In recent years, we witnessed the transformation of corporations’ environmental, societal, and governance (ESG) initiatives from mere token ingredients of public relations statements to industry requirements. Regulatory bodies and policymakers have likewise deployed requirements and directives on how companies should measure and communicate their ESG-related efforts to the public.

In keeping with the strides of neighboring countries like Thailand, Malaysia, Hong Kong, and Singapore, the Philippines’ Securities and Exchange Commission (SEC) issued Memorandum Circular 4, also tagged as Sustainability Reporting Guidelines for Publicly-Listed Companies in early 2019. This requires local publicly-listed companies (PLCs) to report their non-financial and sustainability performance.

Read on to learn how to achieve greater compliance with SEC’s ESG-related mandates.

SEC Sustainability Reporting Guidelines: Explained

SEC’s Sustainability Reporting Guidelines offer organizations an inward look at their corporate efficiency and efficacy concerning their economic, environmental, and social risks, opportunities, and efforts. In the same vein, the Commission sees compliance with this mandate as an opportunity for companies to assess and measure their contributions towards the attainment of global sustainability initiatives like the 2030 United Nations Sustainable Development Goals, and local development goals like AmBisyon Natin 2040.

All PLCs are required to submit a Sustainability Report alongside their Annual Reports.The first three years of the implementation adoptd the “comply and explain” approach, meaning PLCs would need to explain why noncompliance with certain guidelines.

Companies that already issued Sustainability Reports before this SEC directive are already considered compliant provided that their reports are aligned with globally recognized frameworks and standards, such as the GRI standards, TCFD, and IR framework.

What’s in the SEC’s Sustainability Reporting Template?

For PLCs to adhere to SEC’s requirements, the Commission appended Sustainability Reporting Guidelines for Publicly-Listed Companies with a Sustainability Reporting Template. The SEC also provided a Topic Guide that organizations can refer to when responding to disclosure topics. Even though rather heavily anchored into the Global Reporting Initiative (GRI) Standards, the SEC does not discourage companies from adopting other reporting frameworks and standards that fit their operations and ESG goals.

Materiality assessment

Every organization has a wide array of ESG-related policies and issues on which it can report. The topics of environment, economic and social issues revolve around a multitude of aspects and processes. Hence, Materiality Assessment has become crucial in ESG reporting.

The principle of materiality substantiates the relevant topics organizations need to report on. Simply put, any matter or topic that has a consequential influence on various aspects of your company is considered material and warrants disclosure.

To help companies in their materiality assessment, the SEC suggested the use of the Materiality Matrix which provides a graphic representation of a company’s material topics ranked according to importance.

The Commission also recommended the SASB-anchored Materiality Finder in identifying possible material topics specific to a particular organization’s industry.

All companies are expected to detail their materiality process on the Reporting Template, by explaining how they applied the materiality principle to determine their material topics. The SEC provided a suggested materiality assessment process adopted from the Bursa Malaysia Sustainability Reporting Guide that novice organizations in sustainability reporting can use as a reference when preparing their response. This mainly focuses on the significant economic, environmental, and social impacts of the organization on the stakeholders, and the capacity of the stakeholders to influence the economic, environmental, and social impacts or activities of the organization.

In addition to the materiality process, PLCs need to note that every disclosure should be backed by a narrative of their management approach. Ideally, the management approach needs to lay out the policies, commitments, responsibilities, targets, resources, grievance mechanisms, projects, initiatives, and programs to support the given material topic.

Disclosure Topics

The Sustainability Reporting Template covers 4 material topics, namely:

Economic Disclosures. Organizations are required to report on how they aid in increasing the pool of national and local economic resources, this also involves their procurement and anti-corruption practices, and other economic risks and opportunities related to climate change.

Environment Disclosures. These refer to how PLCs manage the natural resources salient to their operations all the while mitigating or reducing their negative impact on the environment and complying with environmental laws and regulations. Efforts and measures taken in the protection, conservation, and rehabilitation of ecosystems and biodiversities under their jurisdiction or within their vicinity are also highlighted under this disclosure topic.

Social disclosures. Under the social umbrella, PLCs are expected to disclose their stakeholder relationship, employee management, supply chain management, customer management, and compliance with labor standards and human rights regulations. Social disclosures also involve access to quality products and services, customer privacy, data security, and responsible business practices employed by the PLCs.

UN Sustainable Development Goals (UN SDGs). As a unit, the 17 UN SGDs are a collective call to improve people’s quality of life by alleviating poverty and protecting the planet. Companies are called to report on how their products and services contribute to the attainment of global sustainability goals.

