According to the American Hospital Association, there are currently 6,120 hospitals in the United States, with over 5,000 classified as community hospitals and a little over 1,000 designated as for-profit facilities. Although both are regulated by the same authorities and adhere to the same requirements, they differ significantly in how they operate.

Non-profit hospitals are usually owned by charities or communities that reinvest earnings locally. For-profit hospitals, on the other hand, are owned by corporations or investors who seek financial gains.

This article aims to provide a deep dive into their differences and the pros and cons of nonprofit vs for-profit organizations.

What is a for-profit healthcare organization?

Much like any corporation, for-profit healthcare facilities are owned and managed by publicly traded companies. They often prioritize generating profit for their owners or stakeholders while ensuring proper adherence to healthcare standards. These entities may include hospitals, clinics, and healthcare service providers that function as businesses. As profitability drives their operations, it heavily influences the board’s decision-making and overall operations.

One of the largest for-profit healthcare systems in the US is the Hospital Corporation of America (HCA Healthcare) with 169 hospitals around the country.

Ownership and Taxation

As mentioned, for-profit healthcare organizations’ ownership typically rests with private investors or corporations. As such, they are subject to corporate income tax on their profits, similar to other commercial enterprises. Profit distribution may occur through dividends to shareholders or reinvestment into the organization for growth and expansion.

Advantages and Disadvantages of For-Profit Healthcare Organizations

Here we list down the pros and cons of managing for-profit medical services organizations, starting with the pros:

Advantages

1. Access to Funding – For-profit hospitals have easier access to capital than their non-profit counterparts. They can attract investment from shareholders, borrow funds from financial institutions, or issue bonds to finance expansions, upgrades, and other strategic initiatives.

2. Financial Sustainability – Because for-profit healthcare organizations aim to generate profits, they focus on financial sustainability. This involves careful financial management, revenue generation, and cost control measures to ensure long-term viability and profitability.

3. Efficiency and Innovation – For-profit hospitals often prioritize efficiency and innovation to remain competitive. With a profit motive driving them, they are incentivized to find more efficient ways to deliver healthcare services and innovate in areas such as technology, procedures, and patient care models. For example, they may invest in state-of-the-art facilities, adopt advanced medical technologies, and develop online portals to facilitate easier transactions for patients. Another important investment they can consider is board portals to streamline their board management.

4. Adaptability – For-profit hospitals often have greater flexibility and adaptability in responding to changes in the healthcare landscape. They can quickly adjust their strategies, services, and operations to meet evolving patient needs, market demands, and regulatory requirements.

5. Patient-Centered Responsiveness – Due to them being revenue-oriented, for-profit hospitals are often more responsive to patient preferences and demands. They may offer a broader range of services, amenities, and conveniences to attract patients and enhance patient satisfaction.

6. Incentives for Cost Control – Profit-driven medical services organizations have incentives to control costs while maintaining quality to maximize profits. This can lead to efficiencies in resource allocation, streamlined processes, and effective utilization of healthcare resources, ultimately benefiting patients by potentially lowering costs without compromising quality of care.

Disadvantages

1. Profit over Patient Care – In for-profit healthcare facilities, there may be a tendency to prioritize profit-making activities over patient care. This can manifest in decisions that put cost-cutting measures or revenue-generation strategies at the expense of patient well-being.

They may also prioritize services and specialties that yield higher profits, potentially neglecting essential but less profitable areas of healthcare. As a result, this can cause uneven distribution of healthcare resources and limited access to certain medical services within the community.

2. Higher Costs and Pricing – Many disadvantages of for-profit medical services organizations stem from money, which often has a direct impact on patients. For-profit hospitals may have higher costs and pricing structures compared to their non-profit counterparts, which can lead to inflated healthcare costs for patients.

Consequently, hospitals may selectively admit patients based on their ability to pay or the profitability of their treatment. This practice, known as cherry-picking, can result in the exclusion of patients who require costly or complex treatments but may not be financially lucrative.

3. Limited Transparency and Oversight – Compared to private entities, nonprofit and public hospitals typically face more stringent regulatory requirements regarding financial disclosures and community benefit reporting to maintain their status. For-profit hospitals may not be subject to the same level of scrutiny and specific mandates, resulting in less transparency. This makes it challenging for patients and regulators to assess the quality of care, financial practices, and ethical standards within these institutions.

4. Impact on Healthcare Workforce – Profit-driven practices can impact the healthcare workforce by prioritizing cost-cutting measures, such as reducing staffing levels or limiting employee benefits. When this happens, it can lead to increased workloads, burnout among healthcare professionals, and ultimately, diminished quality of patient care.

