Over the past years, forward-thinking organisations have been pursuing more socially responsible agendas and greener activities. One crucial part of improving such green initiatives is reporting sustainability data. Considered the best practice employed by companies worldwide, sustainability reporting can help meet the stakeholders’ demand for transparency and accountability.

Since 2016, sustainability reporting has been mandatory for Malaysia’s publicly listed companies (PLCs). Bursa requires PLCs to disclose narrative statements on the management of their economic, environmental, and social (EES) risks and opportunities alongside their financial or annual reports.

Malaysia’s aspiration to achieve carbon neutrality by 2050 sets high expectations from listed firms with most investors considering ESG ratings a major decision-making factor. Firms with a low ESG rating are likely to be deemed as unsustainable assets. To help investors recognise sustainable and socially responsible companies, Bursa Malaysia and its index partner FTSE Russell formed the FTSE4Good Bursa Malaysia (F4GBM) Index and FTSE4Good Bursa Malaysia Shariah Index. Read on to know what these two indices are and how they differ.

What is FTSE4Good Bursa Malaysia (F4GBM) Index

Launched in December 2014, the FTSE4Good Bursa Malaysia (F4GBM) Index requires Malaysian PLCs to adopt more sustainable practices and innovate more socially responsible initiatives. This Environmental, Social, and Governance Index looks at value from a non-financial perspective.

The FTSE4Good Bursa Malaysia Index is designed to:

- support investors in making ESG investments in Malaysian listed companies;

- increase the profile and exposure of companies with leading ESG practices;

- encourage best practice disclosure; and

- support the transition to lower carbon and more sustainable economy.

As part of the FTSE4Good Index Series family, the Index offers companies a way to effectively showcase good practice ESG risk management and capture the attention of many institutional investors. And ultimately, to improve ESG performance.

Criteria and Inclusions

Companies should meet a variety of EGS inclusion criteria to be included in the FTSE4Good Bursa Malaysia Index. All securities that qualify under the following rules are eligible for inclusion:

- 4.1.1. All classes of ordinary shares in issue are eligible, subject to all other rules of eligibility, free float, and liquidity.

- 4.1.2 Companies listed on the Main Market of Bursa Malaysia

- 4.1.3 Companies listed on a stock exchange or recognised market from advanced and secondary emerging countries in the APAC region excluding Japan, Australia, and New Zealand.

- 4.1.4 Companies listed on the ACE Market of Bursa Malaysia

- 4.1.5 Securities listed in Bursa Malaysia and traded on its trading system

- 4.1.6 Converted (convertible) preference shares and loan stocks

For complete details about the criteria, see FTSE Bursa Malaysia Index Series Ground Rules.

