As the financial sector plays a crucial role in the global economy, its influence extends beyond direct operations to the emissions generated by investments and lending activities. These emissions, known as financed emissions, represent the greenhouse gas (GHG) emissions associated with a financial institution’s loans and investments.

Managing financed emissions is becoming increasingly essential, not only for regulatory compliance but also for driving meaningful climate action. Financial institutions have a unique opportunity and responsibility to align capital flows with global sustainability goals.

As ESG reporting frameworks evolve and regulatory bodies demand greater transparency, understanding and managing financed emissions is a key step toward mitigating climate risks and fostering long-term environmental resilience.

What are financed emissions?

Financed emissions refer to the GHG emissions associated with a financial institution’s lending and investment activities. These emissions occur indirectly and stem from the businesses and projects that banks, asset managers, and insurers finance. Given the scale of capital flows, financed emissions often exceed an institution’s direct operational emissions, making them a critical factor in climate impact assessments and sustainability reporting.

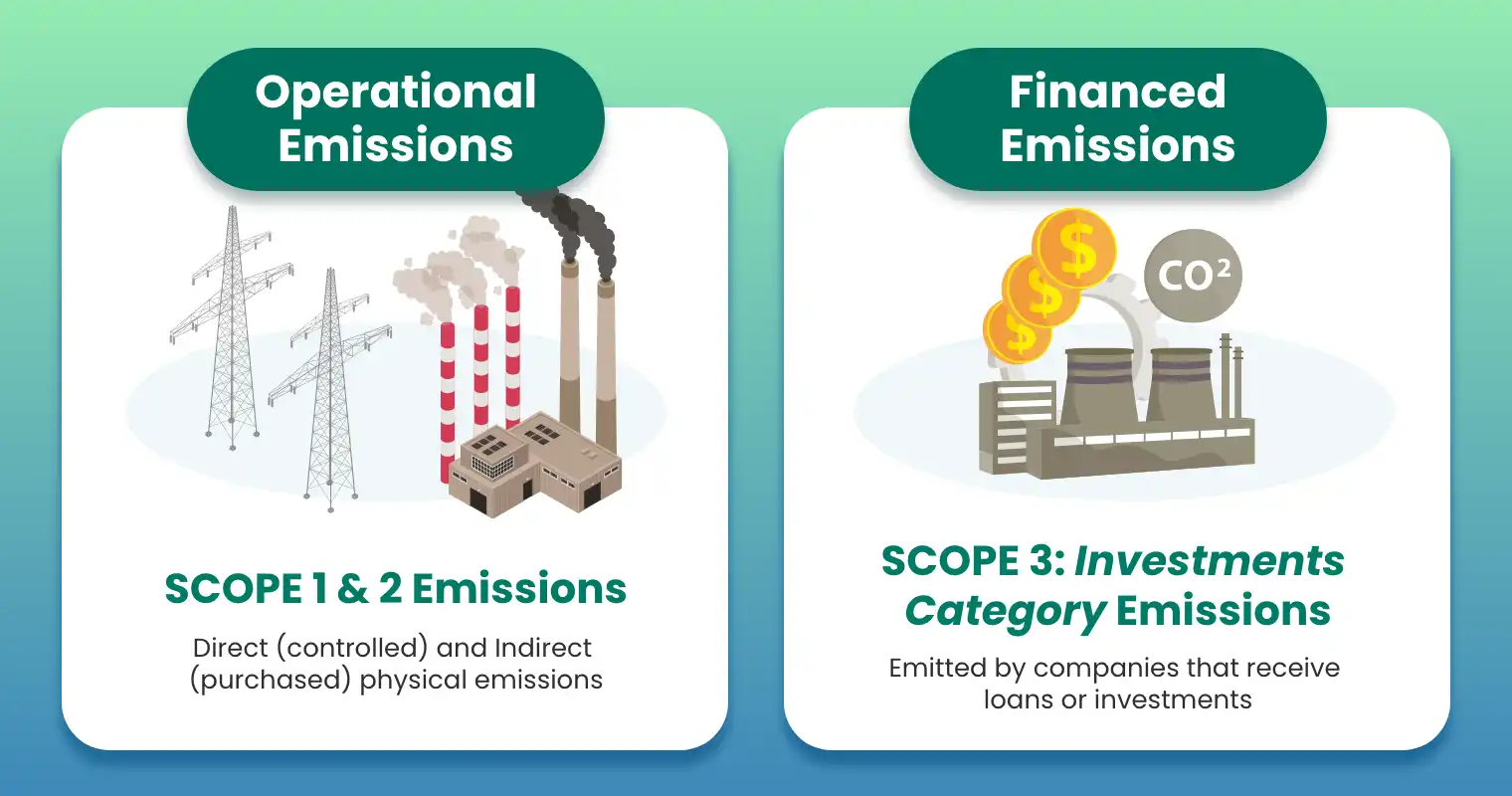

Financed vs. Operational Emissions

GHG emissions are generally categorised into two main types: operational and financed emissions.

