Nonprofit organizations run on donations and volunteer hours. As they often have limited budgets, they cannot afford unexpected expenses that could drain their resources. That’s why having nonprofit board insurance is crucial in emergencies, such as legal claims or lawsuits. It provides the financial protection needed to safeguard the organization and its members’ assets and ensure it can continue its mission without disruption.

This article will delve into what you need to know about nonprofit D&O insurance, including its types, benefits, and other considerations.

What is a board of directors insurance for nonprofits?

Board of directors insurance for nonprofit organizations, more commonly known as directors and officers (D&O) insurance, is a type of liability insurance that provides financial protection for current, former, and future directors against claims arising from decisions and actions taken within their roles. It typically covers legal fees, settlements, and other costs associated with lawsuits alleging wrongful acts, like wrongful interference with a contract, negligence, mismanagement of funds, or breaches of fiduciary duty.

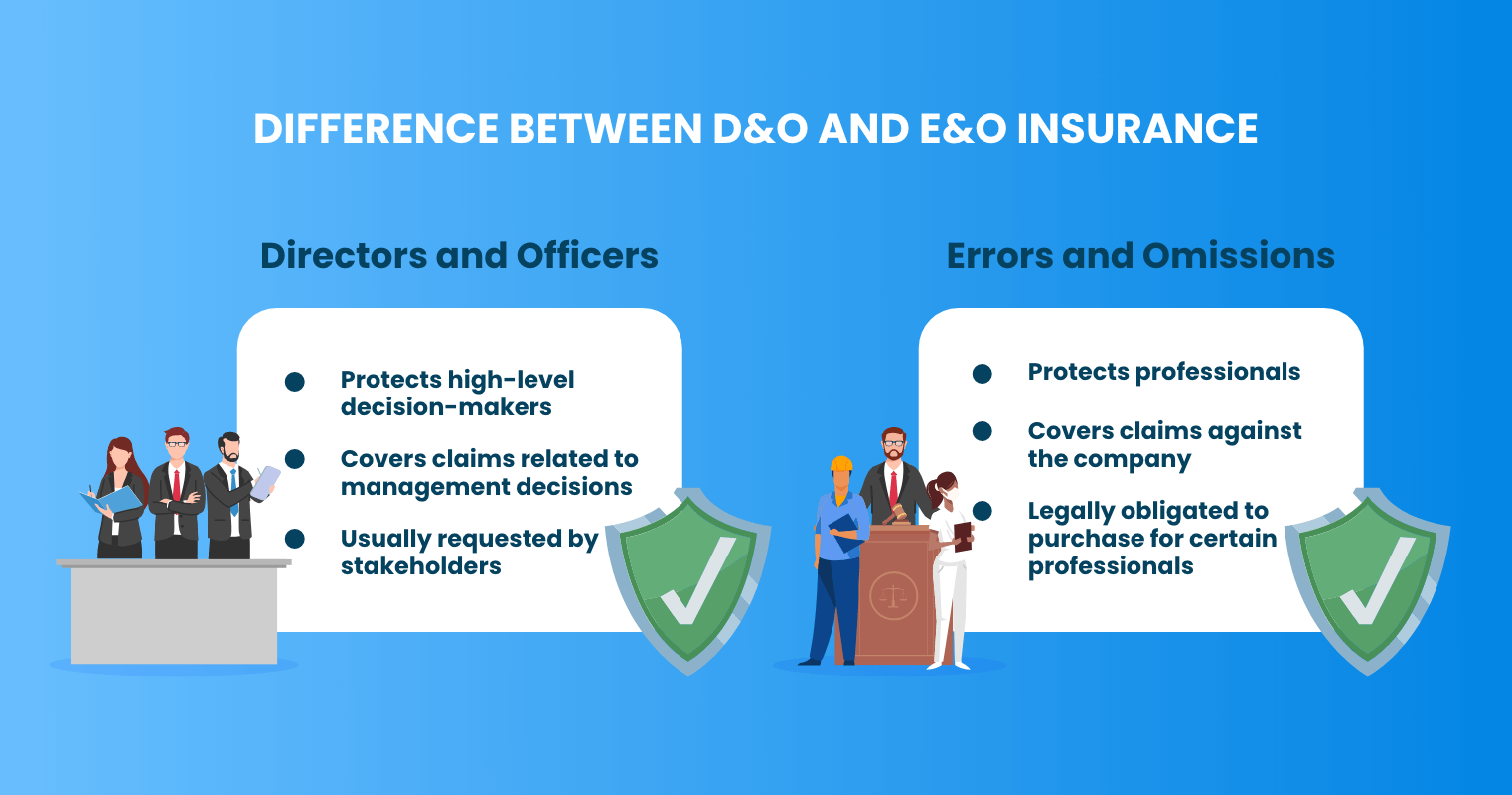

What is the difference between D&O and E&O insurance?

