In recent years, the global business environment has been fraught with unpredictability. Recent crises — ranging from geopolitical conflicts and economic downturns to high-profile cyberattacks — have illuminated the consequences of inadequate risk preparedness.

In the 2024 report from Allianz Risk Barometer, cyber incidents, and regulatory and political risks are among the top global risks for businesses, causing billions in losses. Additionally, the Global Risks Report 2024 from the World Economic Forum highlighted pressing risks that are expected to escalate into material crises:

- 66% of respondents cited extreme weather events,

- 53% on AI-generated misinformation and disinformation,

- 46% on societal and political polarization, and

- 39% on cyber threats.

Amid such a backdrop, companies worldwide are ramping up their efforts to enhance their risk management frameworks. Enterprise Risk Management (ERM) has emerged as a practical approach to identify and manage risks across an organization. Unlike traditional risk management which often operates in silos, ERM integrates risk considerations into day-to-day operations.

Learn more about how ERM helps businesses safeguard their operations, and why getting a certification matters.

What is Enterprise Risk Management?

Enterprise risk management or ERM refers to the structured process of planning, organizing, managing, and monitoring organizational activities to minimize risks, both internal and external. This approach is also used to create a basket of risks that might impact the business – positively or negatively.

An effective ERM process can be vital to the organization’s strategic plan. ERM, however, requires ongoing refinement as risks constantly emerge and evolve. Such risks may be financial, operational, compliance, reputational, and cybersecurity.

ERM frameworks such as those developed by the Committee of Sponsoring Organizations of the Treadway Commissions (COSO) and the International Organization for Standardization (ISO 31000), provide guidelines and principles to ensure effective implementation. Statistics suggest that the ERM market is expected to reach $6.59 billion by 2028.

Why Enterprise Risk Management Matters

The importance of ERM extends beyond risk management to shaping a strategic framework for business success. Some reasons why ERM is indispensable include:

- Protecting reputation and stakeholder trust: ERM helps systematically address risks that threaten a company’s reputation, such as cybersecurity breaches, ethical lapses, or environmental impacts.

- Supporting sustainable growth: ERM equips organizations to adapt to rapid changes in the external environment, including technological advancements, geopolitical instability, and climate change.

- Enabling regulatory readiness: ERM ensures compliance with evolving laws and standards, mitigating the risk of operational shutdowns or costly penalties.

- Facilitate cross-functional collaboration: ERM integrates risk management into all areas of a business (e.g. finance, operations, IT, and compliance) to ensure risks are not managed in silos.

Rising Demand for Risk Management Experts

The surge in risk complexity has also translated into heightened demand for skilled risk professionals. According to the U.S. Bureau of Labor Statistics (BLS), demand for risk management specialists is projected to grow by 16% by 2032 — far outpacing the average for other IT occupations.

Industries such as finance, healthcare, energy, and technology are specifically keen on hiring ERM experts. Depending on experience and location, the average salary for risk management specialists can range from $50,000 to $120,000.

While a career in ERM is challenging, it has never been in more demand across every sector globally. As employment for ERM specialists continues to rise, certification has emerged as a critical differentiator.

What do risk management specialists do?

A risk management specialist is a professional responsible for identifying, assessing, and mitigating potential risks that can negatively impact the business. Their key responsibilities include:

- Perform risk assessments using both quantitative and qualitative methods (e.g. root cause analysis, scenario analysis).

- Evaluate risks based on their potential impact using risk matrices, heat maps, and financial models.

- Develop frameworks and controls to mitigate high-priority risks, ofen leveraging standards like ISO 31000 or COSO ERM.

- Monitor compliance with industry regulations and internal policies to avoid legal penalties.

- Create and test contingency plans to prepare for crises, such as cyberattacks, economic downturns, or natural disasters.

