With the growing scrutiny of ESG performance, companies are taking peer benchmarking more seriously today. Such a process not only offers a structured way to evaluate sustainability performance but can also be used to enhance ESG ratings.

This guide discusses everything you need to know about sustainability benchmarking — from answering questions like what is ESG benchmarking and giving you tips on how to measure ESG performance.

What is ESG benchmarking?

Benchmarking is a widely-used practice of comparing one’s performance against peers within its industry — providing inward and outward viewpoints. In the ESG concept, this practice incorporates sustainability metrics, which are also relative to the peers of the company.

ESG benchmarking involves a systematic process of measuring and evaluating one’s environmental impact, social practices, and governance standards. It offers context, not just on performance, but also on the company’s ESG targets and strategies.

Most companies look at it as a temperature check on how they are pacing with competitors’ ESG performance. Hence, advantageous for shaping future sustainability strategies.

Why is ESG benchmarking important?

If done right, benchmarking gives companies accurate, comparable data that can demonstrate (or improve) the value of their ESG program. Hence, attracting socially responsible investors — and even consumers.

Besides keeping tabs on competitors, ESG benchmarking can help identify gaps within climate-related disclosures. The process can pinpoint ESG topics that a company needs to create policies and report on. In turn, improving one’s ESG ratings and ranking in the eyes of stakeholders.

