risk reports should address potential issues that may surface and discuss ways unions can address them. They should also include charts, graphs, or illustrations that can aid readers in digesting the report more easily. Before a risk report is completed, it has gone through numerous meeting discussions and review stages from the board. In this case, credit union board portal software would be valuable in efficiently drafting reports without the need to use multiple solutions.

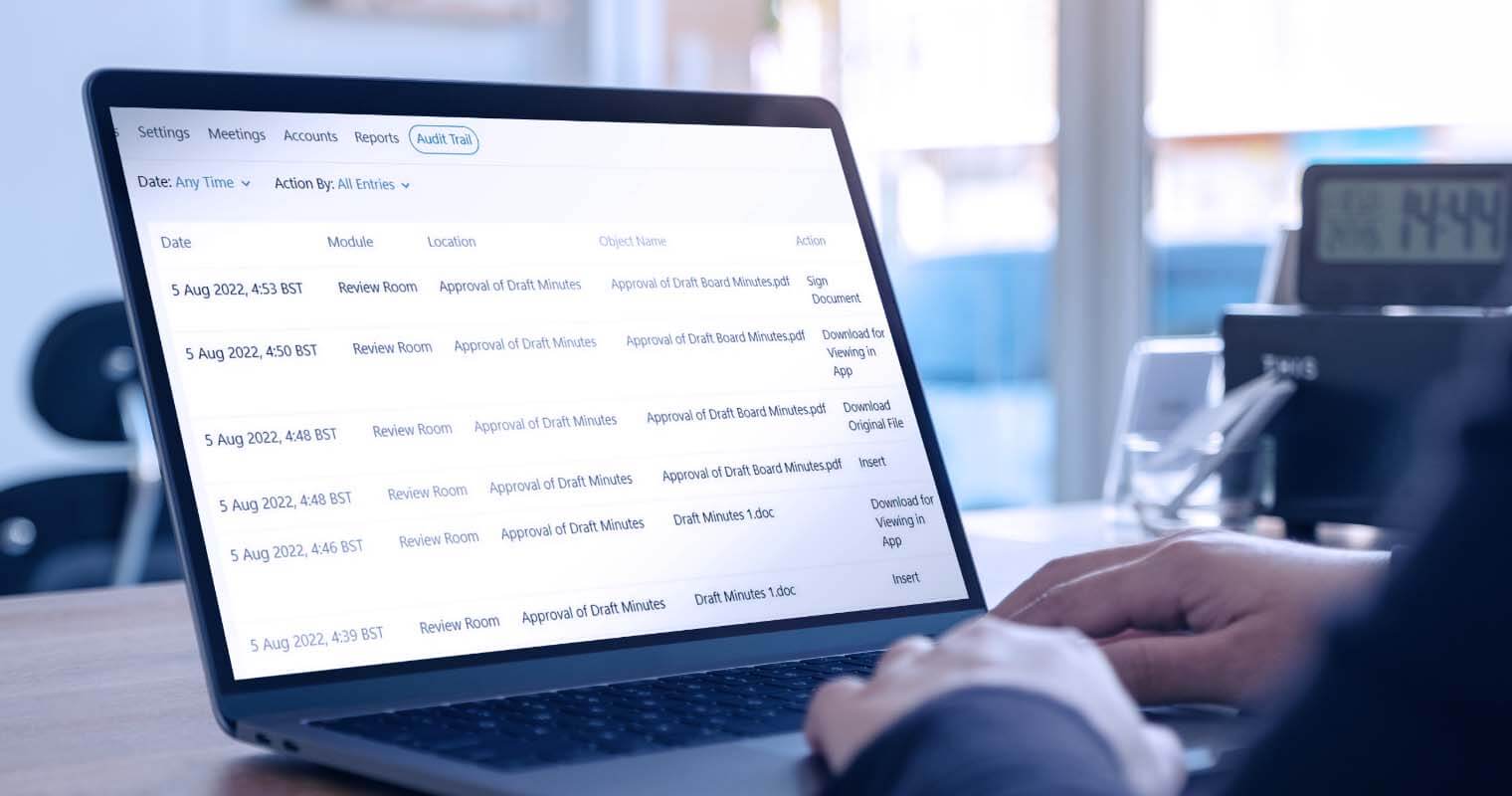

A secure audit trail allows you to easily track and monitor all activities made in and out of meetings and generate reports with detailed logs for compliance purposes. Additionally, features like automated version control and role-based access ensure that sensitive information remains secure and accessible only to authorized personnel. This streamlines the report drafting process and supports effective governance practices within the credit union.

Set Up an Effective Risk Management Plan with Convene

It is impossible to entirely remove risks when running a business. However, integrating board management tools like Convene with features like a secure document repository, seamless document access, audit trail, review rooms, and live conferencing tools makes setting up a credit union’s comprehensive risk management plan more manageable and secure.

Discover other use cases of Convene or find out firsthand how we can improve your board management by booking a walkthrough with us today.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.