While several ESG reporting frameworks have a general application to most industries, specific frameworks stand out for certain fields. For those who deal in real estate, GRESB (the Global Real Estate Sustainability Benchmark) is the first choice when assessing and reporting the ESG impacts of their portfolios and assets.

What does GRESB Stand for?

GRESB stands for the Global Real Estate Sustainability Benchmark. Established in 2009 in the Netherlands, GRESB was created to provide a consistent framework for global assessment of real estate assets’ sustainability performance. Investors, property managers, and other stakeholders in the real estate sector required a standardised way to evaluate and compare the ESG performance of their assets, and GRESB fulfilled this need.

GRESB Reporting operates through an annual survey, meticulously designed to capture a comprehensive range of ESG data from participating entities. This survey covers various topics, including but not limited to energy and water consumption, greenhouse gas emissions, waste management practices, biodiversity initiatives, health and safety protocols, workplace diversity and inclusion policies, and community engagement strategies. Each of these areas is critical in understanding the overall sustainability and social impact of a real estate portfolio.

The data collected through the GRESB Real Estate Assessment is then analysed and used to generate a GRESB rating for each participating company. These scores are benchmarked against industry peers, providing valuable insights into where a company stands in comparison to others in terms of ESG performance. Companies with high GRESB scores are often viewed more favourably by investors, as they are seen as being more proactive and responsible for managing their ESG risks and opportunities.

Who uses GRESB Assessments?

GRESB Assessments are utilised by a wide range of stakeholders in the real estate sector, each with distinct objectives:

- Investors: Investors, including institutional investors such as pension funds, insurance companies, and sovereign wealth funds, use GRESB scores as a critical tool in their decision-making process. High GRESB scores can indicate lower long-term risks associated with environmental regulations, social unrest, or governance issues, making these assets more attractive. Additionally, many investors now have specific mandates to invest in sustainable assets, and GRESB certification provides the transparency needed to fulfil these mandates.

- Managers: Property and asset managers use GRESB data to benchmark their portfolios against industry standards and peers. This benchmarking process is vital for identifying strengths and weaknesses in their ESG strategies. For instance, if a portfolio scores lower in energy efficiency compared to peers, managers can prioritise improvements in that area. Moreover, managers use GRESB reporting to demonstrate their commitment to sustainability to both current and potential investors, often leading to better investor relations and potentially lower capital costs.

- Partners: Partners, including tenants, contractors, and other stakeholders in the real estate ecosystem, leverage GRESB scores to align themselves with companies that prioritise sustainability. Contractors and suppliers might also prefer working with companies that have strong GRESB scores, as these companies are likely to have more robust ESG policies and practices, leading to more stable and ethical business relationships.

Why is GRESB Reporting important?

GRESB reporting is a cornerstone of sustainability efforts in the real estate industry. The importance of GRESB reporting can be understood through several key lenses:

- Transparency and Accountability: GRESB reporting brings a high level of transparency to the ESG practices of real estate companies. In an industry where ESG factors are becoming increasingly critical to stakeholders, being transparent about these practices helps build trust and credibility. GRESB ratings provide a clear and comparable metric that stakeholders can rely on to assess a real estate’s ESG performance.

- Performance Improvement: The benchmarking process inherent in GRESB reporting allows companies to identify specific areas where they can improve their ESG performance. For example, a company might discover through GRESB that its water usage is higher than the industry average, prompting it to implement more efficient water management practices. Over time, this continuous improvement can lead to significant cost savings, risk reduction, and enhanced property values.

- Investor Relations: With the growing emphasis on sustainable investing, companies with strong GRESB scores are more likely to attract investment from funds and institutions that prioritise ESG criteria. GRESB reporting thus plays a direct role in a company’s ability to secure funding. Additionally, strong ESG performance can lead to lower borrowing costs and better terms on financial instruments, as lenders view these companies as lower risk.

- Regulatory Compliance: GRESB reporting can also help companies stay ahead of regulatory requirements related to ESG. As governments around the world introduce more stringent regulations on environmental impact and social responsibility, companies that already adhere to GRESB standards are better positioned to comply with new laws and avoid potential fines or penalties.

