Digital transformation has dominated strategic discussions across industries over the last few years. Organizations are now under pressure to adapt, viewing such a shift as an effective way to increase operational efficiency and reimagine customer experience.

In Canada, the banking sector continues to lead the charge in digital innovation — outpacing other industries in adopting advanced technologies. Numerous banks in the country are increasingly investing in their digital infrastructure, from versatile online banking platforms to extensive payment ecosystems. Some have even formed partnerships with fintech companies to offer tailored services and achieve stronger security.

As the country becomes more digitally focused, Canadian banks must take on a digital transformation strategy that prioritizes the changing market. Read on to learn more about the digital transformation in Canada’s banking sector.

The Current State of Digital Transformation in Banking in Canada

Digital transformation has become critical for Canada’s banking sector to constantly navigate shifting consumer expectations and competitive pressures from fintech disruptors. To put it simply, this shift enables banks to deliver a more seamless, personalized experience while optimizing operations and driving cost savings.

A study by the Canadian Bankers Association shows that Canadians expect to increase the use of banking technologies in the next five years: 41% for mobile banking apps, 40% for Interac e-Transfer, and 32% for Tap & Pay. The study also suggests customers experienced high satisfaction levels from using digital banking services.

The need for fast and accurate banking activities is another reason digital transformation is worth the investment. For instance, bank transfers and deposits can now be done via mobile apps, and loan approvals can be performed through online banking systems.

2023-2025 Key Drivers of Digital Revolution in Canada’s Banking and Finance

In recent years, Canadian banks have been reinventing the way they do banking. Below are the drivers currently shaping the country’s banking industry and compelling them to invest in digital banking.

1. Evolving customer preferences

In PwC’s 2024 Global CEO Survey, 60% of Canadian banks are anticipating increased pressure to adapt to changing customer preferences in the next three years. Customers now demand:

- Frictionless digital experiences through intuitive banking apps and streamlined account opening and closing processes.

- Tailored financial solutions such as customized investment portfolios and multiple loan options.

- Instant access to their financial information including real-time transaction updates, balance inquiries, and other banking insights.

With that in mind, banks are encouraged to invest more in automated, technology-enabled services for existing and potential new customers. For instance, some Canadian banks offer wallet apps that allow customers to store their prepaid cards and gift cards, and mobile payment apps for easier transactions.

2. More customers prefer digital banking

In the 2024 Canadian Bankers Association study, 47% of customers (mainly young adults) use online banking as their primary banking method. The survey also shows that 70% used app-based banking, with 96% saying they were happy with it. Such preference for digital banking is expected to continue to grow, with many finding it convenient and accessible.

To keep pace, banks are expanding digital ecosystems and investing in UX design and cloud computing to offer user-friendly services. Hence, underlining the need for continuous investment in digital infrastructure.

3. Integration of fintech partnerships and open banking

Partnerships with fintech companies and the adoption of open banking are currently reshaping Canada’s banking sector. Such partnerships are primarily driven by the need for innovation and more personalized financial services.

With the country set to support a thriving fintech ecosystem, fintech partnerships enable the development of new products and services (e.g. robo-advisors, blockchain-based solutions, AI-powered chatbots). In the first six months of 2024, investments in Canadian fintech reached a record high of US$7.8 billion, a sevenfold increase from US$1.1 billion in 2023. This indicates a rise in venture capital funding directed toward innovative fintech solutions.

On top of that, the country’s banking system is expecting changes in how Canadians control and manage their finances — through open banking. This system enables customers to securely share financial data with third-party banking service providers. As of 2024, the country is in the process of implementing open banking. The Government of Canada also committed to creating legislation related to the system in line with the mandate of the Financial Consumer Agency of Canada (FCAC).

4. Shift toward sustainable and green banking practices

Among the critical actions of Canada’s banking sector is its move towards sustainable finance to promote sustainable economic growth and financial system stability. In fact, the country’s Big Five banks have committed to the transition to net-zero emissions by 2050 as support.

