The boardroom has long evolved from a place for routine meetings to a strategic hub where important decisions shape the future of organisations. Today, board members are no longer just responsible for the company’s financial performance but are also involved and focused on sustainability, risk management, and keeping up with industry changes.

This transformation extends beyond systems and processes and has had a domino effect on the people around the table.

The recent Board Diversity Index report found significant strides in Australian boardrooms, particularly regarding female representation. Over the past year, women have surpassed the 30% benchmark on Australian Securities Exchange (ASX) boards, reaching 36%. This positive trend suggests that gender parity could be within reach by 2030, signalling a move toward more inclusive and dynamic governance.

But, board diversity is just one factor influencing the future of governance in Australia. To fully understand the trends and changes, we must look into their current state, and this article will provide insights. We will also explore the impact of technology on board governance, legal considerations, and future challenges and opportunities that affect board effectiveness in Australian boardrooms.

What is board governance in Australia?

In simple terms, a board governance framework is a set of structures, processes, and rules that guide the board in fulfilling its responsibilities to the organisation. To ensure board effectiveness, each member’s roles and expectations must be clearly defined in the charter.

Australia’s corporate governance landscape balances legal obligations and market expectations. The primary legal framework is the Corporations Act 2001, which outlines the rights and responsibilities of companies, directors, and shareholders. Additionally, the ASX Listing Rules play an important role in the current state of Australian governance. The ASX Corporate Governance Council (CGC) has issued a Corporate Governance Code, providing recommendations for best practices in corporate governance. Although this code may not be legally binding, it is widely adopted by listed companies and has been instrumental in driving improvements and promoting transparency and accountability within the Australian corporate sector.

True to their commitment to uphold the highest corporate governance standards, ASX CGC released the 5th edition of the ASX Corporate Governance Principles and Recommendations in February 2024. The updates show a shift towards recognising good stakeholder relationships, ensuring board skills for future oversight, and emphasising the importance of board diversity. It is expected to be issued in the first half of 2025, but as with the previous editions, there may be early adoption, as the stakeholders encourage.

But is this enough to prepare Australian boards for the future?

The Current State and Trends in Board Governance in Australia

While the country’s corporate governance has been at the forefront of global best practices, the increasing importance of ESG issues, board diversity, and the heightened demand for technological awareness, among other emerging trends, challenges its current state:

ESG issues

Environmental, social, and governance (ESG) issues are set to dominate board discussions, with social license emerging as a key ethical challenge for directors by 2025, as highlighted by the Governance Institute of Australia. Boards will face increasing pressure to demonstrate their commitment to sustainability and ethical practices. Failure to meet these obligations could result in reputational damage, potentially as severe as financial penalties, especially as investors show heightened interest in companies’ carbon transition plans. Major banks also require significant emitters to present credible energy transition strategies by 2025, adding another layer of accountability.

Currently, boards are responding by either taking on ESG issues at the main board level or delegating them to specialised committees. However, legal liability around ESG is expected to rise in the coming months as regulators push for faster progress, further complicating the board’s role. Therefore, upcoming directors must balance the time spent on traditional governance concerns with emerging ESG and digital transformation issues, managing increasing pressure from shareholders, regulators, and the wider community.

Board diversity

The Workplace Gender Equality Agency, or WGEA, has made substantial progress in promoting gender equality in the boardroom. However, the diversity conversation has expanded beyond gender, now encompassing other areas of difference that, when better represented at the board level, can help businesses accurately reflect the communities they serve.

Age and cultural backgrounds are just two of the factors now being considered.

The 2024 Board Diversity Index showed a wide age range among ASX 300 directors, with the youngest being 29 and the oldest 92. The average age is 60 to 61. While there are examples of younger directors, these are exceptions and not the norm, as they remain underrepresented in boardrooms. One way to resolve this issue is for experienced board members to advocate for greater youth representation and mentor these young talents in good governance.

The same study revealed a lack of diversity, with just 9% coming from a non-Anglo-Celtic background, the same as the previous year. Actions may be taken to rectify the situation, but at the rate things are going, it may take 18 more years for Australian boardrooms to reflect the nation’s cultural diversity. With that being said, it is not beyond reach. The progress made in gender representation shows that change is possible, and future board members can use this as a model to advocate for greater ethnic and racial diversity. Boards can start by broadening the pool of candidates and implementing targeted recruitment strategies prioritising diversity and inclusion.

Technology demands

Despite the benefits, many boards still treat digital literacy or technology as an afterthought. A study by the EY Global Centre for Board Matters found that Australian directors were aware of technology’s impact on their businesses but were hesitant to improve their own tech skills, preferring to rely on experts within their companies instead. This implies a negative consequence and could result in losing credibility and trust among stakeholders, as boards may appear ill-equipped to address the risks and maximise the benefits of the digital age.

It’s even more concerning given the pace at which technology is changing board operations. With digital tools like artificial intelligence (AI) and robotic process automation (RPA) offering both opportunities and challenges to businesses globally, boards are expected to develop at least a basic understanding of these technologies to actively participate if and when it comes to making critical tech decisions that ultimately affect the organisation.

