rIn recent years, an increasing number of organizations recognize the significance of forging long-term value and pursuing ESG investing. Economic pressures play a big role in such initiatives — propelling organizations into becoming more reactive and mindful of their societal and environmental impact.

As more investors today focus on ESG issues, there’s more pressure on companies to work towards better sustainability performance. Sarah Keyes, CEO of ESG Global Advisors and guest speaker for the webinar “Unlocking ESG for Boards: From Strategy to Disclosure” shares what companies should know about ESG and the role of investors in this notion:

“It’s important to note that all these factors are interconnected, so we cannot really look at one ESG factor in isolation. We’ve also seen the capital markets and the investors, in particular, driving this agenda, as they seek to allocate capital in an efficient and effective way that aligns with their ESG priorities and their investment beliefs and strategies”.

To give you more details about the topic, the next sections will answer the following relevant questions:

- What is the difference between CSR and ESG?

- What is the role and impact of ESG in the investment universe?

- How businesses can achieve net-zero emissions by 2050?

- Why are climate-related disclosures crucial for attaining a low-carbon future?

CSR and ESG: Key Distinctions

Before diving deep into ESG investing and integration, it is important to first understand two major terminologies causing a lot of confusion in the landscape. What are the distinctions between CSR and ESG?

Corporate Social Responsibility (CSR) and Environment Social, and Governance (ESG) both play substantial roles in guiding businesses to be socially responsible. One clear distinction is that CSR is a business model and ESG is a set of criteria.

CSR focuses on business accountability and targets internal and external stakeholders. The internal ones include the company employees, while external stakeholders refer to clients and local communities. ESG, on the other hand, makes CSR’s efforts measurable. It evaluates the sustainable practices and values captured by CSR.

In a nutshell, the key difference between CSR and ESG is that the first is more focused on “values” while the latter is focused on “value”. However, as CSR and financially material issues grow and cause ESG to overlap, the lines are increasingly blurring.

