Higher education institutions have always walked a financial tightrope, balancing their income and expenses. And this problem only got worse with today’s unstable economy. As financial pressures continue to grow, colleges and universities are finding effective ways to better manage their funds.

To better organize their finances, many institutions are exploring various budgeting models used in higher education. Read on to know more about these budgeting models and which ones are appropriate for various higher education goals.

What is a University Budget Model?

A university budget model refers to the financial framework that colleges and universities use to allocate financial resources. It determines how revenues (e.g. tuition, state funding, grants, and donations) are distributed across various academic and administrative units, and how expenditures are managed. Overall, a university budget model helps calculate overhead for expenses responsibility.

Why is a university budget model important?

Budgeting models are critical for colleges and universities in carrying out their missions — may it be expanding learning opportunities or enhancing student support services. They help ensure optimal distribution of funds, balance revenue with expenditures, and align financial planning with strategic goals. In addition, budgeting models can boost financial transparency and accountability, as they allow for dynamic adjustments in response to changes like enrollment fluctuations or economic downturns.

Types of Budgeting Models in Higher Education

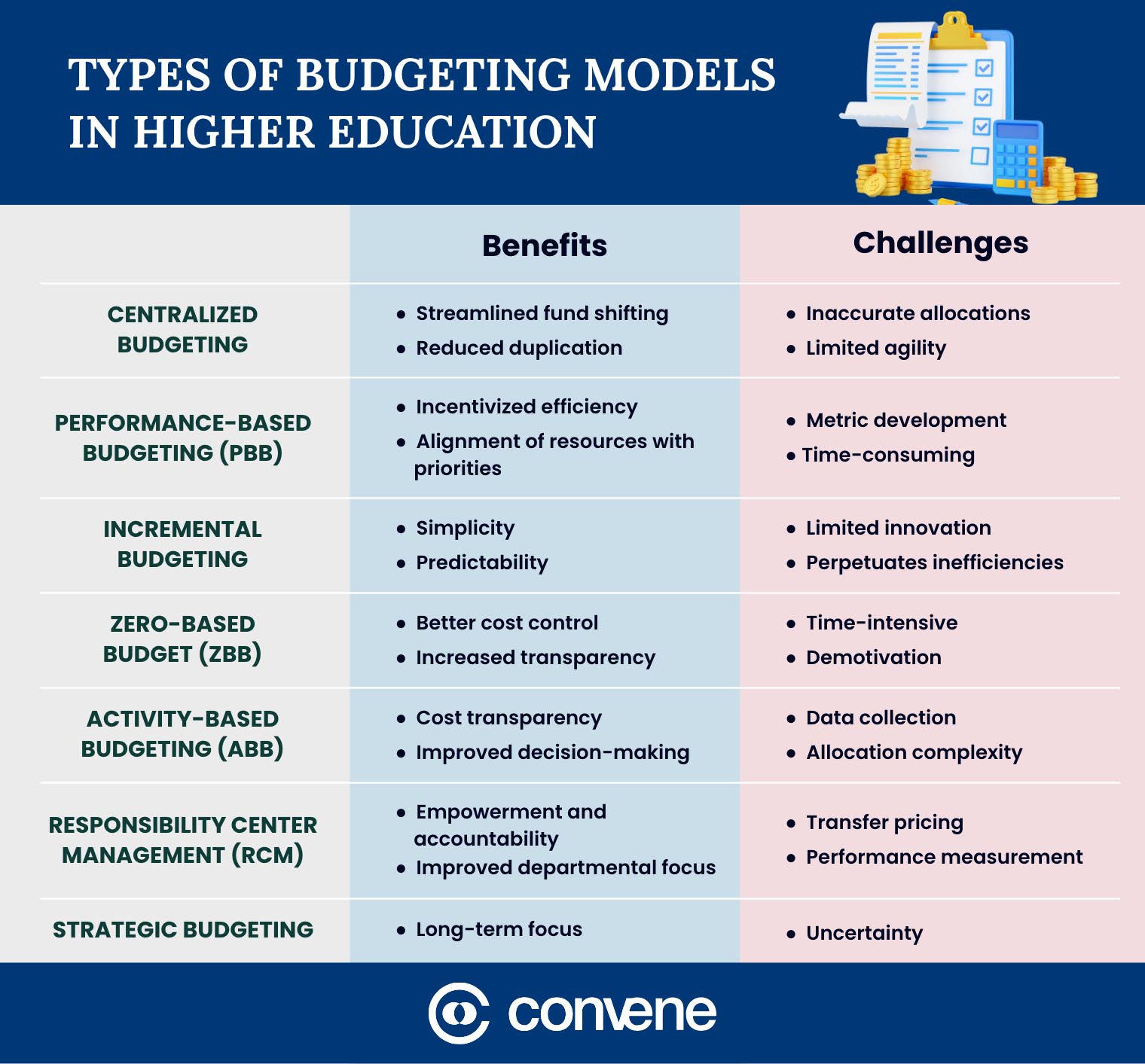

The financial health of a university relies heavily on its chosen budgeting model. Some universities use more than one budgeting method to support additional controls in certain areas of the institution. Here’s a breakdown of the common types of budgeting models in higher education.

1. Centralized Budgeting

Centralized budgeting concentrates decision-making authority with upper-level administrators. While historical data may be considered, this model primarily focuses on allocating resources based on institutional needs and priorities.

This financial model for higher education is often used in conjunction with other models. For example, a university board may want this level of fund control over aspects like tuition income while allowing units or colleges to use a different model for departmental funds.

Benefits

- Streamlined fund shifting: Enables rapid responses to financial emergencies (e.g. sudden drop in government grants) by quickly shifting funds between departments.

- Reduced duplication: Identifies redundant spending across departments, such as multiple subscriptions to the same database.

Challenges

- Inaccurate allocations: Lack of departmental input may lead to inefficient allocations, with departments being underfunded or overfunded.

- Limited agility: Responding to changing needs can be slow due to the top-down nature of the process. For instance, it can be difficult to get approval for budget adjustments on new initiatives, such as offering online courses requiring tech updates.

2. Performance-Based Budgeting (PBB)

