Gone are the days when companies could simply focus on maximising profit and market growth. The world has evolved to embrace those with visible efforts towards sustainability, and the right goals are crucial to getting there. So if an organisation isn’t already setting clear goals for a better future, it is already missing out.

Companies are under increasing pressure to prioritise their sustainability goals. Establishing these objectives has become crucial for businesses looking to maintain competitiveness as investors, customers, and regulatory agencies demand greater openness and responsibility. Organisations have come to use Environmental, Social, and Governance (ESG) goals as a guide to include in their sustainability strategy.

What are ESG goals?

Think of these goals as a roadmap for a future-proof company. ESG goals are especially vital for organisations aiming to improve their sustainable practices and corporate responsibility while appealing to socially conscious investors, customers, employees, and other stakeholders. They are also part of a broader strategy to integrate sustainable and ethical practices into core operations. With an outline of the proper steps in their sustainability plan, organisations are guided towards long-term success in benefitting both people and the planet.

ESG goals examples

They can be categorised into these, each focused on improving sustainability, positive relationships, and ethical practices:

- Environmental goals: Focus on a company’s operations to reduce and minimise its carbon footprint. This includes waste and carbon emissions management, using energy-efficient technology, and integrating sustainable resources. Actions, such as shifting to renewable energy sources like solar energy grids, can be done. Such was the case for the Bank of America with their shift to e-documents, e-transfers, and making contact with stakeholders online.

- Social goals: Aim to improve how a company interacts with its employees, customers, and the wider community. This pushes to promote fair labour practices, encourage diversity and inclusion, and build and maintain trust and positive relationships with stakeholders and local communities. For instance, Coca-Cola is dedicated to advancing female talent into leadership roles as part of its strategy to support a diverse, equitable, and inclusive culture within the company.

- Governance goals: Emphasise running a company with transparency and ethical responsibility. These goals ensure compliance with legal standards, encourage integrity in operations, and promote accountability. They often include fostering an open culture for accountability, including collaborating with an external assurance or establishing an ESG council. Streamlining ESG reporting is another goal, guaranteeing transparent and accurate disclosure of sustainability plans and performance, and showing the stakeholders the company’s commitment to its sustainability goals.

What are ESG targets?

ESG targets are specific next steps to improve and continue sustainability goals for companies and their outcomes. They are typically time-bound and often expressed as percentages or specific numbers. They track a company’s performance and progress toward achieving the broader ESG goals.

ESG targets can simply be drawn from corporate ESG goals by breaking them down into measurable milestones. They can be quantifiable this way:

- One target for Bank of America’s environmental goal is cutting emissions by 42% per unit of energy for particular scopes of emissions.

- A target of Coca-Cola’s diversity, equitability, and inclusivity goal is to have 50% women in leadership globally by 2030 through their Global Women’s Leadership Council.

Why should you set ESG goals and targets?

From attracting investors and consumers to strengthening risk management and boosting stakeholder relationships, well-defined goals lay the foundation for long-term success. Here are the benefits of setting ESG goals for companies.

- Strengthen accountability and risk management: By setting clear ESG goals, companies create metrics for accountability, allowing them to track and report their sustainability efforts effectively. The increasing demand for compliance with ESG guidelines and standards significantly pushes businesses to establish ESG sustainability goals and develop workable strategies. Potential risks related to sustainability can also be identified, allowing companies to address them proactively and improve their overall risk management.

- Operational efficiency: ESG goals and targets cut wasted effort and cost, and improve the organisational environment and operations. A clear sustainable direction helps the company follow ESG principles while improving resource efficiency and operation without compromising environmental responsibility.

- Boost stakeholder relationships and organisational image: Goals with a commitment to ESG improve productivity as they elevate social impact among employees. This also results in developing a strong sustainability system with valuable outcomes. Organisations, as a result, increase their value and improve their public image as well-written and accurate reports demonstrate a commitment to sustainability.