In addition, eight Canadian banks are members of the Net-Zero Banking Alliance, a UN-convened initiative made up of leading banks to align their financial activities with net-zero emissions by 2050. Banks are continuously introducing new green products and services to respond to consumer demand for sustainability, such as co-branded credit cards and paperless bank statements.

Barriers to Digital Transformation in Financial Services

Banks in Canada and worldwide are striving for a smooth digital transformation journey. This modern progress, however, is impeded by several barriers. Here are some digital transformation challenges faced by banks in 2024.

1. Implementing technology overhaul

One major barrier for banks today is the need for a comprehensive technology overhaul. What is a technology overhaul? This refers to the process of updating, upgrading, or replacing existing tech systems and infrastructure (e.g. replacing outdated hardware with a new cloud-based solution).

A 2024 study identified legacy systems as a primary obstacle to digital transformation. The average age of core banking systems in use across such institutions is over 15 years, with some systems dating back to the early 2000s. This outdated infrastructure not only limits the ability to deploy new digital solutions but also poses tech integration challenges.

2. Facing security issues at scale

Cybersecurity remains a critical concern as banks adopt more digital solutions this year and the next. In 2023, the Canadian Anti-Fraud Centre received 63,519 reports from 41,988 cyberattack victims, amounting to $569 million in losses. This involved several forms of cybercrime, such as data breaches, phishing scams, and malware and ransomware attacks.

Experts say that companies that choose not to update their cybersecurity software are the most vulnerable, as cyberattacks get worse. In the 2023-2024 risk outlook of the Office of the Superintendent of Financial Institutions (OSFI), cyberattacks against Canadian financial institutions are said to be increasing in both frequency and sophistication.

3. Breaking down silos

Organizational silos are another major hindrance to effective digital transformation in banking. Such internal silos can also hinder collaboration between departments. Ultimately, this leads to fragmented customer experiences as different departments use disparate systems that do not integrate well.

Many banks are starting to implement cross-functional teams, yet the transition remains slow. On top of that, efforts to break down silos also come with another set of challenges. These include cultural resistance, inadequate change management strategies, and lack of incentives to prevent operating in isolation.

Top Technologies Used in Canadian Banking and Finance

As Canada’s banking sector undergoes a profound digital transformation, several technologies are reshaping the industry. Listed are some leading technologies driving transformation in Canadian banking and finance:

1. Artificial Intelligence (AI)

Artificial Intelligence (AI) is revolutionizing banking and finance industries, in Canada and worldwide, by enabling more precise, data-driven insights and automating complex processes.

In 2023, Canada launched the Voluntary Code of Conduct on the Responsible Development and Management of Advanced Generative AI Systems. Such voluntary commitment aims to support the development of a responsible, robust AI ecosystem in Canada. The federal government committed $2.4 billion in Budget 2024 to secure Canada’s advantage in advanced generative AI systems.

In addition, the country’s stringent compliance requirements make AI-driven solutions essential for tasks like Anti-Money Laundering (AML) processes. In the SOR/2023-194 amendments of Canadian AML regulations, effective 2024, financial institutions are advised to implement AI solutions for advanced pattern recognition in monitoring transactions. Integrating AI into operations helps banks remain compliant.

2. Cloud Computing

Cloud computing refers to the on-demand access to a shared pool of configurable computing resources, including servers, databases, storage, and applications. Canadian banks are increasingly adopting this tech delivery model to accelerate the provision and release of such resources with minimal management effort or service-provided interaction.

In November 2023, the Government of Canada (GC) updated its Cloud Adoption Strategy, which is focused on the concept of cloud-smart procurement and governance. The update offered clarity on how departments identify the locations for their workloads and applications such as enterprise data centres (EDCs) hosted on-premises by Shared Services Canada and public clouds operated by hyper-scale cloud service providers.

Cloud solutions in Canadian banking also play a critical role in regulatory compliance. For instance, data privacy regulations specific to Canada, like the Personal Information Protection and Electronic Documents Act (PIPEDA), are driving banks to partner with cloud providers that offer data residency options within Canadian borders.

3. Blockchain

Blockchain is one of today’s leading technologies, which refers to the digital, often public ledger consisting of records called blocks. These blocks are used to securely record transactions across multiple computers. Canadian banks use this technology to accelerate transactions and store data on a secure blockchain network.

