Since 2015, sustainability reporting has been a growing concern for Malaysia’s publicly listed companies (PLCs) and investors. Bursa ESG guidelines require PLCs to disclose narrative statements on managing their economic, environmental, and social (EES) risks and opportunities alongside their financial or annual reports.

As outlined in the Twelfth Plan, Malaysia aspires to achieve carbon neutrality by 2050, which sets high expectations from listed firms, with most investors considering ESG ratings a major decision-making factor. Firms with a low ESG rating will likely be deemed unsustainable assets. That said, the FTSE4Good Index provides a credible benchmark for ESG performance, helping investors identify companies that meet globally recognised sustainability standards.

This article explores the FTSE4Good Index, its criteria, and what it means for companies aiming to enhance their ESG standing. This also covers how Bursa Malaysia integrates ESG principles into its market framework, encouraging more businesses to align with sustainable practices.

What is the FTSE4Good Bursa Malaysia (F4GBM) Index?

The FTSE4Good Bursa Malaysia Index is part of the globally recognised FTSE4Good Index benchmark, which was introduced to assess companies based on their ESG performance across environmental, social, and governance criteria.

This benchmark includes several indices tailored to different markets and regions including the FTSE Global Index, and Emerging Index, to name a few.

The FTSE4Good Bursa Malaysia (F4GBM) Index was introduced in December 2014 to assess the ESG performance of Malaysian publicly listed companies (PLCs). The index incentivises PLCs to adopt sustainable business practices and implement socially responsible initiatives by measuring their value beyond financial performance. A Shariah-compliant version of the index, the FTSE4Good Bursa Malaysia Shariah Index, was later introduced to cater to investors seeking ESG-aligned investments that also meet Islamic finance principles.

The FTSE4Good Bursa Malaysia Index ESG criteria are designed to:

- support investors in making ESG investments in Malaysian listed companies;

- increase the profile and exposure of companies with leading ESG practices;

- encourage best practice disclosure; and

- support the transition to lower lower-carbon and more sustainable economy.

Since its launch, the index has grown significantly. It started with 24 constituents and has expanded over time, reflecting the increasing number of Malaysian companies adopting ESG best practices.

Constituents of the FTSE4Good Bursa Malaysia Index

In the December 2024 semi-annual review, the F4GBM Index recorded 28 new inclusions and one exclusion, bringing its total number of constituents to 147. This marks the highest number of inclusions since the index was launched in 2014.

New inclusions:

- AEON Credit Service

- Affin Bank

- AirAsia X

- Ann Joo Resources

- Comfort Glove

- Cypark Resources

- Eastern & Oriental

- Evergreen Fibreboard

- IGB Real Estate Investment Trust

- IHH Healthcare

- IJM

- IOI Properties Group

- Land & General

- Magnum

- Malayan Flour Mills

- Mega First

- Optimax Holdings

- OSK Holdings

- Paramount Corp

- Pavilion Real Estate Investment Trust

- Perak Transit

- QES Group

- Sime Darby Property

- Skyworld Development

- Sunway Construction Group

- Swift Haulage

- Thong Guan Industries

- TSH Resources

Exclusions due to FBM EMAS deletion:

- Kawan Food

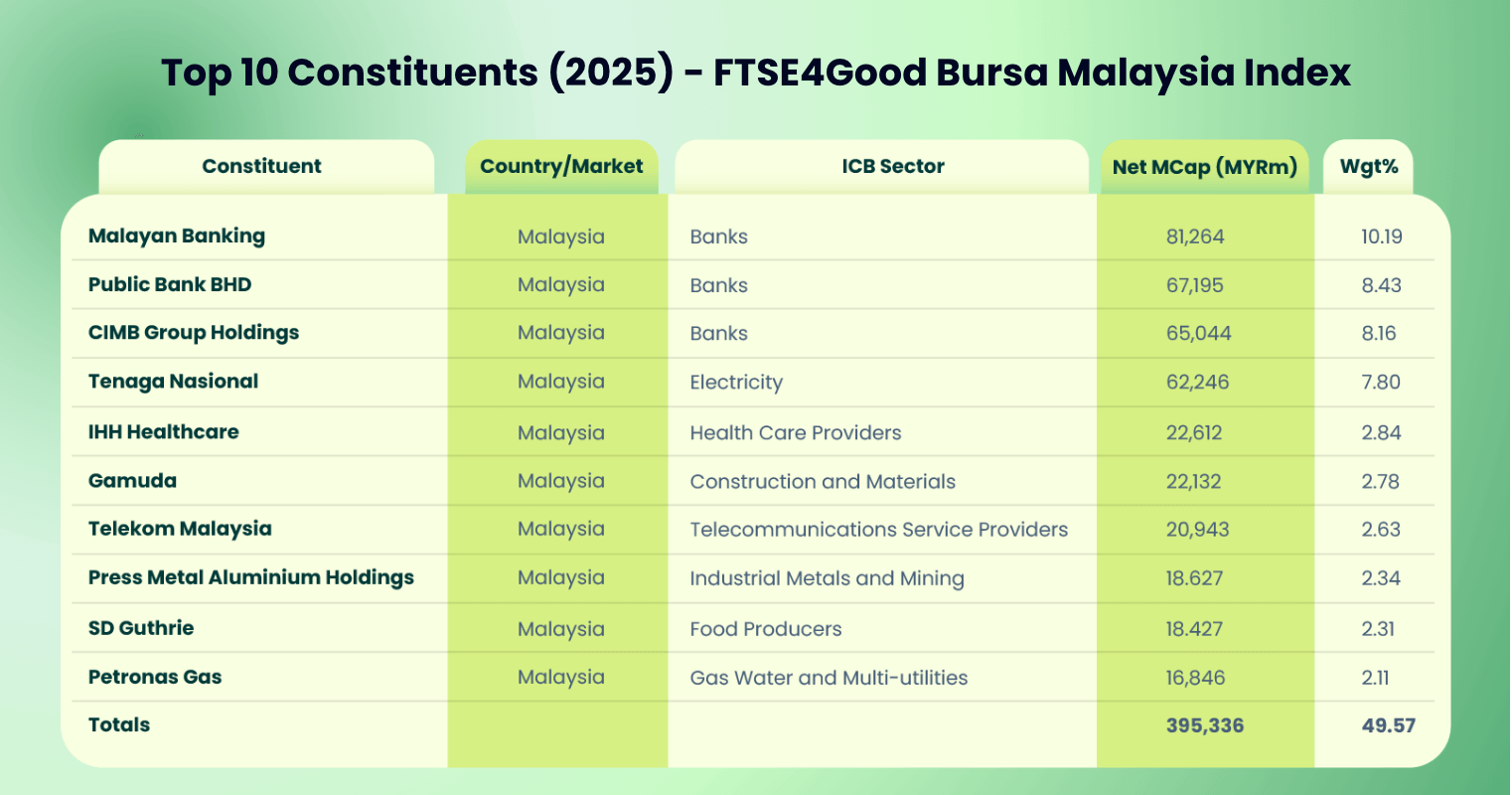

Additionally, according to the latest FTSE Russell Factsheet (FTSE Bursa Malaysia Index Series factsheet, published February 2025), the top 10 companies in the FTSE4Good Bursa Malaysia Index — dominated by banks, are key players in the Malaysian financial and corporate landscape. This highlights the increasing role of ESG considerations in the country’s economic framework.

The FTSE4Good Bursa Malaysia Index provides companies with a platform to showcase their ESG risk management capabilities and attract institutional investors committed to sustainable investment strategies. Inclusion in the index reflects a company’s dedication to improving its ESG performance and aligning with global sustainability standards.

What are the criteria for the FTSE4Good Bursa Malaysia Index?

Companies should meet a variety of criteria to be included in the FTSE4Good Bursa Malaysia Index. All securities that qualify under the following rules are eligible for inclusion:

- 4.1.1. All classes of ordinary shares in issue are eligible, subject to all other rules of eligibility, free float, and liquidity.

- 4.1.2 Companies listed on the Main Market of Bursa Malaysia

- 4.1.3 Companies listed on a stock exchange or recognised market from advanced and secondary emerging countries in the APAC region excluding Japan, Australia, and New Zealand.

- 4.1.4 Companies listed on the ACE Market of Bursa Malaysia

- 4.1.5 Securities listed in Bursa Malaysia and traded on its trading system

- 4.1.6 Converted (convertible) preference shares and loan stocks

For complete details about the criteria, see FTSE Bursa Malaysia Index Series Ground Rules.

FTSE’s evaluation model was extracted from top international reporting frameworks, such as the Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP).

How does the FTSE4Good Bursa Malaysia work?

