Companies have evaluated sustainability mainly in terms of financial performance over the years. However, the worsening impacts of climate change and social conflicts prompted regulators to hold companies accountable for their ESG practices.

Today, the scope of corporate sustainability is undergoing a progressive shift, encompassing both financial and non-financial aspects. This emerging trend paves the way for the growing influence of “double materiality”. Discover how this new approach came to be and how it is transforming the landscape of sustainability reporting today.

What is double materiality?

The concept of double materiality was first formally introduced by the European Commission in their Guidelines on Non-financial Reporting: Supplement on Reporting Climate-Related Information in 2019. It argued that materiality should not merely focus on how financial performance affects businesses, but also give equal weight to the impact businesses have on the environment and society.

Double materiality encourages organisations to view impacts from two perspectives: financial and environmental. As financial performance and ESG become ever more interconnected, stakeholders are urging organisations to be honest and accountable about the implications of their business practices. This has led to regulatory bodies promoting the adoption of “double materiality” in sustainability reporting standards.

What are the two perspectives of double materiality?

Materiality is the process of identifying and evaluating the issues that have the greatest impact on an organisation’s operations and stakeholders. This ensures that organisations focus on the most crucial topics when reporting and making decisions. Within the concept of double materiality, there are two key areas to prioritise:

Environmental Materiality

Environmental materiality or impact materiality reports assess the negative and positive effects of business activities on the environment, society, and economy. Economists refer to these impacts as externalities. It covers issues on the environment, such as climate change, pollution, biodiversity, and social, like resource use, workforce, communities, consumers, and business conduct.

Financial Materiality

Financial materiality, on the other hand, identifies and assesses sustainability issues that could significantly impact the financial performance of an organisation. This involves assessing how climate change and social unrest influence cash flow and enterprise value.

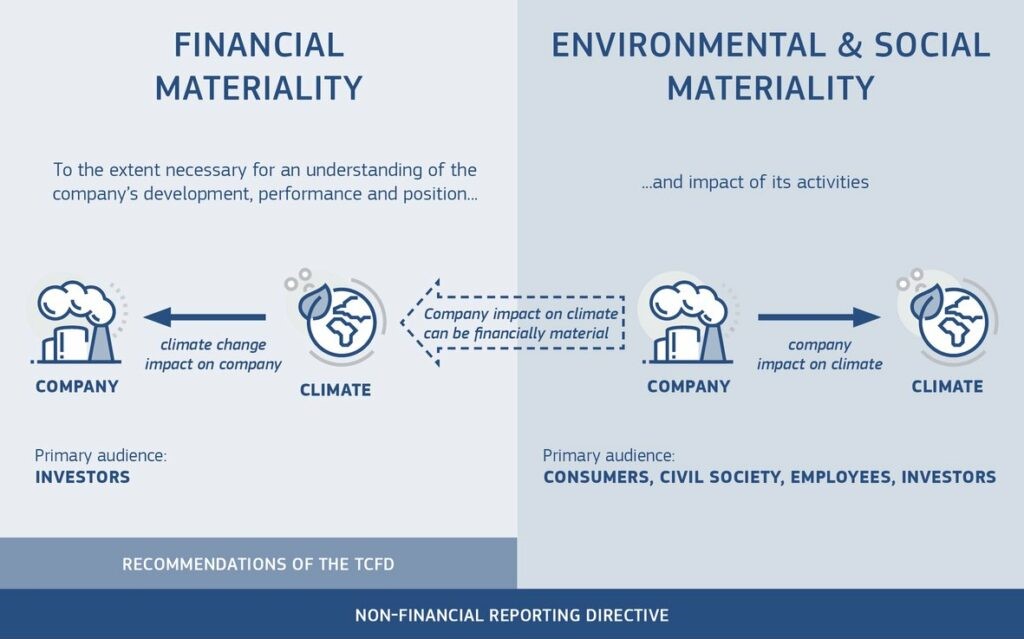

In the context of sustainability, identifying the right material topics is critical for creating accurate impact reporting. This section dives into the key distinctions between single and double materiality, clarifying which topics fall under each and exploring their use cases and limitations.

What is the difference between single materiality and double materiality?