- Attract investors and consumers: When making financial decisions, younger generations and investors are increasingly taking a company’s ethical and environmental performance into account. Data shows that 83% of customers consider it important for businesses to actively advocate for ESG best practices. This signals a shift towards a more value-driven kind of consumerism and not a trend about mere consumer preferences.

Steps on How to Set ESG Goals For Your Company

To effectively set and achieve the goals, organisations must follow a structured approach that emphasises assessment, clarity, alignment, and communication. Here is a closer look at the key steps to establishing impactful ESG goals:

Assess current performance

Start by taking a close look at the current environmental and social impact of your organisation. This means digging into important indicators, such as energy consumption, carbon emissions, waste generation, and water usage, or looking at your previous sustainability reports. Before considering where you want to go, your company can get substantial insights into where it is now by setting a clear baseline. This will serve as a benchmark to gauge future progress and monitor the success of sustainability projects.

Establish clear goals with the SMART model

Clearly define your goal, identify key stakeholders and resources, set a timeline with milestones, and create a straightforward outline of procedures to ensure progress and accountability. What can help is using the SMART framework — Specific, Measurable, Achievable, Relevant, and Time-based — to define your goals. Each one should be:

- Specific and can identify what the company hopes to achieve

- Measurable and have criteria that can be calculated for assessment

- Achievable and feasible with available resources

- Relevant and following the overarching business goals

- Time-based and have a deadline for fulfilment

Align ESG goals with business strategy and ESG standards

Ensure that the organisation’s core objectives are aligned with ESG goals and follow the ESG guidelines. These help clarify what information needs to be disclosed and strengthen future reporting. Alignment also makes sure goals are of global standards and reflect the company’s sustainability commitments. ESG reporting frameworks include:

- Sustainability Accounting Standards Board (SASB) for goals tailored to industries

- Global Reporting Initiative (GRI) for transparency in setting goals

- International Sustainability Standards Board (ISSB) for reporting metrics and targets

Review and adapt

Regular assessment guarantees the goals are still relevant and effective in the face of evolving business priorities and challenges. By proactively monitoring data and Key Performance Indicators (KPIs), organisations remain on course toward their ESG objectives in a methodical manner. KPIs give a comprehensive picture of the qualitative and quantitative performance of your company, which is critical in transparent ESG reporting. Maintaining this responsibility, analysing the effectiveness of projects, and identifying areas that may need improvement raises the ESG score, increasing a company’s competitive edge.

Communicate transparently

Keep everyone in the loop by sharing and reporting your ESG objectives and progress with both your internal teams and external stakeholders. A balanced, complete, and accurate ESG reporting shows the organisation’s commitment to sustainability while increasing credibility and confidence. Frequent updates can inspire and engage employees in achieving objectives. External communication also improves an organisation’s standing with clients, investors, and the public.