Nonprofit D&O insurance protects high-level decision-makers from claims related to management decisions. D&O insurance is never compulsory but is highly recommended and usually requested by stakeholders prior to accepting board positions or entering into significant contracts. Errors and Omissions (E&O) insurance, on the other hand, covers claims against the company for mistakes it made or services it failed to provide. While not mandatory for everyone, certain professionals, such as attorneys, contractors, and medical professionals, may be legally obligated to purchase an E&O insurance policy before starting their practice.

Understanding the Federal Volunteer Protection Act

In 1997, the Federal Volunteer Protection Act (FVPA) was enacted to limit the risks of volunteering in nonprofit organizations and governmental entities. Under the FVPA, volunteers are shielded from liability for harm caused by their acts or omissions on behalf of these organizations, provided they were acting within the scope of their responsibilities and the harm was not caused by willful or criminal misconduct.

However, this protection may not be sufficient to fully protect directors and officers as it mainly supports minor negligence and does not cover the legal costs of defending a lawsuit, which can be significant even if the individual is not held liable.

Why You Should Prioritize Nonprofit D&O Insurance

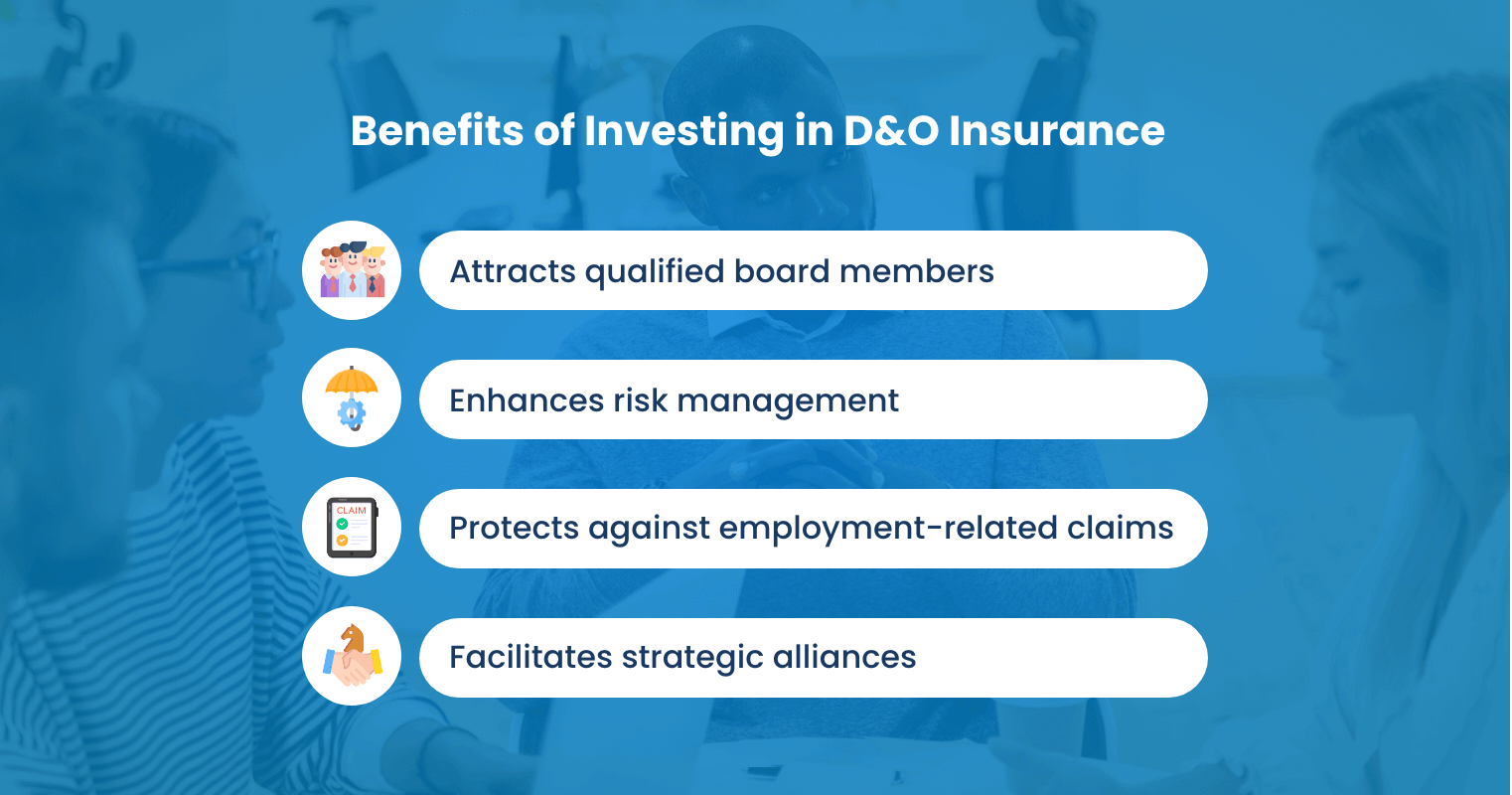

Relying solely on FVPA to protect your directors and officers from risks and liabilities is not enough; D&O insurance is essential for peace of mind. Like other types of insurance, directors and officers insurance for nonprofit organizations mitigates any financial risks that could impede operations. That reason alone should be enough to obtain a policy, but here are other important benefits of investing in D&O insurance:

Attracts qualified board members

Knowing they are protected against personal financial repercussions can attract experienced and skilled individuals to serve on the board. With liability concerns mitigated, they can concentrate on their duties without fear or distractions, leading to better decision-making. This mirrors the way the community views the nonprofit. Donors, volunteers, and other stakeholders may trust the organization more, knowing its leadership is protected.

Enhances risk management

