Fundamentally, nonprofits are mission-driven entities, with approximately 10 million existing worldwide. These organizations are geared towards different areas and issues, such as scientific, political, or overall benefit of the public. Unlike for-profit entities, nonprofits reinvest their revenue into furthering their mission rather than distributing profits to owners or shareholders.

Nonprofits vary widely in scope and structure, each operating under distinct legal frameworks and regulatory requirements. But despite this diversity, all nonprofits share a common commitment to advancing social good and serving the community.

Read on and get answers to frequently asked questions about nonprofits, like what does a nonprofit organization mean, what is the primary purpose of a nonprofit organization, and how they get funding.

What is a nonprofit organization?

A nonprofit organization is an entity that is primarily built for socially beneficial or charitable reasons. As they don’t generate profits for private stakeholders or individuals, these entities may be exempt from paying federal income taxes as long as they operate exclusively for purposes set in the Internal Revenue Service’s (IRS) Section 501(c)(3).

But how do nonprofits work? These organizations are organized and operated for different causes, primarily focusing on societal challenges or positive change. Nonprofits undertake programs beneficial for the community or society using the funds given by individuals, governments, or corporations. In the United States alone, over 1.5 million registered nonprofits are advocating for change.

Qualifications and requirements for obtaining a nonprofit organization status may vary. In the US, for instance, the IRS requires an organization to operate exclusively for specific purposes, such as “charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and the prevention of cruelty to children or animals.”