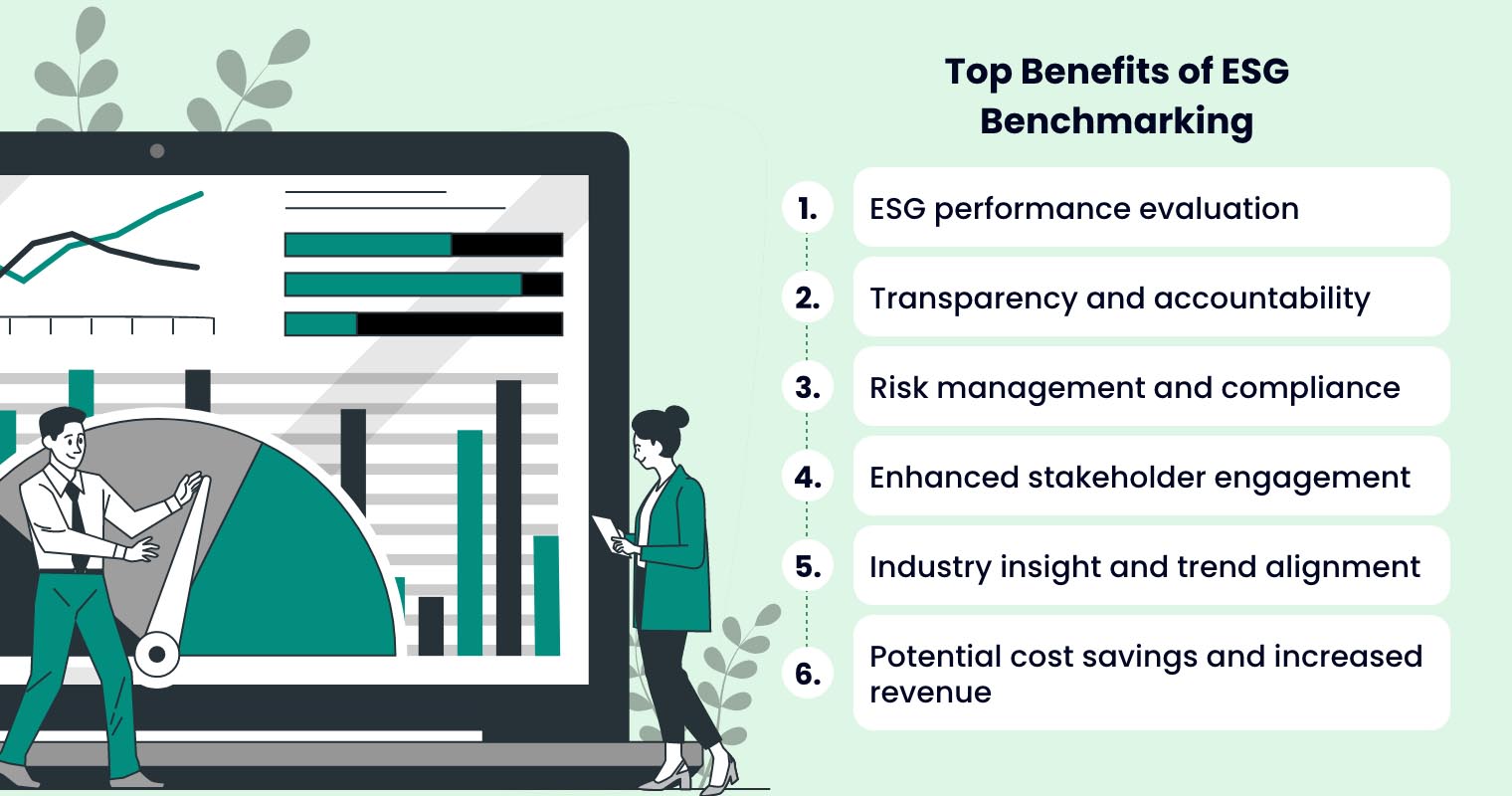

Top Benefits of ESG Benchmarking

Conducting regular performance benchmarks provides multiple benefits to companies, especially those looking to gain a competitive edge. Here’s what exactly you can get from an ESG benchmark analysis.

- ESG performance evaluation — Benchmarking is a performance evaluation across the ESG criteria. It provides a clear overview of how well a company integrates sustainability principles into its operations. Thereby, determining what areas should be improved and what efforts are working. This also gives companies insights into what actions can be replicated or what they’re missing out on to significantly improve their ESG performance.

- Transparency and accountability — This process also gives you insights into how your sustainability efforts are doing, which you’re required to disclose. This helps you meet investors’ demand for transparency and enhances accountability, particularly for meeting ESG targets that your company is publicly committed to.

- Risk management and compliance — Benchmarking against certain ESG criteria can help identify and assess potential risks with your operations, and ensure compliance with prevailing regulations. It is useful for the early detection of issues, like regulatory compliance risks or supply chain vulnerabilities. Recognising such risks makes it easier for your company to develop effective mitigation strategies for long-term sustainability, and align your operations with the relevant regulations.

- Enhanced stakeholder engagement — Demonstrating your company’s commitment to responsible business practices can be done through benchmarked ESG performance. Benchmarking allows you to evaluate and report accurate information about your sustainability efforts, thus, facilitating strengthened stakeholder engagement and relationships.

- Industry insight and trend alignment — Another advantage of benchmarking is getting insights into the trending ESG aspects reported by your industry peers. This knowledge keeps the company’s sustainability efforts aligned with current industry trends while staying informed about peers’ performances. Hence, ensuring the company remains responsive to evolving industry expectations and positions itself as a leader in sustainability practices.

- Potential cost savings and increased revenue — Benchmarking is a strategic tool for identifying cost-saving opportunities in your ESG initiatives. It helps pinpoint sustainable plans that need improvement and how you can streamline operations, leading to tangible cost reductions. Also, a strong ESG performance, validated through benchmarking can attract more investors and customers into your business. Ultimately, driving increased revenue through enhanced market reputation and brand value.

Basic Methods for ESG Benchmarking

In general, companies utilise benchmarking techniques to effectively evaluate their performance and metrics against peers. Two of the commonly used methods are absolute benchmarking vs relative benchmarking. Read on to find out how they work.

Absolute Benchmarking

This benchmarking method is about evaluating your company’s ESG performance with internally set criteria or fixed standards (e.g. GRI, SDGs), irrespective of external comparisons. This means your current progress may only be compared against your past performance, instead of doing a direct comparison to your peers.

Most companies use absolute benchmarking to create unique sustainability targets and emphasise the achievement of self-defined goals. These targets can be:

- Achieving a 20% reduction in greenhouse gas emissions by 2025, regardless of industry averages.

- Setting a goal to achieve zero waste in the manufacturing process within the next five years, based on your company’s internal sustainability objectives.

Relative Benchmarking

On the other hand, relative benchmarking is the method used to compare the company’s ESG performance against its industry peers. This comparative analysis enables your company to gauge how well you’re doing compared to the competition.

Having an idea of your standing in the broader market gives you insights into your areas of strength and improvement opportunities. Some examples are:

- Comparing your company’s gender diversity metrics with peers, then setting targets based on industry averages. This can be an opportunity to align or exceed your selected peer group’s gender diversity ratios.

- Evaluate your company’s energy efficiency against industry benchmarks. The goal is to be more energy-efficient than the average industry performer in your market.

Useful Tips for a Successful ESG Benchmarking

Performing an ESG benchmark analysis means your company gets insights that support strategic decision-making. If you don’t know where to start, below are the integral steps to successfully conduct your benchmarking process.

1. Define ESG metrics and peer group

Identifying the right ESG metrics to measure is the foundation of benchmarking. Listing specific metrics depends on your company’s industry and business activity. Some common examples are:

- Environment metrics: Levels of carbon dioxide (CO2) produced, cubic metres of water consumption, land use, and resource depletion.

