As the stakeholder interests and global focus have shifted to the environmental, social, and governance (ESG) factors, the Hong Kong Exchanges and Clearing Limited (HKEX) is continuously enhancing its ESG reporting requirements on issuers. Since 2013, HKEX has required listed companies to report on their ESG and sustainability information, alongside their annual reports.

In December 2019, the HKEX issued the 2019 Consultation Conclusions to amend the ESG Guidelines and existing provisions on ESG reporting. The 2019 Conclusions amended the timeframe of the ESG report submission, shortening it to no later than five months after the financial year-end. It also introduces mandatory disclosures on ESG matters and climate-related risks.

To better address the investors’ demands, HKEX revised the ESG Reporting Guidelines in 2021 to include more ESG aspects and implement mandatory and ‘comply or explain’ disclosure requirements. Read on to know how to comply with the mandate and prepare for your sustainability reports.

Unpacking HKEX ESG Disclosure Requirements

In the revised guidelines, HKEX set a strengthened direction for issuers listed in the Main Board and General Enterprise Market (GEM) to publish their ESG reports.

The overall approach of the Guide sets out general disclosures and key performance indicators to report on. It also encourages issuers to follow the Reporting Principles in preparing their ESG reports, namely:

- Materiality — Identifying the impact of the ESG issues on investors and other stakeholders as determined by the board.

- Quantitative — Setting measurable targets and KPIs to evaluate the effectiveness of ESG policies and management systems. This can be accompanied by narratives.

- Balance — Providing an unbiased image of the company’s ESG performance — no selection or omissions of information. Both positive and negative trends in performance are reported.

- Consistency — Using consistent methodologies to compare historic ESG data.

Mandatory Disclosures

Following the 2019 Consultations, HKEX introduces disclosure requirements highlighting the board’s role in ESG governance. This includes a mandatory statement from the board containing:

- Disclosure of the board’s oversight of ESG issues,

- The Board’s ESG management approach and strategy, and

- The Board’s progress review on ESG goals and targets relating to the issuer’s businesses

HKEX also requires companies to disclose their application of the Reporting Principles, specifically Materiality, Quantitative, and Consistency, in preparing the ESG report. They must be able to report on the process of selecting the material ESG factors, standards and methodologies used, and the changes in methods or KPIs.

Lastly, issuers must disclose a narrative explaining the reporting boundaries of their ESG report. It should describe the process of selecting the entities or operations included in the report and if there are changes in the scope.

With these disclosure requirements, issuers must be able to formalise their ESG approach and strategy to establish an effective ESG governance structure. They must also perform materiality assessment and develop a consistent reporting methodology.

‘Comply-or-Explain’ Disclosures

As per the Guide, the HKEX does not feed a one-size-fits-all approach to comply with the ESG reporting requirements. Instead, it allows for ‘comply or explain’ provisions, requiring the company to report on its social and environmental impact and performance. Below are the most common themes and issues in this provision, focusing on environmental and social subject areas.

As for the environmental disclosures, HKEX is requesting issuers to report on significant climate-related issues, risk exposure, and mitigation policies. The ESG report should include the reduction targets for emissions, wastes, energy use, water use, and procedures to achieve these targets.

In November 2021, HKEX released the Guidance on Climate Disclosures explaining how to comply with the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. The Guidance assists issuers in identifying climate-related risks and provides a step-by-step guide on preparing TCFD-aligned reporting.

For social and governance disclosures, HKEX encourages issuers to discuss issues, risks, and policies on employment and employment matters, product responsibility, community investment, and anti-corruption. This calls companies to re-examine the materiality of Social KPIs, address the reporting gaps, and establish a reporting mechanism on the social and governance subject areas.

Read more on the KPIs and general disclosures of each aspect in the revised ESG Reporting Guidelines (Part C).