- Reputation and Market Position: In today’s market, consumers and businesses alike are increasingly favouring companies that demonstrate a commitment to sustainability. GRESB ratings are often used in marketing and public relations efforts to showcase a company’s leadership in ESG, enhancing its reputation and competitive position in the market.

What factors does GRESB assess?

GRESB assessments are comprehensive, covering a wide array of factors across the ESG spectrum. These factors are carefully selected to provide a holistic view of a company’s sustainability performance:

- Environmental: GRESB assessments prioritise environmental factors, evaluating metrics like energy consumption, water usage, waste management, and biodiversity. Companies are assessed on their ability to optimise energy efficiency, implement sustainable water and waste practices, protect natural habitats, and manage carbon emissions.

- Social: The social aspect focuses on workplace diversity, employee well-being, and community engagement. Companies are evaluated on diversity and inclusion policies, health and safety protocols, and efforts to support local communities, including affordable housing and community development.

- Governance: Governance in GRESB assessments covers corporate governance structures, risk management, and transparency. Companies are assessed on board composition, risk mitigation strategies, and the clarity and accuracy of their ESG reporting.

Key Dates for GRESB Reporting

The GRESB reporting process follows a well-defined annual timeline, designed to give companies ample time to collect, analyse, and submit their ESG data:

- Data Collection (January – March): At the beginning of the year, companies start gathering the necessary data for GRESB reporting. This includes data on energy consumption, water usage, waste management, diversity and inclusion policies, and other ESG metrics. Companies often engage various departments, such as sustainability, finance, and human resources, to collect accurate and comprehensive data.

- Survey Preparation (April): In April, GRESB opens its official survey for the year. During this period, companies begin inputting their collected data into the GRESB survey platform. This stage involves careful preparation to ensure that all data is accurately represented, and that any required documentation or evidence is properly submitted.

- Submission Deadline (July): The survey submission deadline typically falls in July. Companies must ensure that all their data is submitted by this date to be included in the year’s assessment. This deadline is crucial, as late submissions may not be accepted, potentially impacting a company’s ability to participate in the benchmarking process.

- Validation and Scoring (August – September): After submission, GRESB conducts a thorough validation process to ensure the accuracy and consistency of the submitted data. This process may involve follow-up questions or requests for additional documentation. Once validation is complete, GRESB generates GRESB scores based on the data provided. These scores are then benchmarked against industry peers.

- Results Release (September): GRESB releases the results in September, providing participating companies with their GRESB ratings and detailed feedback. Companies can access their scores through the GRESB platform and compare them against the industry benchmarks. This feedback is critical for companies to understand their performance relative to peers and to identify areas for improvement in the coming year.

- Post-Assessment Review and Strategy (October – December): Following the release of results, companies typically conduct a post-assessment review to analyse their performance. This review involves senior management and ESG teams, who use the insights from the GRESB assessment to inform their sustainability strategies for the following year.

The GRESB Real Estate Assessment

The GRESB Real Estate Assessment is a globally recognized tool that evaluates the environmental, social, and governance (ESG) performance of real estate assets. It helps real estate stakeholders benchmark their sustainability efforts against peers and identify areas for improvement. This assessment is a key component of GRESB reporting and is widely used by real estate companies seeking GRESB certification and to improve their GRESB rating.

The 4 Types of GRESB Benchmarks

The GRESB Real Estate Assessment generates four primary benchmarks, each catering to different aspects of real estate and infrastructure:

- GRESB Real Estate Benchmark: This benchmark evaluates the overall ESG performance of real estate portfolios, focusing on operational assets. It helps participants compare their sustainability efforts against global peers.

- GRESB Development Benchmark: Specifically for new developments and major renovations, this benchmark assesses how well companies are integrating ESG principles during the design, construction, and renovation phases of real estate projects.

- Infrastructure Fund Benchmark: This benchmark is tailored for infrastructure funds and assesses the ESG performance of managed infrastructure assets, ensuring that they meet the highest sustainability standards.

- Infrastructure Asset Benchmark: Focused on individual infrastructure assets, this benchmark evaluates their ESG performance, enabling comparison with similar assets globally.

