Have you ever wondered how businesses operate independently from their owners? How do they enter into agreements, conduct business transactions, or even handle legal issues without the need or presence of a company executive? A legal entity is what makes this possible.

Legal entities exist to, one, help protect the personal properties of the business owners, and two, ensure business continuity. In this reading, you can explore the importance of a legal entity, its types, and its rights and responsibilities. You’ll also learn how to form a legal entity for your organization.

What is a legal entity?

A legal entity or a ‘legal person’ refers to any individual or organization that has legal obligations to its stakeholders, isolated from the personal liabilities of its owners or ‘natural persons.’ These obligations usually include signing contracts, owning assets, incurring liabilities, and most importantly, being a party in a lawsuit.

Think of a legal entity structure as a separate person – except it isn’t a physical one. It’s a legal construct created to separate the business’s finances and liabilities from its owners’ personal finances. This means that if the company gets into trouble, the owner’s personal assets, like their homes or cars, are protected, and cannot be used as collateral to cover the business’s debts.

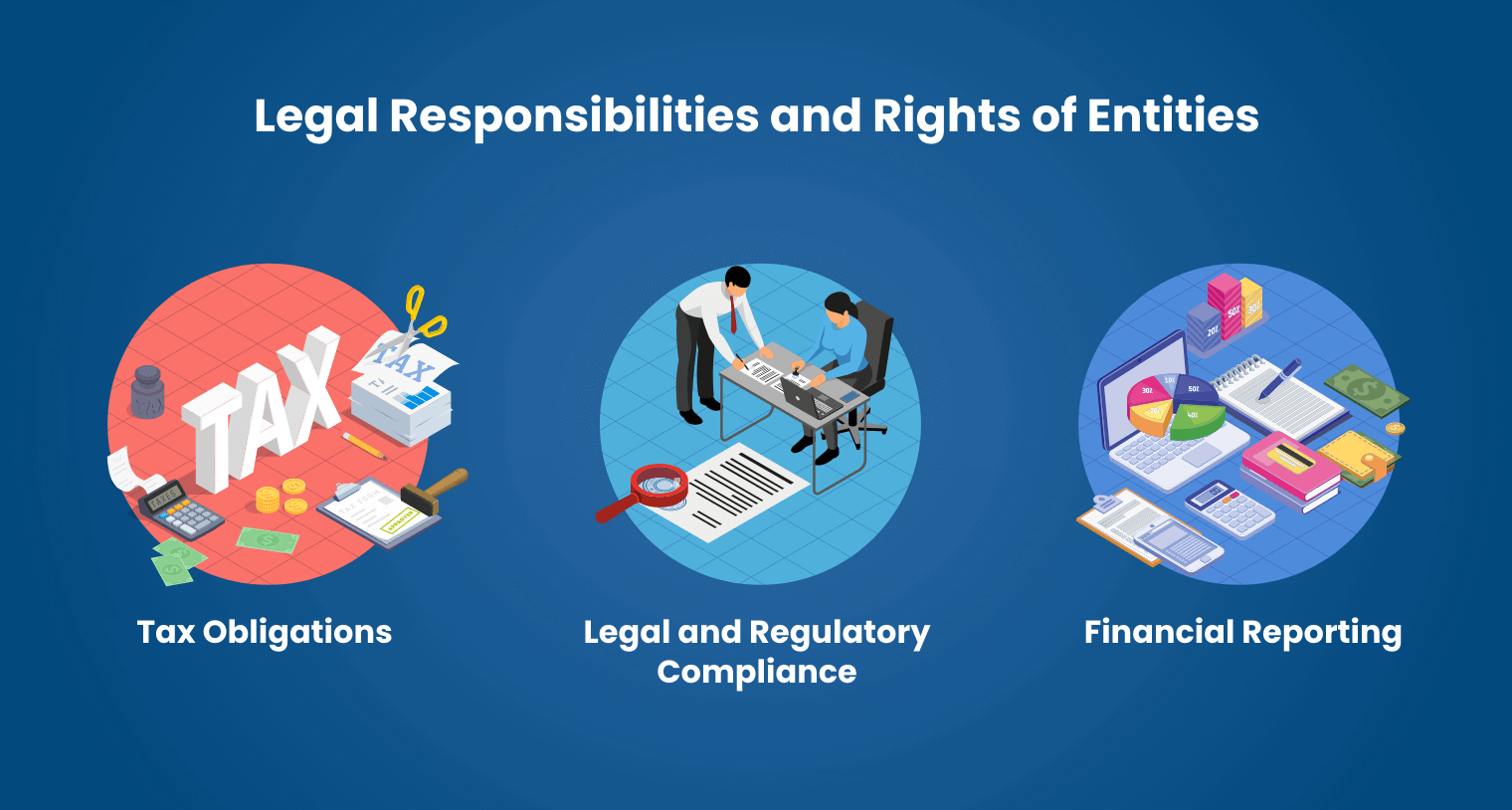

Legal Responsibilities and Rights of Entities

As a legal person, an entity is obligated to file taxes, comply with regulations, and maintain accurate financial records. Specific responsibilities may vary per state, but they generally include:

- Tax Obligations: Filing tax returns, paying taxes, and adhering to tax regulations.

- Legal and Regulatory Compliance: Meeting industry-specific regulations and obtaining necessary licenses. Also comprises obeying all applicable laws, including contract, employment, and consumer protection laws.

- Financial Reporting: Maintaining accurate financial records and statements.

What is a legal entity identifier?

Every legal entity is given a one-of-a-kind twenty-character code called a Legal Entity Identifier or LEI. This means no two entities have the same identifier. This code acts like a global barcode for businesses, linking each entity to its financial information.

By tying financial transactions to specific entities, LEIs help reveal complex ownership structures and identify potential risks early on. As a standardized identifier, LEIs also encourage transparency among legal entities and other organizations and streamline due diligence processes. Once issued, LEI cannot be used by any other entity. So, even if a legal entity closes down, its LEI will go down with it.

If anyone wants to verify the legitimacy of an organization, they can refer to the Global LEI Index, a free, publicly accessible resource.

Types of Legal Entities