- Operational emissions include both direct and indirect emissions from an organisation’s physical operations. These cover Scope 1 emissions (direct emissions from owned or controlled sources) and Scope 2 emissions (indirect emissions from purchased energy).

- Financed emissions, on the other hand, fall under Scope 3 emissions, specifically, the “investments” category. They encompass the emissions generated by companies or projects that receive financial support through loans, investments, and underwriting activities.

Why measure and address financed emissions?

The emissions of financial institutions greatly outweigh their direct or operational emissions by a substantial 700%. Undoubtedly, these organisations have a powerful role in shaping the global transition to a low-carbon economy as it extends beyond their direct effect.

Their investment choices influence the trajectory of industries, either reinforcing high-carbon sectors or accelerating sustainable alternatives. By integrating sustainability criteria into lending and investment strategies, financial institutions can significantly contribute to decarbonisation while mitigating financial risks linked to climate change.

Taking proactive steps to address financed emissions offers several key advantages:

Regulatory Compliance

Many jurisdictions, such as New Zealand, the United Kingdom, and the European Union, require banks and asset managers to disclose financed emissions under sustainability reporting regulations such as the Task Force on Climate-related Financial Disclosures (TCFD) and the European Sustainability Reporting Standards (ESRS). The Science Based Targets initiative (SBTi) and the GHG Protocol are also relevant, as they provide frameworks for measuring, reporting, and aligning financed emissions with global climate goals.

Reputation and Investor Confidence

Demonstrating transparency in climate-related disclosures can attract ESG-conscious investors and clients, helping firms stay competitive in an evolving market. With many countries and financial institutions committing to net-zero targets, such as MasterCard and Bank of America, clear reporting on financed emissions is crucial for meeting regulatory expectations and aligning with global climate goals.

Risk Management

Financed emissions pose significant climate-related risks, including transition risks from policy changes and physical risks from climate events. This can impact portfolio stability. Assessing and managing these emissions allows financial institutions to mitigate exposure and align their investments with long-term sustainability goals.

Reporting on Financed Emissions: Guide and Approaches

Financed emissions reporting varies depending on regulatory requirements and industry frameworks, reflecting different approaches to climate-related financial disclosures.

In the European Union, the Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR) require financial institutions to disclose their investment-related emissions and demonstrate alignment with environmental objectives.

In the United States, the Securities and Exchange Commission (SEC) has proposed rules for climate-related disclosures, which could include financed emissions for large financial institutions. Meanwhile, in Asia, countries like Japan and Singapore are integrating financed emissions disclosure into their sustainability reporting expectations, often aligned with TCFD.

Beyond these regulations, financial institutions often adopt voluntary frameworks such as the GHG Protocol and the Partnership for Carbon Accounting Financials (PCAF), which provide standardised methodologies for financed emissions calculation.

These frameworks help ensure consistency across reporting practices, enabling investors and regulators to assess the climate impact of financial portfolios more effectively.

Who should disclose financed emissions?

Banks, asset managers, pension funds, and insurance companies play a critical role in financing carbon-intensive industries and are expected to report their financed emissions. Many jurisdictions now require financial institutions to integrate these disclosures into sustainability reports, ensuring transparency in how capital allocation aligns with net-zero commitments.

Key Asset Classes in Financed Emissions Reporting

To ensure accurate measurement, financed emissions reporting considers a range of financial activities. Examples of commonly assessed asset classes include:

- Sovereign bonds: Government-issued debt, where emissions are assessed based on national carbon footprints.

- Trade finance: Short-term financing for import and export activities, which can support industries with varying levels of carbon intensity.

- Agricultural lending: Loans provided to agribusinesses, which may contribute to emissions through deforestation or land use changes.

- Microfinance and SME lending: Financing for small businesses, where emissions may be harder to track due to limited reporting requirements.