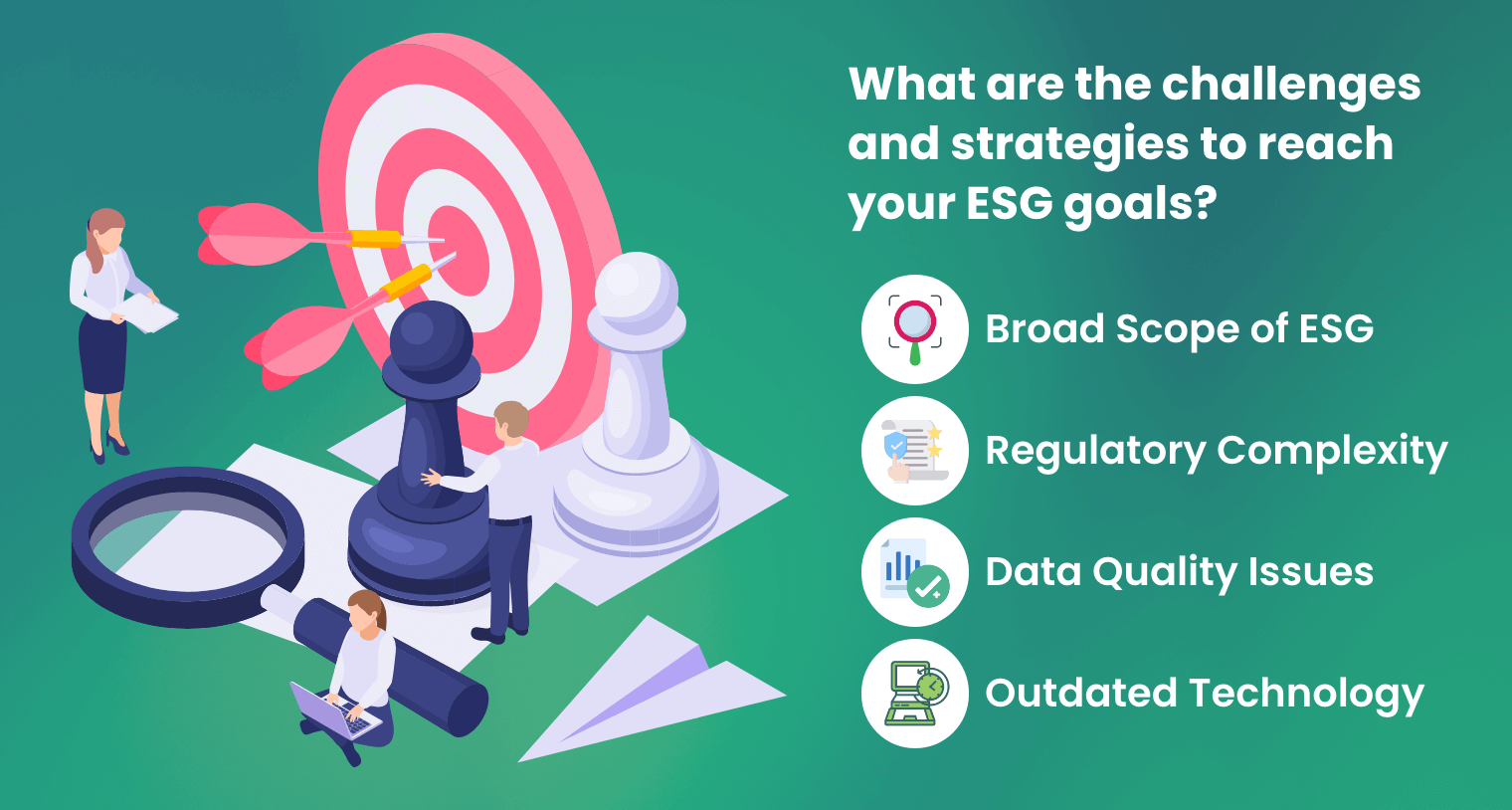

What are the challenges and strategies to reach your ESG goals?

Setting effective goals is one thing to the path of sustainability, but that doesn’t mean it won’t come with roadblocks. These difficulties, ranging from poor data collecting to antiquated technology, among others, will set a business a step back and delay its progress.

Broad Scope of ESG

ESG covers various topics, from environmental practices to diversity and governance, and it can be challenging to set specific goals. Companies often struggle to prioritise which areas to focus on due to the broad scope of ESG issues, but this can be narrowed down by:

- Conducting materiality assessments, analysing both internal and external impacts relevant and significant to the business operations and its stakeholders

- Incorporating ESG principles and mapping them to the United Nations’ Sustainable Development Goals (SDGs) which helps identify priority targets and adopts a broad, global perspective on ESG concerns

Regulatory Complexity

Being required to comply with several frameworks and regulations makes navigating ESG goals for companies difficult. Although common frameworks like SASB and GRI are employed, regulations continue to evolve and get even more detailed and complex over time. Businesses should stay informed about the latest ESG reporting requirements, ensure their disclosures are accurate, and improve their readiness to better meet expectations. Such is the case for 89% of companies that have strengthened internal goal-setting and accountability mechanisms and are investing in new sustainability technology to stay ahead with stricter disclosure requirements.