The F4GBM Index is part of a broader category of Socially Responsible Investment (SRI) indexes, designed to evaluate and highlight companies that demonstrate strong ESG practices.

In collaboration with FTSE Russell, Bursa Malaysia introduced this index to encourage Malaysian publicly listed companies to improve ESG disclosures and sustainability initiatives. Companies included in the F4GBM Index must meet strict ESG criteria and are subject to regular evaluations to ensure compliance with evolving sustainability standards.

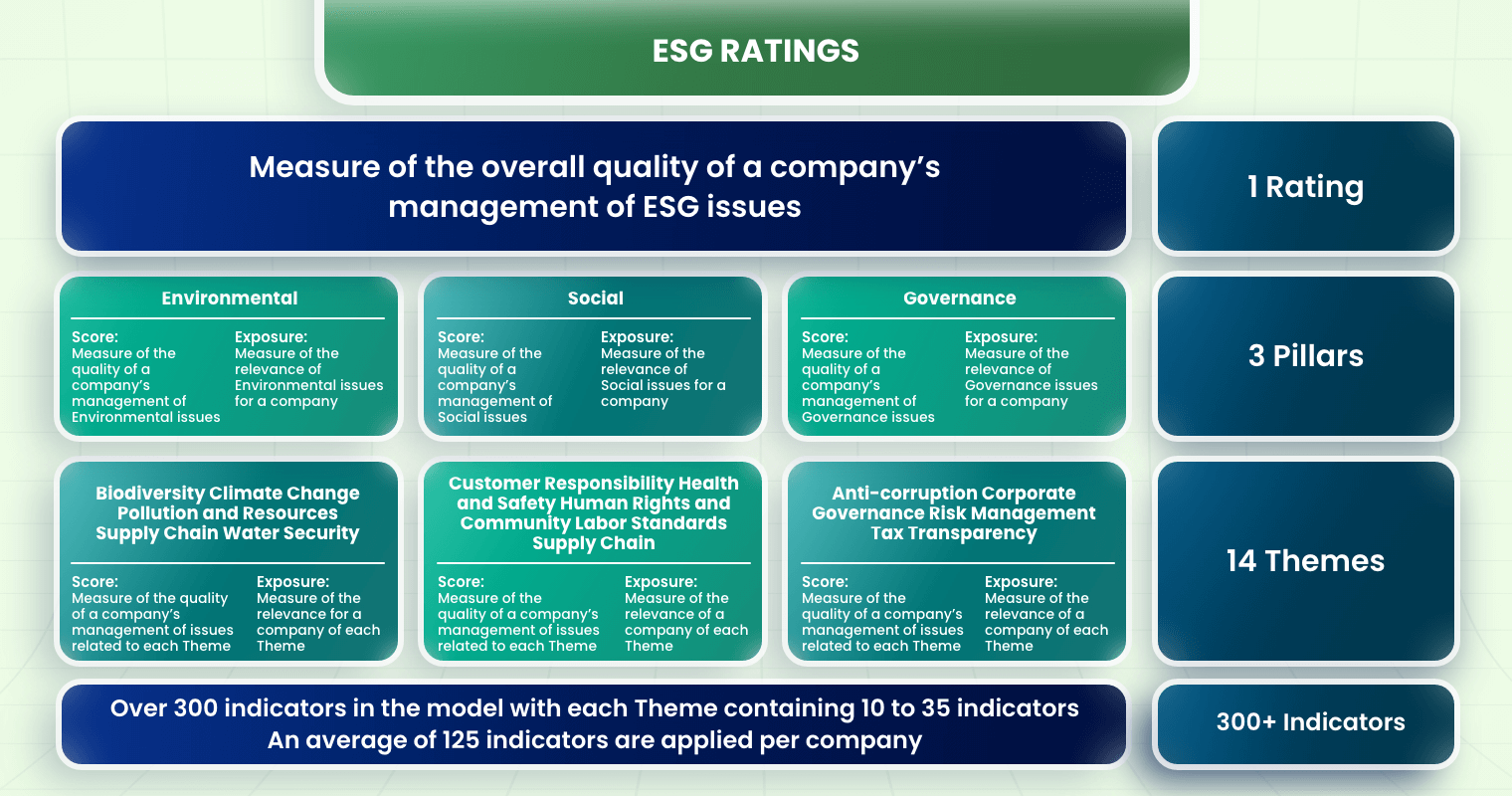

To be included in the F4GBM Index, companies must meet FTSE Russell’s ESG Ratings criteria, which assess their commitment to sustainability. These ratings evaluate companies based on three key ESG pillars, Environmental, Social, and Governance, covering 14 themes such as climate change, supply chain management, human rights, corporate governance, and anti-corruption. Each theme is assessed using over 300 indicators, ensuring a comprehensive measure of ESG performance.