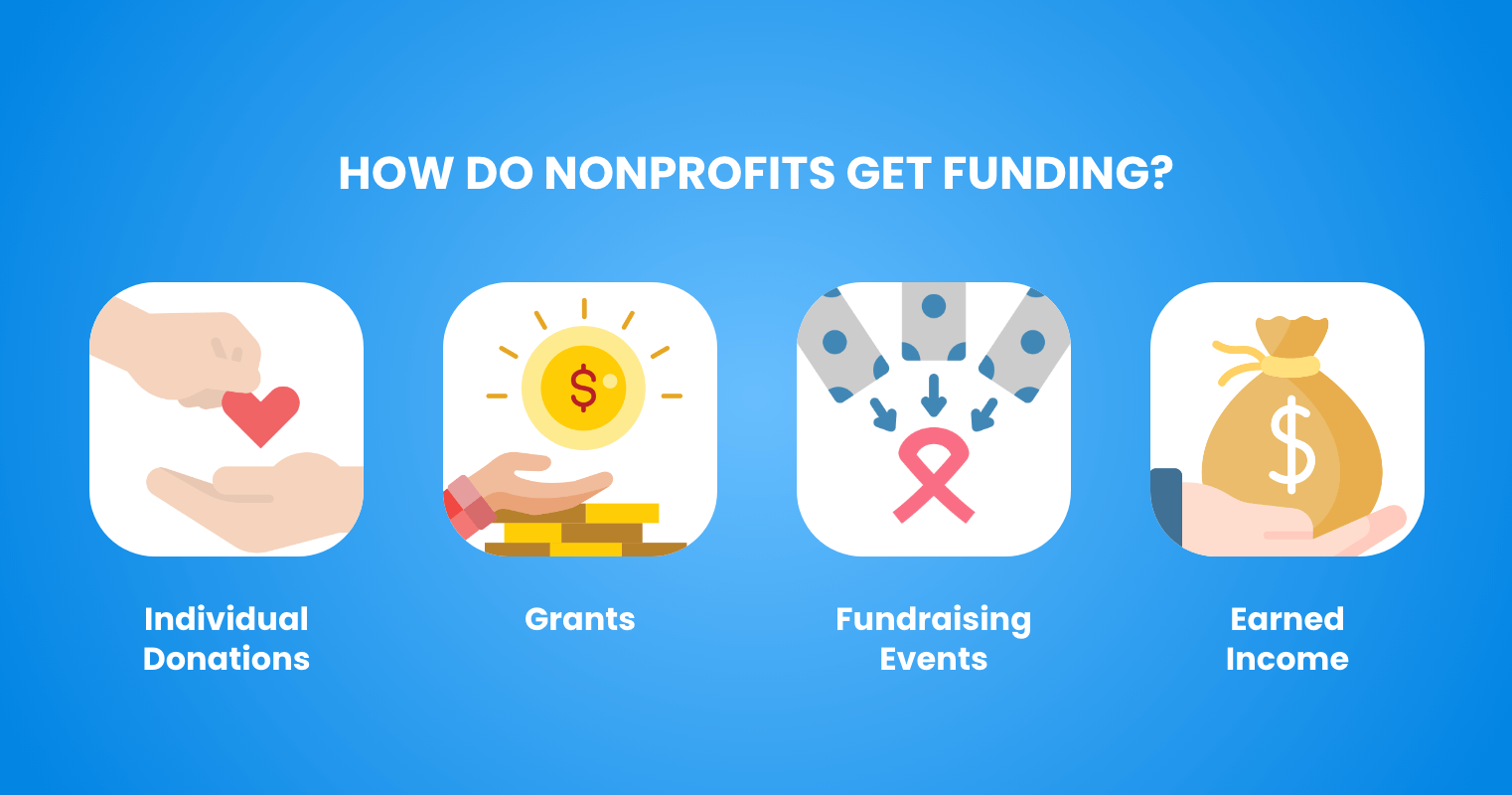

How do nonprofits get funding?

Nonprofits rely on a variety of funding sources to keep their social mission running. Rarely using a single funding source, they typically use a combination of the following:

- Individual Donations: This makes up a significant portion of nonprofit funding, and can be one-time gifts, recurring donations, or bequests. To solicit donations, nonprofits utilize direct mail campaigns, online giving platforms, and major gift programs.

- Grants: Nonprofits often seek grants from government agencies, foundations, and corporations. To qualify for government grants (federal, state, or local), nonprofits must meet specific eligibility criteria and application requirements. As for other grants, nonprofits usually write compelling proposals detailing their causes and budget to apply.

- Fundraising Events: Nonprofits organize these events to raise awareness and secure donations for their cause. These can be upscale events like gala and dinners featuring entertainment or auctions, usually attracting high-value donors. Another example is peer-to-peer fundraising via marathons or charity walks/runs.

- Earned Income: Some nonprofits generate revenue through activities that align with their cause. They can charge fees for specific services (e.g. educational courses, vocational training programs), or sell merchandise (e.g. tote bags, handmade crafts) to generate income and promote their cause.

Unrestricted Funds vs. Restricted Funds

Unrestricted funds are donations that nonprofits can use freely for any purpose, or without the donor’s specific conditions. These can be used for staff salaries, general operating expenses (e.g. rent, utilities, supplies), or unforeseen costs.

Restricted funds, on the other hand, are donor-directed contributions, which means they can only be used for a specific cause the donor supports. These funds include program-specific donations, scholarship aids, or capital project donations.

How do nonprofits pay their staff?

While nonprofits often benefit from volunteer labor, some still hire full-time staff who are paid the same way as for-profit employees. Their compensation is determined by position or experience and might be eligible for performance-based bonuses.

On average, salaries of nonprofits tend to be lower than for-profit’s, particularly for executive positions. Besides monetary compensation, some nonprofits also offer extra benefits such as membership perks, health insurance, and insurance packages.

While nonprofits are exempt from federal unemployment taxes (FUTA), they are still subject to most payroll taxes, including Federal Income Tax Withholding (FITW), State Unemployment Taxes (SUTA), and Social Security and Medicare (FICA).

