ESG reporting has been a corporate mainstay across various industries worldwide. This sustainability initiative requires organisations to be more transparent on how they manage sustainability risks. In fact, many government agencies and regulatory bodies have mandated ESG reporting — pushing more businesses to practice sustainability and transparency.

This guide gives you a glimpse into the current state of ESG reporting in the Middle East, as well as strategies for improving sustainability disclosures.

What is ESG reporting?

ESG reporting, also widely known as ESG disclosure, is a type of public reporting that discloses a company’s performance on the environmental, social, and governance (ESG) criteria.

- Environmental — This aspect considers how an organisation manages or performs in areas like climate change, energy efficiency, air and water quality, carbon emissions, and biodiversity.

- Social — This criterion focuses on how an organisation fosters its culture and people, and how it contributes to its community. Facets under the category include employee engagement, inclusivity, gender and diversity, community relations, labour standards, and customer satisfaction.

- Governance — This part of the report discloses the organisation’s internal system of practices, procedures, and controls adopted to govern itself. Corporate governance also considers how a company fosters transparency and follows industry best practices. Other factors included are board composition, shareholder rights, bribery and corruption, and the company’s leadership.

The disclosures must also be prepared and presented following guideline principles set forth by major EGS reporting standards and frameworks. Some notable ones include the Task Force on Climate-Related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the IFRS Sustainability Disclosure Standards by the International Sustainability Standards Board (ISSB).

ESG Reporting in the Middle East: An Overview

It is quite evident how the Middle East’s engagement with ESG reporting has significantly transformed over the past years. Traditionally, the region was focused on only financial metrics like other parts of the world. Its emphasis on sustainability and responsible practices, however, has grown remarkably — leading to an upsurge in ESG reporting initiatives.

Early Beginnings and Regional Trends (Pre-2020)

Prior to 2020, the region remained nascent with limited awareness of the significance of ESG reporting. While environmental concerns such as climate change were put into the spotlight, social and corporate governance issues received less attention. This limited awareness stemmed from:

- The region’s economic reliance on fossil fuels overshadowed broader sustainability concerns.

- Lack of comprehensive ESG reporting or regulatory frameworks, resulting in limited transparency and accountability.

- Traditional investors primarily focused on short-term financial gains with limited consideration for ESG factors.

Turning Point and Key Developments (2020-Present)

The global shift towards sustainability and increased investor focus on ESG criteria field a paradigm shift. Middle Eastern companies began recognising the long-term risks and opportunities linked to ESG. Several countries in the region have also implemented reporting guidelines and mandates. A few examples are:

- Bahrain: The Bahrain Bourse, partnered with the Central Bank of Bahrain, implemented voluntary ESG reporting guidelines in 2020.

Saudi Arabia: In 2021, Tadawul (Saudi Stock Exchange) launched sustainability disclosure guidelines to promote greater ESG reporting. - UAE: In 2022, the Securities and Commodities Authority (SCA) mandated ESG reporting for listed companies, affecting over 130 entities.

- Qatar: The Qatar Stock Exchange issued ESG reporting guidelines in 2022.

- Kuwait: Boursa Kuwait released a voluntary ESG reporting guide for listed companies in 2021, while the Capital Markets Authority of Kuwait (CMA) implemented regulations to drive sustainability in the financial sector in 2022.

- Oman: The Muscat Stock Exchange (MSX) launched voluntary ESG disclosure guidelines in 2023, with mandatory sustainability reporting expected in 2025.

Besides the regulatory push, increased demand from socially conscious investors and growing green finance initiatives have also spurred interest in ESG reporting. The MENA ESG 2023 report by Bain & Company highlighted that investors in the Middle East are increasingly integrating ESG risks and opportunities into their decision-making, and are committing to more net-zero targets.

State of ESG Reporting: UAE, Saudi Arabia, and Egypt

As the region’s journey towards sustainability gains momentum, certain countries in the Middle East are emerging as frontrunners for their ESG initiatives on responsible practices and reporting. Among these are the United Arab Emirates (UAE), Saudi Arabia, and Egypt, all with active plans to achieve an environmentally conscious future.

UAE

In 2023 COP28 Summit, UAE announced a $30 billion pledge to fund clean energy and other climate projects worldwide. These are just one of the many pledges the host country made at the summit. COP28 focused on four facets:

- Fast-track the energy transition

- Transform climate finance

- Put nature, people, lives, and livelihoods at the heart of climate action

- Mobilise for the most inclusive COP ever

From hosting the COP28, businesses are encouraged to support the UAE national agenda, and in line with the UN Sustainable Development Goals (SDGs).

In 2020, the UAE Securities and Commodities Authority (SCA) mandated sustainability reporting for public joint stock companies listed in the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX). Additionally, the Abu Dhabi Global Market (ADGM) also implemented its Sustainable Finance Regulatory Framework in 2023 to set further standards for ESG disclosures in the country.

Saudi Arabia

Driven by its Vision 2030 plan, Saudi Arabia is on the course of achieving sustainability goals and practices across various sectors. Hence, creating a more sustainable future. The country is currently taking concrete steps towards integrating ESG into its economic and social landscape.

