Sustainability and climate-related matters have been climbing atop the concerns of boards and top management. They need clear and robust information to support efforts and investments toward climate resilience. Thus, regulations and standardizations are being developed for better sustainability reporting.

In 2019, the Philippine Securities and Exchange Commission (SEC) issued Memorandum Circular No. 4, also known as the Sustainability Reporting Guidelines for Publicly-Listed Companies, requiring PLCs to report on sustainability on a comply-or-explain basis. Since its publication, the compliance rate has increased to 90.4% in 2020 and 91.07% in 2021.

By 2023, the SEC will implement mandatory sustainability reporting for all PLCs. With three years to prepare, PLCs should be able to assess how they can comply with the requirements.

The Benefits of Sustainability Reporting

Upholding transparency in reports can bring about benefits for the company and its stakeholders. Within the business, accurate sustainability disclosures can effectively identify and manage risks and opportunities while improving strategies and business plans. At the same time, it can build positive relationships between the company and the employees. Understanding where the perils are and how to address them can give clearer directions that will cascade to operations.

Externally, transparent sustainability reports can build trust from external stakeholders. Having ready access to your ESG information can create stronger engagement with stakeholders and investors. High-impact disclosures can improve your company’s reputation and brand, eventually giving you a competitive advantage.

The growing recognition of effective sustainability reporting cannot be achieved by mere compliance or fancy preparation alone. There is a need for reliable processes and support that can report on quality and transparent sustainability information.

Breaking the Barriers to Best-Practice Sustainability Reporting

To reap the benefits of accurate sustainability reporting, PLCs must be able to overcome the challenges that come with it. In a recent webinar by Convene, entitled Breaking Barriers to Sustainability Reporting: Guidance to Following PSE/SEC ESG Requirements, esteemed panelists discussed the barriers and solutions to sustainability reporting. Below are the challenges in reporting and the support to overcome them.

1. Evolving ESG Requirements — One barrier that companies face is the growing landscape of ESG reporting and requirements. With the constant changes in reporting requirements coupled with the numerous global frameworks and standards, companies may find it overwhelming to comply with everything.

They need the support of consultants who can help in guiding and driving the ESG strategy and reporting. This includes identifying the frameworks, metrics, and topics that the company should report on. Arturo Dell, one of the speakers in the webinar, said “Make sure that the consultants are experts in your sector and they have a credible track record, so they can guide you accurately.”

2. Limited Visibility on Trends and Benchmarking — In the Philippine context, it has been difficult to benchmark against peers and examine trends because not all disclosures are available or standardized. To overcome this hindrance, companies must explore partnerships with other organizations and firms to understand how their peers are approaching sustainability reporting. Moreover, partnerships can get together similar organizations and come up with standards.

3. Lack of Knowledge and Understanding — At times, ESG goals are not achieved when involved teams are not fully aware of the concepts, requirements, resources, and solutions to start the reporting. Not knowing the company’s potential can also result in a lack of understanding of the long-term impact of sustainability reporting.

PLCs are encouraged to acquire sustainability training, especially on the constant changes in requirements and how to approach sustainability. Consultants can help in transferring knowledge to the company regarding the best practices.

Leadership or management also has a role to support sustainability understanding. They must be able to integrate ESG within the corporate strategy. As Arturo puts it, “Leaders must understand how ESG weaves within the whole strategic fabric of the organization. There should be a commitment to support and nurture sustainability efforts.”

4. Manual Data Collection — For novices, it might be difficult to ascertain which data should be collected on top of the amount of data to gather and analyze. Doing data collection manually may incur missing data and data inaccuracy.

To prevent such struggles, PLCs should consider investing in ESG technology that can aid in automating data collection and provide analytics. It is important to choose the most suitable solution that has the ability to accurately collect data, visualize the report, and integrate with the standards. ESG solutions are investments that can save you time by digitalizing manual processes.

How to Comply with the SEC ESG Requirements

With three years to prepare, PLCs should now be ready to conform to the expectations of the SEC. Below are the expert tips on creating a high-impact sustainability report compliant with the SEC requirements.