ESG and the Investment Universe

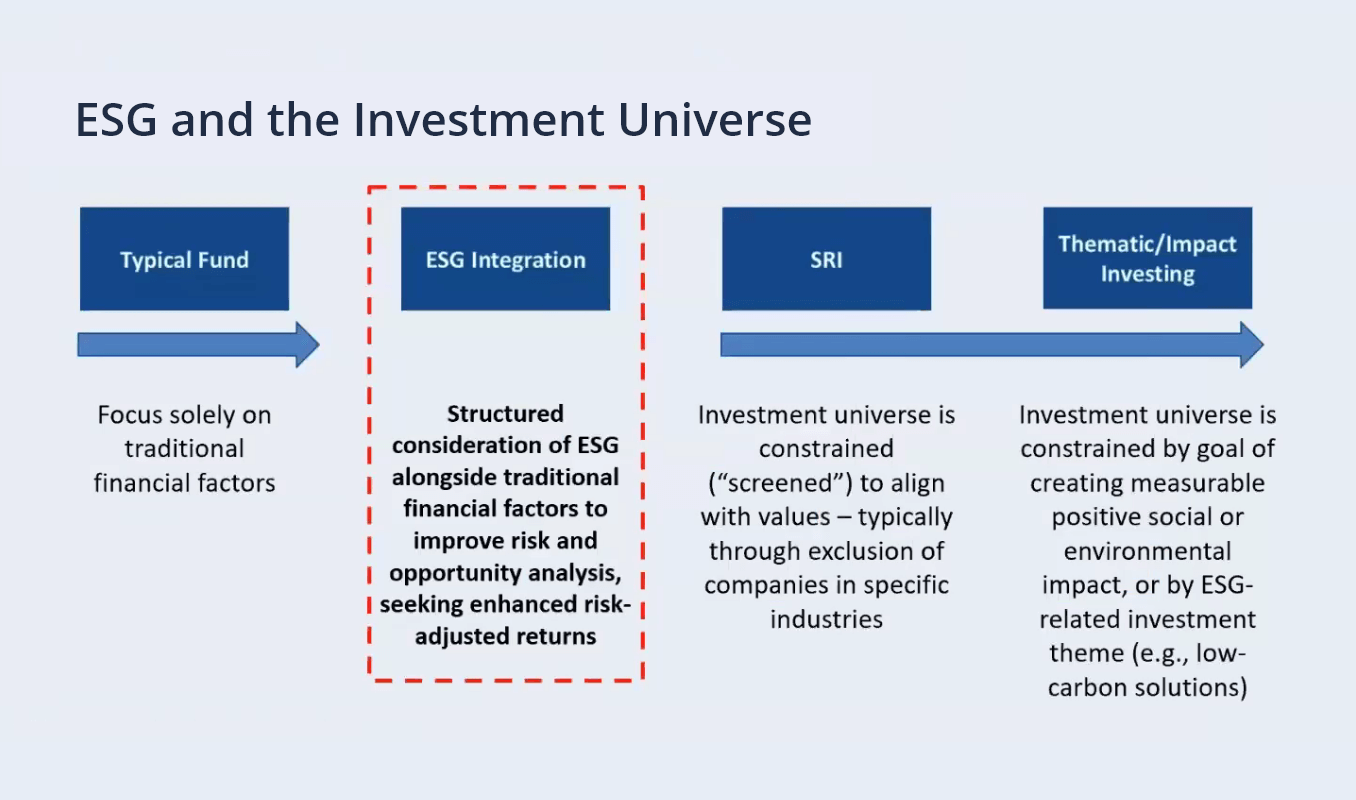

The potential for creating value has always been too vast for companies and investors to explore. With a strong proposition and integration into the investment process, ESG can create value. Organizations and businesses planning for ESG integration should understand that this requires structured consideration alongside traditional financial factors. In essence, it is about value.

The spectrum of ESG and the investment universe includes these four elements:

Source: ESG Global Advisors

This also means having a more structured ESG consideration alongside the traditional financial factors and focused on maximizing risk-adjusted returns. Moving to SRI and Impact Investing, the returns may be compromised by screening companies from the investment universe to align with values.

Tinuade Awe, CEO of NGX Regulation Ltd and also a guest speaker for the said webinar, shared her insights about the key interests of the investing community in terms of global issues and profit: “The investing community is interested in what is happening to people, the planet, and to profit. They’re looking from the point of view: What is the impact of your activity on the environment? What is the impact of your activity on people? You’re making a lot of profits but are you doing it at what expense?”

What is Responsible Investment?

The responsible investment approach explicitly refers to the integration of ESG factors into investment analysis. It also pertains to the creation of long-term sustainable value — financially and non-financially. The financial value may take the form of increased or improved returns as a result of better ESG performance or internalization of externalities. Non-financial value, on the other hand, can improve sustainability performance by individual companies like boosted job creation, or across the market as a result of policy engagement.