Create Compliant Reports with ESG Reporting Software

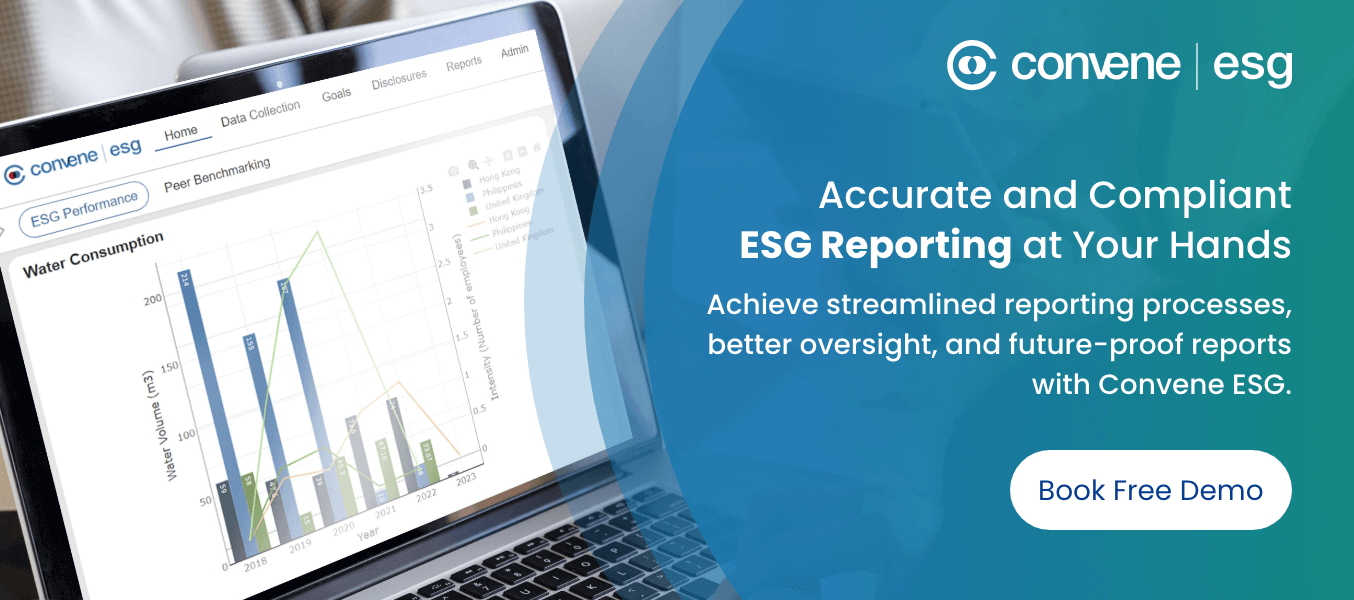

Given the multifacetedness of ESG and sustainability, there is no denying that ESG reporting can be a painstaking and taxing initiative for many PLCs, especially for those who are just starting on their ESG journey. Staying ahead in the ever-evolving ESG landscape necessitates a digital platform that enables your organization to analyze your ESG performance, benchmark against peers, and generate SEC-compliant reports.

Convene ESG is a reporting software made to digitalize your ESG journey — from efficient report preparation to generation. It allows automated collection workflows and a digital repository where years’ worth of data are consolidated for accuracy. Additionally, it provides full visibility and ownership of your data to monitor progress towards ESG goals and track processes.

Set targets and boundaries

Convene ESG allows you to set targets that are aligned with your goals and performance management practices. This reporting software offers a customizable dashboard where you have maximum visibility of your performance and other organizations. This makes it easier to benchmark against peers and set ESG goals based on the identified gaps.

A powerful ESG reporting platform can easily help you assess if you are on track with the ESG metrics and limitations you have set for your organization. With Convene ESG, you can color-code your goals as you input them for efficient tracking and follow-up.

Follow global ESG standards and frameworks

With the myriad of reporting standards and frameworks in the ESG scene, it’s inevitable for novice sustainability report issuers to feel disoriented on how and where to start. The SEC recommends the use of any of the four globally accepted sustainability frameworks for ESG reports, namely:

- Global Reporting Initiative’s (GRI) Sustainability Reporting Standards

- International Integrated Reporting Council’s (IIRC) Integrated Reporting (IR) Framework

- Sustainability Accounting Standards Board’s (SASB) Sustainability Accounting Standards

- Task Force on Climate-related Financial Disclosure (TCFD)

Convene ESG can easily bridge the information gap and alleviate the overwhelm by keeping you up to date with ESG best practices across your industry. You can calibrate your reports to suit your chosen reporting framework and adhere to the mandatory provisions. You may also explore multiple frameworks without recalibrating your report every time. Convene ESG tracks similar topics across frameworks and adapt the reports to changes.

Automate data collection

ESG data digitization simplifies the data collection process and creates efficient workflows for you and your collaborators. You can do away with the laborious process of collating years of data from several sources, and focus instead on strengthening your ESG efforts. You can also expect a less human error to get in the way of your compliance.

With Convene ESG, you are assured that your data is in one centralized location and is accessible to the relevant people in your team. Accuracy of data would be no point of worry, as Convene ESG also employs robust data validation processing that helps you match the data you have inputted with your hardcopy evidence.

Visualize and generate reports

An ESG reporting software is your apprentice in telling a compelling tale of your company’s ESG journey. Generate SEC-compliant sustainability reports with Convene ESG by translating hundreds of your sustainability data into digestible graphs and dashboards. It also supports report customization with templates that allow easy incorporation of the company brand and inputting of qualitative narratives. With Convene ESG, ensure the distribution of compelling ESG reports that resonates with investors and keeps you ahead of the competition.

Take Full Ownership of Your SEC-Compliant Report

The ESG trends in the past have foretold how ESG will remain to continuously evolve through the years. As regulations and guidelines change and advance, your ESG reporting should be able to quickly follow suit. Convene ESG enables you to take full ownership of your reporting while assuring compliance with regulating bodies like the SEC and adhering to globally recognized reporting frameworks.

Consistency, data accuracy, and comparability of sustainability reporting and data are attainable for your company with integrated ESG reporting software. Reach out to us to know how Convene ESG can help you create stand-out reports compliant with the SEC requirements.