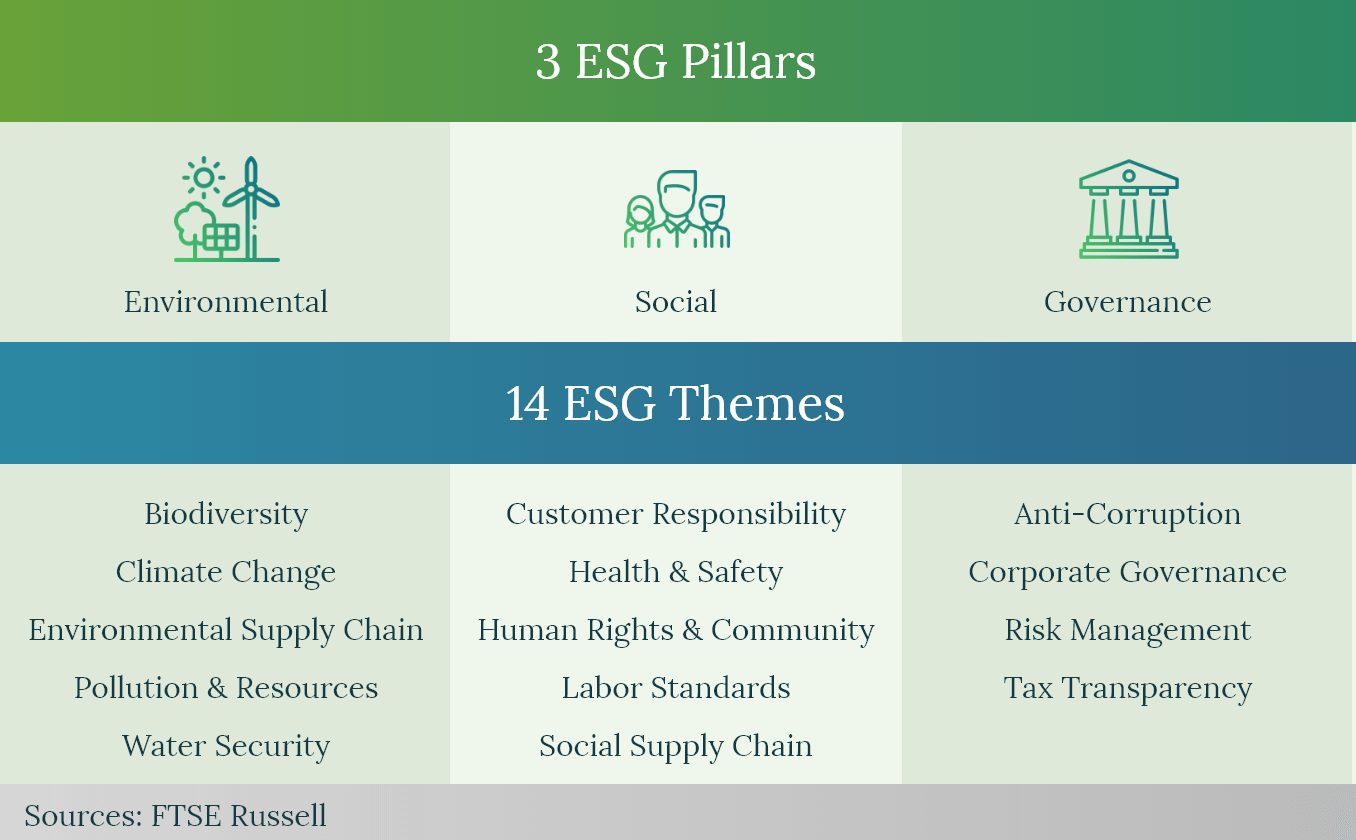

FTSE’s evaluation model was extracted from top international reporting frameworks, such as the Global Reporting Initiative (GRI) and Carbon Disclosure Project (CDP), in which the Index’s criteria and the following themes are aligned:

Constituents of the F4GBM Index

Started with 24 constituents during its launch, the FTSE4Good Bursa Malaysia Index’s constituents comprise PLCs from small to large market capitalisation segments. In their latest semi-annual review of June 2022, the Index has a total of 87 constituents — including its 10 new additions and two deletions:

Inclusions due to meeting the FTSE4Good criteria:

- Dialog Group

- George Kent (M)

- Greatech Technology

- Innature

- Malaysian Pacific Industries

- Paramount Corporation

- Press Metal Aluminium Holdings

- Scicom (MSC)

- Scientex

- SP Setia

Exclusions due to FBM EMAS deletion:

- Magnum FBM EMAS deletion

- MNRB Holdings

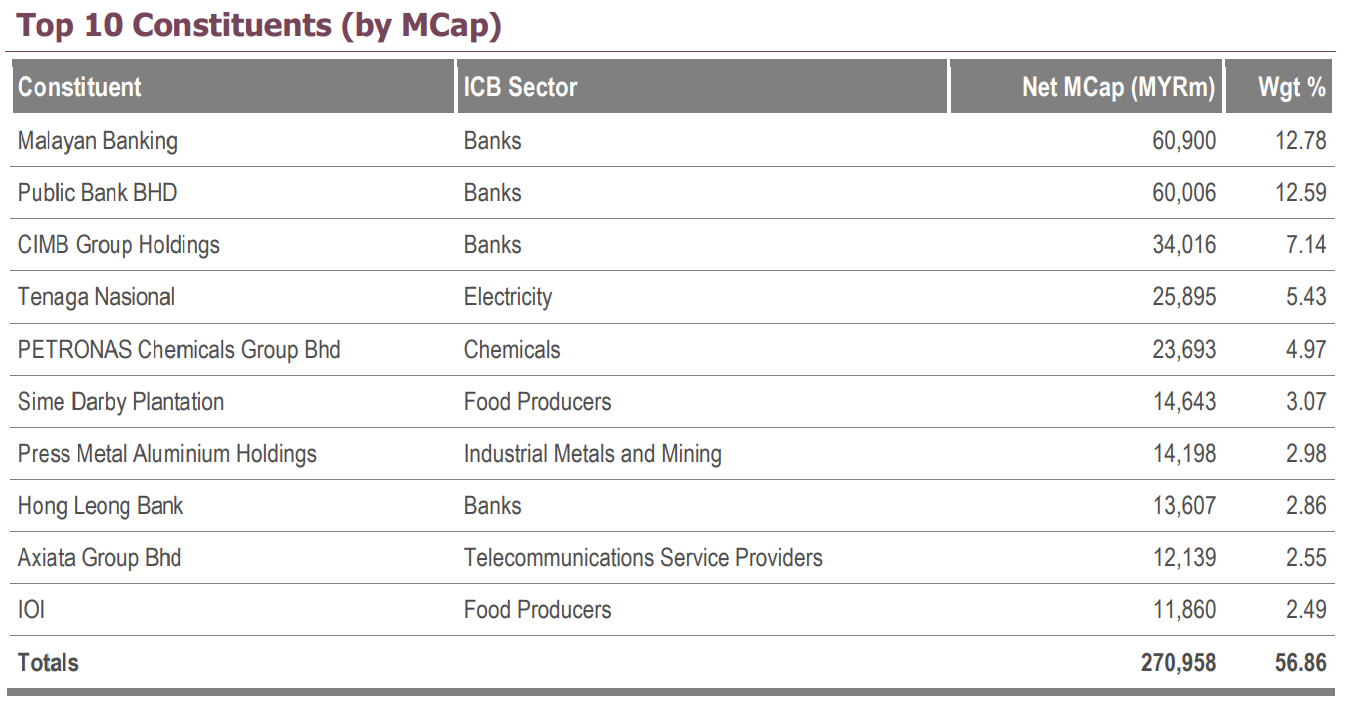

Also, according to the data from the latest FTSE Russell Factsheet released in September 2022, the top 10 constituents for the FTSE4Good Bursa Malaysia Index — topped by banks — are as follow:

What is FTSE4Good Bursa Malaysia Shariah Index

The FTSE4Good Bursa Malaysia Shariah Index is launched in July 2021 to recognise PLCs that have stepped up their ESG practices and reports. It also served as a guide for fund managers in creating investment portfolios of shariah-compliant equities that meet sustainable investing principles.

This Shariah-compliant version of the F4GBM Index will require listed issuers to meet the following objectives:

- Facilitate investors seeking investment in Shariah-compliant shares listed on Bursa Malaysia.

- Centralisation of Shariah decisions domestically.

- Enhance disclosure and transparency.

- Promote the development of Islamic Capital Markets.

- Encourage the development of Islamic instruments.

Criteria and Inclusions

The Shariah Advisory Council (SAC) of the Securities Commission Malaysia (SC) uses a specific screening method to determine securities with commendable corporate responsibility practices.

As a general rule, Shariah-compliant securities should not be involved in any of these core activities:

- Financial services based on riba (interest)

- Gaming and gambling

- Manufacture or sale of non-halal products or related products

- Conventional insurance

- Entertainment activities that are non-permissible according to Shariah

- Manufacture or sale of tobacco-based products or related products

- Stockbroking or share trading on Shariah non-compliant securities, and

- Other activities deemed non-permissible according to Shariah

Companies are also evaluated by the SAC of SC based on their activities’ public image from the Islamic teaching perspective. With the FTSE4Good Bursa Malaysia Shariah Index in place, companies are better guided in improving their sustainability performance.

