Pandemic or not, insurance companies aim to securely and efficiently provide financial assurance to the population. To further support this goal, the insurance market has adopted hybrid workplace setup but is now facing challenges in selecting a digital solution that ensures high-level security, increases efficiency, and facilitates governance practices.

This article provides all the answers on how to address the needs of insurance companies to successfully adopt a hybrid workplace with a meeting management platform.

Needs of Insurance Companies in a Hybrid Workplace

Due to the ongoing pandemic, insurance companies have adopted new technologies to efficiently cater to their clients while observing compliance and risk management. Today, digitalization is no longer a question of what — but a question of how. Insurance companies are now open to hybrid setups to address the needs of their workforce, as well as board members. However, along with the shift to hybrid setup, financial companies also face multiple issues with their processes, including cybersecurity threats, disorganization, and lack of centralization.

- Cybersecurity Threats — One of the threats that insurance companies face today is the cyber risk or the potential leakage of confidential information through various online attacks. Ransomware events, a form of cyber-attack, increased by 400% in just a span of two years. Such attacks can lead to monetary damages due to data and productivity loss. To remedy this, insurance companies can start investing in robust cybersecurity measures and look for an all-in-one platform.

- Multiple Applications — The use of multiple apps to facilitate board and internal meetings is one of the prominent practices among most companies, and insurance companies are no exemption to that. Be it Zoom or MS Teams, companies choose solutions that are accessible to them online, but using multiple applications just for one meeting takes up too much time. Secure apps protect confidential information, but using an all-in-one platform increases efficiency and productivity among secretaries and board members. While multiple apps are readily accessible, using them in today’s situation also increases cyber risks, which may lead to huge losses among insurance companies.

- Decentralized Process — Hybrid workplace setups have multiple implications. Oftentimes, it offers a flexible workplace setup allowing boards and committees to either work remotely or in the office. This allows insurance companies to observe health protocols against COVID-19, but it also entails a dual workplace setup. With such duality, some finance companies face difficulties in centralizing their processes. Centralized repositories help insurance companies access information, whether online or offline, at home or at the office. A digital repository software ensures that processes and workflows happen in one secure location, removing the need to switch to different apps for different functions.

The sudden shift to hybrid workplace setups has resulted in more risks rather than more benefits as insurers struggle to find an all-in-one digital solution for meetings and resolutions. Insurance companies have always been a people business, and not being able to meet customers face-to-face has presented them with several issues. These issues include meeting customer demands, such as security and efficiency in their transactions. Thus, InsurTech, or the use of technology to create efficient processes using the insurance model, became highly preferred by customers and has disrupted the insurance market during the pandemic. This has created market competition among insurance companies with digital processes and those without.

Insurance companies have experienced multiple risks in the digital space. Now, more than ever, they need to establish a working framework that best suits their internal processes to meet customer needs. Well-established management processes lead to increased productivity among employees and increased customer satisfaction. Insurance companies that cannot manage their risks are less likely to be trusted by customers. The refusal to switch to a centralized all-in-one platform increases the risk of failing to comply with relevant laws and regulations in the insurance market. Using multiple apps to accomplish one task will also make them vulnerable to cyber-attacks and will cause several losses.