Components of the GRESB Real Estate Assessment

The GRESB Real Estate Assessment is composed of three core components that together provide a comprehensive overview of a company’s ESG performance:

- Management: This component assesses the entity’s leadership, strategies, policies, risk management, and stakeholder engagement tactics. It evaluates how well these elements are aligned with ESG goals.

- Performance: This component measures the actual performance of the real estate portfolio concerning environmental and social metrics, such as energy efficiency, water usage, and tenant satisfaction.

- Development: This component focuses on the efforts made to address ESG-related issues during the design, construction, and renovation of buildings. It evaluates the sustainability of new developments and major renovations.

Scoring Methodology

The GRESB Real Estate Assessment employs a rigorous scoring system, assigning points on a scale from 0 to 100:

- Performance and Development: Each of these components is weighted at a maximum of 70 points, reflecting their importance in the overall assessment.

- Management: This component has a maximum score of 30 points, evaluating the integration of ESG principles into the entity’s management.

Participants may receive multiple points for questions with more than one correct answer, offering flexibility and multiple pathways to achieve the maximum score.

GRESB Ratings

The GRESB rating system uses a five-point scale to reflect the level of ESG integration and performance of participating entities. The scale ranges from one to five stars, with each rating indicating a different level of sustainability achievement.

- One Star indicates a basic level of ESG integration. Entities with this rating are in the early stages of incorporating sustainability practices and have significant room for improvement.

- Two Stars represents a moderate level of ESG integration. These entities are making progress but still have areas needing enhancement to achieve higher performance.

- Three Stars denotes a good level of ESG integration and performance. Entities rated with three stars have implemented robust sustainability practices and are performing well in comparison to their peers.

- Four Stars signifies a high level of ESG integration. Entities at this level demonstrate strong sustainability practices and are considered leaders in ESG performance.

- Five Stars represents excellence in ESG integration and performance. Entities awarded five stars are regarded as industry leaders, setting high benchmarks in sustainability practices and demonstrating exceptional performance.

Entities that achieve a Green Star designation have scored at least 50% in the Management component and 50% in either the Performance or Development component. This designation highlights industry leadership in ESG practices and reflects a high level of commitment to sustainability.

Additionally, the Sector Leader designation is awarded to the top-performing entity within each real estate sector. This recognition is for those demonstrating exceptional performance and leadership in ESG practices relative to their sector peers.

The Most Improved designation is given to entities that have shown the most significant improvement in their GRESB rating over the previous year. This award recognizes organisations that have made notable strides in their sustainability efforts.

On a global scale, the GRESB Global Sector Leader acknowledges the highest-scoring entities within their respective sectors, reflecting outstanding ESG performance and leadership internationally.

Limitations of GRESB Assessments

While GRESB assessments provide valuable insights into the ESG performance of real estate entities, there are several limitations to consider:

- Dependence on Self-Reported Data: One significant limitation is that the data used in GRESB assessments is largely self-reported by participating entities. This reliance on self-disclosed information can introduce biases and inaccuracies, as entities may present their practices more favourably than they are in reality.

- Variability in Reporting Practices: The GRESB Real Estate Assessment is based on standardised reporting frameworks, but there can be variability in how different organisations interpret and report their ESG data. This inconsistency can affect the comparability of results across different entities and sectors.

- Scope of Assessment: The assessment primarily focuses on the management and performance of ESG practices but may not cover all relevant sustainability issues comprehensively. Certain nuanced aspects of sustainability, such as local environmental impacts or specific social issues, might not be fully addressed in the assessment.

- Benchmark Limitations: The benchmarks provided by GRESB, including the GRESB Real Estate Benchmark and GRESB Development Benchmark, are useful for comparison but might not capture all the unique challenges and opportunities faced by specific entities. As a result, the benchmarks may not always fully reflect the diverse practices and performance levels across different regions or property types.

- Limited Coverage of Smaller Entities: Smaller real estate entities or those with limited resources might face challenges in meeting the comprehensive requirements of the GRESB Real Estate Assessment. This can limit their ability to participate effectively and be evaluated on an equal footing with larger organisations.

Best Practices for GRESB Reporting

To achieve the best results in GRESB assessments and maximise the benefits of GRESB reporting, consider the following best practices:

- Understand the GRESB Framework: Familiarise yourself with the GRESB Real Estate Assessment framework and its criteria. Understanding what GRESB evaluates—such as management practices, performance metrics, and development efforts—will help you align your reporting with their requirements and improve your overall score.

