ESG compliance and governance is a hot topic for many companies in the Philippines. Such initiative is primarily focused on instilling socially and environmentally conscious behavior and practices. These are critical for addressing dreadful sustainability issues like climate change and waste production — not just in the country but in other parts of the globe.

However, as companies in the Philippines move towards more sustainable practices and approaches, the regulatory environment in ESG has become evidently more challenging and complex. This is in addition to the sustainability recommendations and standards already present on the global stage.

One of the major requirements under the ESG criteria is creating a sustainability report. In a nutshell, this report discloses a company’s ESG goals and performance. Recently, ESG experts shared their insights on sustainability reports last July 24, 2022, in the webinar as part of the Institute of Corporate Directors Philippines’ Distinguished Corporate Governance Speaker Series.

With the topic Getting the Right Tools for ESG Compliance and Governance, concerns such as factors and features to look for in an ESG reporting software were discussed. To have a better understanding of this discussion, read through the next sections.

The Challenges in ESG Reporting

In response to the global-scale sustainability issues, the Securities and Exchange Commission (SEC) is now looking to mandate ESG reporting to publicly listed companies in the Philippines by 2023.

As a part of this effort, SEC has issued the Memorandum Circular No. 4, releasing highly relevant and strict guidelines on sustainability reporting. This specifically requires Philippine public-listed companies (PLCs) to submit the ESG reporting template with their annual reports. To put it simply, this mandate enables PLCs to measure and monitor their contributions toward universal global targets such as the UN Sustainable Development Goals and AmBisyon Natin 2040.

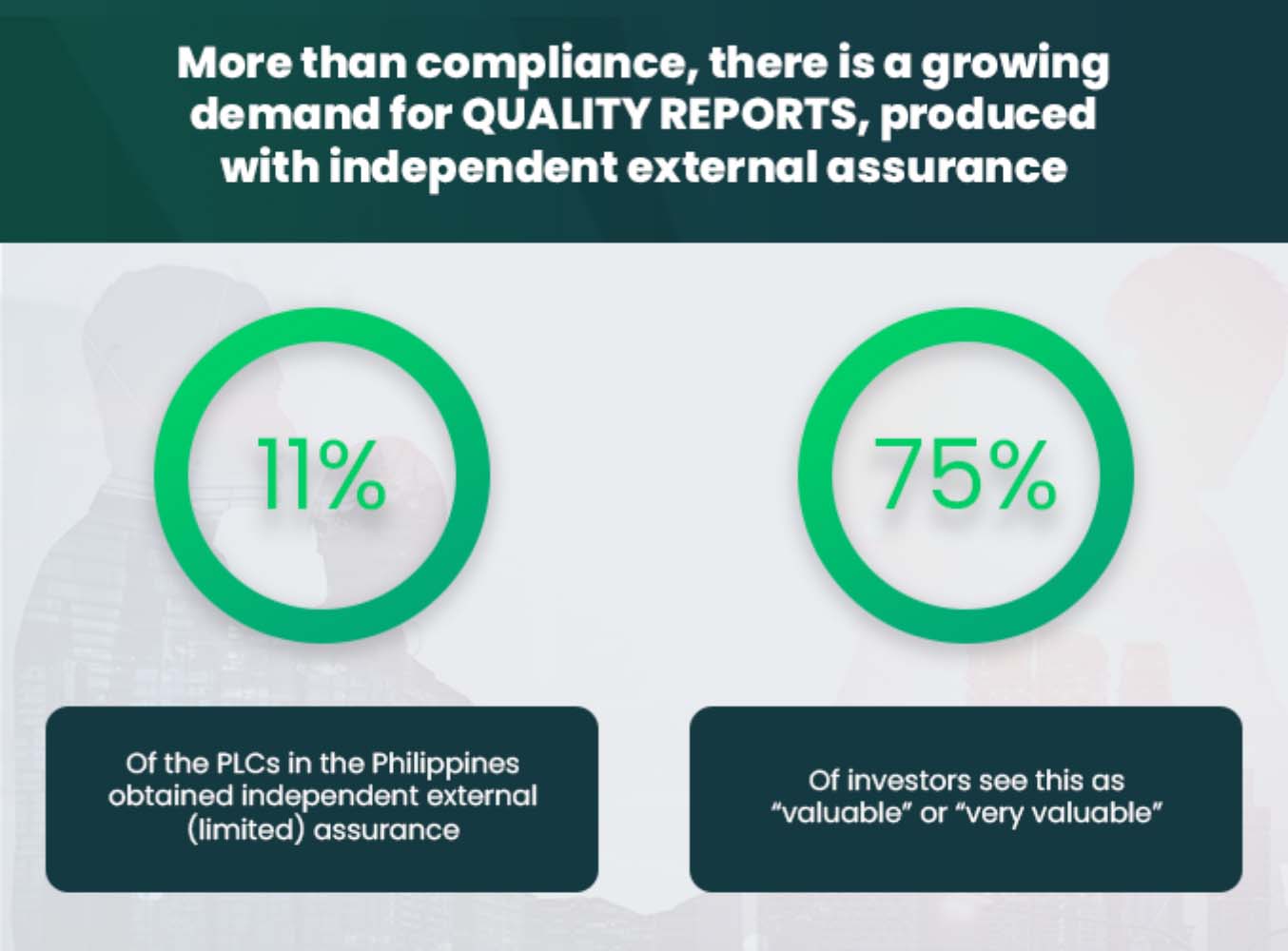

Besides mandatory or voluntary requirements recommended by regulatory bodies, it’s also imperative to consider what the investors expect to see. Depending on your business, there are specific material concerns that may impact your company.