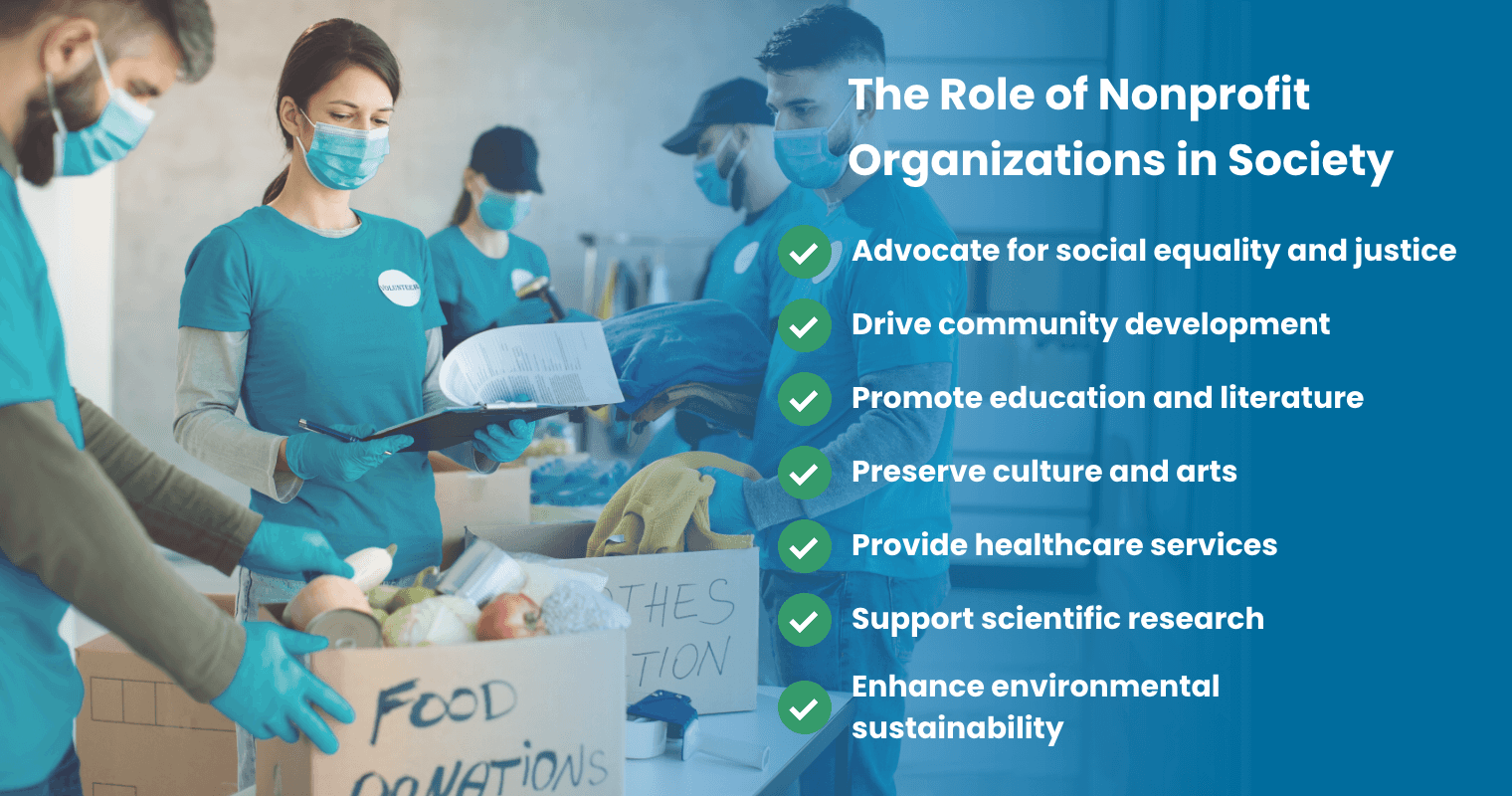

The Role of Nonprofit Organizations in Society

Nonprofits are undeniably crucial in addressing societal challenges, from promoting equal opportunities to driving overall positive change. How do nonprofits work in creating a better society? Below are some of the roles they play:

- Advocate for social equality and justice — Promotes equal opportunities by organizing protests, campaigning for policy reforms, and offering legal aid to marginalized communities.

- Drive community development — Helps the underprivileged by providing resources and skills training to create sustainable livelihoods and break the poverty cycle.

- Promote education and literature — Contributes by operating schools, providing scholarships, and offering educational programs for all ages.

- Preserve culture and arts — Includes managing museums, libraries, historical societies, and theaters to make art, history, and cultural experiences accessible to the public.

- Provide healthcare services — Delivers healthcare to underserved communities by operating clinics, providing to the uninsured or underinsured, or conducting medical research to improve public health.

- Support scientific research — Contributes to scientific advancement by funding research, operating research institutions, and promoting scientific literacy.

- Enhance environmental sustainability — Advocates for conservation efforts, promotes renewable energy sources and educates the public about environmental issues.

Nonprofits offer such services to help low-income individuals and families to achieve self-sufficiency. They also work closely with the communities to determine their unique needs and create tailored programs to address them. In Forvis Mazars’ 2024 State of the Nonprofit Sector Report, 71% of nonprofits saw an increased demand for their programs and services in 2023. Hence, reinforcing how communities require the services of nonprofits.

Types of Nonprofit Organizations

Each nonprofit organization serves a unique purpose and contributes to the well-being of their communities in different ways. Understanding each type helps in appreciating the diverse nonprofit efforts and roles. The following are the three major types of 501(c)(3) organizations:

- Charitable Organizations: Public charities are organized and operated for religious, educational, scientific, literary, charitable, public safety, or other similar purposes. This type also includes public benefit organizations such as food banks, hospitals, animal shelters, and environmental organizations. They typically provide aid to the underprivileged or fund research.