The type of legal entity you choose can greatly influence your business structure, liability, and tax obligations. Among the many business structures available, the most common legal entity examples include:

Sole Proprietorships

A sole proprietorship is the simplest type of legal entity, where a single individual owns and operates a business. For example, the owner of a one-person Etsy shop is considered a sole proprietor. In this setup, there is no legal distinction between the owner and the business, so the owner is personally liable for all debts incurred. There are pros and cons to this type. On the plus side, it is easier to establish, and decision-making is quicker. However, since there is no separation between the legal and natural person, the risks are higher and the access to capital is limited.

Partnerships

This type of legal entity structure involves two or more individuals teaming up to run a business together. There are two kinds of partnership: general and limited. In a general partnership, everyone shares responsibilities and liabilities equally. A limited partnership, on the other hand, has general partners with total liability and limited partners whose liability is restricted to their investment. Bloomberg L.P. is a good example of this kind. Partnerships offer shared decision-making and pass-through taxation, where profits are taxed at the individual partners’ rates.

Corporations

Is a corporation a legal entity? Yes. A business that has the legal rights of a person and may have many owners is a corporation.

To further clarify, a corporation is a separate legal entity created under state law. Distinct from its owners or shareholders, it offers limited liability protection but may also require legal entities to face increased regulatory burdens.

Corporations can be C-Corporations (Apple Inc., Starbucks Corp.), the standard corporation structure subject to corporate taxes and offering unlimited growth potential through stock sales, or S-Corporations (Ace Hardware Corp.), which allow for pass-through taxation but restrict the number of shareholders. Their ability to raise capital by selling shares makes corporations a popular choice for large businesses. However, since profits are taxed at both the corporate and shareholder levels, one problem that organizations might face along the way is double taxation.

Limited Liability Companies (LLCs)

A Limited Liability Company (LLC) is a type of legal entity that combines elements of both corporations and partnerships, offering the limited liability protection of a corporation without the penalty of double taxation. LLCs also have the flexibility to choose how they are taxed—either as a partnership or a corporation—making them a popular choice for all types and sizes of businesses. IBM Credit LLC, a subsidiary of IBM, is one popular example of this type of entity.