What is a not-for-profit healthcare organization?

Nonprofit healthcare organizations are driven by their commitment to provide free services to the community and make healthcare accessible to everyone without the intent of making a profit. Charitable foundations and religious groups find these institutions and may have affiliations with medical schools.

Because they run based on some charitable model, they do not have the financial obligation to return value to shareholders, unlike their for-profit counterparts. However, they are accountable to their donors and the community for their use of resources and for abiding by their stated missions. The Department of Veteran Affairs (VA) is known to be the largest nonprofit health system in the US, with a network of over 160 hospitals nationwide.

Ownership and Taxation

Nonprofit hospitals and clinics are considered charities by the Internal Revenue Service (IRS), so they are typically exempt from federal and state income taxes due to their charitable status. Instead of distributing profits to shareholders, surplus funds are reinvested to support patient care, medical research, community outreach, and other philanthropic activities.

Advantages and Disadvantages of a Nonprofit Healthcare Organization

Governing nonprofit healthcare organizations have a fair share of pros and cons. Here are some key items:

Advantages

1. Healthcare Advocacy – Nonprofit healthcare organizations make a meaningful and positive difference in people’s lives by providing essential healthcare services to those in need. Whether providing medical care to underserved populations, researching to advance medical knowledge, or advocating for healthcare policy changes, nonprofits play a vital role in improving healthcare outcomes and addressing public health challenges.

2. Tax Exemption – Not-for-profit medical services organizations are exempt from paying certain taxes, such as federal income tax, state sales tax, and property tax. Because of this exemption, they are able to allocate more resources to their mission of providing healthcare services. It also enables donors to receive tax deductions for their contributions, incentivizing support for the organization.

3. Independent Management – Nonprofits are typically established by founders who are separate entities from the organization. This separation ensures that the organization operates independently and is not subject to its founders’ personal interests or influences. At the same time, it allows the organization to make decisions based solely on its mission and the community’s needs rather than external pressures.

4. Access to Grants – Nonprofit healthcare organizations with 501(c)(3) status have access to a wide range of public and private grants. These grants provide additional funding opportunities for programs, research, and initiatives that support the organization’s mission. Grants can also help expand services, reach underserved populations, and improve healthcare outcomes.

5. Employee Benefits – Despite being nonprofit, healthcare organizations can offer competitive employee benefits to attract and retain talented professionals. Such benefits may include health insurance, retirement plans, paid time off, and professional development opportunities. Offering competitive benefits helps nonprofits attract skilled individuals passionate about the organization’s mission.

At the same time, employees of nonprofits may be eligible for the Public Service Loan Forgiveness (PSLF) program. This federal program forgives the remaining balance on eligible federal student loans after the borrower has made 120 qualifying payments while working full-time for a qualifying employer, such as a nonprofit healthcare organization. This benefit can help alleviate the financial burden of student loan debt for employees dedicated to public service.

Disadvantages

1. Extensive Paperwork Requirements – Nonprofits face extensive paperwork requirements when establishing and maintaining their tax-exempt status. The process often includes submitting detailed documentation to the IRS and other regulatory bodies, such as articles of incorporation, bylaws, financial statements, and annual reports. Compliance with these requirements ensures transparency and accountability in nonprofit operations.

2. Costs of Filing for Nonprofit Status – Achieving a nonprofit status is not as easy as it seems. There are several costs associated with filing for nonprofit status, including application fees, legal fees for incorporation, and ongoing administrative costs for compliance and reporting, which may vary depending on the organization’s size, structure, and location.

3. Requirement for Shared Control – Not-for-profit hospitals are required to have shared control and governance structures. This means decisions are made collectively by a board of directors or trustees rather than by a single individual or entity.

4. Indefinite Measurement of Results – Unlike for-profit businesses that can measure success based on financial profits, nonprofits often measure success based on social impact, which can be more difficult to quantify and communicate to stakeholders.

For-profit vs Not-for-Profit Healthcare Organizations: Comparison

To help you quickly delineate the two, we’ve created a comparison table highlighting the difference between for-profit and nonprofit hospitals, including funding sources, financial objectives, and patient care priorities.

Boost Healthcare Operations with Convene

There’s a higher stake in running hospitals than any other business because you’re not just saving files but people’s lives. Thus, healthcare organizations need board management tools like Convene to ensure that governance and administrative processes are as efficient and effective as possible.

With features like a secure Document Library, healthcare facilities can securely store and access sensitive documents, such as patient records, financial reports, and regulatory compliance documents. This ensures confidentiality and streamlines document management processes.