Create your sustainability reporting process according to SEC’s requirements

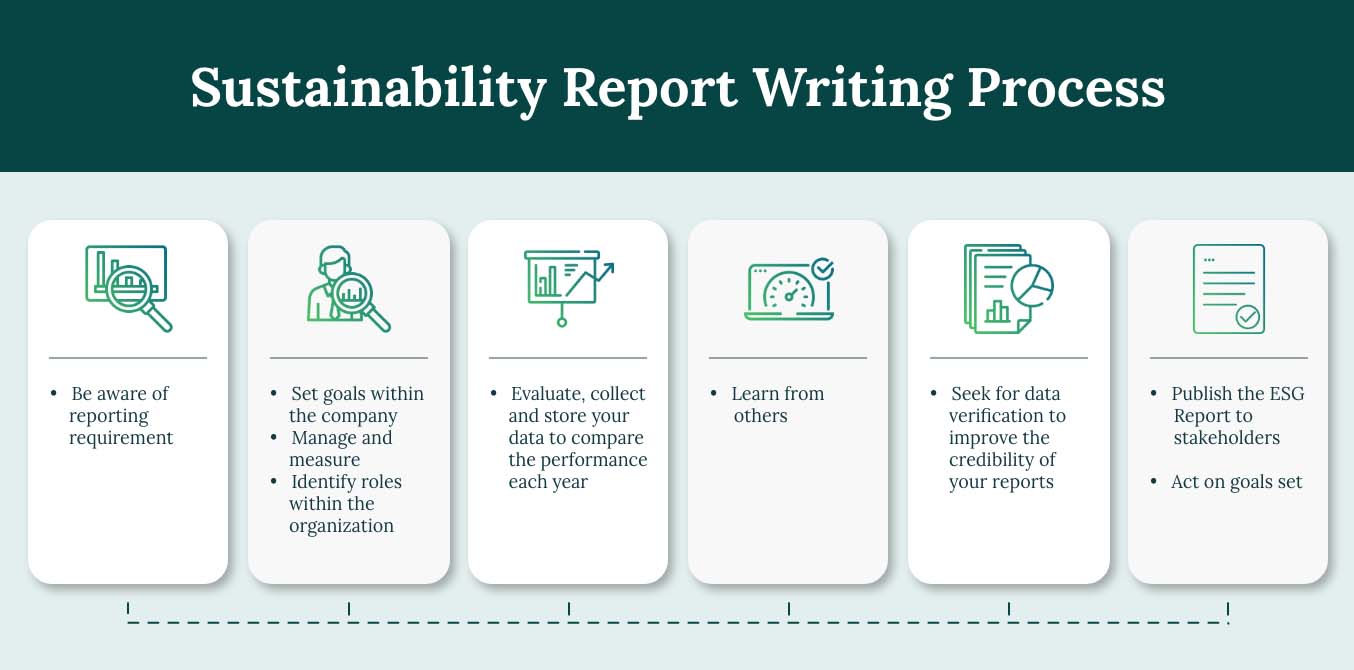

The above figure shows a systematic way of preparing and generating sustainability reports. Instead of scrambling for data every time the annual report deadline is near, our experts recommend identifying first the right data to collect and the requirements to comply with — in this case, the SEC’s Reporting Template. This includes conducting a materiality assessment and reporting on the disclosure topics (EESG) and the UN Sustainable Development Goals.

A comprehensive and insightful reporting process involves monitoring and benchmarking your ESG performance against others. Regarding external assurance, there is no mandate yet around it in the Philippines. Katherine Pamintuan, ESG Manager at Convene, shared, “External assurance is not yet a requirement, but it has benefits to it such as guaranteeing the reliability and accuracy of the report.”

Follow SEC’s Sustainability Reporting Principles

The reporting principles set by SEC should guide PLCs in choosing the information they will set out in their reports, including presentation. Katherine offered recommendations on how to assess your reports through these guidelines.

- Materiality and Stakeholder Inclusiveness — PLCs should be able to report on the relevant material topics that impact and address the needs of the internal and external stakeholders.

- Balance and Completeness — Sustainability reports must have no bias in presenting the information and covers the scope of information disclosed. Are positive and negative information disclosed?

- Reliability and Accuracy — All data and processes disclosed must be subject to examination to ensure quality and accurate information. PLCs should also assess the credibility of the internal systems to collect and analyze ESG data.

- Consistency and Comparability — It is recommended to present consistent and comparable data in the sustainability reports. Are data from previous years available? Is data comparable? Can performance trends be extracted?

Implement an ESG Software for Effective Reporting

Investing in ESG reporting software can simplify the data collection process and build efficient reporting workflows for your ESG team. Convene ESG is a reporting platform designed to automate data gathering and store your years’ worth of data in a centralized location. It also implements a secure data validation processing that helps with matching the data.

To guide you in creating high-impact disclosures, Convene ESG also supports the generation of SEC-compliant reports by converting your data into visual graphs and dashboards that allow you to extract valuable insights.

Start Investing in Your PSE-Compliant Sustainability Reports

The ESG reporting landscape will continue to evolve and regulations around it will constantly change. As Katherine puts it, “Reporting should not just be an output of an organization’s sustainability performance and initiatives. Together, let’s promote transparency — one report at a time.”

Convene ESG is reporting software that can help you create compelling and compliant sustainability reports while allowing oversight. Learn more about its features or book a one-on-one consultation with our experts today!