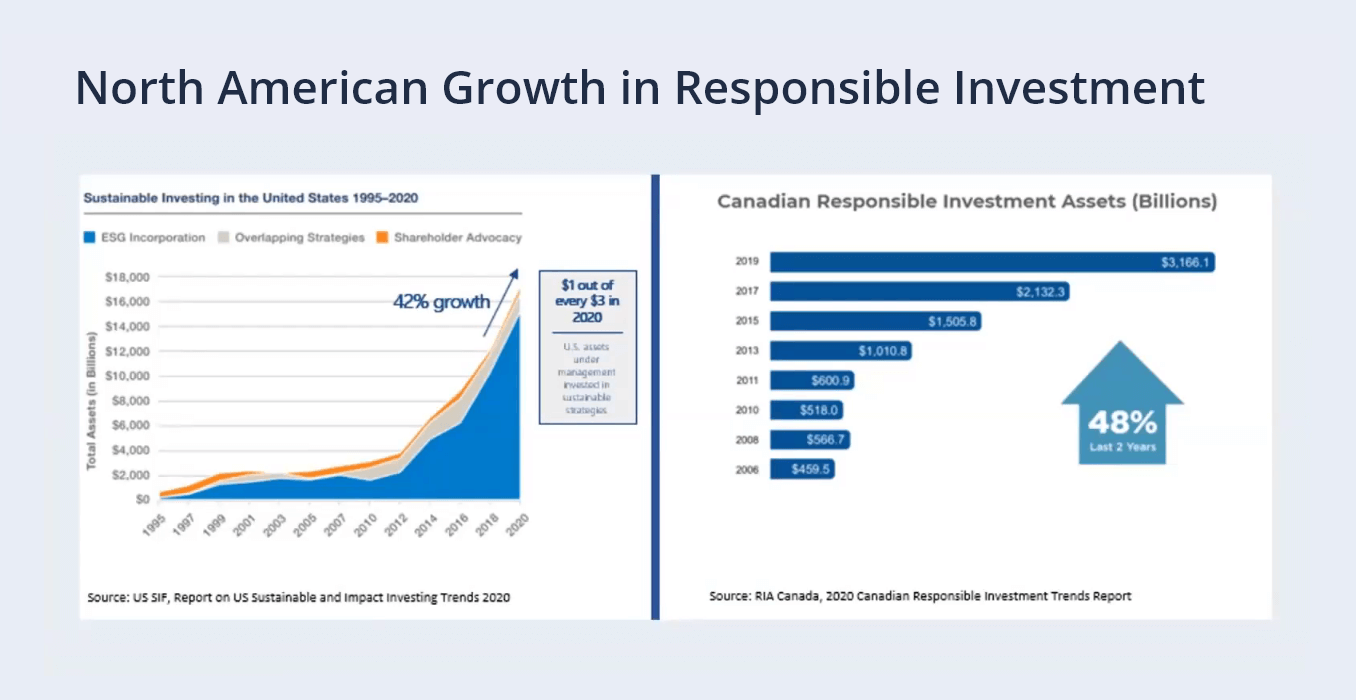

Reports found a massive acceleration in responsible investment commitments, with the United States experiencing 42% growth in assets under management from 2016 to 2020. This shows how an increasing number of investors are committing to ESG integration using some sort of responsible investing approach.

2050 Net-Zero Emissions Transition

With the menaces of global warming quickly threatening the global economy, the target to reach net-zero emissions by 2050 becomes even more imperative. However, this goal is yet far from reality. In fact, there’s still a massive gap between the required negative emissions for 2030 and the current levels of emissions as of 2020.

To achieve net-zero emissions by 2050, widespread and rapid changes in business practices and policies across all sectors are necessary. According to a report by IPCC, greenhouse gas emissions must peak by 2025 and cut them down by 45% by 2030. This is the only way to maintain the 1.5C pathway and reach it by 2050.

Going on the pathway to limiting global warming, the preferences of investors and customers are also likely to change. Demand for more eco-friendly services and products is anticipated, forcing many businesses to find low-emissions alternatives. In the Glasgow Financial Alliance for Net Zero (GFANZ) report, currently, over 450 financial institutions spanning 45 countries and representing over $130 trillion of assets are committed to shifting their portfolios and investment decisions to help the globe decarbonize.

The GFANZ campaign is backed by several initiatives — two of which are established to provide guidance into portfolio and net-zero alignment. The first one is the Science Based Targets initiative (SBTi) which aims to help the economy with zero-carbon emissions. Providing resources like webinars and guidance documents, they also created a new protocol for determining a credible net-zero plan.

Next is the investor-led initiative, Climate Action 100+. The initiative is led by some of the leading global investors connecting to companies also committed to driving net-zero emission transition. It also launched its own net-zero company benchmark that uses a 10-point scale and other key metrics for assessing performance against the Climate Action 100+’s goals: emission reduction, governance, and disclosure.

These initiatives further intensified the significance of embarking on the journey to a low-carbon future. But more than that, they gave a tighter clutch into how climate-related disclosures can support such ambitious decarbonization targets. Continue reading to find out why these disclosures are vital for attaining net-zero emissions by 2050.

ESG Landscape: Climate-Related Disclosure

The fast-growing expectation to address climate change risks and work towards better sustainability performance forces business organizations to reconsider their decisions and plans. On a positive note, companies with embedded sustainability principles are rewarded with a better reputation, investor and customer relationships, and financing.

Dr. Ashraf shared that companies in the MENA region are also paying more attention to the idea of being socially responsible, “In the MENA region, we have seen some companies which have been reacting voluntarily. However, most of the companies are reacting because of regulatory pressures. The regulators within the region are putting more emphasis on these issues. Because for the last couple of years, you can see that the GCC countries, which have been known to actually export capital and invest in other countries, are trying to attract investors to come to the region”.

In relation to ESG reporting regulations, Tinuade Awe added, “In the Niger situation, there has been some regulatory activity. For example, NGX has sustainability disclosure guidelines that were issued in 2019. The SEC, last year (2021) in November, issued guidelines on sustainability for the banking sector in Nigeria — sustainable banking principles.”