Data Quality Issues

Companies would often find themselves with data spread out across different departments and suppliers and often in different formats. This scattered information can make it challenging to collect consistent and reliable ESG data. Without standardised data, it becomes tough to get a clear picture of overall performance, steer clear of greenwashing, and identify potential ESG risks. Inconsistent data can also lead to misinterpretation, making it harder to track progress and affecting the decision-making and planning for sustainability initiatives.

How can data issues be resolved? The 2024 survey highlights improving data management and reporting using AI technology and advanced ESG-specific and data collection software. This enhancement can help better analyse data and results for further improvement and alignment of sustainability goals and business objectives.

Outdated Technology

Following data quality is the technology in ESG reporting. Relying on manual tools such as spreadsheets causes inefficiency, as it is also prone to errors. As ESG regulations evolve, fragmented systems make it even harder to manage and report data accurately. Part of the solution is investing in sustainability or ESG-dedicated personnel and technology, with 40% of organisations already focusing on ESG software.

FAQs about ESG Goals and Targets

There are several crucial elements to take into account while developing and talking about ESG goals and targets. Compiled is a list of other concerns that go into further detail on goal-setting.

What is an ESG strategy?

An ESG strategy is a plan or outline of how a company will manage its environmental, social, and governance responsibilities while also aligning with business objectives. Strategising this includes setting specific goals and practices, looking into future results, and improving long-term value.

Who sets ESG goals?

These goals are typically set by the leadership, often with input from various stakeholders, including employees, investors, and customers. With this collaborative approach, the goals are guaranteed to reflect the values of the company and the interests of its key stakeholders have been taken into consideration.

How do evolving regulatory requirements impact ESG goal-setting?

These regulatory changes encourage companies to strengthen their reporting frameworks. As these regulations around sustainability reporting tighten, companies must adapt their ESG goals to comply with new legal standards, making ESG data more reliable and comparable across industries. This can lead to more defined objectives and improved transparency in ESG sustainability goals and efforts.

How does technology affect establishing ESG goals?

ESG software or sustainability reporting software plays a crucial role in automating, centralising and analysing data related to ESG performance, making it easier for companies to:

- Set goals and track performance in real-time and enhance reporting capabilities with advanced tools