- Churches and Religious Organizations: This type of nonprofit is established and operated exclusively for religious purposes. Denominations, synagogues, mosques, temples, and other established houses of worship typically qualify for 501(c)(3) status.

- Private Foundations: These organizations are established by individuals, families, or corporations, and usually have a single major source of funding (e.g. gifts for families or corporations). They often have stricter rules regarding how much they distribute each year.

In general, other types of nonprofits operate worldwide. Below are some nonprofit organizations examples:

| Types of Nonprofits | Nonprofit Organizations Examples |

|---|---|

| Social service organizations |

|

| Education organizations |

|

| Arts and culture organizations |

|

| Human rights organizations |

|

| Disaster relief organizations |

|

Best Practices for Nonprofit Organizations

Implementing best practices ensures nonprofits have efficient operations and maintain their credibility among stakeholders and the community they service. Here are six best practices that nonprofits should follow:

- Prioritize transparency and accountability: Transparency builds trust with donors, beneficiaries, and the public. Nonprofits are recommended to regularly share clear financial reports, program results, and impact stories. This way, donors are also assured their contributions are used for the right cause.

- Steward donor relationships: Donors are the nonprofits’ partners in making a difference. That said, it’s important to cultivate strong relationships by keeping them updated about the impact of their gifts and showing appreciation for their support.

- Leverage digital storytelling: Having engaging narratives that highlight the nonprofit’s mission or cause can attract more supporters and raise awareness at the same time. Make use of multimedia channels to share compelling stories about the nonprofit.

- Master statement of functional expenses: Nonprofits should fully understand their statement of functional expenses. They must know where their funds are going, including programs, fundraising, or operating expenses. People will generally feel more encouraged about donating if they know their contributions are properly allocated.

- Embrace sustainable practices: Adopting sustainable practices cannot only help nonprofits reduce costs. This also promotes ethical considerations that many donors find crucial. Minimize environmental footprint by reducing reliance on paper, investing in energy efficiency, and promoting eco-consciousness among staff and volunteers.

Frequently Asked Questions About Nonprofit Organizations

1. What are the differences among nonprofit, not-for-profit, and NGO?

These terms are often used interchangeably, but there can be subtle distinctions. First off, a nonprofit primarily exists to benefit a specific cause or the public. It reinvests any profits back into its mission rather than distributing them to owners or shareholders.

Not-for-profit, on the other hand, typically refers to organizations that are focused on activities that benefit their members or a specific group rather than the general public.

Lastly, a non-governmental organization (NGO) is a type of nonprofit that operates independently of a government, usually with a focus on social, environmental, or humanitarian issues on a national or international level.

2. Who regulates nonprofit organizations?

In the United States, nonprofit organizations are primarily regulated by the Internal Revenue Service (IRS) at the federal level, which oversees their tax-exempt status. At the state level, regulation can vary but typically involves the state’s Attorney General or a similar office that ensures compliance with state laws and regulations governing nonprofits. Other countries also have national-level regulatory bodies for nonprofits, usually focusing on registration, financial reporting, and governance.

3. What are the reporting requirements for nonprofit organizations?

Reporting requirements for nonprofits vary by country. But generally, they must file annual financial statements and report on their activities, with some requiring audits as well. For example, nonprofits in the US are required to file annual information returns with the IRS (e.g. Form 990, 990-EZ, or 990-PF) depending on their size and revenue. They may also need to file additional reports with state regulators, maintain accurate financial records, and adhere to specific disclosure requirements for transparency.

Streamline Your Nonprofit Operations with Convene

Efficiency and organization are imperative for nonprofits today. Paperwork can pile up, communication can get bogged down in email threads, and finding critical documents can even waste time. For such reasons, many nonprofits opt to invest in tools like board portals to keep them organized.

Convene, a leading board portal software, offers a secure, centralized platform for nonprofits to collaborate and get things done digitally and sustainably. With Convene’s Document Library, nonprofits can upload, share, and manage confidential documents. Multi-level encryption and password protection are also available in the platform to keep your nonprofit’s files safe. For board or donor meetings, the board management software also offers meeting tools that make it easier for nonprofits to plan and collaborate. These include the agenda builder, meeting notifications capability, real-time voting and poll features, and an easy-to-use minute-taking tool.

Learn more about Convene and why it’s the best software for nonprofits. Book a demo today!

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.