Source: Guidelines on Reporting Climate-Related Information by European Commission

Single Materiality

Single materiality in sustainability reporting identifies only the topics with a significant impact on an organisation’s financial performance. Focusing solely on financial concerns, single materiality assessments only show how sustainability issues affect the bottom lines of organisations.

When is it used?

Organisations seeking to prioritise sustainability issues with the strongest impact on their financial performance often use single materiality. This approach effectively communicates their financial competitiveness to investors and stakeholders, potentially influencing their business decisions.

Limitations

Though widely incorporated by international frameworks, this approach to sustainability assessment has limitations. Its focus is mainly on internal impacts and single-metric performance. This makes it easier for organisations to disclose deceptive claims resulting in greenwashing.

Double Materiality

This approach analyses both the internal and external impacts of an organisation’s activities. It acknowledges how non-financial aspects can also influence sustainability performance, as much as financial aspects can. Therefore, double materiality ESG goes beyond financial reporting but also takes into account environmental impacts on society.

When is it used?

Double materiality insights offer valuable information for risk management and sustainability business planning by revealing the broader context for organisations. It addresses critical social concerns that stakeholders are becoming increasingly conscious of such as climate change, social capital, diversity, human resources, and financial performance.

Limitations

Adopting double materiality means organisations need to look into many issues when creating reports. This makes double materiality reports more tedious, complex and costly. Because this approach needs more analysis and data collection, organisations often hire ESG consultants or acquire relevant business solutions to assist them in building the reports – from gathering data to reporting writing.

Reporting Standards Incorporating Double Materiality

Find out what reporting standards support double materiality to know your options when you decide to conduct a double materiality assessment.

- GRI Standards: In 2021, GRI adopted double materiality in support of the European Union’s proposal. The updated GRI Universal Standards emphasise that analysing the impacts of business activities on the environment, society, and economy is key to identifying financial risks and opportunities. It specifically highlights the importance of reporting on human rights using the double materiality approach. GRI double materiality remains the only sustainability standard capable of reporting for multiple stakeholders, including communities, employees, and investors. This unique characteristic seemingly aligns with double materiality, making it valuable for comprehensive sustainability reporting.

- SASB: Sustainability Accounting Standards Boards was created to help businesses and investors develop a common language to document the financial impacts of sustainability. This global framework focuses on the “inward impacts” or financial materiality. Many organisations use SASB along with GRI to holistically cover both internal and external impacts, therefore, achieving double materiality. The main audience for SASB reports are investors, lenders, and other creditors.

- CSRD: Corporate Sustainability Reporting Directive is a relatively new law initiated by the European Union that came into effect in early 2023. It mandates EU organisations to report their financial and non-financial impacts. It is patterned from double materiality and follows the guidelines of the European Reporting Standards (ESRS). The CSRD double materiality requires reports to undergo third-party assurance before being disclosed to the public.

- CDP: Carbon Disclosure Project was founded in 2000. The organisation has long advocated for investors, companies, cities, states, and regions to manage their impacts on climate change, forests and water security. It promotes the use of CDP questionnaires – a framework to provide environmental information to their stakeholders through a scoring methodology. They assess key areas such as governance, risks and opportunities, environmental strategy, and scenario analysis.

What is a double materiality assessment?

Double materiality assessment is a framework for organisations to determine what material topics should be included in their sustainability reporting. These topics can be important based on their environmental and social impact (impact materiality), their financial implications (financial materiality), or both.

The two perspectives of a double materiality assessment offer an expanded view of how business activities affect the bottom lines and the wider society. Empowering decision-makers to make informed decisions, double materiality assessment helps organisations develop strategic initiatives and make investments that are aligned with their sustainability goals.

The Corporate Sustainability Reporting Directive (CSRD) was the first EU legislation to mandate double materiality assessment. Notably, countries in ASEAN, South Asia, the Middle East, and Central Asia, along with South Korea and Japan, are already familiar with this framework through their use of GRI standards. Double materiality may not be mandatory in these regions yet, but their existing reporting practices on financial and non-financial factors give them a head start for an easy transition if it becomes required in the future.

Why should companies implement double materiality assessment?

- Long-Term Value Creation: The wide scope of double materiality assessment generates valuable insights into key business aspects like financial performance, human resources, and environmental impact. This holistic view translates into actionable opportunities to enhance business resilience and secure long-term success. As a result, companies gain a competitive edge, potentially attracting new investments and customers.