10 Best Enterprise Risk Management Certifications

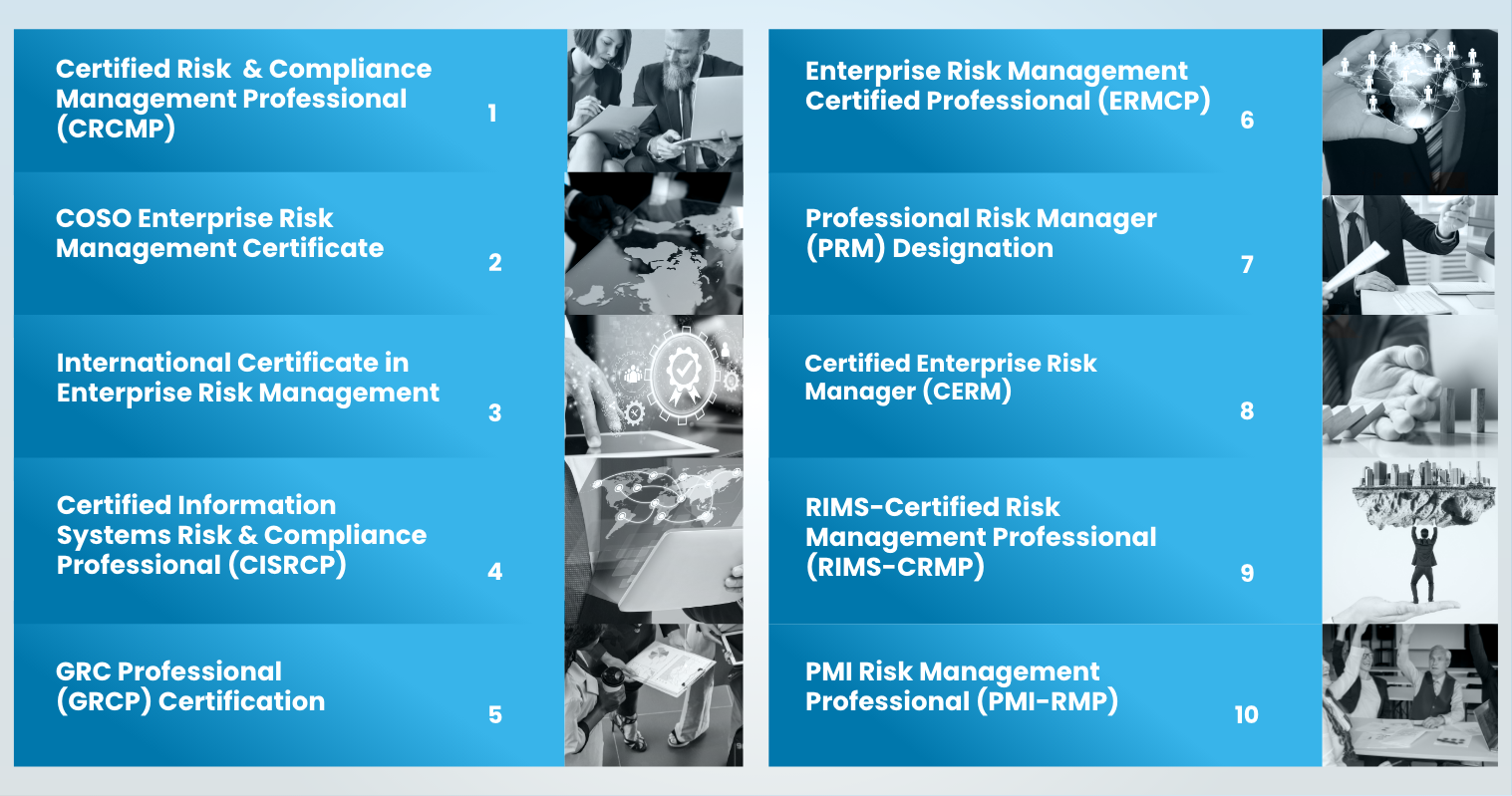

There are multiple risk management certifications for organizations and individuals to take—each differs in their area of concentration. It is also crucial to consider the risk management certification cost of each, as pricing can vary depending on the provider and course’s depth. Here are the top risk management certifications to consider:

1. Certified Risk and Compliance Management Professional (CRCMP)

Issuer: International Association of Risk and Compliance Professionals (IARCP)

Description: The CRCMP provides necessary knowledge in managing risk and compliance within financial, governmental, and corporate entities. It also focuses on best practices for implementing risk management frameworks and compliance programs in line with international standards.

Requirements: Pass a mandatory online exam that covers risk and compliance theories, policies, and case studies. No formal prerequisites are required, but industry experience is recommended.

Best for: Early-career ERM specialists, or those transitioning into enterprise risk and compliance management roles.

Cost: $297

2. COSO Enterprise Risk Management Certificate

Issuer: Committee of Sponsoring Organizations of the Treadway Commission (COSO)

Description: This risk management certification focuses on the COSO ERM framework, and covers principles of governance, risk appetite, and performance management.

Requirements: Complete a self-paced online or in-person enterprise risk management course, followed by a proficiency exam. A basic understanding of enterprise risk concepts is necessary.

Best for: Intermediate ERM professionals who seek structured knowledge of the COSO framework.

Cost: $1,499 – $1,799

3. International Certificate in Enterprise Risk Management

Issuer: Institute of Risk Management (IRM)

Description: This certification covers the foundations of ERM, including risk identification and control techniques. It prepares candidates for advanced risk management qualifications.