- Shipping and aviation finance: Loans or investments in transportation sectors that contribute significantly to global emissions.

The Challenges When Reporting Financed Emissions

- Data Availability and Accuracy: Many financial institutions struggle with obtaining reliable emissions data from companies with diverse portfolios. Limited disclosure from investee firms can lead to inconsistencies in reporting.

- Methodological Variability: Different sustainability reporting standards, such as PCAF, GRI, and TCFD, may require varying approaches to financed emissions calculation, making harmonisation a challenge.

- Regulatory Complexity: With multiple evolving regulations, like the most recent update to the ESRS under the CSRD, introducing stricter finance emission reporting requirements, institutions must continuously update their disclosure practices to stay compliant and aligned with emerging reporting frameworks.

- Attribution challenges: Assigning emissions to specific financial activities can be complex. This is most apparent when dealing with indirect exposure through equity holdings, bonds, or loans. Financial institutions may finance companies engaged in high-emission activities without directly owning or controlling their operations, making accurate attribution difficult.

What is PCAF?

The Partnership for Carbon Accounting Financials, or PCAF, is a global initiative that provides a standardised approach for financial institutions to measure and disclose their financed emissions.

Established in 2015 by a group of Dutch financial institutions, PCAF has since expanded internationally, with banks, investors, and asset managers adopting its methodology to enhance transparency in climate-related financial risks.

PCAF plays a critical role in disclosing financed emissions by offering a harmonised framework that aligns with global sustainability reporting standards like the GHG Accounting Standards or GHG Protocol. Its methodology helps institutions quantify their indirect emissions, those arising from loans, investments, and other financial activities, allowing them to set credible decarbonisation targets.

In recent years, PCAF has continued to refine its approach to financed emissions accounting. The 2022 update to its Global GHG Accounting and Reporting Standard introduced methodologies for measuring sovereign debt emissions and provided new guidance on accounting for emission removals. Further, the launch of the Global GHG Accounting and Reporting Standard for Insurance-Associated Emissions in November 2022 expanded the framework’s applicability to the insurance sector.

Recently, PCAF launched its public consultation on developing new methods to measure and report GHG emissions associated with financial activities. This covers the new guidance on PCAF financed emissions following the Global GHG Accounting and Reporting Standard, alignment with the International Financial Reporting Standard (IFRS) S2, and expanding emissions measurement within the international insurance sector.

These updates have strengthened PCAF’s role as the leading standard for financial institutions looking to align their climate impact reporting with global best practices.

What is the PCAF methodology?

PCAF provides a robust methodology to assess financed emissions using a sector-specific, asset-class approach. Financial institutions apply PCAF’s Global GHG Accounting and Reporting Standard, which includes different financed emissions calculation methods based on data availability, ensuring a balance between accuracy and feasibility.

To standardise measurement, PCAF assesses financed emissions using four key carbon metrics:

- Absolute financed emissions: The total greenhouse gas (GHG) emissions associated with an institution’s lending and investment portfolio.

- Emissions intensity: The ratio of financed emissions to a financial metric, such as revenue or enterprise value, to compare emissions efficiency across investments.

- Attributable emissions: The portion of a company’s total emissions that can be linked to a financial institution’s level of investment or exposure.

- Carbon footprint: Financed emissions normalised by total assets under management (AUM), helping assess emissions relative to portfolio size.

The standard follows the Greenhouse Gas Protocol (GHGP) principles, ensuring consistency with the international emissions reporting framework. It categorises PCAF financed emissions across seven asset classes, each with its own calculation method:

- Listed Equity and Corporate Bonds: Emissions associated with publicly traded shares and corporate debt securities. Financial institutions must assess the carbon footprint of the companies they invest in.

- Business Loans and Unlisted Equity: Financing provided to private businesses, requiring direct engagement with borrowers to obtain emissions data.

- Project Finance: Funding for large-scale infrastructure or industrial projects, such as energy plants and transport systems, where emissions are attributed based on financial involvement.

- Commercial Real Estate: Investments in office buildings, shopping centres, and industrial properties, where emissions are typically tied to energy consumption and building efficiency.

- Mortgages: Residential real estate financing, with emissions primarily driven by household energy use and construction practices.

- Motor Vehicle Loans: Loans used to purchase automobiles, with emissions calculated based on vehicle type, fuel efficiency, and expected lifespan.

