Investors and organizations that prioritize future-proofing understand the real-time risks revealed by the pandemic. One of the worldwide responses that industries and economies are focusing on is sustainable investing. Shifting their focus to the environment, social, and governance (ESG) factors aims to prevent or mitigate the impact of supply chain disruption.

To portray a responsible attitude that investors and consumers prefer, businesses and organizations must provide a transparent and accurate ESG disclosure. Such reports will include both financial and non-financial performance indicators relating to how they address factors, such as carbon emissions, diversity and inclusion, and supply chain governance.

Read the first article of this two-part series here: Creating Real Value: ESG Investing and Sustainability Reporting

The Sustainable Development Goals

As industries and economies take action against environmental degradation, the United Nations adopted the Sustainable Development Goals (SGDs) to promote the earth’s prosperity. But among all the 17 goals, businesses and organizations are recommended to focus on the 12th goal, which is guaranteeing sustainable consumption and production patterns.

Under this is Target 12.6: Encourage Companies to Adopt Sustainable Practices and Sustainability Reporting, wherein Lau Shih Hor, CEO of Elixir Technology and guest speaker for the webinar: Unlocking ESG for Boards: From Strategy to Disclosure, shared his thoughts about:

“The Sustainable Development Goals target 12.6 is talking about the importance of measuring. Thus, the start of a sustainable journey. If you want to go somewhere, you must know where you’re at right now. And that is going beyond just producing a report, but also taking ownership of this entire journey”.

Major global goals like the SGDs exist to only guide companies through their journey to sustainable growth, social responsibility, and transparent corporate governance. Increased ESG accountability is still a much more critical component when working on sustainability goals. To simplify this initiative, investing in digitization is recommended.

ESG and Digital Transformation

Any organization that wants to future-proof itself should have environmental, social, and corporate governance matters on top of its mind. Nearly all public sector organizations and corporations consider ESG as a major strategic imperative.

Nowadays, pressing issues such as climate change, reduced crop yields, and supply chain disruption endangers businesses and their serving communities. For that reason, an increased focus on ESG practices and programs is on the rise. In a 2020 survey by McKinsey, most executives and investment professionals indicated that ESG programs help them create and enhance short- and long-term value.

The Transition to ESG Digitization

With both environmental and economic pressures present today, organizations require an effective and fast approach toward responsible consumption and production. Some are still navigating their ESG processes manually, while others have used technology to improve efficiency.

In the Unlocking ESG for Boards: From Strategy to Disclosure webinar, Shih Hor shared the four pain points that come with using a manual-based system.

- Yearly scrambling for missing data at the last minute

- Uncertainty in data accuracy

- Limited visibility of trend and benchmarking

- Nightmare repeats with every change

Shih Hor stated, “If you have a manual base kind of system every year, you know the drill. You scramble for missing data, check who has not submitted, and worst, you don’t know whether the data is accurate, because it was manually gathered. How do you make sure it’s correct? Otherwise, garbage in, garbage out”.

In these challenges of finding missing data and adopting the ever-evolving disclosure requirements, digitization comes in. This allows organizations and businesses to transform their manual workflow and process into something more efficient, accurate, and consistent.

The Importance of ESG Digitization

The impact of digital technology is completely visible in the entire business landscape. Operational costs and human errors are reduced, as workflows and processes do not have to be done manually. There are also less likely to be data silos as information is already stored on the cloud instead of physical storage devices.