Effective risk management is vital to a nonprofit’s sustainability. D&O insurance contributes by identifying potential risks before they become a problem. Because obtaining insurance often involves a thorough risk assessment, nonprofits can gain insights into areas where they may be vulnerable. As a result, they can plan their strategies to mitigate these risks. This proactive approach not only helps prevent potential issues from escalating but also ensures the organization operates smoothly and remains stable in the long term.

Protects against employment-related claims

Nonprofits, like any other employer, can face claims related to employment practices. According to a Nonprofit Risk Management Center report, 85% of nonprofit insurance claims filed under D&O liability policies are employment-related. In such cases, D&O insurance can be bundled with Employee Practices Liability Insurance (EPLI) or an EPLI extension can be appended to cover claims for:

- Wrongful Termination: Protects against claims that an employee was wrongfully terminated.

- Discrimination: Covers claims related to alleged discrimination based on race, gender, age, disability, or other protected characteristics.

- Harassment: Provides coverage for claims of workplace harassment, ensuring that such allegations do not financially cripple the organization.

Facilitates strategic alliances

Partnering with other businesses, whether for sponsorships or shared advocacy efforts, is the bread and butter of a nonprofit organization. That’s why investing in a D&O insurance policy is extremely important.

Firstly, it demonstrates stability and effective management, which enhances the nonprofit’s appeal as a reliable partner to collaborate with other organizations, funders, and governmental bodies. Secondly, by mitigating risks associated with leadership decisions and governance practices, D&O insurance reduces uncertainty for potential partners, thereby increasing their willingness to engage in partnerships. Lastly, having D&O insurance boosts the nonprofit’s negotiation power during discussions and agreements, assuring that the organization is protected from potential liabilities that could arise from its operations.

Types of Directors and Officers Insurance Nonprofit Coverage

D&O insurance policies vary in coverage depending on the insurer, but a typical one is divided into three insuring agreements:

- Side A Coverage: This type of coverage protects individual board members and officers when the organization refuses or is financially unable to repay them. This usually happens when the company has declared bankruptcy.

- Side B Coverage: Under Side B, the company is insured and will be reimbursed for indemnifying its board members and officers. This coverage is more commonly known as corporate reimbursement.