- Sovereign Debt: Financing provided to governments, where emissions are estimated using national emissions data and budget allocations for high-carbon industries.

How to calculate financed emissions with PCAF?

The PCAF methodology enables financial institutions to attribute emissions from lending and investment portfolios accurately. Below is a step-by-step guide to measuring PCAF financed emissions:

- Identify relevant asset classes: Determine which financial activities contribute to financed emissions. PCAF categorises these into asset classes such as listed equity, corporate bonds, business loans, real estate, and motor vehicle loans.

- Collect financial and emissions data: Gather necessary data, including financial exposure (e.g., outstanding loan amounts or equity stakes) and emissions data from investee companies. Where company-specific emissions data is unavailable, proxy data or industry averages may be used.

- Apply attribution rules: Allocate emissions based on financial exposure. This typically involves calculating the financier’s share of the company’s emissions in proportion to its investment or loan share.

- Use appropriate emission factors: Assign the correct emission factor to each asset class. These factors help estimate the GHG emissions associated with different industries and investment types.

- Calculate total financed emissions: Multiply the financier’s share of investment by the investee company’s emissions to derive the portion attributed to the financial institution. This process is repeated across all relevant assets.

- Ensure data quality and improve accuracy: Use PCAF’s data quality score to assess the reliability of emissions data and identify areas for improvement in future reporting cycles.

- Disclose and integrate into reporting frameworks: Report financed emissions in line with recognised sustainability frameworks such as TCFD, ISSB, or ESRS. Transparency in disclosures supports regulatory compliance and aligns with net-zero commitments.

Key Organisations & Initiatives Supporting PCAF

PCAF collaborates with various global sustainability initiatives to enhance alignment and credibility in financed emissions reporting. These include:

- Greenhouse Gas Protocol (GHGP): Establishes the foundation for carbon accounting, including Scope 3 emissions.

- Carbon Disclosure Project (CDP): Encourages companies and financial institutions to disclose environmental impacts, including financed emissions.

- Glasgow Financial Alliance for Net Zero (GFANZ): Supports the financial sector in aligning portfolios with net-zero goals.

- Net-Zero Banking Alliance (NZBA): Aims to align banks’ lending and investment portfolios with net-zero emissions by 2050.

- Task Force on Climate-related Financial Disclosures (TCFD): Provides recommendations for climate-related financial disclosures, influencing PCAF’s reporting guidelines.

- Science-Based Targets Initiative (SBTi): Helps financial institutions set science-based decarbonisation targets for their portfolios.

This ecosystem of organisations ensures that PCAF’s methodology remains relevant, actionable, and aligned with global sustainability efforts.

How can firms manage their financed emissions?

- Assess portfolio emissions: Conduct a baseline analysis using the PCAF carbon accounting methodology to understand emissions exposure.

- Set science-based targets: Align emissions reduction goals with SBTi and net-zero commitments to ensure meaningful impact.

- Integrate ESG in investment decisions: Shift capital allocation towards low-carbon industries and incorporate climate risk assessments into investment processes.

- Engage with clients and borrowers: Encourage corporate clients to adopt sustainability initiatives, such as emissions reduction plans and renewable energy adoption.

- Use technology for data management: Implement ESG reporting software to enhance emissions tracking, ensure regulatory compliance, and streamline sustainability disclosures.

- Stay ahead of regulatory requirements: Monitor evolving sustainability regulations to ensure compliance and proactively adapt ESG reporting practices.

- Explore green investing opportunities: Research and invest in sustainable assets, such as green bonds and renewable energy projects, to drive long-term climate-positive impact.

Manage Financed Emissions Reporting with Convene ESG

As financial institutions face increasing regulatory scrutiny and investor demand for transparency, managing financed emissions has become a critical component of sustainability strategy.

Convene ESG provides an end-to-end solution to streamline emissions reporting, enhance regulatory compliance, and drive meaningful climate action. With advanced data analytics, automated reporting capabilities, and alignment with global standards, Convene ESG enables financial institutions to effectively measure, disclose, and reduce their financed emissions.

For a comprehensive carbon accounting solution, Convene ESG features a carbon calculator enabling precise measurement of Scope 1, 2, & 3 emissions, leveraging country-specific, sector-specific, and global emission factors. It also provides a GHG accounting dashboard for full visibility and compliance with international frameworks.

Book a demo today to discover how Convene ESG can support your financed emissions disclosure and reduction strategies.