- Engage Stakeholders: Involve key stakeholders in your ESG reporting process. This includes engaging with senior management, property managers, and other relevant personnel to gather accurate and comprehensive data. Stakeholder engagement also ensures that sustainability goals are integrated into the company’s broader strategy.

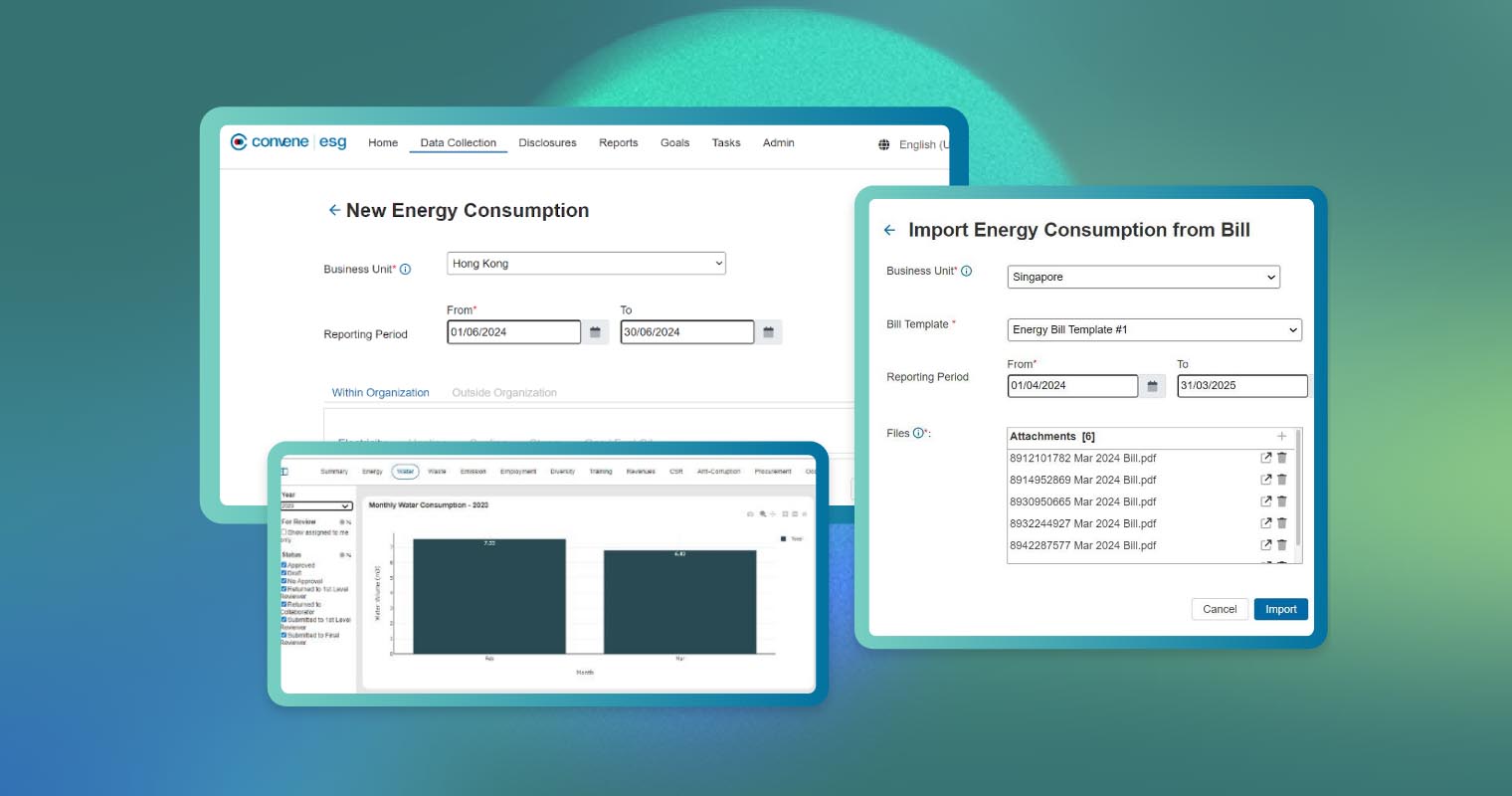

- Collect Comprehensive Data: Ensure you collect detailed and accurate data across all relevant areas. This includes operational performance, energy and water consumption, and tenant satisfaction. Use reliable data collection methods and systems to enhance the accuracy of your reports.