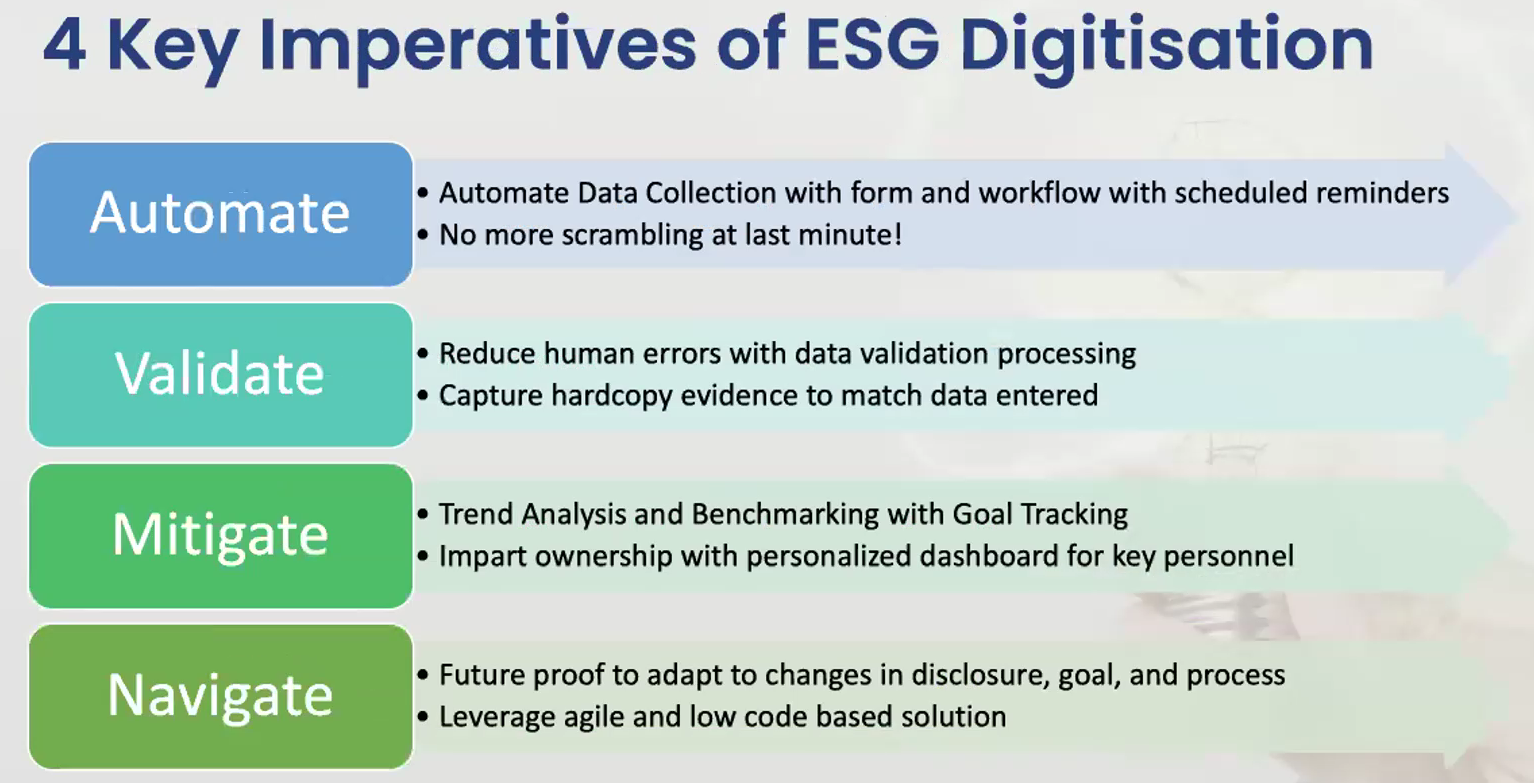

Apart from general business operations, technology is also beneficial for upgrading the ESG process. In ESG digitization, four imperatives should be taken into account:

In addition to the validation process, Shih Hor said, “With some jurisdiction, looking at external assurance, you may want to capture the hard copy as evidence to match the support of the data that’s been entered. This evaluation process is one of the key processes we should put in place”.

He added it is vital for businesses to go through these four imperatives on their digitization journey — from automating data collection to navigating this continual journey. With the right technology and approach, companies can improve their ESG data collection and reporting in an effective and cost-efficient way.

Convene ESG: Helping You Streamline Your ESG Data Collection and Reporting

Without the right digital technology, ESG data collection and reporting can be a real challenge for any corporation. This is what Convene ESG is engineered to solve. This specialized software features better data tracking and consolidating of a company’s ESG performance, offering readily available forms for provisions and framework.

Sustainability reporting is now made easier with Convene ESG. Companies take advantage of its ESG goal tracking and report generation features, helping them get a clear cut of their priorities. Whether it’s digitizing ESG data or improving oversight, Convene ESG can help you on the continual sustainability journey.

Interested in discovering more about our ESG reporting software? Head over to Convene ESG page today. You can also opt to start a free trial for 21 days with the assistance of our team of seasoned ESG and digital specialists.

*Graphs and figures are grabbed from a recent webinar hosted by CSIA and Convene, “Unlocking ESG for Boards: From Strategy to Disclosure”.