How Meeting Management Platforms Can Address the Needs of Insurance Companies

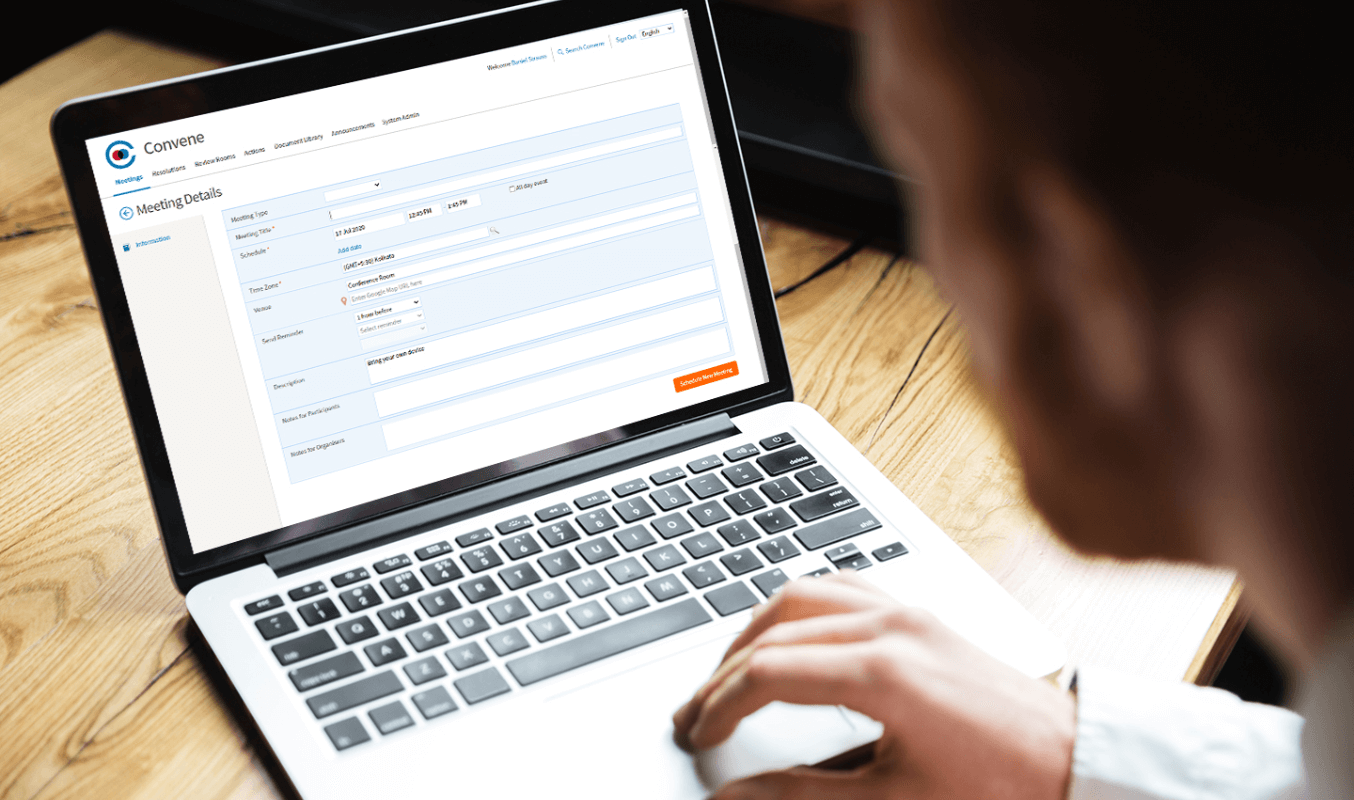

Among the many choices in the market for internal collaboration, meeting management platforms provide the maximum benefits in the shortest time. It also provides a one-stop platform where insurance companies can manage their meetings, search and retrieve documents, approve proposals, review important files, and sign-off amendments on their own devices. A meeting management platform is a global tool that has many names in the market, such as board management software, board meeting software, governance software, repository software, and digital corporate secretarial tool, among many others.

As a digital corporate secretarial tool, this platform allows secretaries to define workflows in one centralized location, removing the need to transfer to multiple apps for one meeting. A meeting management software also enables the board and committees to exercise governance and decision-making despite working remotely. During this time of constant change, financial institutions should choose digital solutions that best fit their current processes. Meeting management platforms or board portals can provide them with the necessary tools to combat cyber threats, disorganization, and mismanagement brought by the sudden shift to hybrid setup.

- Secure — A meeting management software allows insurance companies to observe security and compliance. This software enables insurance companies to meet certain frameworks and regulations. Meeting management platforms have tight cybersecurity measures to ensure that no data leakage will occur and ensure data privacy. Meeting management software provides secure user authentication, device security, automated security alerts, and role-based access controls for users. The banking, financial services, and insurance industry would greatly benefit from using board management portals to strengthen their business management and insurance model.

- Efficient — Meeting management portals are easy to use even for those with little knowledge of online platforms. It has a consistent user interface in any device, with simple and replicable processes for both secretaries and executives. It only takes up a few seconds to create the agenda and schedule meetings with this software, removing the hassle and security risk of using multiple apps to prepare for one meeting.

- Facilitates Good Governance — A digital corporate secretarial tool helps insurance institutions achieve good governance, with features such as Audit Trails for transparency, Meeting Management for equity and inclusiveness, Voting Tools for consensus, and Version Control for accountability. While these features can be found in multiple separate apps in the market, an all-in-one platform that has it all enhances productivity and strengthens security. Secretaries and executives will also be able to easily transition to this type of software, as it only requires a few minutes to get used to its functions.

Security, efficiency, and good governance are just some of the major benefits that financial institutions can achieve with meeting management platforms. Investing in a future-proof technology in today’s situation gives clients the assurance of fund security and safety. A centralized meetings tool helps boards achieve sound and transparent management and leave behind traditional and outdated policies.

Important Features of a Meeting Management Platform

Meeting Management Platforms are needed for conducting remote meetings, especially when board members and directors cannot meet in person. With the pandemic, financial institutions have adopted the hybrid workplace, allowing boards, executives, and employees to plan and meet remotely or in-person while observing health protocols. Flexible working conditions have given insurance companies the freedom to experiment and adjust based on both company and client needs.

