As ESG issues continue to capture investors’ attention, companies are under immense pressure to become sustainable and future-proof. In 2023, 85% of surveyed investors planned to boost ESG investment over the next five years. These investors use ESG ratings and rankings from rating agencies to make smarter investment decisions.

If you want to learn more about ESG ratings and how they impact companies and investors, this comprehensive guide will provide in-depth insight.

What are ESG ratings?

ESG ratings are percentages or letter grades given to companies that aim to measure their reporting transparency, performance, and exposure to environmental, social, and governance risks and key topics. ESG rating agencies in different parts of the globe conduct reports on companies’ ESG performance. The sustainability scores generated from these reports are known as ESG ratings.

ESG Ratings vs ESG Scores

Although these terms are often used interchangeably, there are significant differences that separate one from the other. ESG ratings, as mentioned above, are typically produced through a process involving human analysts who assess a company’s sustainability performance based on a range of qualitative and quantitative factors. In contrast, ESG scores embrace a systematic, data-driven methodology to measure sustainability performance. It leverages technology and algorithms to eliminate human biases and inconsistencies.

In light of the foregoing, here are some factors that influence a company’s ESG scores or ratings:

Environmental rating

- Carbon emissions

- Financial and environmental impact

- Raw material sourcing

- Packaging material and waste

- Renewable energy

- Green building

Social rating

- Labour management and standards

- Health and safety practices

- Community relations

- Workplace diversity

- Political contributions

- Consumer financial protection

Governance rating

- Board diversity

- Business ethics

- Financial management

- Executive compensation

A favourable score means a company proactively manages sustainability risks while taking advantage of the relevant opportunities. A less favourable rating, however, usually indicates that the business exhibits low reporting transparency or mishandles its exposure to ESG risk factors.

The rating enables investors to gauge whether the companies’ values align with their particular goals. Some even use it to decide whether to invest in the business. According to the Harvard Law School Forum on Corporate Governance, these reports and ratings often initiate shareholder-company engagement on environmental, social, and governance matters.

What are the sources of data for ESG ratings?

Data comes from various sources, some publicly accessible while others must be requested. Here are five different kinds of data sources every business or investor need to know:

- Corporate Sustainability Reports – Companies voluntarily share corporate sustainability reports to detail their ESG practices. These reports offer insights into their policies, strategies, and performance.

- Regulatory Filings – Regulators like the Securities and Futures Commission of Hong Kong (SFC) and the Singapore Exchange (SGX) mandate companies to disclose specific ESG-related data so investors and stakeholders can easily access it.

- Non-Governmental Organisations (NGOs) – With the primary goal of improving social conditions, NGOs gather and share ESG data on companies, focusing on their environmental impact and social responsibility, including labour practices and human rights.

- Social Media – Social media platforms, like Instagram and Facebook, offer alternative data sources through posts highlighting sustainability initiatives, community engagement, and employee involvement.

- ESG Ratings Providers – Ratings and other information collected by these providers are often readily available on their websites to aid investors in comparing companies and making the right decisions.

Understanding ESG Rating Methodologies

ESG rating methodologies generally involve assessing a company’s environmental, social, and governance practices. However, specific methods vary among different providers. The process includes quantitative and qualitative analysis of factors, such as the organisation’s contribution to climate change, labour practices, and ethical business conduct. Some agencies use proprietary algorithms, while others rely on industry standards and frameworks, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) guidelines.

What are ESG rating agencies?

ESG rating agencies are organisations that evaluate and score a company’s ESG performance to determine its sustainability. They do it by collecting relevant data from various sources, such as company disclosures and regulatory filings, among other sources stated above.