Beyond understanding, boards can leverage technology to improve oversight. AI and RPA can streamline the review of board materials by analysing vast amounts of data quickly and providing predictive insights. At the same time, advanced analytics can help identify risks and opportunities faster. AI can also assist in routine tasks like agenda preparation and tracking action items, freeing members’ time for more important things.

Additionally, technology allows for virtual boardrooms. Since most boards now operate remotely or in hybrid formats, meeting virtually has become crucial for maintaining effective governance. This is where board meeting software comes in. These platforms allow directors to collaborate seamlessly from different locations, reducing geographical barriers.

To help Australian boards navigate the technology era, the Australian Institute of Company Directors (AICD), in partnership with the University of Technology Sydney, has published a three-part guide that offers directors foundational knowledge of AI, and progressively delves into more complex AI concepts related to AI governance:

- A Director’s Introduction to AI

- AI Governance Checklist for SME and NFP Directors

- A Director’s Guide to AI Governance

AICD has also provided a quick questionnaire in the first part of the guide that lets boards determine which part benefits them the most.

Regulatory and Legal Considerations in Board Governance Australia

Given the enormous stakes involved in board operations, directors must ensure their organisation adheres to relevant legal frameworks, including corporate governance codes, employment laws, environmental regulations, and financial reporting standards. Non-compliance can lead to fines, penalties, or even legal action, which could tarnish the company’s reputation.

While the regulations vary per region and industry, these are four legal areas that the board must prioritise to maintain compliance:

1. AICD Security Regulations

As the largest director-member organisation in the world, AICD is committed to educating boards about their legal duties, including acting in the best interests of the company. On that account, their recent initiative involved a focus on the 2023-2030 Australian Cyber Security Strategy, a roadmap that could potentially lead the country to be a world leader in cybersecurity by 2030. The AICD has been actively promoting this strategy so that organisations can stay resilient against future cyber attacks.

This is in line with their Cyber Security Governance Principles, which provide practical tips and guidance to help Australian directors manage cyber risk.

2. Public Administration Act 2004

The Public Administration Act 2004 outlines governance standards and obligations for most boards, directors, and chairs. Key duties include acting per the entity’s objectives, informing relevant authorities of major risks, and providing requested information. Boards must also have policies on performance assessment, conflict of interest, and fraud prevention, as well as a code of conduct for directors and proper processes for meetings and decisions.

Directors must act honestly, with integrity, in the entity’s best interests, and with financial responsibility. Thus, conflicts of interest must be declared, and they should never use their current position for personal gain or to harm the entity. Breaching these duties can lead to legal action, though directors who act honestly may be protected by insurance or indemnity.

3. Taskforce on Climate-Related Financial Disclosures (TCFD)

As the attention on ESG intensifies, so are the regulations surrounding sustainability. The introduction of mandatory climate-related financial disclosures in 2024/2025 will require boards to adopt the TCFD framework, which outlines specific reporting requirements for governance, strategy, risk management, targets, and metrics. This move aligns with the broader global effort to enhance corporate transparency and accountability regarding climate-related risks and opportunities.

As the International Sustainability Standards Board (ISSB) continues to develop climate disclosure standards, boards can expect further evolution in this area. What they can do is proactively address climate-related risks and opportunities, demonstrating their commitment to sustainability and positioning their organisations for long-term success.

Future Challenges and Opportunities for Australian Boards

Due to the growing public awareness of corporate governance issues, board performance and accountability will likely be scrutinised more heavily in the years to come. That’s why companies, as early as now, must be able to identify the challenges and opportunities that will come their way to ensure their boards remain effective and resilient.

In line with this, the Governance Institute of Australia highlighted what board members think would be the core factors influencing board dynamics by 2025:

- According to the survey, maintaining a culture of transparency, trust, and respect was the most important driver of board effectiveness. A lack of trust and respect can hinder open communication, leading to suboptimal decision-making and a toxic work environment.

- The lines between board and management roles will increasingly blur in the future, as the two will have to work together to strategise and respond to the shifting market conditions. However, while closer collaboration is beneficial, boards must maintain a clear distinction from management to avoid operational involvement. Blurring the lines between board and management can lead to confusion, accountability issues, and a loss of focus on strategic oversight.

- Addressing the issues around ESG will require the board’s deep understanding of the organisation’s operations and a commitment to sustainable practices. Since there are more stringent regulations related to ESG, failure to address its concerns can result in reputational damage, financial penalties, and loss of investor confidence.

- Board diversity is as much a challenge as it is an opportunity. To remain effective, the survey urges boards to prioritise inclusivity and representation, identifying them as one of the top factors defining the dynamics of the board in 2025. Boards must strive for diversity in skills, backgrounds, and perspectives to represent their organisations better, leading to more innovative and effective solutions.

- Utilising technology to enhance board effectiveness is also a top priority. Technology can improve communication, access to information, and decision-making processes. By keeping up and adopting new technologies as they evolve, boards can streamline operations and make more data-driven decisions.