Nonprofit Organization

A nonprofit organization is a legal entity created for purposes other than generating profit for owners or shareholders. Instead, nonprofits focus on serving a social, educational, charitable, or public benefit. One known example is the American Red Cross. They often qualify for tax-exempt status, meaning they do not pay federal income tax on money earned related to their mission.

Nonprofits are governed by a board of directors, who oversee the organization’s activities and ensure compliance with regulations. While they rely on donations, grants, and fundraising, their limited liability protection shields the personal assets of board members and officers from the organization’s debts or legal liabilities.

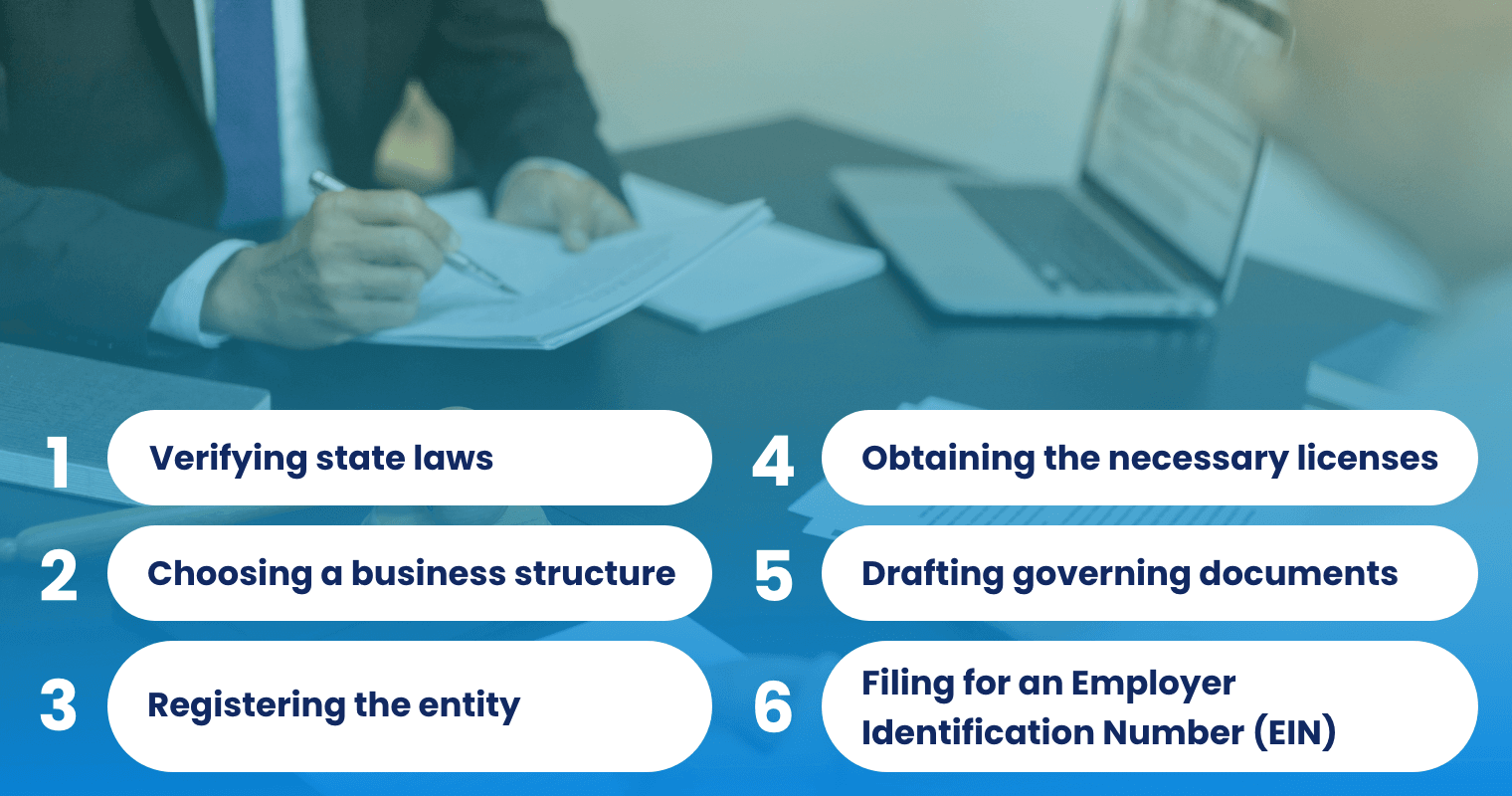

How to Form a Legal Entity

There would be specific actions depending on the type of entity and the jurisdiction, but the steps on how to become a legal entity typically include:

- Verifying state laws: Start by determining prevailing laws that will govern the business depending on your location, and build your business structure from there.