Upcoming Changes to the Regulation

In December 2020, the Green and Sustainable Finance Cross-Agency Steering Group declared that TCFD-aligned climate-related disclosures will be mandatory for issuers by 2025. HKEX has been recommending alignment with the TCFD framework before 2015 to assess the challenges and ease the transition according to the mandate.

HKEX will continue to review its ESG framework to align better with the TCFD recommendations on climate-related disclosures. The Steering Group also hinted at the adoption of the International Sustainability Standards Board’s new standards.

With the current efforts to strengthen ESG excellence and governance in Hong Kong, HKEX initiated creating a “Board Diversity & Inclusion in Focus” repository, where information on issuers on board diversity can be accessed by investors and other stakeholders. In this centralised platform, data on the company’s board of directors, by age, gender, and years of tenure, are made available for assessment and peer benchmarking.

Prime HKEX-Compliant ESG Reports with Digital ESG Software

Navigating through the HKEX regulations and provisions on top of the stakeholders’ demands may inundate companies when preparing their ESG reports. What you need is an ESG reporting software that can automate the processes while accurately reporting on your ESG policies, performance, and impact.

Set the scope of your report

Before writing your ESG report, it is important to set goals, scope, and roles first. HKEX released in March 2020 a step-by-step guide to preparing an ESG report focused on the procedures pre-generation of the disclosure.

First, issuers must identify the roles of the board in overseeing and implementing ESG governance. This includes identifying the ESG-related risks to approving reports. Issuers may also establish an ESG working group to serve as consultants on sustainability matters which report to the Board.

Next is understanding the HKEX reporting requirements and identifying the needed data and suitable methods for the ESG report. Issuers must also set the criteria for determining the report boundary based on the business goals and circumstances.

Parts of scoping your report are conducting materiality assessments and setting goals. Doing such can provide direction to the material ESG topics and targets you should report on to validate the effectiveness of your ESG policies.