The Standing Committee on Industry and Technology recognized that blockchain technology is currently transforming Canada’s digital landscape. Globally, the blockchain market size is expected to reach $1.2 billion by 2030. Cryptocurrency and digital assets like NFTs use blockchain technology.

4. Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is a game-changer for Canadian banks looking to enhance operational efficiency by automating repetitive tasks. Financial institutions have implemented RPA for functions like data reconciliation, loan processing, and compliance reporting. But beyond simple task automation, banks integrate RPA with AI to enable intelligent automation (to process unstructured data).

Moreover, as Canadian banks face compliance demands from the Office of the Superintendent of Financial Institutions (OSFI), RPA bots help ensure accuracy and consistency in regulatory reporting. RPA bots can also help banks save up to 30% on average in operational expenses.

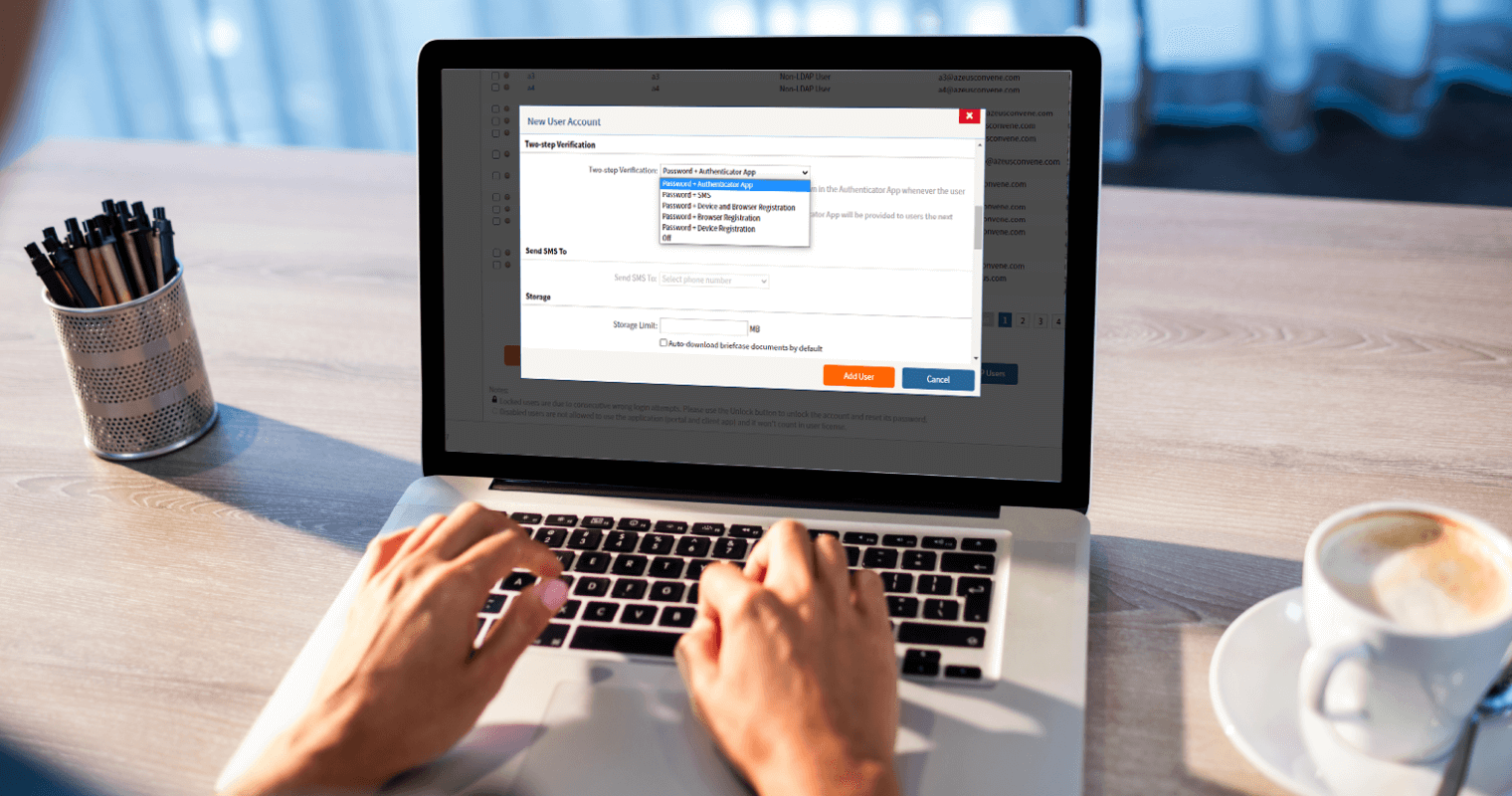

5. Board Portals

Board portals are becoming an essential tool in Canadian financial governance. They enable banks to securely manage board communications, document sharing, and compliance. With the provisions of the Canada Business Corporations Act (CBCA) for accurate, comparable financial statements and data protection, board portals offer secure and centralized access to sensitive information for bank directors.

On top of that, such software enables banks to review audit trails and collaborate on policy decisions in real time. Some board portals also include advanced meeting features such as secure document management, agenda creation, live voting, and task tracking. Others even come with AI capabilities for better meeting insights and automation.

Three Benefits of Digital Transformation in Banking

There’s no question how digital transformation completely elevated the game in the finance industry, particularly in banking. Below are the benefits of digital transformation in banking:

1. More personalized banking

Today, banks are using advanced analytics and AI-based solutions to provide tailored, flexible pricing options — completely deterring way from fixed pricing. These are typically applied to loan interest rates, credit card pricing, bank fees, deposit interest rates, and transactional banking fees.

Besides pricing, technology also enables banks to accurately analyze customer interaction data and behavior. Therefore, guiding them in developing and delivering personalized services. Banks can now analyze new users’ activity on their apps and websites to offer personalized banking experience.

Moreover, the availability of digital channels made it easier for banks to streamline the onboarding and verification of new customers. Customers, on the other hand, can now open accounts and manage their finances online with 24/7 access.