Performance-based budgeting is used by colleges and universities to award funds based on performance. It offers a direct monetary impact from achieving the desired goals, through different parameters such as enrollment growth and graduation rates.

Benefits

- Incentivized efficiency: Employees will have more motivation to find cost-effective ways to achieve results, like optimizing faculty workloads to reduce adjunct instructor costs.

- Alignment of resources with priorities: Allows educational institutions to allocate more funding to departments with high graduation rates or strong job placement rates for its graduates.

Challenges

- Metric development: It can be difficult to choose the right metrics that can accurately reflect departmental performance.

- Time-consuming: Reviewing performance measures or evaluations can take a significant amount of time.

3. Incremental Budgeting

In this traditional model, the budget proposals and allocations for the upcoming year are based on the previous year’s figures. While centralized budgeting may consider historical data, incremental budgeting tends to focus heavily on it.

Usually, adjustments are made considering the changes in revenue streams and expenses — including factors like inflation, enrollment fluctuations, or facilities’ investments.

Benefits

- Simplicity: Easy to implement and requires minimal historical data analysis.

- Predictability: Departments can rely on a relatively stable funding base, facilitating long-term planning.

Challenges

- Limited innovation: Use of historical spending may stifle new initiatives that need additional funding.

- Perpetuates inefficiencies: Existing inefficiencies in the previous year’s budget can be carried forward, which may lead to wasted money on ineffective programs.

4. Zero-Based Budget (ZBB)

Contrary to the incremental budget model, zero-based budgeting wipes out the previous year’s budget and restart the new fiscal year from zero. In this financial model for higher education, departments will make a bid for funding and justify all operation and capital requests every year.

Benefits

- Better cost control: Focuses on the careful evaluation of spending priorities or each budget item.

- Increased transparency: Justification for each expense category promotes greater accountability and understanding of resource allocation.

Challenges

- Time-intensive: Requires significant effort from both administrators and departmental staff to justify every expense, which likely requires more negotiation in determining funding priorities for both sides.

- Demotivation: Constant justification of financial activities can be demoralizing for staff, hindering innovation and creativity.

5. Activity-Based Budgeting (ABB)

Activity-based budgeting allocates resources to institutional activities that offer the greatest returns (e.g. increased revenues, investments). This university budget model may involve creating activity groupings for budgeting, fund source groupings, or activity-based campus budget allocation. While PBB awards funds based on the number of outcomes and standards, ABB considers the amount of revenue-generating activity a unit undertakes.

Benefits

- Cost transparency: Gives a clear picture of how resources are consumed by specific activities like administrative processes.