The index is reviewed semi-annually in June and December, ensuring that only companies maintaining strong ESG performance remain listed. Firms that fail to meet the requirements may be excluded from the index.

The F4GBM Index plays a crucial role in Malaysia’s financial landscape, serving different stakeholders:

- Institutional Investors: The FTSE4Good Bursa Malaysia Index serves as an important ESG investment benchmark for Malaysia’s capital market. It helps fund managers and investors integrate ESG considerations into their portfolios by identifying sustainable Malaysian companies.

- Publicly Listed Companies: The index provides an objective benchmark for PLCs to assess their ESG performance and attract ESG-conscious investors.

- Regulators and Policymakers: The F4GBM Index supports Malaysia’s commitment to sustainability and responsible investment by encouraging greater ESG disclosures across industries.

By encouraging responsible investing, the index contributes to Malaysia’s long-term transition toward a more sustainable economy and reinforces the role of ESG in corporate strategy.

What are the benefits of F4GBM Index inclusion?

As sustainability becomes a key factor in investment decisions, Malaysian organisations with strong ESG credentials can experience significant financial and reputational benefits:

Enhanced credibility and investor confidence

Inclusion in the FTSE4Good Bursa Malaysia Index enhances a company’s credibility among domestic and international investors. The index serves as a recognised benchmark for ESG performance in Malaysia, signalling that a company meets globally aligned sustainability standards. As investors increasingly prioritise ESG considerations, PLCs in the index are viewed as lower-risk, more sustainable investments, leading to increased investor confidence and capital inflows.

Increased access to ESG-focused funds

Companies included in the F4GBM Index benefit from greater access to ESG-focused funds and institutional investors seeking responsible investment opportunities. Many local and regional asset managers reference the index when constructing ESG-aligned portfolios, making inclusion a strategic advantage for attracting sustainable capital. Additionally, Bank Negara Malaysia’s initiatives to promote sustainable finance further support ESG-focused investments, increasing funding opportunities for index constituents.

Competitive advantage in sustainable finance

Banks and financial institutions in Malaysia, including those involved in Islamic finance, are integrating ESG factors into their lending criteria. This means that index constituents may qualify for better loan terms, green bonds, and sustainability-linked financing, aligning with the country’s goal of achieving a low-carbon economy by 2050.

Improved reputation and brand positioning

Participating in the FTSE4Good Bursa Malaysia Index reinforces a company’s reputation as an ESG leader within Malaysia’s corporate landscape. This recognition can strengthen relationships with environmentally and socially conscious stakeholders, including customers, employees, and business partners. Additionally, Bursa Malaysia actively promotes the index, increasing the visibility of its constituents among responsible investors and sustainability advocates.

Long-term value creation

Sustainability-driven businesses in Malaysia are more resilient to regulatory changes, reputational risks, and operational disruptions. By aligning with the F4GBM Index’s ESG best practices, companies can ensure long-term value creation, enhance risk management, and position themselves for sustainable growth in Malaysia’s evolving corporate governance framework.

FTSE4Good Index Series: Global and Regional Indices

The FTSE4Good Index Series includes a range of benchmarks designed to evaluate companies’ ESG performance across different markets and investment needs. These indexes help investors identify businesses that meet FTSE Russell’s ESG criteria, promoting responsible investment worldwide.

- FTSE4Good Global Index – Includes companies from both developed and emerging markets that meet ESG performance standards.

- FTSE4Good Emerging Index – Focuses on emerging market companies demonstrating strong ESG commitments.

- FTSE4Good Developed Index – Covers companies from developed economies that align with sustainability best practices.

- FTSE4Good ASEAN 5 Index – Tracks ESG leaders across Indonesia, Malaysia, the Philippines, Thailand, and Singapore.

- FTSE4Good UK Index – Recognises ESG-compliant companies listed on the London Stock Exchange.

- FTSE4Good Japan Index – Highlights Japanese firms committed to sustainability and strong corporate governance.