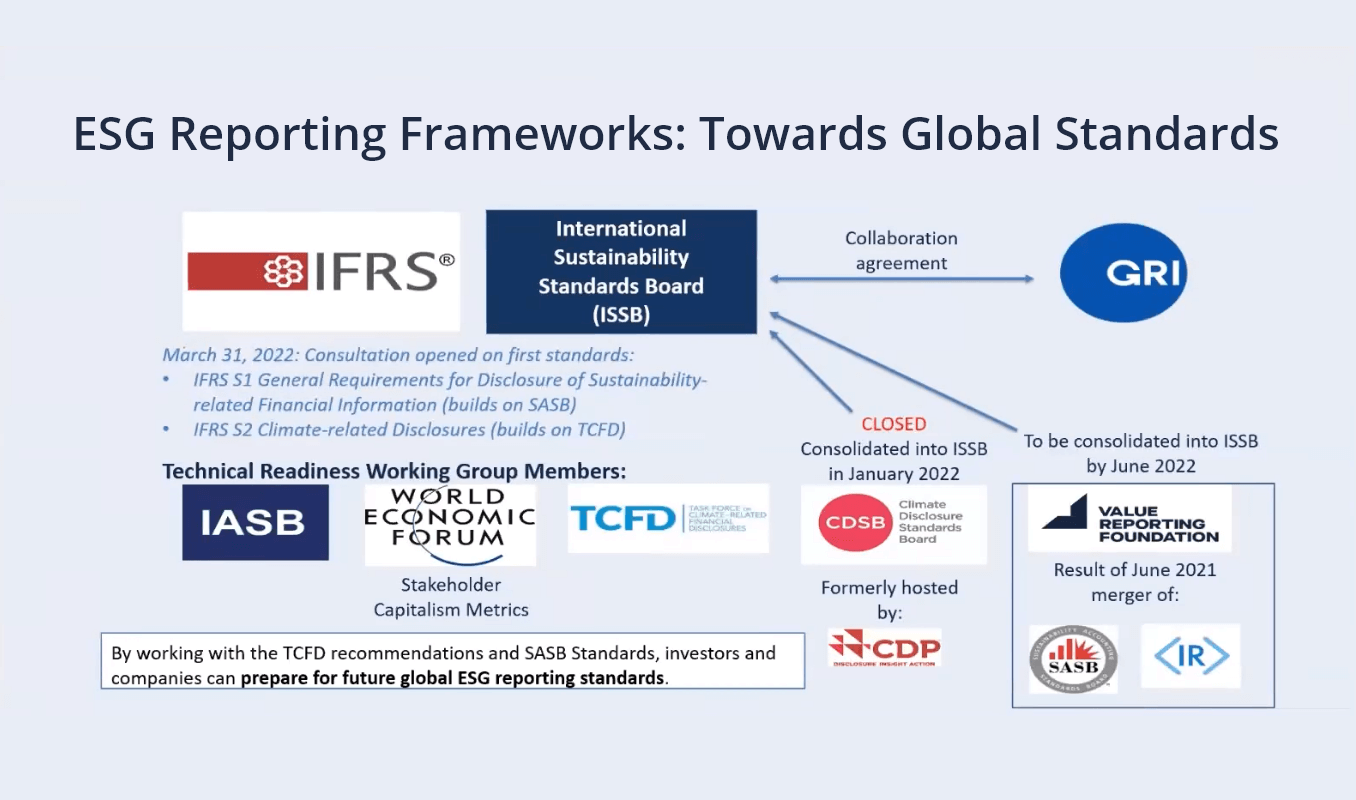

The active rule-making reporting landscape in Canada and the US, on the other hand, plays a major part in North America’s global harmonization progress for ESG standards. Below is the currently evolving landscape that presents the voluntary reporting standards made by the market, and the mergers of frameworks, particularly into the ISSB.

Source: ESG Global Advisors

Firms with difficulty in creating appropriate climate-related disclosures are advised to start with the TCFD recommendations and the SASB standards. The said frameworks are wrapped around the ESG issues and their impacts on an enterprise value — substantially beneficial for organizations dealing with public markets and institutional investors.

While pressures are pushing companies to adhere to the present standards for sustainable reporting, OECD’s Financial Economist Alejandra Medina pointed out, “There are currently many standards around. Different regulators are adhering to different standards, some of them are mixing the standard, some of them are building their own local standards. I think that we need a bit more guidance on what standard we need to use”. Nonetheless, companies will continue to face pressure from investors and global reporting standards in transitioning to net-zero emissions by 2050.

A Sneak Peek: The Role of Digitalization in ESG

These rising challenges in moving towards better sustainability intensify the firms’ need for technology. ESG disclosures, for example, prove to be a costly and time-intensive task for organizations — not to mention the compliance with reporting guidelines and standards. Through digitalization, sustainability reporting and business processes are more likely to be revolutionized.

Interested in learning more about ESG and digital transformation? Read our related articles here.

*Graphs and figures are grabbed from a recent webinar hosted by CSIA and Convene, “Unlocking ESG for Boards: From Strategy to Disclosure”.