An ESG rating agency is typically personally hired by the company to perform an in-depth analysis of its existing practices and evaluate what needs improvement. They generally address seven critical areas of corporate sustainability:

- Energy production

- Materials management

- Labour rights

- Community relations

- Consumers’ rights

- Product responsibility

- Corporate governance

14 Widely Known ESG Rating Agencies

The first thing to note is that rating providers use different methodologies and formulas to score companies. They range from analysis firms to research companies and agencies, each having its own rating concepts and scales to evaluate a business’s ESG competitiveness.

Below are some of the top ESG rating agencies with their respective scoring scales and methodologies:

MSCI ESG Research

Rating scale: AAA to CCC

Source: MSCI

Launched in 2010, the Morgan Stanley Capital International (MSCI) ESG Research has one of today’s most widely referenced rating systems. Utilising a rules-based methodology, MSCI identifies the top and poor-performing companies according to their exposure and management of sustainability risks. It collects ESG data from company disclosures, academic databases, regulatory organisations, and NGOs. As part of the MSCI Group, they provide MSCI ESG ratings for over 6,000 global companies and more than 400,000 equity and fixed-income securities.

RepRisk ESG Rating (RRR)

Rating scale: AAA to D

Established in 1998, RepRisk screens relevant data from over 84,000 companies across 34 sectors worldwide. It also provides reports for 14,000 NGOs, 10,000 governmental bodies, and 20,000 projects. Its rating system facilitates the benchmarking of companies based on their ESG performance, specifically in the areas of risk and investment management, compliance, and supplier evaluation.

S&P Global ESG Scores

Rating scale: Out of 100

The S&P Global ESG Score evaluates how well a company handles essential ESG issues. Its methodology uses a mix of company disclosures, media analysis, stakeholder input, and in-depth assessments via the S&P Global Corporate Sustainability Assessment (CSA). Scores range from 0 to 100, with 100 being the best. Each company gets around 130 points based on up to 1,000 data points, graded against set criteria for availability, quality, relevance, and performance in sustainability areas such as environmental, social, and governance risk, opportunity, and impact.

Sustainalytics’ ESG Risk Ratings

Rating scale: Out of 100

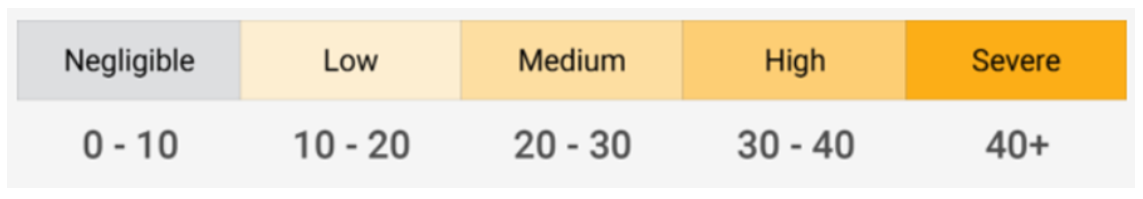

A subsidiary of Morningstar ESG ratings, Sustainalytics is an ESG data and rating supplier that measures sustainability performance on a global scale. This independent firm delivers data to over 14,000 companies and covers most major global indices. Its ratings measure companies’ sustainability performance through multi-level qualitative insights and score businesses using these five risk levels:

Source: Sustainalytics

Bloomberg ESG Data Services

Rating scale: Out of 100

Catering to over 15,000 companies in 100 countries, Bloomberg offers reliable ESG score data and metrics intending to clarify sustainability issues. It checks and standardises over a hundred sustainability topics, including climate change, energy management, health and safety, materials and waste, board independence, shareholders’ rights, etc. They gather public information released on corporate social responsibility (CSR) websites, reports, and more.

ISS’ Ratings and Rankings

Rating scale: Out of 100

Institutional Shareholder Services (ISS) conducts extensive data analysis and provides ratings across different ESG investment matters. For its ESG rating methodology, ISS uses a standardised scorecard, reviewed annually, which benefits both industry and company-specific assessments. Its scorecard comprises five assessment and informational elements: Climate, Social, Governance Risk, Industry Key Issues, SDG’s Impact on Products & Services, Industry Risk Profile, and EU Taxonomy (for SMEs).