What is FTSE4Good Bursa Malaysia Shariah Index?

The FTSE4Good Bursa Malaysia Shariah Index was launched in July 2021 to recognise PLCs that have stepped up their ESG practices and reports. It also served as a guide for fund managers in creating investment portfolios of Shariah-compliant equities that meet sustainable investing principles. Shariah-compliant equities adhere to Islamic finance principles, which prohibit investments in businesses related to alcohol, gambling, and other activities deemed unethical under Shariah law.

This Shariah-compliant version of the F4GBM Index will require listed issuers to meet the following objectives:

- Facilitate investors seeking investment in Shariah-compliant shares listed on Bursa Malaysia,

- Centralise Shariah decisions domestically,

- Enhance disclosure and transparency,

- Promote the development of Islamic Capital Markets, and

- Encourage the development of Islamic instruments.

Criteria and Inclusions

The Shariah Advisory Council (SAC) of the Securities Commission Malaysia (SC) uses a specific screening method to determine securities with commendable corporate responsibility practices.

As a general rule, Shariah-compliant securities should not be involved in any of these core activities:

- Financial services based on riba (interest)

- Gaming and gambling

- Manufacture or sale of non-halal products or related products

- Conventional insurance

- Entertainment activities that are non-permissible according to Shariah

- Manufacture or sale of tobacco-based products or related products

- Stockbroking or share trading on Shariah non-compliant securities, and

- Other activities deemed non-permissible according to Shariah

Companies are also evaluated by the SAC of SC based on their activities’ public image from the Islamic teaching perspective. With the FTSE4Good Bursa Malaysia Shariah Index in place, companies are better guided in improving their sustainability performance.

Constituents of the FTSE4Good Bursa Malaysia Shariah Index

The FTSE4Good Bursa Malaysia Shariah Index kicked off with 54 constituents back in July 2021. The Index is launched to track F4GBM constituents that comply with the Shariah Advisory Council (SAC) screening methodology or are eligible for the F4GBMS Index.

As of the latest review period (December 2024), F4GBMS Index has 22 new inclusions and two exclusions, increasing its total to 115. The new inclusions in the F4GBMS Index are:

- AirAsia X

- Ann Joo Resources

- Bumi Armada

- Comfort Glove

- Cypark Resources

- Eastern & Oriental

- Evergreen Fibreboard

- IHH Healthcare

- IJM

- Land & General

- Malayan Flour Mills

- Mega First

- Optimax Holdings

- Paramount Corp

- Perak Transit

- QES Group

- Sime Darby Property

- Skyworld Development

- Sunway Construction Group

- Swift Haulage

- Thong Guan Industries

- TSH Resources

The exclusions are:

- Kawan Food (no longer part of the FBM EMAS Index)

- Shangri-La Hotels (Malaysia) (did not meet SAC criteria)