In terms of identifying what data to collect and report, Atty. Ma. Jasmine Oporto, Lukeshire Ltd’s Managing Director and also a speaker in the webinar, shared, “Basically, sustainability reporting goes up the ladder. When you do reporting, investors are looking at the businesses that you control. So, report on the businesses that you know”.

In complying with such mandates and investor expectations, PLCs face different challenges in creating their ESG disclosures, which are:

1. Staying compliant with multiple standards and requirements

As PLCs work to comply with the mandates and address these challenges, it is worth noting that requirements for sustainability reporting continue to increase globally. And on top of that, there’s also a growing number of great expectations from regulatory bodies, stakeholders, investors, customers, employees, and suppliers.

Katherine Pamintuan, Azeus Systems Philippines Limited’s ESG Manager and one of the webinar speakers, shared the seven reporting principles emphasized by SEC:

- Materiality — Identifying relevant topics and factors

- Stakeholder Inclusiveness — Acquiring useful ESG-related insights from stakeholders

- Balance — Reflecting both positive and negative aspects of the company’s performance

- Completeness — Extent of information a company needs to disclose

- Reliability — Gathering of information that can be subjected to examination

- Accuracy — Information must be accurate and detailed, including the proper citation of information sources

- Consistency and Comparability — Presenting of information should be consistent and comparable with other organizations to create real value.

Moreover, it is imperative to consider that for companies listed not only in the Philippines but also in other countries, like Singapore or Malaysia, complying with multiple standards becomes even more challenging. Some of the global sustainability reporting frameworks include GRI, SASB, IR, CDP, TCFD, and CDSB. (Read: A Quick Guide to ESG Reporting Frameworks)

2. Collecting accurate and complete data manually

Data gathering has been one of the top challenges in ESG reporting. In the webinar, Katherine emphasized, “Sustainability reports should be an output of an organization’s sustainability performance and initiatives”. She also pointed out that the process of creating these reports is not a one-man job — but requires the entire organization’s participation.

Data collection should be organized throughout the year to avoid missing or lost data. Notably, these issues typically present themselves in the manual data gathering process, and below are its pain points:

- Struggle to find missing data

- Unreliable verification of data correctness

- Outdated on trends or benchmarking process

- Changes in reporting requirements replay the taxing journey

In view of these pain points, the ideal scenario for data consolidation suggests that it should promote the auditability and trackability of data. Data must also be embedded in the regular course of business operations. Ideally, a good quality report should embody the following:

- Accuracy. Stakeholders require accurate and detailed data to precisely assess a company’s performance, may it be quantitative measurements or qualitative responses.

- Balance. Presented ESG data should have no bias to guarantee an exact calculation of the company’s overall performance, including both favorable and unfavorable results.

- Clarity. A sustainability report should consist of information that is both understandable and accessible, especially to the stakeholders or investors.

- Comparability. ESG data should be comparable among peers or support analysis relative to others. This provides a better picture of the company’s efforts across sustainability.

- Reliability. Collected ESG data must be prepared and valid in a way that they can be subject to evaluation. The veracity of the contents should be checked confidently.

- Timeliness. A quality report must deliver accurate and current data in a clear, timely manner to enable information comparability and accessibility to stakeholders.

With these factors, sustainability officers and the board can monitor a company’s ESG performance, as well as address adverse incidents in real-time.

3. Unreliable risk management process

Before anything else, it’s crucial to remember that the voice of the Board of Directors plays a huge role in mobilizing PLCs towards climate action. At the same time, it’s their responsibility to oversee the company’s risk management process — whether through the board, audit committee, or corporate governance committee.

Risk management traditionally involved financial compliance, and credit and liquidity risk. At present, however, there’s an increasing number of extra activities that can impact a company’s cash flow. And these risks can be found under the ESG criteria, which include natural disasters, cybersecurity, and supply chain.

Given such risks, improved oversight is strongly necessary. Companies need to assess how efficient their data collection is by looking into how data is provided, stored, and verified. To get started, companies can start creating better oversight by following these key activities:

- Identifying ESG-related risks

- Monitoring company performance related to their ESG-related risks

- Managing ESG-related risks in line with existing strategy

- Implementing and following these changes to the company

Addressing the ESG Reporting Challenges

Being aware of the challenges that come with ESG reporting is one thing — addressing them is another. As mentioned in the webinar’s discussion, technology plays a major role in addressing reporting challenges.