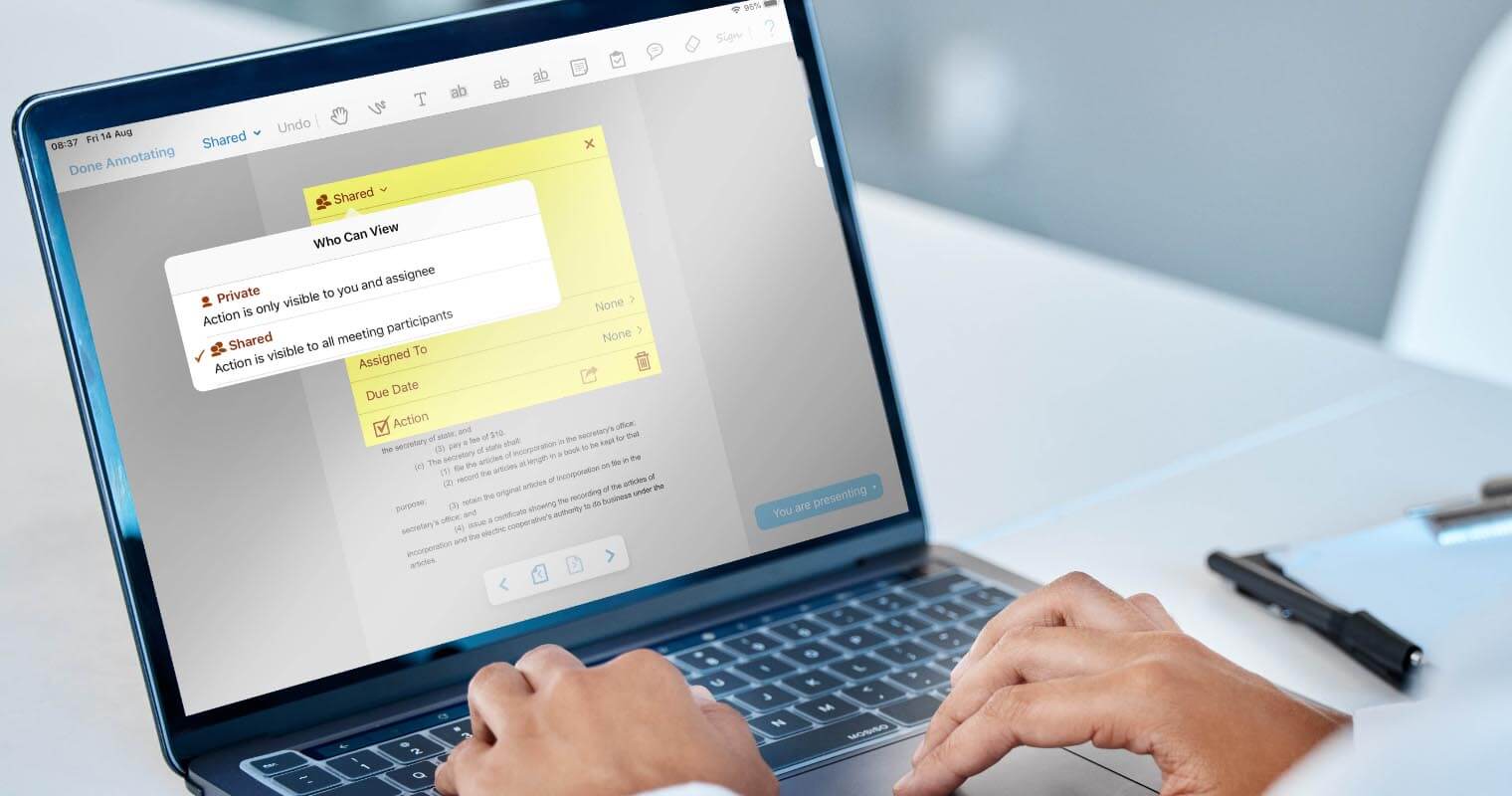

Integrated video-conferencing capabilities enable healthcare boards to conduct virtual meetings seamlessly, facilitating collaboration and decision-making regardless of geographic location. Real-time annotation tools also allow board members to annotate documents during meetings.

Convene’s built-in audit trail provides a transparent record of board activities. This is particularly important for medical services organizations, as it guarantees accountability and compliance with regulatory requirements. Additionally, features such as intuitive voting tools and agenda builder empower healthcare boards to simplify meeting processes and maximize productivity.

These are just some of the things Convene can help your business with. If you want to learn more about Convene’s helpful features, explore this page or book a demo today.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.