- Social metrics: Workforce diversity percentage, comparative living wages, gender pay gaps, health and safety policies, and charity or community volunteering.

- Governance metrics: Executive’s pay ratio, ethics and anti-corruption policies, tax payments, and diversity ratio of the executive board.

Next, select the peer group you’ll use for the benchmarking. It may consist of 10 up to 100 peers, depending on the organisation’s size and goal. Generally, the potential peers should be the same size or twice as the company. Having too large or too small can lead to inaccuracies.

In addition, peers can be refined by market capitalisation and market revenue, or further filtered by the number of employees or other financial metrics.

2. Collect the relevant data

Having a good data collection workflow lets you ensure accuracy and consistency across all selected metrics. On top of your ESG data from internal reports, you can gather your peers’ information from various sources (e.g. third-party databases, publicly available information).

To make the task easier, it’s best to work with relevant departments (sustainability, finance, and human resources) to collect all the benchmark ESG data you need.

3. Perform a detailed analysis

Following your data collection is the analysis of data to make inferences. To assess your performance against the selected peer group, you can use quantitative tools like trend analysis and benchmark comparisons.

Benchmarking ESG data between your company and peers can help you better understand where performance gaps are. Looking into your materiality assessment can also guide you in defining how ambitious your ESG goals must be — in reference to your competitor’s goals as well.

4. Set ESG improvement targets

Evidently, benchmarking ESG performance is beneficial for determining areas where your company excels and where it needs improvement. Using the data identified in your analysis, set ESG measurable improvement targets with realistic timelines — which may factor in resource availability and initiative complexity. Here are some target examples:

- Achieve carbon neutrality by a specific year

- Increase the percentage of recycled materials used in product packaging

- Reduce gender and ethnic pay gaps

- Increase community investments and engagement

- Implement employee training programs with a specific completion rate

- Set whistleblower protection mechanisms with a certain resolution time for reported concerns

5. Monitor and report

After analysing the data and setting your targets, it’s time to monitor the changes you will apply. It’s best to have action plans that specify the tasks, timelines, resources, and expected results for each area of improvement.

Depending on the type of benchmark ESG data, frequencies for monitoring may vary. Any progress on targets and performance must also be communicated through reports for transparency. They must be shared internally with executives and sustainability teams, and externally through ESG disclosures or press releases, where necessary.

Frequently Asked Questions on ESG Benchmarking

How to address challenges related to data collection in ESG benchmarking?

Collecting ESG data for benchmarking can be done successfully if you have a robust data management system or tool for automated data gathering. Consider investing in ESG benchmarking tools and platforms like Convene ESG for easier and more accurate data gathering. Plus, you can ensure all processes are aligned with standardised reporting frameworks like GRI or SASB.

Are there industry-specific ESG benchmarking standards?

Yes. Organisations like the Sustainability Accounting Standards Board (SASB) focus on financially material, industry-specific ESG topics for various sectors. The Carbon Disclosure Project (CDP) also offers sector-specific questionnaires and benchmarks, for comparing environmental performance with industry peers. The industry-specific metrics highlighted in such standards are vital for relevance and comparability when benchmarking.

How can companies improve their ESG benchmark scores?

There are tons of actions that companies can take to improve their benchmarking scores. Some common actions include:

- Regularly monitoring and reporting progress. This involves creating detailed ESG reporting and disclosing both achievements and areas for improvement.

- Implementing strategies to mitigate identified ESG-related risks within the business operations.

- Conducting ESG integration to the supply chain and supplier engagement programs for responsible sourcing.

- Investing in research and developments to innovate sustainable products, services, and processes.

- Fostering a culture of sustainability through employee training and engagement programs.

Is ESG performance linked to financial performance?

Yes, and their connection can be observed in several ways such as:

- Strong ESG practices give a company the upper hand to manage or mitigate risks, which leads to reduced financial volatility.

- Implementing ESG initiatives can also result in resource efficiency and operation cost savings.

- Having strong ESG credentials is also often perceived as less risky and may find it easier to attract investment capital.

- ESG-focused operations can bring new market opportunities for companies and may result in competitive advantage and revenue growth.