Requirements: Complete the IRM’s enterprise risk management course and pass an online exam. No prior experience in risk management is required.

Best for: Beginners in ERM or professionals building further specialization.

Cost: $3,182 (Standard Rate), $2,863 (Member Rate)

4. Certified Information Systems Risk and Compliance Professional (CISRCP)

Issuer: International Association of Risk and Compliance Professionals (IARCP)

Description: CISRCP focuses on IT governance, information security risk management, and compliance. The program also covers how U.S. and EU regulations, like the GDPR, work together to guide global compliance. It also tackles key GDPR principles such as “data protection by design and default”.

Requirements: Completion of an exam that assesses knowledge of IT risk and compliance frameworks. No specific prerequisites are required.

Best for: ERM specialists working in IT or information systems who need to integrate ERM practices.

Cost: $297

5. GRC Professional (GRCP) Certification

Issuer: OCEG (Open Compliance & Ethics Group)

Description: GRCP certifies understanding of Governance, Risk, and Compliance (GRC) principles, and the ability to integrate these domains into organizational processes.

Requirements: Completion of OCEG’s training program and passing the GRCP exam. No prior experience is mandatory.

Best for: New and experienced ERM professionals who want to explore GRC integration into advanced ERM.

Cost: Vary widely depending on OCEG’s global training partner (usually starts at $500 and up).

6. Enterprise Risk Management Certified Professional (ERMCP)

Issuer: Enterprise Risk Management Academy (ERMA)

Description: This enterprise risk management certification covers advanced ERM practices, focusing on strategic risk management, performance alignment, and leadership. It also tackles practical applications of ERM concepts in real-world scenarios.

Requirements: Candidates must complete ERMA’s training and pass an exam. Industry experience in risk management is typically required.

Best for: Seasoned ERM specialists, with more than 4 years of experience, aiming to master strategic ERM leadership roles.

Cost: $599

7. Professional Risk Manager (PRM) Designation

Issuer: Professional Risk Managers’ International Association (PRMIA)

Description: A rigorous program focusing on financial risk management, including quantitative methods, liquidity risks, and risk modeling techniques.

Requirements: Candidates must pass a series of exams within a two-year period, and score 60% or higher on each test. Retaking of exams are allowed 60 days from the date of the last test.

Best for: ERM specialists with a focus on financial risk.

Cost: $175 (Member and Non-member)

8. Certified Enterprise Risk Manager (CERM)

Issuer: American Association for Investment and Financial Management (AAIFM)

Description: CERM offers practical knowledge for designing and implementing ERM frameworks, covering strategic, operational, and financial risk management.

Requirements: Completion of training programs and passing the certification exam. Candidates must have a bachelor’s degree in any field or at least two years of work experience related to risk management.

Best for: Mid-career ERM specialists or managers wanting structured expertise.

Cost: $460

9. RIMS-Certified Risk Management Professional (RIMS-CRMP)

Issuer: Risk and Insurance Management Society (RIMS)

Description: RIMS-CRMP is the only risk management certification accredited by the American National Standards Institute under ISO/IEC 17024:2012. It covers strategic and operational risk management, including risk analysis and mitigation techniques.

Requirements: Candidates must have relevant education and experience (bachelor’s degree + 3 years in risk management or 7 years without a degree), and pass a proctored exam.

Best for: Seasoned ERM professionals seeking globally recognized credentials.

Cost: $375 (RIMS Member), $525 (Non-member)

10. PMI Risk Management Professional (PMI-RMP)

Issuer: Project Management Institute (PMI)

Description: The PMI-RMP certification validates a professional’s ability to identify and assess project risks while maximizing opportunities. It is designed for those specializing in risk management within project environments.

Requirements: Completion of the 115-question exam, and must meet the following sets of certification requirements:

- Set A: A secondary degree (high school diploma, associate degree, or equivalent) plus 36 months of project risk management experience and 40 hours of risk management education, or

- Set B: A four-year degree (bachelor’s degree or equivalent) with 24 months of project risk management experience and 30 hours of risk management education.

Best for: Intermediate to advanced ERM professionals who focus on risk management in project settings.

Cost: $364 (Member), $670 (Non-member)

Course details, especially costs, are subject to change. For the most up-to-date information, visit the official website of the course provider, or contact them directly.