- Improved decision-making: Understanding the true cost of each activity allows for better-informed decisions.

Challenges

- Data collection: Gathering accurate data on activity costs can be taxing.

- Allocation complexity: Assigning indirect costs (e.g. utilities) to specific activities can also be difficult, leading to inaccurate budget allocations.

6. Responsibility Center Management (RCM)

Deemed as the most decentralized approach, RCM budget model gives operational authority to the units and divisions within the university.

Each unit receives its own income and revenues (e.g. tuition of its enrolled students) and is responsible for its own expenses. Hence, giving them more control over their finances.

Benefits

- Empowerment and accountability: Department heads are likely to be motivated and accountable as they keep any savings they generate.

- Improved departmental focus: RCM budget model promotes greater incentive to focus on core departmental activities and cut non-essential spending.

Challenges

- Transfer pricing: Educational institutions need a system for transferring costs between departments at a fair market value, especially for shared resources like libraries or IT services.

- Performance measurement: Creating a system for measuring the performance of responsibility centers is challenging, as there’s no one-size-fits-all approach.

7. Strategic Budgeting

As its name suggests, this financial model for higher education is about aligning resource allocation with the university’s strategic goals and aspirations. This approach transcends the limitations of annual cycles by focusing on future possibilities and their financial implications. These may include evolving student demographics or technological advancements impacting teaching methodologies.

Benefit

- Long-term focus: Encourages institutions to consider future financial needs and make sound decisions for long-term benefits.

Challenge

- Uncertainty: The future is unpredictable, which makes it difficult to develop a strategic budget that remains effective over time.

FAQs About Budgeting Models in Higher Education

1. How do I determine which budgeting model is best for my institution?

There’s no one-size-fits-all answer. The ideal budgeting model depends on several factors specific to the educational institution, such as:

- Size and structure: Large universities may benefit from Activity-Based Budgeting (ABB) to analyze costs associated with activities. Smaller colleges, on the other hand, might find Incremental Budgeting efficient for maintaining stability.

- Strategic goals: If the key goal is attracting students, Responsibility Center Management (RCM) could help departments compete for enrollment. Performance-Based Budgeting (PBB) is a better choice if the university aims to incentivize departments when achieving specific results.

- Current financial situation: If the university has financial difficulties, Zero-Based Budgeting (ZBB) could support a more critical analysis of expenses. But for institutions with stable financial situations, ZBB’s time-intensive nature might not be necessary.

In some cases, however, a hybrid approach combining elements of different models often proves most effective. For instance, a state university can pilot a hybrid approach to address specific facets:

- Incremental budgeting for base funding, ensuring core functions remain funded since they’re already noted in the previous year’s budget.

- Activity-based budgeting for proposing new programs, and tracking costs for each activity for transparency.

- Performance-based budgeting for incentivizing faculty efforts that exceed pre-determined metrics like graduation rates.

2. What are the key considerations when transitioning to a new budgeting model?

Transitioning to a new budgeting model requires consideration of several factors, including:

- Stakeholder involvement — Get feedback and engage with faculty, staff, and administrators about the new budgeting model and how it will impact their roles.

- Training — Offer comprehensive training for stakeholders on the new budgeting model’s principles and procedures.

- Communication strategy — Develop a clear communication plan to explain the new model’s rationale and benefits to the entire university community.

3. What role does technology play in modern higher education budgeting?

Technology plays a crucial role in streamlining and optimizing budgeting processes. Here are two tech solutions and how they can help with higher education budgeting:

- Board portals: Centralizes financial data, facilitates collaboration, and enables real-time reporting.

- Budgeting software: Automates tedious tasks like financial data consolidation and calculations to reduce human error.

Leveraging technology can make the budgeting process for universities more efficient and transparent.