2. Payment modernization

Customers always expect easy, fast, and secure transactions with their banks. With the right technology, banks can now modernize their payment processes — offering real-time person-to-person (P2P) and person-to-business (P2B) transactions. Not only does this enhance payment accuracy but also facilitates a better customer experience.

Many banks also take advantage of APIs, integrating them for seamless connections between an instant payment network and their actual systems. Hence, ensuring a more secure and fast transaction. Through digital transformation, banks also get to upgrade their core systems to support multiple payment networks and types, as well as migrate to cloud-based infrastructure to improve scalability.

3. Streamlined banking operations

Another benefit of digital transformation in banking is the automation of routine tasks and processes for the staff and boards. Hence, improving the bank’s operational efficiency with minimal human error. Instead of being bogged down by manual processes, banks can instead focus on strategic initiatives.

These include back-office processes such as data mining, adjudication, fulfillment, and document processing — which are all typically error-prone and time-consuming. Board portals, for instance, are an effective tool for banks to secure confidential information, such as customers’ personal data and other critical documents of the bank.

Streamline Your Bank’s Digital Transformation with Convene Board Portal

Canada’s banking sector is witnessing a technological evolution driven by the need to meet regulatory standards, improve customer experience, and optimize their operations. But besides AI tech and cloud solutions, Canadian banks are increasingly investing in board portals — reflecting the country’s commitment to secure, data-driven decision-making and governance.

Convene is one of today’s leading board portals for banks and financial services in the country, and worldwide. The software is equipped with comprehensive security and document management features to further safeguard sensitive financial data.

Security features such as data encryption, audit trails, multi-factor authentication, and role-based access control allow banks to protect both corporate and client information, may it be at rest or in transit. Centralization, processing, and controlled distribution of financial documents can be done via Convene Board Portal. Some document management features that banks can utilize are version control, annotation and e-signing, and document search and retrieval.

Learn more about Convene’s features and how it can help your bank transition to a better, digital workspace. Book a demo with us today.

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.