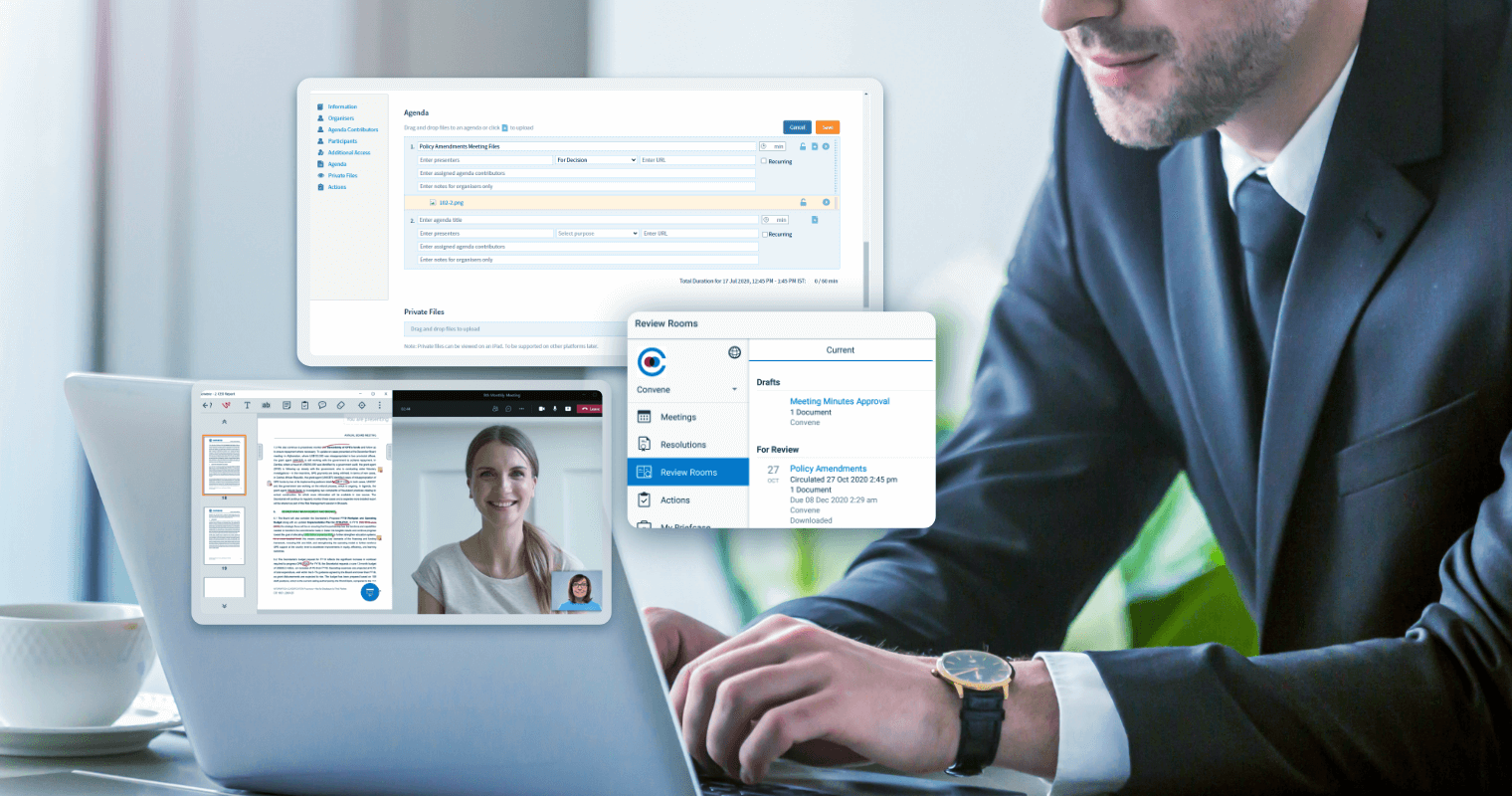

How Convene Board Portal Supports Enterprise Risk Management

An effective ERM framework equips organizations to navigate uncertainties and safeguard their assets. But how can your ERM process go from functional to transformational? ERM specialists and technology can work hand-in-hand to achieve this. Enter Convene Board Portal—a secure, intuitive platform that can supercharge your risk management strategy.

Convene is a cutting-edge solution designed to support a structured approach to risk management. It enables organizations to centralize risk-related data, improve board-level discussions, and maintain compliance. Convene can redefine your ERM process with its:

- Ironclad Security: Your data is protected by top-tier encryption and advanced access controls, so your sensitive ERM insights stay safe.

- One-Stop Repository: Keep all your ERM documents organized and accessible in Convene’s Document Library and Review Room.

- Built-in Audit Trails: Automatically document every action, providing a clear record for accountability and regulatory compliance.

With Convene, you can manage risks more efficiently while staying ahead of compliance demands. Elevate your ERM game and book a free demo today!

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.