FTSE Russell’s ESG Ratings

Rating scale: 0 to 5 (5 being the highest)

Financial Times Stock Exchange (FTSE) Russell is a widely recognised organisation specialising in analytics and data solutions. Using publicly disclosed information, it provides sustainability-based assessments of over 8,000 securities in 47 developed and emerging markets. Its ESG company ratings and data model use Pillar and Theme Exposure and Scores, which cover about 300 indicators to provide an overall rating.

Source: FTSE Russell

CDP Scores

Rating scale: A to D-

Launched in London in 2000, CDP (formerly known as Carbon Disclosure Project) uses a methodology aligned with the Taskforce on Climate-Related Financial Disclosures (TCFD) and with other major environmental standards. Companies are scored from A to D-, A being the highest rate, depending on their performance on environmental impact. However, there are instances wherein companies are given an F if they fail to disclose the required information. In 2023, CDP awarded A to more than 400 companies and 120 cities.

Refinitiv ESG Scores

Rating scale: Out of 100

Refinitiv ESG Ratings provides a comprehensive assessment of a company’s ESG performance and assigns ratings on a scale of 0 (worst) to 100 (best). They serve over 7,000 global companies, covering 70% of the global market cap and over 400 metrics. Their methodology consists of four primary components: Material ESG factors, Data Collection, Scoring and Weighting, and ESG Rating Calculation.

All four ensure companies meet investment mandates and quickly identify investment risks.

Thomson Reuters ESG Research Data

Rating scale: A+ to D-

With a history that goes back to 2009 when they acquired ASSET4, the first agency to provide raw ESG data to investors, Thomson Reuters has expanded its service to over 6,000 public companies across over 400 ESG metrics. Their percentile rank score is divided into two categories: Thomson Reuters ESG Score, measuring a company’s performance based on reported data in the public domain, and Thomson Reuters ESG Controversy Score, discounting the final score based on recent controversies that negatively impact the company. The latter consists of twenty-three controversy topics, divided into different areas, like communities, human rights, product responsibility, and resource use. Both data are updated every two weeks for better results.

Dow Jones Sustainability Index (DJSI)

Rating scale: Out of 100

Since its launch in 1999, DJSI has been a trailblazer in assessing sustainability-driven public companies. They teamed up with RobecoSAM to establish a robust ESG analysis framework, setting the benchmark for corporate responsibility. Today, it represents the top 10% of the largest 2,500 companies in the S&P Global BMI, a global index suite maintained by Standard and Poor’s (S&P), chosen for their strong performance in long-term economic, environmental, and social factors.

Corporate Knights Global 100

Rating scale: Out of 100

The Global 100 is an annual ranking by Corporate Knights that spotlights the world’s most sustainable corporations. Corporate Knights examines all industries and regions and studies 14 important indicators, such as supplier performance and how companies manage resources, employees, and finances. Each company is rated based only on the indicators that matter most to its industry.

EcoVadis

Rating scale: Out of 100

EcoVadis is a global provider of sustainability ratings for organisations worldwide. It recognises the completion of the EcoVadis assessment process, which has twenty-one sustainability criteria that target the environment, labour and human rights, ethics, and sustainable procurement. The assessment also demonstrates strong sustainability management per the guidelines by awarding medals and badges to eligible companies. Currently, EcoVadis ratings have been tested on over 130,000 companies across more than 220 industries and 180 countries.

To guarantee its credibility, the criteria for medals and badges are reviewed periodically.

Climetrics

Rating scale: 1 to 5

Climetrics rates investment funds on their environmental performance. It evaluates over 23,000 funds in the equity and corporate bond asset classes in greenhouse gas emissions, water resource protections, and deforestation. It then assigns each fund a rating based on the companies’ average score. The ratings range from 1 to 5, with five being the highest.