- Choosing a business structure: Determine which type of legal entity, whether a sole proprietor or a corporation, among others, best fits your needs.

- Registering the entity: Once decided what your business structure would be, the next step is to register the entity. Before you proceed with the process, make sure that your chosen business name is eligible for use. Check with the US Patent and Trademark Office (USPTO) and your state’s secretary of state to avoid conflicts and consider registering your domain name and trademarks for additional protection. Most entities must be registered with the appropriate state authorities as well. This may involve filing articles of incorporation (for corporations) or articles of organization (for LLCs).

- Obtaining the necessary licenses: Depending on the business type and, again, the location at which you want to build your legal entity, additional permits or licenses may be required. Make sure to list down and tick off all the necessary authorizations to avoid legal issues.

- Drafting governing documents: Corporations require bylaws, while partnerships may need a partnership agreement to outline the rights and responsibilities of each partner.

- Filing for an Employer Identification Number (EIN): To establish your business legally, you’ll need to obtain an EIN, often referred to as a business tax ID number. This number is essential for tax purposes, similar to a Social Security Number of individuals. Registering for an EIN involves filing with the Internal Revenue Service (IRS) and may require setting up a business banking account. For businesses that opt to register at the federal level, a federal employer identification number (FEIN) is required. It’s advisable to consult with legal and financial professionals throughout this process to ensure compliance with all necessary regulations.

Frequently Asked Questions on Legal Entities

Which type of corporation is owned and operated by the federal, state, or local government?

Also known as a public corporation, this type of corporation is, as the name implies, owned and operated by the government. Examples include the United States Postal Service (USPS) and Amtrak.

What are the characteristics of a corporation as a legal entity?

A corporation is a legal entity that can raise capital by selling shares, provide limited liability protection to its shareholders, and operate independently of its owners. However, it also faces regulatory requirements and potential double taxation.

Describe what it means for a corporation to have legal status as an entity.

It simply refers to the corporation being recognized by law as a separate legal person. This status allows the corporation to conduct business independently of its owners. To achieve legal status, state corporation laws typically require the filing of articles of incorporation, which document the creation of the corporation and outline the rules for managing its internal affairs.

What can a business possibly do to make a legal entity no longer legal or valid?

A legal entity can become invalid if it is dissolved, either voluntarily by the owners or involuntarily by the state, due to failure to comply with legal requirements, such as not filing necessary documents or paying taxes. Additionally, illegal activities or bankruptcy can also result in the loss of legal status.

Optimize Legal Entity Management with Board Software

Establishing and managing a legal entity requires another set of hands on deck. Since it is technically and legally a separate entity from the main organization, it needs a dedicated team to oversee its operations, ensure compliance with regulations, and uphold corporate governance.

Its responsibilities are largely similar to typical workplace duties, including maintaining accurate records, preparing financial statements, and managing reporting requirements. As such, regular meetings, documentation of actions, and transparency in communication are vital to efficiently administer all things related to its management.

This is where board portals come into play. Utilizing board management software like Convene can significantly ease these challenges.

Convene simplifies entity management by providing a centralized platform that digitizes and streamlines your governance processes. Here are some of the key features:

- Centralized Information: All relevant documents and data to manage legal entities are stored in one secure Document Library for easy access and organization.

- Real-Time Collaboration: Board members can share ideas and collaborate on documents seamlessly via live video-conferencing and online and offline annotation tools, both available regardless of location.

- Streamlined Meeting Management: Build meeting agendas, track action items, and document meetings with ease on a single platform, minimizing administrative burdens and accelerating decision-making.

- Enhanced Security: Advanced measures such as multi-factor authentication and role-based permissions ensure that all corporate data is protected at all times. You may also add customizable watermarks to documents to discourage misuse of sensitive material.

Find out what other features Convene has in store for your legal entity. For a more comprehensive walkthrough of our software, book a one-on-one demonstration with our product experts.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.