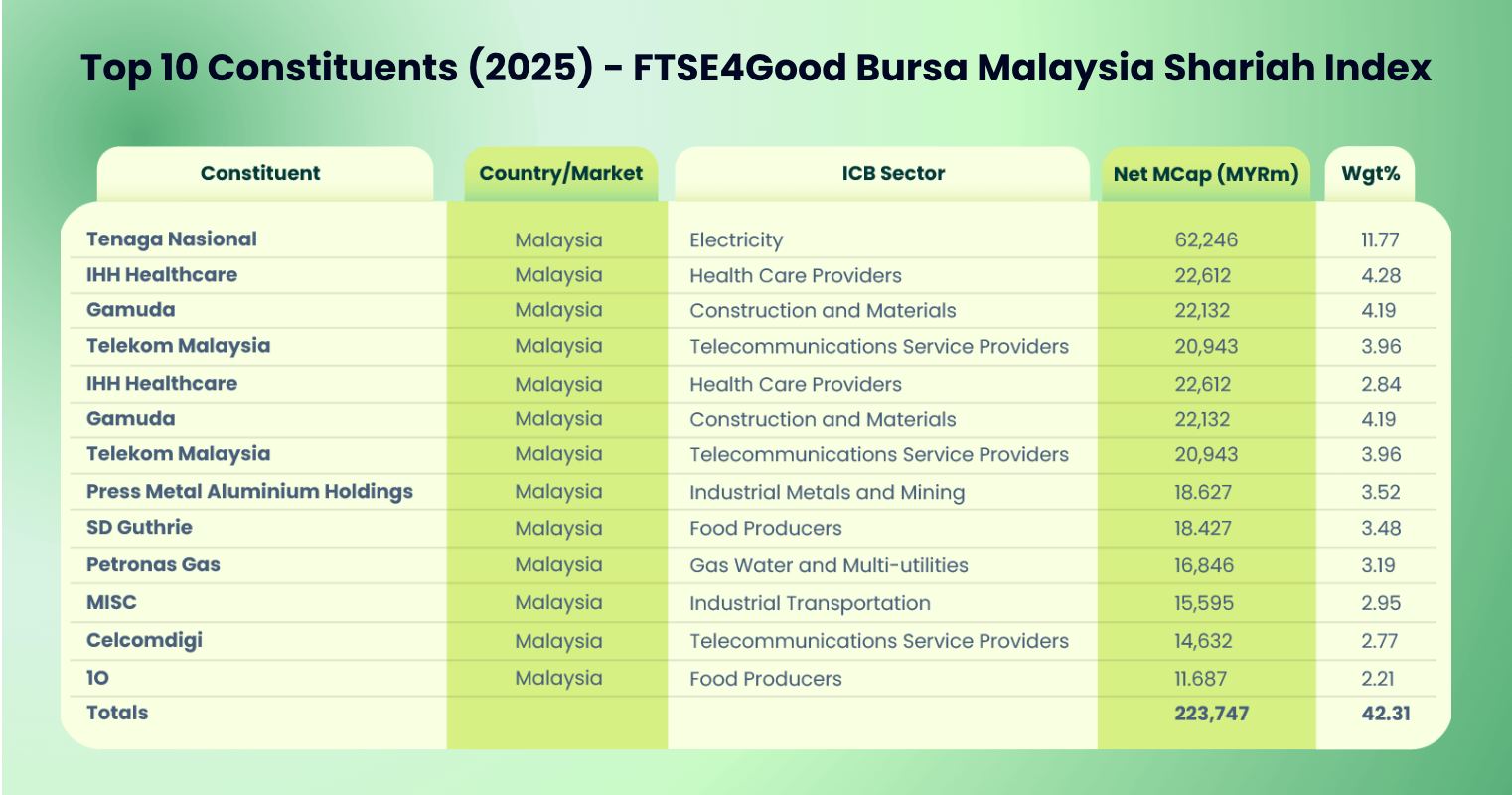

Based on the latest FTSE Russell report (FTSE Bursa Malaysia EMAS Shariah Index, published February 2025), the top 10 constituents for the FTSE4Good Bursa Malaysia Shariah Index include:

FAQs on F4GBM Index

What is the FTSE4Good Index?

The FTSE4Good Index is a series of benchmark indices designed by FTSE Russell to measure the performance of companies demonstrating strong ESG practices. It serves as a tool for investors who want to incorporate sustainability considerations into their investment decisions.

How do I get into FTSE4Good?

Companies are assessed based on FTSE Russell’s ESG Ratings, which evaluate various sustainability factors, including climate impact, human rights policies, and corporate governance. To be included in the FTSE4Good Index, a company must:

- Meet the minimum ESG rating threshold set by FTSE Russell.

- Demonstrate continuous improvement in ESG performance.

- Comply with global sustainability standards and best practices.

How does the FTSE4Good Index work?

The FTSE4Good Index operates on a structured methodology that ensures transparency and accountability. Key aspects include:

- ESG Ratings-Based Inclusion: Companies are evaluated and scored based on their ESG performance.

- Regular Reviews: FTSE Russell conducts periodic assessments to ensure that only companies maintaining high ESG standards remain in the index.

- Sector-Specific Adjustments: Different industries have unique ESG risks, and FTSE Russell adjusts its criteria accordingly to ensure fair assessments.

Inclusion in the FTSE4Good Index can enhance a company’s credibility, attract ESG-focused investors, and provide opportunities for sustainable financial growth.