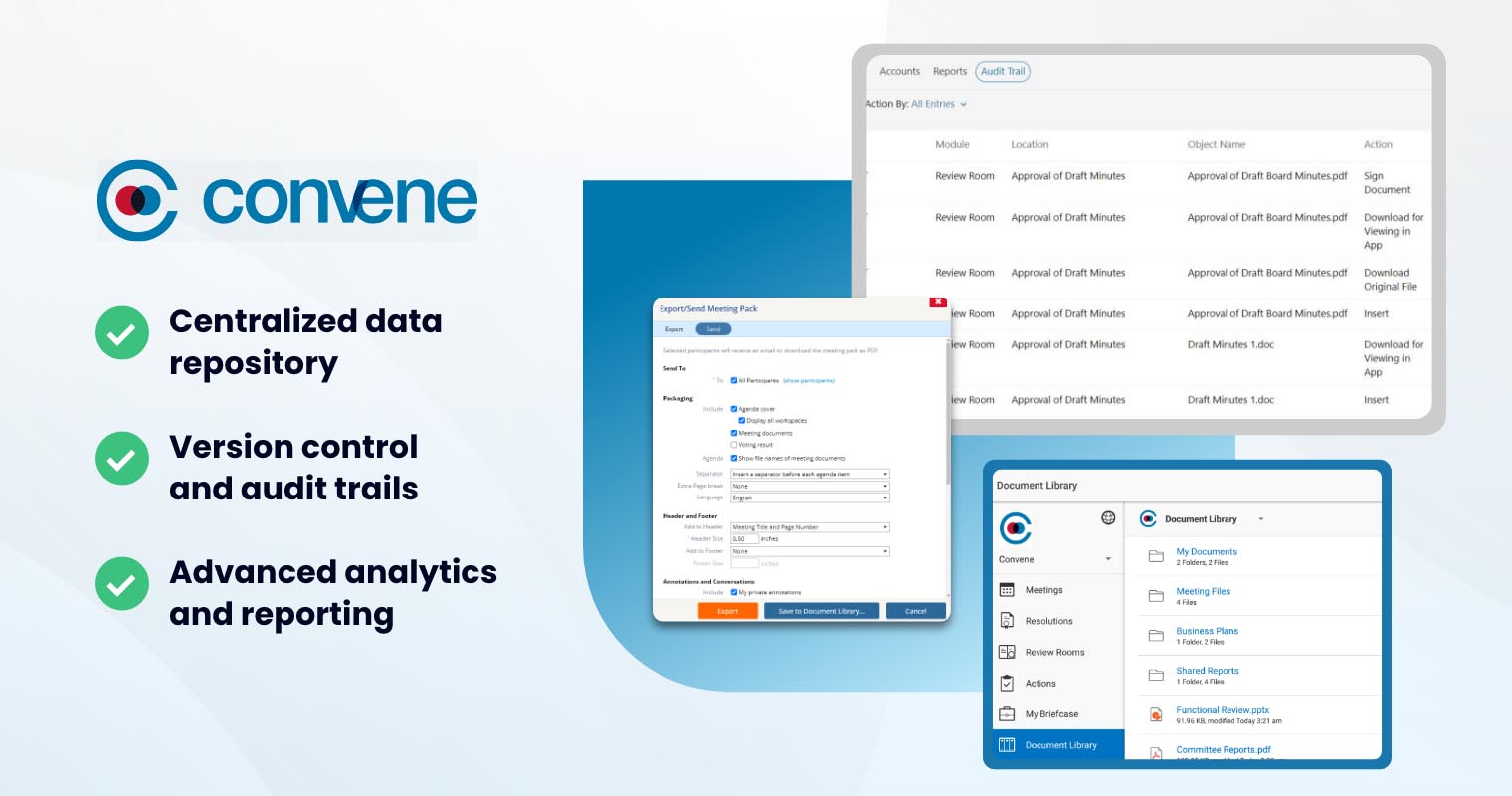

Optimizing Higher Education Budgeting with Convene

Allocating resources effectively across different units and programs requires a data-driven approach. For colleges and universities using manual or traditional budgeting processes, compiling and analyzing financial data can be a logistical nightmare.

Fortunately, board portals offer a powerful solution to streamline budgeting. Recognized as a leading board portal, Convene optimizes higher education budgeting with its state-of-the-art features, including:

- Centralized data repository to store all financial data in a single, secure location

- Version control and audit trails to track all changes made to financial documents

- Advanced analytics and reporting to improve data-driven resource allocation and management

- Secure video conferencing that allows administrators and faculty from different departments to collaborate on budget discussions and financial plans.

Learn more about these Convene features and more by requesting a demo now!

Jielynne is a Content Marketing Writer at Convene. With over six years of professional writing experience, she has worked with several SEO and digital marketing agencies, both local and international. She strives in crafting clear marketing copies and creative content for various platforms of Convene, such as the website and social media. Jielynne displays a decided lack of knowledge about football and calculus, but proudly aces in literary arts and corporate governance.