Experience the Convene Difference in Board Governance Australia

Boardrooms will continue to evolve and adapt to emerging trends, and keeping up with the changes might be overwhelming, especially for the future members of the board. Fortunately, one of the pros of the digital era is that it brings new tools to ensure board effectiveness and streamline corporate governance.

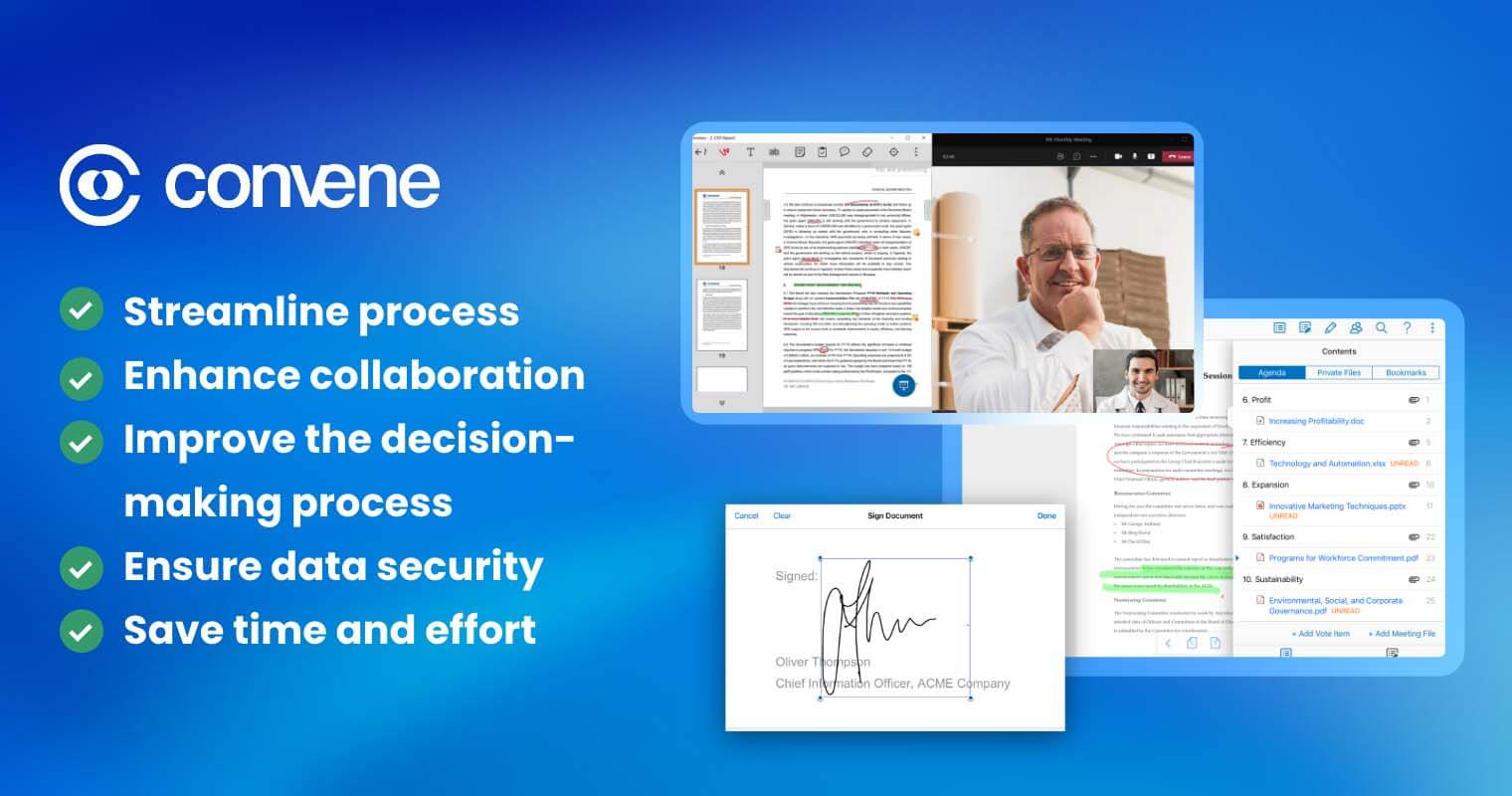

The board makes decisions every day that influence the direction of the organisation; a board portal can make the decision-making process easier. Convene, a trusted board meeting software for modern boardrooms, offers a centralised space for seamless communication and collaboration among board members. It can:

- Streamline processes through the digitalisation of board materials and workflows.

- Enhance collaboration with live video conferencing, annotation tools, and secure document sharing with permission-based access.

- Improve the decision-making process by easily tracking action items and audit trails. Convene also provides Review Rooms where directors can review, approve, and sign documents to speed up approvals.

- Ensure data security with advanced encryption and access controls.

- Save time and effort by efficiently building meeting agendas and distributing relevant documents in just a few clicks.

Do not wait for tomorrow; book a demo now to see for yourself how Convene can help improve your board governance.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.