- Side C Coverage: Also known as entity coverage, this type of insurance coverage protects the entire organization from certain liabilities. For example, if the company is sued for financial mismanagement, the insurer will cover all the legal costs.

Depending on the resources and risks of the nonprofit, they can opt to avail one or a combination of these types of coverage.

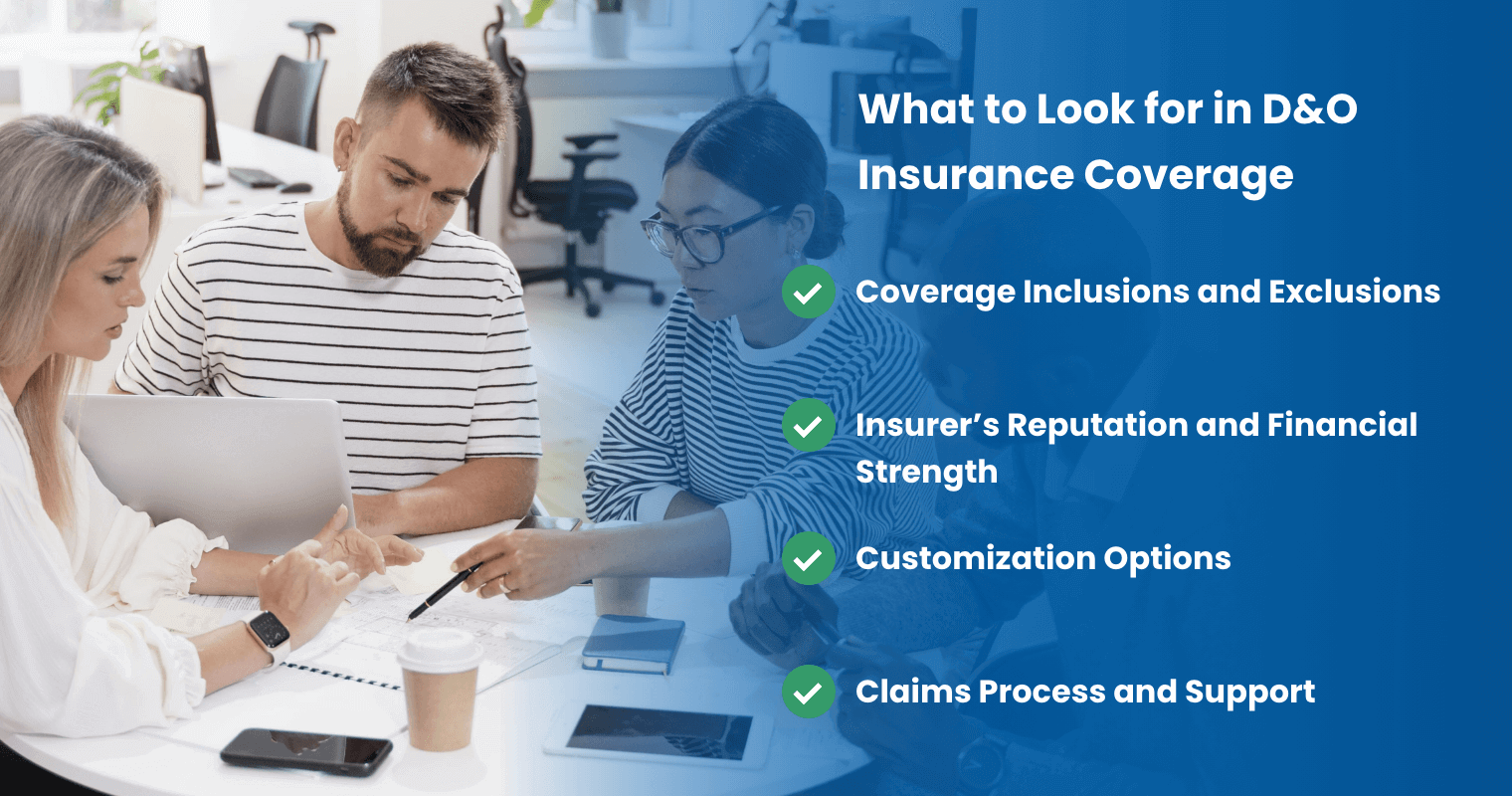

What to Look for in D&O Insurance Coverage

There are many things to consider when choosing a board of directors insurance for nonprofit organizations. From understanding the specific features and limitations to selecting a reputable insurance provider, each item below plays a critical role in ensuring protection for your nonprofit:

Coverage Inclusions and Exclusions

A comprehensive directors and officers insurance nonprofit policy should include protection against claims arising from managerial decisions, employment practices, fiduciary duties, and regulatory compliance. However, it’s equally important to be aware of exclusions that may leave the organization vulnerable. For instance, many policies exclude coverage for fraudulent or criminal activities, intentional misconduct, and certain types of discrimination claims. You must decide and select a policy that caters to your organization’s size and needs. A more prominent non-profit may need a policy with a higher limit or cover more incidents as they are involved in higher-risk activities.

Insurer’s Reputation and Financial Strength

An insurer’s ability to honor claims hinges on its financial stability. One way to assess this is to look into rating agencies, like AM Best and S&P Global, that provide scores that reflect an insurer’s financial health. Additionally, considering reviews and testimonials from other nonprofits can provide practical insights into an insurer’s reliability and customer service quality. These firsthand accounts can highlight how effectively an insurer handles claims and supports clients, offering a more comprehensive view of what to expect beyond the ratings.

Customization Options

A one-size-fits-all policy may not adequately address specific organizational risks. Policies that offer flexibility regarding coverage limits, deductibles, and additional endorsements can better align with a nonprofit’s unique needs. For instance, a nonprofit focusing on environmental advocacy might need coverage that includes liabilities related to environmental regulations and public relations crises. Customizable policies ensure that the insurance coverage is both comprehensive and cost-effective.

Claims Process and Support

Efficient and supportive claims handling can significantly mitigate the stress and financial strain during a legal challenge. Nonprofits should prioritize insurers known for their responsiveness, clear communication, and comprehensive support services. Swift and fair claim resolution is essential to prevent prolonged disputes that could drain organizational resources and divert attention from mission-critical activities. By selecting insurers with a proven track record in claims management, nonprofits can ensure they receive timely assistance and maintain focus on their core objectives.

Frequently Asked Questions (FAQs)

Does D&O insurance cover all nonprofit employees?

No. D&O insurance coverage explicitly protects the organization’s directors and high-level executives against claims related to their decisions and actions in their official capacities. For the rest of the members of the nonprofit, particularly employees, EPLI may be more relevant. Unlike D&O insurance, EPLI specifically covers claims brought by employees alleging wrongful employment practices. This can include allegations of discrimination, harassment, wrongful termination, and other employment-related issues.

Is the directors and officers insurance nonprofit mandatory?

While D&O insurance is not legally required for nonprofit organizations in most jurisdictions, it is highly recommended given the benefits nonprofits can gain from investing in one.

Is D&O insurance expensive?

The cost of nonprofit D&O insurance can vary depending on factors, such as the organization’s size and activities, coverage limits, deductible amounts, and claims history. Typically, $1,000,000 of coverage costs between $5,000 and $10,000 annually for organizations with less than $50 million in revenue. Costs increase with higher revenue and additional coverage options.

If the price seems high, just think of it this way: the financial protection and peace of mind it offers outweigh the costs in the long run.

Empower Nonprofit Governance with Convene

When it comes to protecting your nonprofit and the people who lead it, D&O insurance is an essential investment. However, obtaining the right D&O insurance can be a long, complex process. This is where nonprofit board management software like Convene can make a significant difference.

Convene, one of the leading board portals for nonprofits, can help simplify aspects of the insurance acquisition process through its comprehensive suite of features designed for nonprofit boards. With a secure Document Library, you can safely store and manage all necessary documentation for insurance applications. Real-time video conferencing allows you to consult with insurance providers and board members efficiently and at once, ensuring everyone is on the same page.

During these consultations, live meeting annotation tools enable you to highlight and discuss important policy details. At the same time, the precise audit trail feature of the nonprofit organization software keeps a record of all communications and decisions for accountability. Convene’s intuitive voting feature also makes it easy for board members to promptly approve critical decisions. Finally, the board portal’s integrated e-signature function streamlines the signing of contracts and agreements wherever the members are.

Find out how Convene can empower your nonprofit boardroom by requesting a demo today!

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.