In 2021, the Tadawul Saudi Stock Exchange released its ESG Disclosure Guidelines to help companies understand the context, characteristics, and market best practices when creating their reports. These guidelines also aim to improve awareness in listed companies about ESG practices, and the importance of transparency. And in 2023, the Saudi Exchange also urged listed companies to prioritize and assess the most relevant ESG factors to them, driving responsible business practices within the Saudi capital market.

Egypt

Egypt’s Financial Regulatory Authority (FRA) released regulations and guidance (Green Bond Guidelines in 2012 and Decrees 107 and 108 in 2021), which required companies in the non-banking sector to submit ESG reports related to sustainability and the financial impacts of climate change.

Also in 2021, the country launched its Environmental Sustainability Criteria Guidelines created to encourage the integration of environmental sustainability best practices into business initiatives. The guidelines sought to contribute to Egypt’s long-term sustainability by promoting environmentally responsible development.

ESG Reporting Hurdles Faced by Middle Eastern Companies

Despite the evolving ESG landscape in the region, Middle Eastern companies still face several challenges in their reporting journey. Some notable hurdles are:

Regulatory Uncertainty

Unlike Western counterparts, companies in the Middle East currently lack harmonised and standardised reporting frameworks to produce complete and compliant disclosures. Such inconsistency creates confusion and compliance difficulties for reporting companies across the region. A 2023 report suggests that this lack of clarity makes it challenging for organisations to interpret or implement regulations, which demands additional standardised guidance.

Data Availability and Quality

An effective ESG reporting process requires a robust data infrastructure. Limited access to standardised and reliable data makes it challenging for Middle Eastern companies to accurately measure and report their ESG performance. One primary cause is the lack of unified reporting metrics and standards, which hinders the companies’ ability to obtain accurate and comparable data.

Talent Gap and Internal Expertise

The human resource gap also exists as a hurdle in ESG reporting. Implementing effective sustainability practices requires qualified professionals and dedicated ESG teams. In the PwC’s 2023 Middle East report, 41% of the respondents considered the absence of adequate internal skills and expertise to be the biggest challenge in progressing an organisation’s ESG strategy. This talent gap necessitates upskilling and training programs to better equip professionals with expertise for robust ESG practices and reporting.

These challenges require collective efforts — involving governments, regulators, and businesses — to foster a conducive environment for effective reporting. By addressing such gaps, Middle Eastern companies can not only comply with ESG regulations but also thrive as true sustainability leaders.