Kickstart ESG Peer Benchmarking with Convene ESG Today

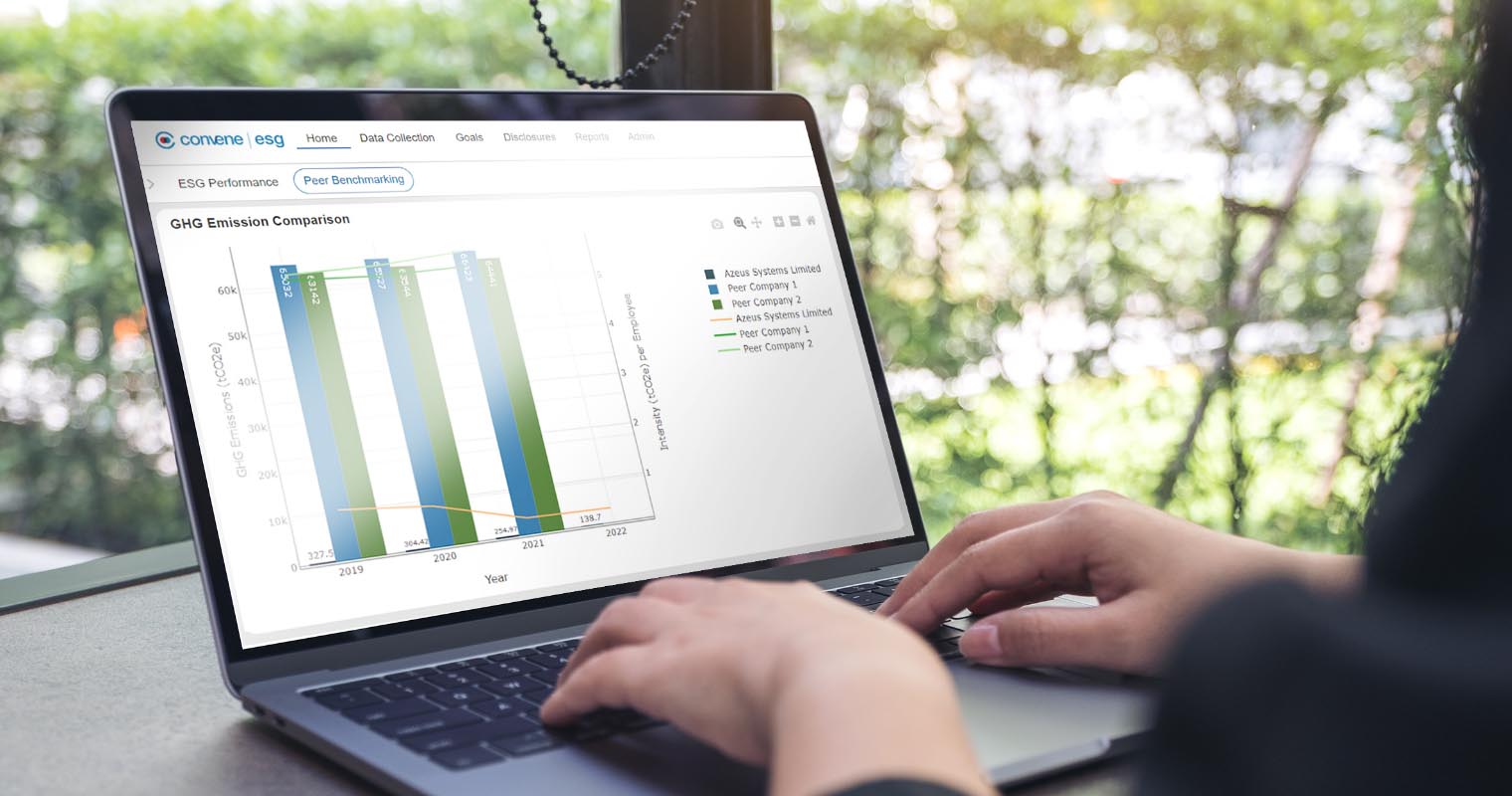

Conducting accurate ESG benchmark analysis can be daunting, given all the data needed. Convene ESG is designed to support companies like yours engaging in sustainability benchmarking by offering the necessary features you need!

Convene ESG offers a Peer Benchmarking feature that enables quick comparison of your company data against its peers. Upon software implementation, you can look into publicly available ESG disclosures of your peers when writing your report. Comparing your organisation’s performance chats against your peers is also available.

Convene ESG also provides a historical data storage capability for comprehensive benchmarking across different time periods. Such a feature enables users to access and analyse years of past ESG data, aiding in the evaluation of your company’s progress over time and setting ESG goals. Thus, making Convene ESG the ideal platform for both relative and historical benchmarking needs.

On top of that, Convene ESG can also streamline the reporting process with automated data collection. Users can set collection frequency, start date, and collaborators for specific data-gathering tasks. Moreover, this ESG reporting software is also compliant with global standards and frameworks, allowing the configuration of report formats. Users can easily customise their reports to adhere to specific frameworks and ensure they meet the relevant international guidelines and local regulations.

Book a demo now and explore how Convene ESG can improve your peer benchmarking process!