Audit committees are vital in every company as they are involved in maintaining the company’s financial stability. One of their responsibilities is to prevent any misconduct in auditing and fraud in the company’s finances. Thus, they are crucial in gaining the trust and confidence of investors and stakeholders.

Audit committees have an impact also on the board’s plans and decisions. By understanding the roles and responsibilities of audit committees, the whole board and management can expect how the company can achieve better financial status and corporate governance, leading to the company’s growth.

What is the function of audit committees?

An audit committee is formed with the specific purpose of overseeing the financial aspect of the company. It is made up of a select group of board directors, who are collectively responsible for various financial processes within the company. With that being said, they are heavily involved in financial reporting, audits, internal controls, disclosures, risks, and compliance. Given the nature of an audit committee, most of its members are experts in finance and accounting.

Audit committees work hand-in-hand with several teams within the company, particularly internal auditors and the management team. They also work with people outside the company, such as independent auditors and regulatory bodies. These people can aid the audit committee in developing processes, refining the internal controls, making crucial decisions, and ensuring compliance of the company with the regulations.

What are the audit committee’s responsibilities?

The Sarbanes-Oxley Act of 2002 (SOX) established the role of audit committees in upholding corporate governance. The Act has been developed in relation to restoring the trust and confidence of shareholders in the US companies which sets out the President’s Ten-Point-Plan and the SEC’s response and action towards corporate scandals.

SOX gives executives, especially the CEO and CFO, accountability by certifying financial reports. This ensures that executives will have ownership over the company’s financial statements and discourage any form of fraudulent activity.

SOX mandates the independence of the audit committee from the management — emphasizing the committee’s essence in every company. The Act strengthens and expands audit committees with the goal of enhancing corporate governance. It also holds the audit committee responsible for the selection, oversight, and compensation of the company’s independent auditor. The committee must cooperate with the management, internal auditors and the independent auditor during discussions on financial statements.

Beyond its main duty of overseeing financial activities, below are the other responsibilities of audit committees:

- Work alongside the management and board to properly execute governance responsibilities. For instance, they are the ones who formulate processes to effectively manage complaints regarding accounting practices.

- Superintend and evaluate internal auditors as well as report performance evaluations to the board.

- Provide insights and ensure the integrity of the company’s financial statements, making sure these are clear, sound, and factual. They are also responsible in evaluating financial reports especially on crucial matters and management decisions.

- Conduct legal review of disclosures, SEC filings, and earnings releases, ensuring the accuracy of the financial information.

- Initiate effective internal controls and fine-tune existing ones. They should be able to review and drive financial initiatives such as accounting and regulatory initiatives.

- Uphold the integrity of the company by creating airtight ethical policies. The committee must be proactive in identifying and preventing any form of conflict of interest and fraudulent activities in compliance with regulations.

- Work together with other committees in assessing and analyzing financial risks the company might encounter. They must understand and address the repercussions of such risks on financial reporting.

How can governance tools help audit committees?

The effectiveness and success of audit committees depends on numerous factors. One is transparency which is key to shareholder trust and confidence. The committee must consist of members with diverse experience and expertise and an eager chairperson to facilitate meetings and collaboration. Lastly, the committee must establish strong communication and rapport within themselves and with the people they work with.

Although these factors drive effective audit committees, the committee needs more help to achieve better communication and boost their productivity. One solution is to adopt a solution that can help manage the audit committee’s workflow and processes efficiently.

A digital governance software has unique features that aid in real-time dissemination of information, automated meeting preparation, digitized documentation, and clearer communication channels among and beyond the audit committee. Such features will lead to thorough legal and financial reviews, risk and conflict resolution, and simplified financial reporting. Ideally, the digital governance software has the following features and tools:

Meeting Tools

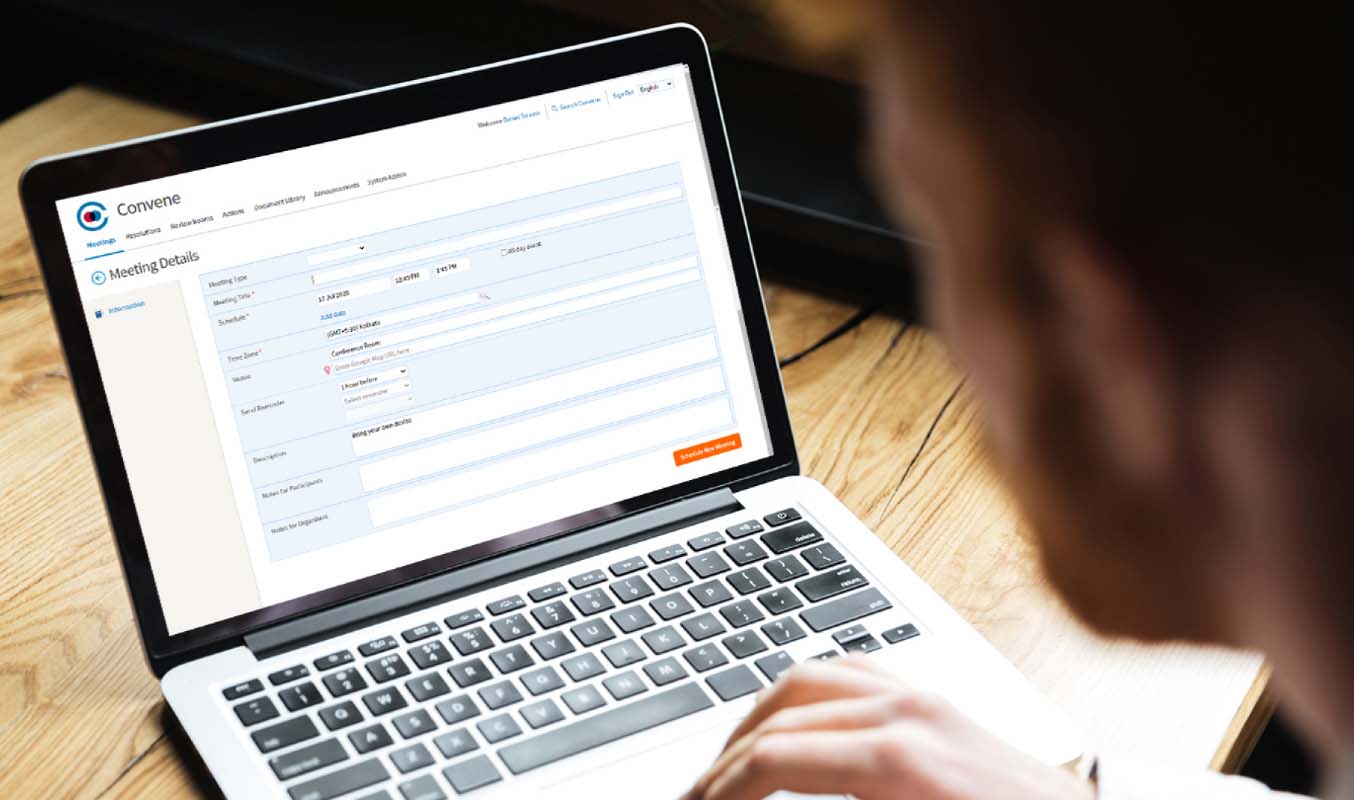

The meetings of the committee have predetermined frequency and schedule, as stated in the audit committee charter. The digital governance software is equipped with meeting tools that streamline the meeting cycle of the audit committee. It lets them effortlessly organize and schedule meetings and create a comprehensive agenda for their meetings. Notably, financial statements can easily be attached to the meeting materials using the software. It also allows for the faster circulation of meeting materials even when there are last-minute amendments.

It also aids the committee to communicate better in less time in sharing the annotated documents within the team. The voting feature lets the committee vote on resolutions in real-time and shows the results for transparency afterward. Meeting minutes can also be easily generated and circulated in the software, which helps in revisiting action items.

Document Repository

The audit committee deals with various sensitive reports and documents. Thus, it needs a centralized and secure repository to store the financial reports, financial statements, and the committee charter. The digital governance software is integrated with a repository for safekeeping documents and updated regulations for compliance. Important and frequently used documents can be easily located and retrieved in the repository. The latest versions of documents can be updated in the repository while keeping track of the version history for transparency. Past meetings can also be archived in the repository, allowing for quick access whenever needed.

To prevent unwanted access, the committee can customize access control permissions, may it be for the whole committee, independent auditors, or the management. Permissions may be managed on a folder, subfolder or individual document level, allowing the committee to uphold the integrity and confidentiality of the documents. Through the software, the committee can control who can access meeting materials, especially for independent auditors who are not part of the company.

Review Rooms and E-Signature

The amount of materials that the audit committee needs to review can be unmanageable. The digital governance software has review rooms where documents can be collaborated and approved on. This holds committee members accountable in making sure that the financial statement and reports are accurate and verified. Several annotating tools are available to communicate suggestions and concerns before approval. Such insights will help the audit committee devise the best courses of action and speed up the decision-making process.

Once done reviewing, the audit committee members can affix their e-signatures to effortlessly sign and approve reports and documents anytime and anywhere. This allows committee members to be equipped with a complete suite of digital signature tools that lets them affix signatures and sign documents in and out of meetings with just a single tap. Moreover, the status of documents for sign-offs can be tracked and monitored in the digital governance software. This addresses the bottleneck of sign-offs during urgent approvals through sending follow-ups and reminders.

Actions Tracking and Audit trails

Aside from the collective deliverables of the audit committee, each member of the audit committee has their own set of deliverables. It is best practice to monitor deliverables to ensure that no task is left undone. The digital governance software will aid in the monitoring of assignments for each committee member with the action items tracking feature. This gives each member ownership of their respective tasks and assignments.

The audit trail can aid in documenting revisions and who has accessed sensitive board documents, especially financial statements. This allows the committee to easily trace discrepancies and potential malicious activities. The audit trail shows the whole history of actions of all members in the system for transparency.

Better Governance with an All-in-One Digital Governance Software

The audit committee is crucial as it oversees the financial reporting and auditing processes — ensuring the management and auditors are up-to-date with the company’s financials.

Empower the audit committee and beyond with Convene. Convene is a digital governance software equipped with powerful features and tools that aid audit committees in their auditing, meeting, and reporting needs. Beyond the committee, Convene helps boards and committees to conduct reviews, pass resolutions and make decisions.

Build trust and confidence within and beyond your business by promoting transparency, accountability, security, and compliance. Learn more about the benefits of Convene for your board and committees.

Darren is the Content Director at Convene. Driven by his passion for content writing and knowledge of digitalization, he takes pride in providing content that helps drive digital transformation. Over the years, he has written blogs related to digital meetings, board management, and modern governance.