To explore this, here’s an overview of how companies can address the three primary challenges mentioned above:

1. Compliance with Mandatory Sustainability Reporting Requirements

Based on SEC’s sustainability mandate, PLCs should be able to angle their reports in accordance with both the locally and globally accepted standards. Using the right software can make the work easier, particularly ensuring alignment of disclosure content and quality with the reporting requirements and principles.

Quick tip for starters: Atty. Jasmine shared in the webinar, “If it’s your first time it’s good to start with the SEC template in the Philippines. It’s taking baby steps. To start with the SEC format and just integrate it with the annual report. Also, don’t forget to analyze the 17 SDG Goals and pick the most relevant ones that reflect your business”.

2. Gathering ESG Data Efficiently

Using the right technology allows companies to automate their workflows and data collection processes — cutting down manual or human errors. They can schedule regular data collection, set automotive reminders, and structure the data to ensure the consolidated information is what’s required both for the report and the company’s performance management.

3. Oversight of ESG Performance

In the third challenge, companies should ensure that there are no missing or incorrect values and documentation, no untraceable changes, and no unusual values. This can be done by automated data validation. Technology also helps boards analyze, track, and monitor data collection goals.

Choosing the Right Reporting Technology

Given the challenges in sustainability reporting, technology offers an easier and more efficient way to collect data while staying compliant with different standards and mandates. CEO of Elixir’s Technology Shih Hor Lau, shared the six key areas companies and boards should consider when choosing the right software for their reporting needs.

Data Flexibility and Adaptability

Having a flexible database for ESG data collection is better than a structured one. Similarly, instead of using a structured Data Warehouse, the new concept of Data Lake, which acts as a reservoir to store multi-structured data, offering unrivaled flexibility in data storage and analysis. Opt for modern technology that allows you to collect and model the data dynamically.

Data Collection and Automation

Collecting multi-level data requires a smarter format, which ideally is a multi-form input. You’d also need to dive deeper in terms of content validation, identifying which data is necessary and which is not. And again, the right technology can help you automate multi-level consolidation, calculate ESG metrics, and customize the formula requirements needed.

Data Mapping and Configuration

Using a low-code, integrated software when addressing the reporting frameworks allows for better adaptation, giving you access to numerous tools and configurations like a graphical interface. Additionally, the right technology prevents duplicate entries or topics when creating multiple disclosure reports to meet different requirements.

Data Security and Auditability

In enforcing data security and privacy, the best software offers modern access controls such as the 2FA and SSO, or built-in data hashing and encryption. You’d also want your data to be trackable, wherein you’ll need capabilities like role-based security and audit trail. Beyond monitoring for changes, you need evidence of the captured data, wherein you can consider guided optical character recognition (OCR) integration or human guidance for more effective consolidation.

Data Visualization and Presentation

Having access to software features such as automatic alerts for data collection status enables you to identify what information is still missing or already inputted. Maintaining a configurable dashboard is also crucial for pushing ownership down to each user. As for viewing the information, a good software can filter the content based on the login information.

Data Interfacing and Interoperability

Being able to compare with third-party data or other players in the market is another feature to consider in choosing a reporting solution. More so, it should be able to support other critical steps such as benchmarking against peers, qualitative and quantitative comparison, and auto submission in digital output formats.

To sum these all up, here’s an overview of what exactly you should consider when selecting the right reporting tool:

While these factors are critical to consider, Shih Hor reminded companies to still consider their specific sustainability reporting journey. According to him,

“I think a lot depends on the journey. If you’re starting out in an early stage, maybe a very simple system is good enough. But as you go further on your aspiration or all the way to be a leader in this arena, and not just to so-called fulfill that basic compliance, then you will want to have a system that is more capable”.

Bonus tip: Besides using technology to kick start the sustainability reporting journey, is hiring a consultant worth it

In response, Atty. Jasmine shared, “Yes, you can get a consultant or you can hire somebody who’s familiar. However, while consultants can guide you in what you should do, chances are, you still have to gather the information for the work. And when you use technology, you’d also need to consider data governance — who are the owners of the data, and who has the right to revise, to collect, and to change the data”.

Convene ESG: The Perfect Reporting Software for You

Digitizing ESG data proves to save a great amount of time and effort from manual work. Through automation, data can be broken down into digestible insights that are easy to manage and track. If you’re looking to ramp up your ESG efforts, digitization is the key. And this is where you’ll need a capable ESG reporting software.

Convene ESG is designed to deliver guaranteed flexibility, automation, and accuracy — three important ingredients of a good sustainability report. This software offers a powerful engine, allowing companies to streamline data consolidation, set up email alerts for all information providers, and generate the report in just a few clicks.

Get to know Convene ESG more by visiting our page, or filling out the contact form for your questions. Want to request a demo instead? Reach out to our team and we’ll be happy to accommodate you!

*Graphs and figures are grabbed from the webinar discussion, Getting the Right Tools for ESG Compliance and Governance — a part of ICD’s Distinguished Corporate Governance Speaker Series*