- Utilise Sustainability Software: Implement sustainability reporting software or ESG reporting software to streamline data collection, analysis, and reporting. These tools can help you manage and track ESG metrics more efficiently and provide insights for continuous improvement.

- Document Evidence and Policies: Maintain thorough documentation of your ESG policies, procedures, and performance. Clear documentation supports your GRESB assessment by providing evidence of your sustainability practices and compliance with GRESB’s criteria.

- Regularly Review and Update: Periodically review and update your ESG practices and reporting processes to reflect the latest standards and best practices. Regular updates ensure that your reporting remains relevant and aligned with evolving GRESB requirements.

- Conduct Internal Audits: Perform internal audits of your ESG data and practices before submission. Internal audits can help identify discrepancies, validate data accuracy, and ensure all required information is included in your GRESB Real Estate Assessment.

- Seek Third-Party Verification: Consider engaging a third-party verifier to review your data and practices. Independent verification can enhance the credibility of your report and provide additional assurance of data accuracy.

- Communicate Transparently: Clearly communicate your ESG practices and performance in your reports. Transparency in reporting helps build trust with stakeholders and improves the overall quality of your GRESB reporting.

- Integrate Other ESG Reporting Frameworks and Standards: Align your GRESB reporting with other ESG reporting frameworks and standards, such as the ISSB, GRI, SASB, CDP, and TCFD. Leveraging these frameworks ensures that your ESG strategy is comprehensive and consistent across various reporting requirements. Additionally, consider using real estate-specific standards like the EPRA’s Sustainability Best Practice Reporting (sBPR) recommendations to further enhance your GRESB compliance.

GRESB Reporting in 2024 and beyond

This 2024, GRESB is introducing several key updates to its standards that reflect the evolving landscape of sustainability and ESG reporting. One significant change is the expanded scope of climate resilience and opportunities. The revised indicator RM5 now includes both climate-related risks and opportunities, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) framework. This shift encourages participants to integrate comprehensive resilience strategies into their climate planning, addressing a full spectrum of climate scenarios.

Another notable update is the introduction of energy efficiency scoring, which, while not directly impacting the GRESB score in 2024, sets the stage for future refinements. This new focus underscores the critical role of energy efficiency in sustainable real estate. Additionally, GRESB is refining energy data reporting by separating operational from non-operational energy consumption. This change aims to enhance the accuracy of energy intensity calculations and improve data clarity.

GRESB is also updating its approach to building certification by introducing an expiration year for certifications. This change emphasises the need to keep certifications current and relevant. Looking further ahead, the 2025 standard will introduce changes to employee safety indicators, promoting a comprehensive approach to safety monitoring.

FAQs

Is GRESB reporting mandatory?

GRESB reporting is not mandatory but is highly recommended for organisations seeking to benchmark their ESG performance and demonstrate their commitment to sustainability to investors and stakeholders.

Is there a GRESB certification?

GRESB does not provide certification but offers assessments and ratings. High performers may receive a GRESB Green Star or be recognized in other ways based on their assessment scores.

Where to submit GRESB assessments?

GRESB assessments are submitted through the GRESB Portal. Participants log in to the portal to complete and submit their assessment forms for evaluation.

Enhance Your GRESB Reporting with Convene ESG

Whether you’re familiar with GRESB or just discovering how it can elevate your real estate business, you can take your reporting to the next level through Convene ESG. This all-in-one ESG reporting software incorporates useful tools and visualisation capabilities to generate error-free reports. This toolbox of functions can also be used to centralise and streamline the large amounts of data required by the GRESB Assessment and a variety of additional industry-specific frameworks, standards, and guidelines.

Ready to automate and improve your GRESB reporting process? Request a demo at Convene ESG to see how this innovative ESG software can support your sustainability reporting.