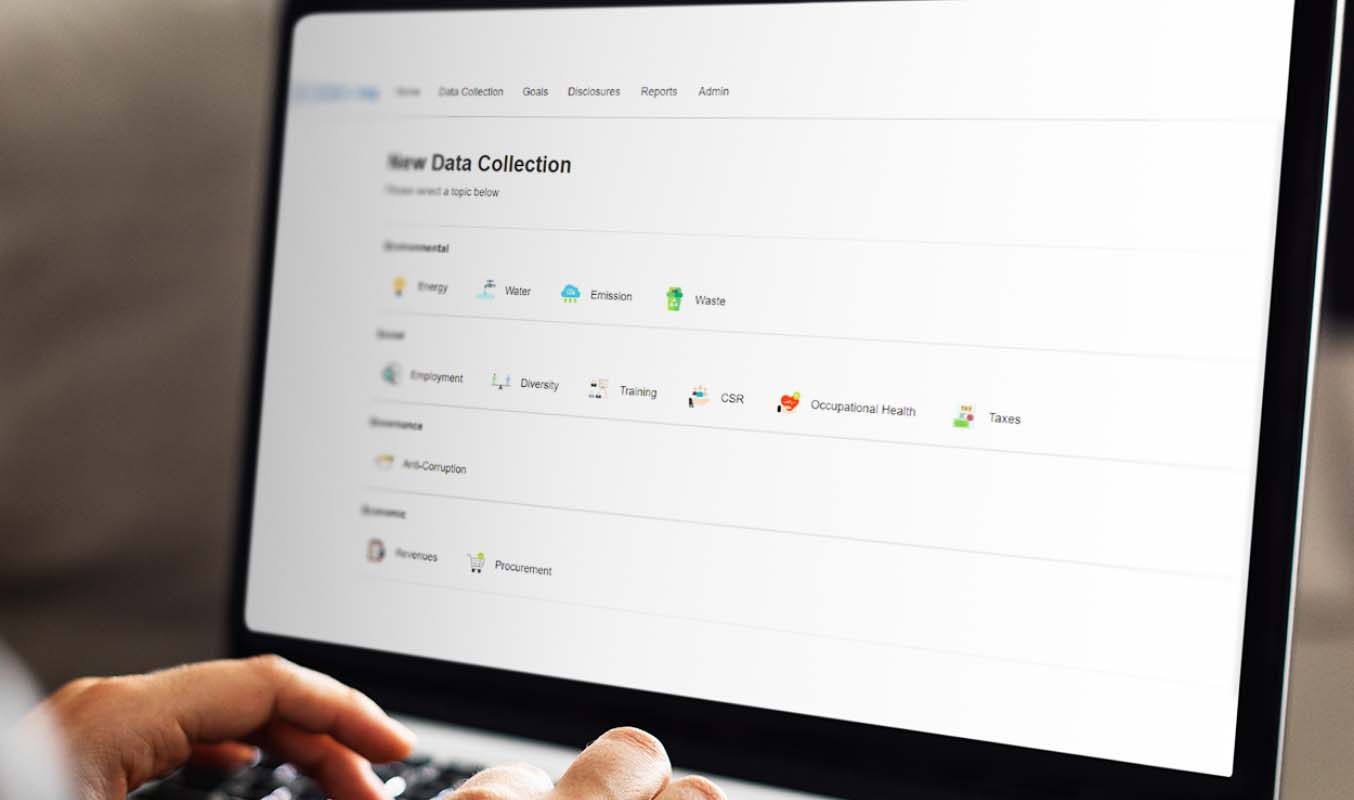

Digitalise data collection

Data collection and management across various materiality topics can be laborious. An ESG reporting software can automate data collection and manage your data in a centralised digital repository. Convene ESG guarantees efficiency in data consolidation and reporting. Instantly input your data within the system in just a few clicks. No need to manually enter your data in spreadsheets.

Convene ESG provides custom-designed workflows to digitalise data collection. Your ESG working group can assign ESG topics or disclosures to collaborators and automatically send reminders to them. You can also set the frequency and deadlines of data collection.

Through optical character recognition (OCR), collaborators can easily upload accurate data from bills or receipts. Additionally, the system automatically converts different units of your collected data. With Convene ESG, your data is assurance- and audit-ready. Easily verify data by accessing evidence trails within the software.

Generate compliant and compelling ESG reports

To meet the reporting requirements set by HKEX, the next step is to align your ESG reports with the recommended standards and frameworks. The regulator has identified a non-exhaustive list of ESG frameworks to guide issuers, which include:

- CDP’s Climate Change Questionnaire and Water Security Questionnaire

- Climate Disclosure Standards Board’s Climate Change Reporting Framework

- Dow Jones Sustainability Indices

- Global Reporting Initiative (GRI) Sustainability Reporting Standards

- ISO 26000 Guidance on Social Responsibility

- OECD’s Guidance for Multinational Enterprises and Principles of Corporate Governance

- SASB Materiality Map

- TCFD Recommendations

- UN SDGs

In 2020, the Global Sustainability Standards Board released guidance, stating the linkage between the GRI Standards and the HKEX ESG Guide in various disclosures. Issuers then may feel overwhelmed by the multiple standards to follow. With Convene ESG, companies won’t have to go from scratch when exploring newer frameworks. The system can easily track the common points among multiple frameworks and help calibrate your ESG report accordingly.

This is an efficient means of meeting the stakeholders’ demands while adhering to the requirements. A compliant report also involves translating ESG data into an output that most resonates with the stakeholders. Convene ESG allows companies to create compelling sustainability narratives by inputting qualitative insights alongside quantitative data. It also supports customising your reports to align with your brand and business goals.

The ESG arena will continuously evolve with various regulation changes. Hong Kong-listed companies are expected to empower ESG excellence with compliant disclosures. Prime your ESG reports with Convene ESG! Discover how Convene ESG can help you better align with the HKEX reporting requirements.