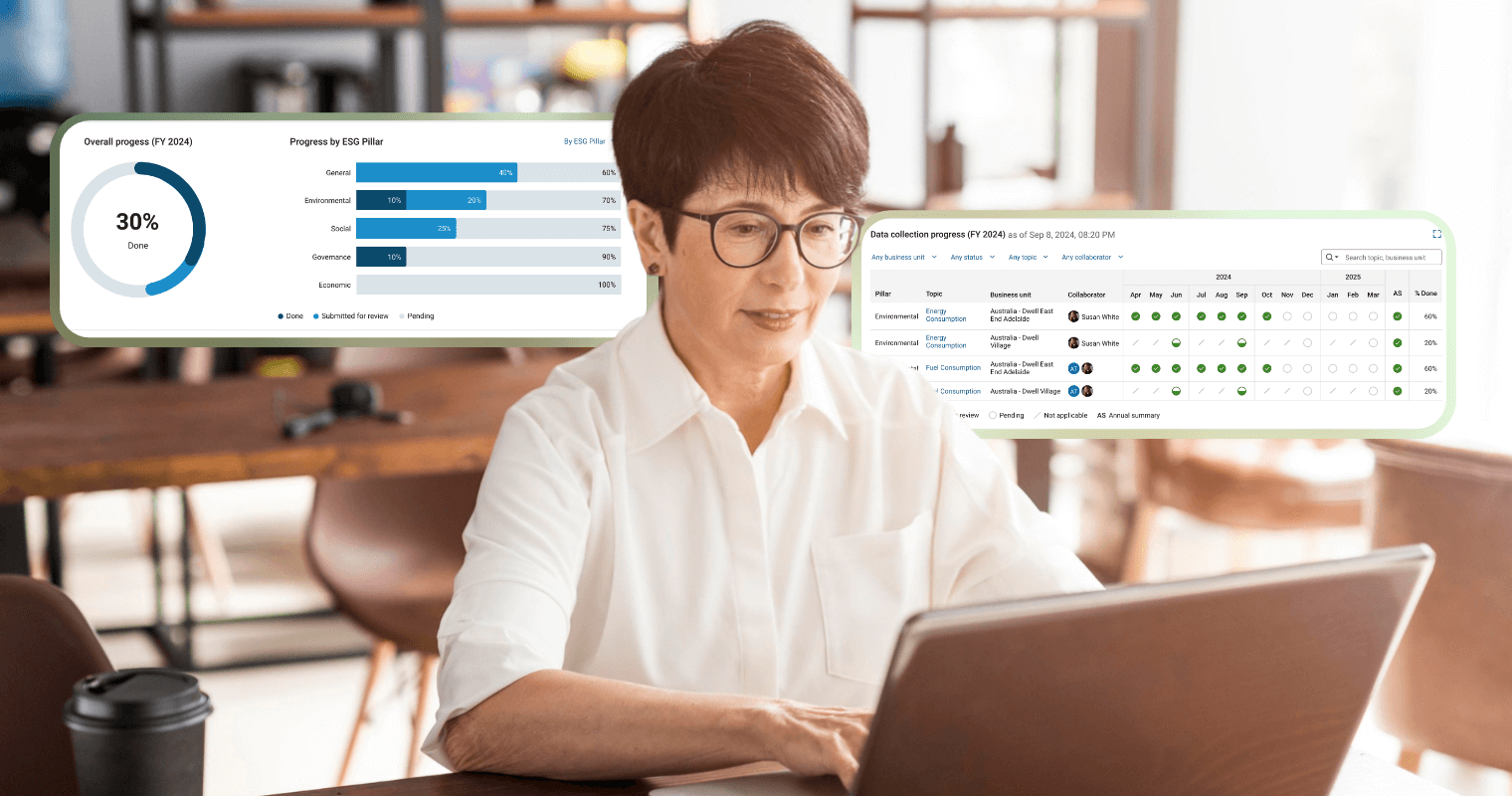

Start Building Accurate and Compliant Reports with Convene ESG

Improving ESG practices to meet the criteria for F4GBM and F4GBMS requires collaborative efforts from boards and other members of the organisations. In Convene ESG, we make it possible to create compliant disclosures that will get the attention of institutional investors.

Convene ESG is an ESG reporting software designed to help companies create future-proof, audit-ready reports that comply with the latest requirements and standards. It enables businesses to align with Bursa Malaysia’s ESG reporting guidelines, ensuring compliance with frameworks such as the FTSE4Good Bursa Malaysia (F4GBM) Index criteria and the Malaysian Code on Corporate Governance (MCCG).

With built-in templates and automated data collection, Convene ESG simplifies the disclosure process, enhances data accuracy, and ensures reports meet regulatory expectations, reducing the risk of non-compliance.

Schedule a demo to see how Convene ESG can transform your sustainability journey.