How do ESG ratings and rankings affect companies and investors?

Many use the ratings in their investment strategies. This means that investors may deem a company with a less favourable ESG score an unsustainable asset. Bear in mind that the scores come from globally recognised external experts, making them credible to investors. Their sustainability performance evaluation can show how you compare with peers and competitors. It can help your company continue to attract investment.

As for investors, ESG company ratings become a vital factor in their decision-making process. Some utilise these scores as a foundation for their investment strategies, readily informing them what companies meet their standards. The ratings are also beneficial for supplementing financial analysis and adding insight into certain companies. Investors use them to dive deeper into the sustainability risks that impact business performance.

How can you boost your company’s ESG score and ratings?

It is increasingly evident that a company’s ESG performance is a significant deciding factor for numerous investors. Experts even believe ESG considerations will be at the heart of mainstream investing, requiring more available corporate data on sustainability.

So, how can you improve your ESG score? Here are a few things that you can do today:

- Determine your key ESG drivers – To get better ratings, you must first identify what business aspects drive ESG performance. These may include CO2 emissions, waste management, community engagement, social cause donations, an inclusive hiring process, and business work conditions. Ensure that you also identify the key ESG issues for your stakeholders to guide your ESG efforts.

- Embed ESG into your strategy- Companies need to be transparent about their sustainability policies. However, for them to be effective and favourable, it is crucial to integrate ESG into your business strategy. You can embed it in your mission statement and value proposition. Doing so allows your company to be a forerunner in the ESG landscape.

- Align to global reporting standards – One surefire way to improve your ESG approach and performance, which are vital points for your rating, is to follow global standards and frameworks. Among the accredited reporting standards are GRI, SASB, TCFD, UN Global Impact, CDP, and Sustainable Development Goals.

- Integrate sustainable practices into your culture – ESG is not only to be embedded into business strategy but also in your company’s culture. Highly motivated employees will likely be more effective in communication and managing ESG challenges. Build a strong ESG program that can guide you in creating a corporate culture focused on sustainability.

While creating strategies and policies is a good move, applying them to real situations ensures consistent practices and legal compliance. Most importantly, company policies should not be linked to controversial ESG topics such as tax fraud, privacy, business ethics, public health, responsible marketing, and more. Properly implementing the right policies can further help your company boost its ESG scores.

Boost Your ESG Ratings with Convene ESG

Taking notes on rating agencies’ scoring scales and methodologies can guide your company toward more sustainable practices. But regardless of the methods in use, it’s vital to ensure all the company’s relevant information is disclosed.

If you want to ensure transparency and make your overall reporting efforts more efficient, it is best to use ESG reporting software like Convene ESG. Such a solution can boost your ESG ratings by streamlining data consolidation and report creation while ensuring full compliance with the appropriate provisions. Additionally, this ESG software provides consultations from ESG experts to guide reporting efforts effectively.

Find out how Convene ESG optimises your ESG reporting for reliable performance management by reaching out today.

Katherine Pamintuan is currently the ESG Manager at Azeus Systems Philippines Limited. Prior to this, she worked at Institutional Shareholder Services, Inc. (ISS) for 13 years, holding various roles within the ESG Corporate Ratings and Governance Operations Data Team. She most recently held the position of VP for ESG Corporate Ratings at ISS-ESG, the responsible investment arm of ISS, until October 2021. Her work experience includes analysis of public company disclosures and review of data to provide ESG rating/scoring for various companies (which involved analysis of company’s management of ESG issues on the basis of up to 100 rating criteria, using company disclosures and documents), as well as analysis of Corporate Governance practices. She is also a seasoned team manager, with experience in managing team performance and providing support for development. She was also co-lead of ISS Manila's Sustainability Committee (2020), promoted sustainability initiatives for that firm's Manila office. Katherine holds a B.S. Business Management degree from the University of the Philippines