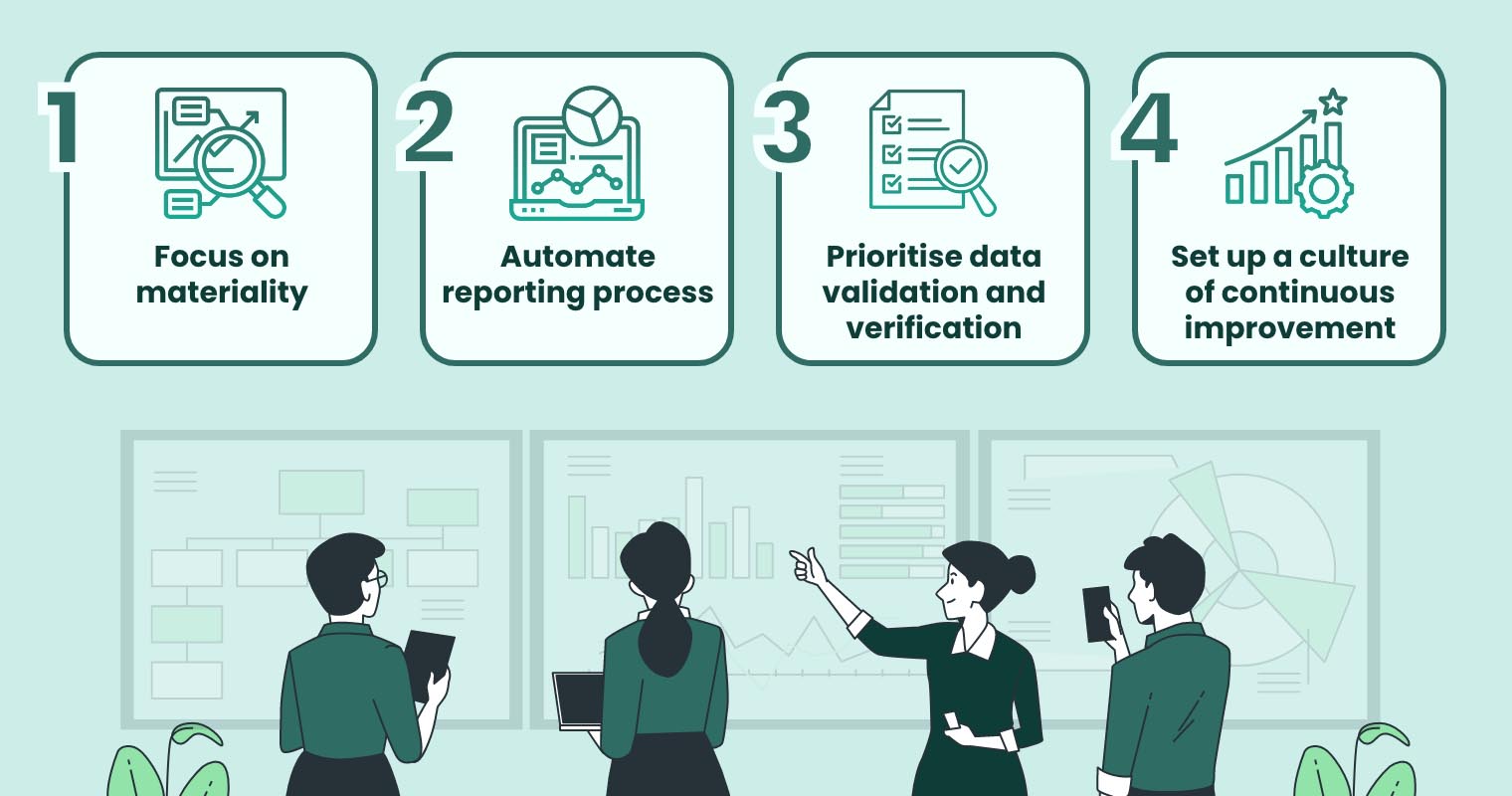

Four Strategies to Enhance Your ESG Reporting

As discussed above, collecting and reporting ESG data do come with several challenges. But all these can be repressed with the right strategies and practices in place. Here are four ways to drive more effective sustainability reporting.

1. Focus on materiality

ESG reporting is not a one-size-fits-all process, which means a company should know what issues are material and relevant to them. The first step is to outline the boundaries by considering your industry, type of operations, and geographical reach. Next is to compile potential ESG matters based on your internal and external sources.

- Internal data sources — Includes risk assessments, employee surveys, sustainability policies, and community engagement reports.

- External data sources — Involves industry reports, governmental regulations, sustainability reporting frameworks, and data from peer benchmarking.

It is also a good idea to create a materiality map to easily visualise the most relevant ESG issues. On top of that, make sure to only select ones that have a material impact on your business strategy, financial performance, and bottom line.

2. Automate reporting process

Manually collecting and analysing data can both be time-consuming and prone to errors. To guarantee the accuracy and completeness of the ESG report, consider automating your process through a reliable reporting platform.

ESG reporting software like Convene ESG offers extensive features and tools for easy data collection, management, and report generation. Look for one that aligns with global standards and frameworks, such as TCFD, SASB, and GRI. This ensures your ESG disclosure is not just accurate, but also relevant and compliant.

3. Prioritise data validation and verification

If you want to ensure the accuracy and reliability of your ESG data, having robust data validation and verification practices is necessary. Besides utilising reporting software, make sure you have clear procedures for data collection across your departments. This ensures your team knows what data to gather and input, reducing risks of errors and inconsistencies.

Independent data verification is another strategy that can help ensure data integrity in your report. Seek help from external auditors or assurance providers to independently review and validate the collected data. Doing so adds an objective layer of scrutiny and credibility to your company’s reported performance.

4. Set up a culture of continuous improvement

The sustainability reporting process does not end once the disclosure has been published. Companies should conduct debriefing with stakeholders to identify gaps in their strategy and reporting. Also, get feedback from investors and analysts on how to enhance your report’s quality and relevance.

Keep in mind that the ESG reporting landscape is constantly evolving, which means continuous improvement in reporting practices is essential. Stay informed on the latest regulations, standards, and best practices to maintain investment-grade data.

Predicting the Future of ESG in the Middle East

As sustainability takes centre stage in the Middle East, ESG reporting is quickly emerging as a great force for change. But while the region is still finding its footing in this field, there are some emerging trends and predictions to look forward to.

As global companies take advantage of technology, Middle Eastern companies are also expected to utilise more cloud-based platforms and data analytics to streamline data collection, verification, and reporting. In the 2023 Middle East ESG Reporting Summit, technologies for effective ESG reporting were highlighted, enabling data security and traceability.

Also driven by global momentum, mandatory requirements for certain sectors and company sizes are likely to materialise. The Muscat Stock Exchange (MSX) plans to set mandatory ESG reporting starting in 2024, following the release of ESG reporting guidance from the Tadawul Stock Exchange. Also, driven by the previous COP28, a surge of ESG initiatives is expected in the region, with more Middle Eastern companies recognising the importance of sustainability.

Convene ESG: Your Partner for Impactful ESG Reporting

As data-driven ESG reporting emerges as a key driver of sustainability, Convene ESG stands as the technology partner for Middle Eastern companies in this transformative journey.

Convene ESG, a reliable ESG reporting software, offers tools for streamlined data management, from collection to analysis. Users will have access to tailored dashboards for data monitoring and analysis, and hassle-free report generation plus templates. The best part? Reports created and generated using Convene ESG are guaranteed compliant with the latest guidelines and standards, such as TCFD and GRI.

Contact our dedicated team today to schedule a demo and discover how Convene ESG can transform your ESG reporting journey.