At present, most companies have digitalized, paving more ways for insurance agents to reach out to their customers in a fixed and replicable method. Such digitalization is also needed by board members and executives for efficient collaboration. Insurance companies should choose a centralized platform with tight cybersecurity measures and robust collaboration tools to cater to the work from home (WFH) and hybrid setup. Here are some aspects of meeting management software that enable efficiency, security, and good governance:

Flexible Hosting Options

Meeting management platforms offer flexible hosting options such as cloud for Software as a Service (SaaS) and on-premise. Both options offer data security for insurance companies, alleviating the worry about cyber threats. For cloud hosting, data are stored in data centers in your preferred region or location. For on-premise hosting, data are kept and manage on your premises. Both options offer the same powerful functionalities and enterprise-grade security necessary to secure your important data.

User Authentication and Application Security

Meeting management tools have multiple options for user authentication, with layers of application security to ensure that your data is safe. User authentications such as one-time password (OTP) and biometric authentication will assure you that only authorized users can access your environment.

Audit Trail

Audit trails provide data on the transactions that occurred in the meeting software. This gives your system administrators the advantage of being able to view who accessed specific documents and other data.

Document Sign Off

A board management software has Document Sign Off capabilities that give board members the ability to sign and approve confidential documents anytime, anywhere. This removes the long waiting time for approvals and accelerates internal processes.

Annotations

For member collaboration, annotating documents is a must to come up with decisions efficiently. A meeting management platform comes with Annotations for note-taking, highlighting, and underlining. This highly increases collaboration among board members, and ensures easy note-taking for secretaries.

Document Library

Meeting management software for insurance companies comes with a secure Document Library for document management and storage. This repository can contain confidential information, with role-based access control for maximum security.

Live Voting

Corporate meeting portals have Live Voting functions that enable effective collaboration among board members and directors. This will help them come up with actions, decisions, and resolutions anytime during our outside meetings.

Shield Life Limited, a registered life insurance company in South Africa, recently transitioned into a meeting management platform. With this transition, they were able to increase efficiency, circulate resolutions, and transition seamlessly during the pandemic. They chose a solution known for ease of use, which enabled them to transition to paperless meetings in a short period.

Innovation and Meeting the Needs of the Changing Workspace

Although some companies are still reluctant to adopt new processes, financial institutions are expected to follow regulations amidst the changing workspace. While face-to-face interactions are limited, the BFSI sector needs to consistently innovate its processes to continuously align with its existing business framework. Having established the important features of a meeting management platform, insurance companies should also consider future-proof features that will give them the advantage today and in the coming years.

Here are some innovative functions which meet the changing workspace:

- Flexible Integrations — A meeting management portal with flexible integrations allows you to integrate multiple apps into one platform. If your company needs to retain the use of multiple apps, a centralized meeting management software may just be the key. For example, if your company utilizes Microsoft Teams for communication, a meeting tool that caters to MS Teams users is the right choice. Flexible integrations with email systems, multi-factor authentication methods, and audio-video conferencing solutions will help financial institutions in conducting successful meetings.

- Audio-Video Conferencing — Insurance companies will benefit from a repository software that has Audio Video Conferencing features integrated within the platform. If you’re currently using other Audio-Video Conferencing platforms such as Google Meet, Zoom, WebEx, or other external apps, your company should choose a meetings management portal that allows you to connect to these apps whenever the need arises.

- Customizability — Future-proof meeting management platforms support flexible hosting, branding, and customizability to meet insurance companies’ needs. Flexible hosting gives you the freedom to choose between cloud or on-premise, depending on how you want to store your data. Branding, on the other hand, gives insurance institutions the ability to brand their meeting solution with their logo and templates. In addition, customizability in this software enables insurance companies to fully own their environment, personalize permissions, and manage users, meetings, and documents on one platform.

Apart from those mentioned, a meeting management software provider with a clear vision of their solution’s path will also help you innovate even when the pandemic ends. Your procurement team should seek meeting portals with a product roadmap. Product roadmaps give you a clear vision of what you are investing in. A solution that constantly innovates and improves to keep up with the changing workspace will solve your problems today.

To fully adjust to the ongoing pandemic, adopting the hybrid workplace setup is the key to a safe and successful working environment for board members and employees. Bring your internal meetings to the next level with a meeting management platform that takes care of your pre- to post-meeting needs while ensuring good governance and compliance with regulations. Convene meets the needs of insurance companies to facilitate seamless and secure meetings.

Learn more about how you can digitalize your insurance company workplace with Convene.

Trisha is a Bid Writer at Convene with a strong background in IT and the arts industry. She continues to grow her writing portfolio with articles on cybersecurity, environmental protection, and board meeting management. Trisha earned her Bachelor of Arts in Communication Arts degree from the University of the Philippines, Los Baños.