Constituents of the F4GBMS Index

The FTSE4Good Bursa Malaysia Shariah Index kicked off with 54 constituents back in July 2021. The Index is launched to track F4GBM constituents that comply with the Shariah Advisory Council (SAC) screening methodology or are eligible for the F4GBMS Index. As of the latest review period (June 2022), there are now 65 F4GBMS Index constituents — including these nine new additions:

Inclusions due to meeting the SAC status:

- Dialog Group

- George Kent (M)

- Greatech Technology

- Innature

- Malaysian Pacific Industries

- Paramount Corporation

- Press Metal Aluminium Holdings

- Scientex

- SP Setia

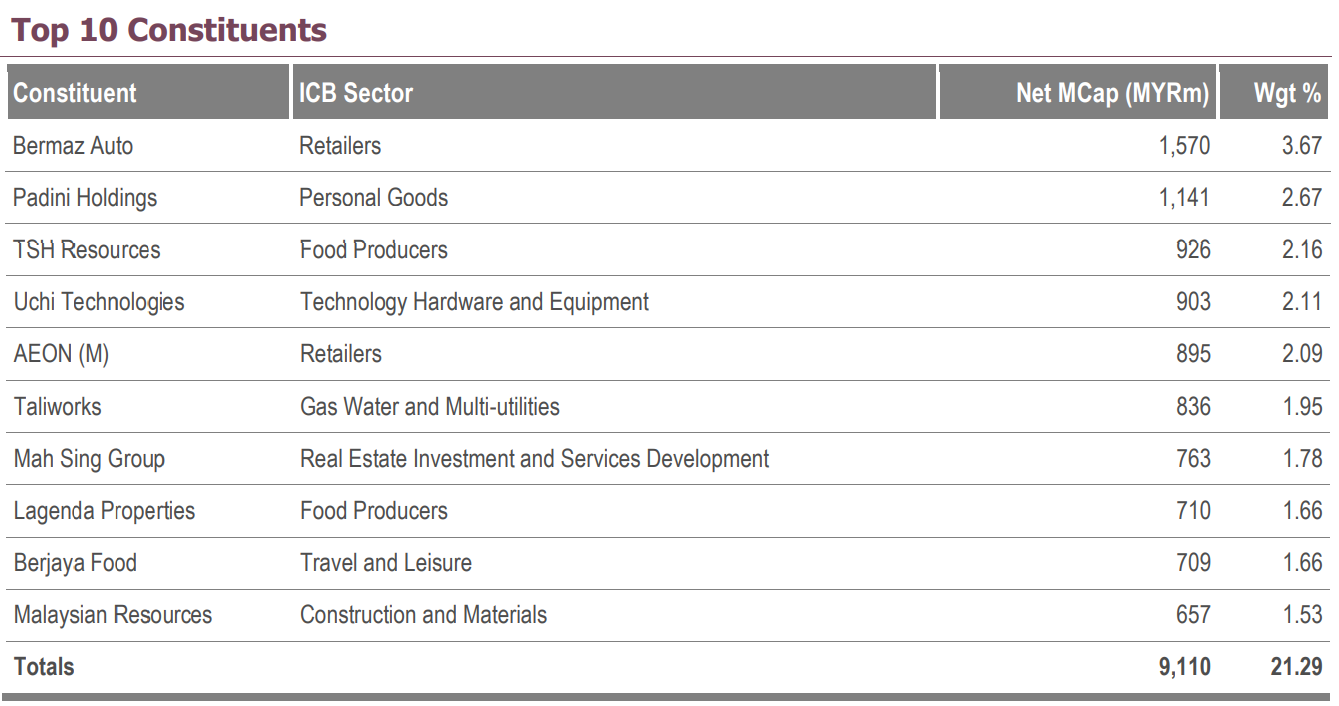

Based on the latest FTSE Russell report (September 2022), the top 10 constituents for the FTSE4Good Bursa Malaysia Shariah Index include:

Get Qualified for the F4GBM and Create Shariah-Compliant Reports with Convene ESG

Improving ESG practices to meet the criteria for F4GBM and F4GBMS requires collaborative efforts from boards and other members of the organisations. In Convene ESG, we make it possible to create compliant disclosures that will get the attention of institutional investors.

Convene ESG is designed to help companies create future-proof, audit-ready reports that comply with the latest requirements and standards. Pumped up your ESG performance and earn a spot as an F4GBM and F4GBMS constituent today! Learn more about how Convene ESG can help digitalise your sustainability journey.