- Future-Proof Risk Management: By evaluating material issues through the lens of double materiality, organisations can better understand the nature of their risks and their interconnectedness. This gives them foresight on how these risks will evolve through time, making it easier to develop future-proof and holistic mitigation strategies across financial and non-financial vulnerabilities.

- Develop Strong Stakeholder Engagement: Double materiality assessments address issues that are both material to the organisation and material to stakeholders. This relays a clear message to stakeholders that the organisation is dedicated to achieving their expectations, rather than just profits. It establishes shared objectives and develops active engagement with investors and consumers — boosting reputation and trustworthiness over time.

- Robust Regulatory Compliance: Organisations must be agile in improving their reporting compliance as local and international sustainability regulations evolve. With frameworks and legislations like CSRD requiring double materiality assessments, conducting one now can be a strategic and cost-effective decision. While double materiality has not been mandated across Asia yet, some countries recognise the importance of incorporating ESG within their requirements. For instance, Bursa Malaysia, HKEX, and SGX mandate listed companies to disclose their ESG practices.

Best Practices for Conducting a Double Materiality Assessment

A well-executed double materiality assessment results from the synergies of structured processes, foresight planning and technology. Here are the best practices your team can implement to create a valuable and actionable double materiality assessment:

1. Take a forward-looking perspective

As impacts become more interconnected and multifaceted, organisations must adopt a forward-thinking mindset and anticipate how materiality will evolve. Ignoring how time can alter risks and opportunities will make organisations vulnerable because what is considered material today might be immaterial in years to come.

Building a future-proof double materiality assessment process starts by determining the strategic path that the company wants to take. From there, teams can identify potential roadblocks through scenario analyses and intensive research on industry trends.

2. Know what frameworks incorporate double materiality

It would be easier to use frameworks and standards in your ESG and sustainability report that align with the double materiality approach. GRI and SASB are two complementary and well-recognized frameworks that can provide comprehensive references for non-financial and financial disclosures.

3. Conduct stakeholder mapping for better engagement

Before starting a double materiality assessment, organisations need to determine which stakeholders should be involved in the process. Stakeholder mapping helps organisations understand the interests and influence of their stakeholders.

4. Seek help from topic experts

Conducting double materiality assessments entails delving into multiple facets of business including sales, finance, risk management, legal, HR, and operations. To accurately assess impacts, threats, and opportunities, collaborating with experts proves invaluable. A company can leverage the expertise of ESG consultants to enrich teams with insights to empower them to create accurate and compliant sustainability reports.

5. Document the entire assessment process

Standardising the assessment through transparent documentation ensures consistent application, crucial not only for comparing results over time but also for enhancing credibility. Stakeholders are more trusting of organisations that implement systematic and streamlined processes for double materiality assessments.

6. Communicate outcomes across the organisation

Disseminate the findings from double materiality assessments effectively to internal teams and stakeholders. This helps integrate them into all levels of decision-making and fosters active engagement from teams. It empowers them to take ownership of their projects and contribute meaningfully towards positive impacts.

7. Make the most out of technology

Technology streamlines and optimises the double materiality assessment process – from data collection to report writing. By maximising business solutions, it can analyse vast data and identify hidden connections between sustainability issues and the business, revealing risks and opportunities.

Navigate Double Materiality Assessments with the Right Tool

Sustainability reporting is a complicated endeavour that requires organisations to juggle data collection, interpretation, and report writing. Navigating these complexities can be simpler and less complicated with Convene ESG — a centralised ESG reporting software designed to help organisations streamline their processes from data collection to writing. With its pre-built reporting templates, teams can be confident in creating double materiality assessments that comply with global frameworks like GRI, SASB, and CSRD.

Convene ESG facilitates seamless collaboration between internal teams, topic experts, and ESG consultants. This transparency allows everyone involved to follow the life cycle of data. Fine-grained access controls grant access to assigned individuals who can contribute directly via Optical Character Recognition (OCR) and automated data collection methods. Teams can have clear visualisations of progress through the software’s interactive dashboards, empowering everyone to make factual decisions and interpretations.

Ready to streamline your sustainability reporting? Schedule a demo today and see how Convene ESG can empower your organisation.