- Identify trends within your industry to stay competitive

- Access reports for better goal setting and improved future reporting

- Increase efficiency for a more precise and informed decision-making

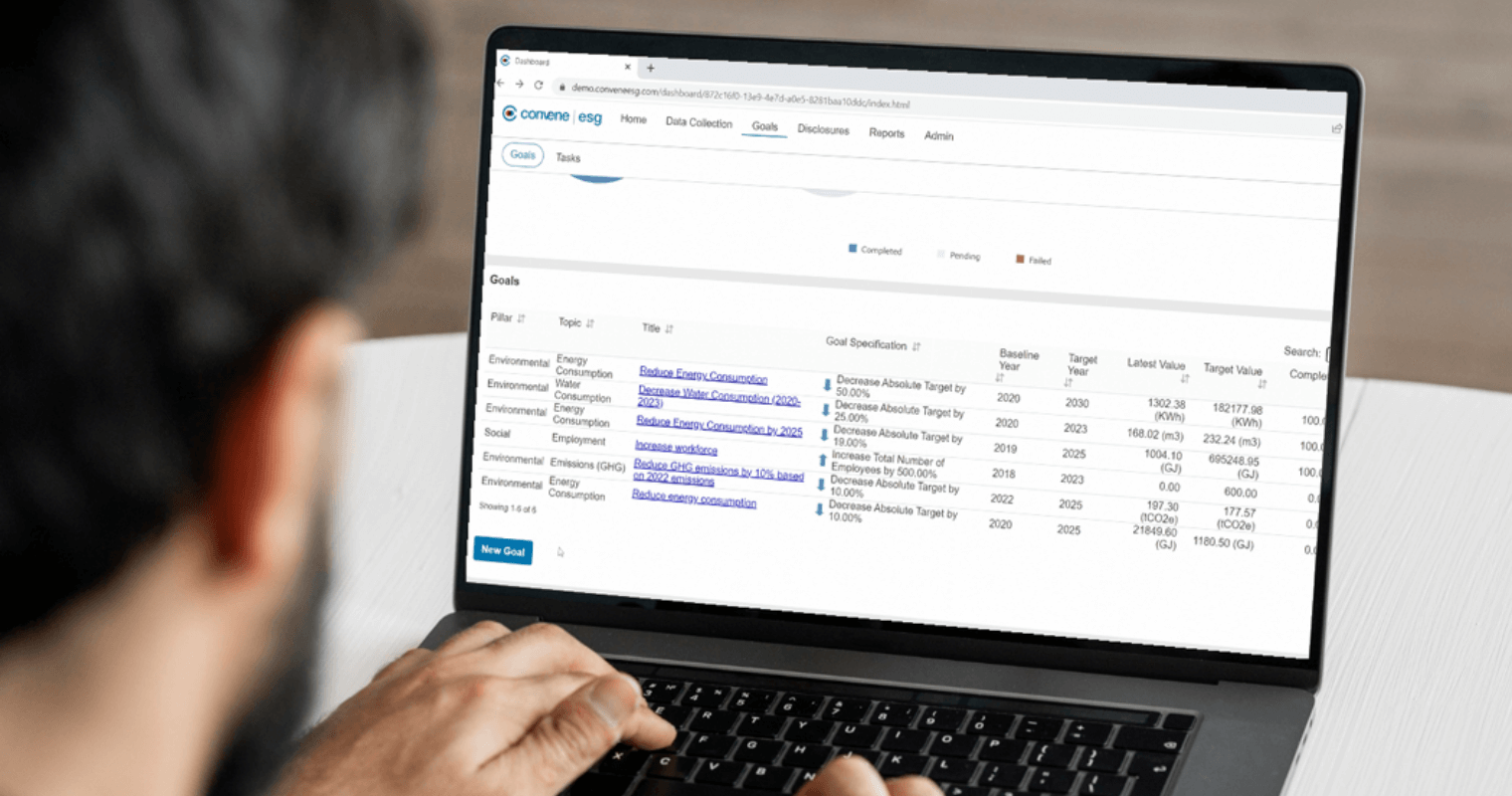

How Convene ESG Helps You Achieve ESG Goals

Setting ESG goals is a power move for companies working toward sustainability, but the process of getting the resources needed for sustainability reporting can be tricky and feel overwhelming. To tackle challenges like these, ESG reporting software can simplify this and guarantee compliance with evolving regulations. Companies can efficiently manage ESG goals and obtain clear and reliable insights from stakeholders to constantly refine objectives and results.

Convene ESG takes the complexity out of all this, converting data into easy-to-understand graphs and reports while ensuring accuracy and keeping stakeholders in the loop. With this ESG software, businesses can effortlessly create error-free reports that meet regulatory standards, keeping investors and stakeholders informed while enabling real-time performance monitoring and effective goal setting.

Achieve ESG goals with confidence— get started with a demo of Convene ESG today!

Pat is a Content Writer, focusing on informative and purposeful content for Convene ESG. She has written for sustainable living and art exhibitions, and took part in research and communication projects linked to the UN's Sustainable Development Goals, further diving her into sustainability and ESG values. Outside of marketing and content, she explores new subjects in film, drawing, and occasional overthinking.