ESG calls for increased emphasis on a range of global issues, with investors demanding disclosures from businesses. Working around watchful eyes, companies need to carry out impactful ESG action and disclose everything through sustainability reporting. The Boston Consulting Group shared,

“Strong performance with regard to ESG factors can unlock significant positive impact for investors, companies, and society. Similarly, integrating forward-looking ESG considerations into strategy and practice can lead to long-term corporate resilience and improved allocation of capital”.

Similar to the financial reporting process, ESG disclosures entail both quantitative and qualitative data. New standards and guidelines like the ones from FASB and IASB urge companies to account for ESG items and issues in their financial performance. Fusing finance function into the disclosure is imperative for establishing transparency over data outputs.

The evolution of sustainability data requirements, however, drives organisations to face an ongoing turnaround in data management. This demands large-scale shifts in business operations and a clear ESG strategy. But luckily, these are complications made significantly easier by technological solutions.

Why You Need to Digitise

The growing number of regulations and requirements around ESG reporting is a huge business concern. To essentially keep up with these, complex reporting processes like ESG data collection need a modernised approach.

This significant step is a byproduct of the increasingly ambitious global targets to cut carbon emissions and attain net-zero. More and more industries require auditable and accurate data to better gauge their ESG performance. But this is often restrained by manual data collection, which is prone to human error and results in missing or inaccurate information — a challenge that digital solutions can address.

While the need to digitise isn’t something new for businesses, applying it to ESG data demands great attention and effort. If done correctly, one could gain full visibility over the entire action and better inform their sustainability strategies.

From managing reams of data to eliminating operational inefficiencies, ESG digitisation can help create more decisive actions toward sustainability. If your business is just taking the first step in digitisation, one rewarding tactic is adopting enterprise-wide ESG software.

With tons of technological solutions today, organisations should take time to filter the available options and pick the best one that suits their needs. Continue reading to find out why you should invest in ESG software and how to choose the right one.

What is ESG software?

ESG software is a technological solution designed to facilitate, streamline, and enhance the process of collecting, analysing, and reporting on an organisation’s environmental, social, and governance performance metrics. This solution plays a significant role in enhancing data management, serving as a central repository that consolidates information from various sources and locations.

Equipped with tools for performance evaluation and strategic planning, the software plays a pivotal role in building and managing ESG strategies, as well as monitoring ESG performance. Through centralised data management and automated monitoring, companies can effortlessly measure their progress against established ESG goals and benchmarks.

In addition, ESG software enables organisations to align with industry standards, comply with regulations, and meet the growing demand for transparent ESG reporting. In essence, it aids businesses to showcase their commitment to sustainable practices, engage stakeholders, and drive positive impact.

The Benefits of Adopting ESG Reporting Software

Capturing and managing ESG data are onerous yet critical parts of sustainability reporting. To save a considerable amount of time and effort in manual data collection, companies invest in sophisticated ESG software. The list below details the advantages of adopting ESG reporting software.

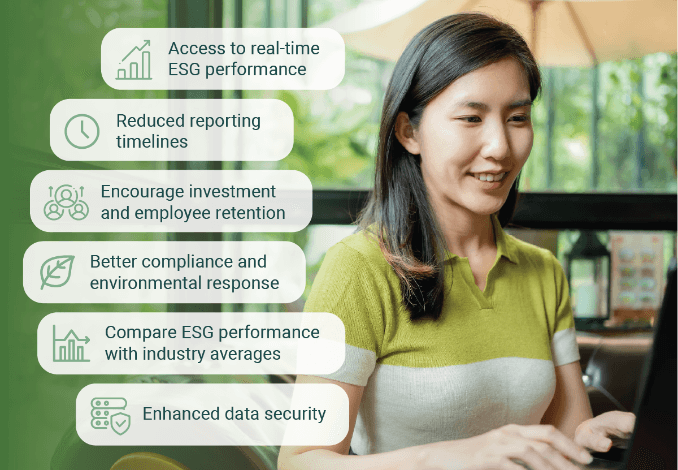

1. Access to real-time ESG performance

One key point to understanding the long-term risks and opportunities is through ESG performance monitoring. Both the company and its investors should be able to access current and accurate ESG information. This tedious task can be made easier with the right ESG software.

Such platforms can make regular assessment of performance data possible — instead of it being an annual effort. The best ESG reporting software allows users to set deadlines and send notifications to alert investors automatically. Updates on ESG data and reports can also be done and tracked in real-time, making sustainable portfolio scoring much faster.

2. Reduced reporting timelines

Before, it would take a whole month to manually gather the data, analyse it, and generate reports. Today, it only accounts for companies to input all the data, and the software will do the rest while granting full oversight of the process.

Besides the manual process, managing complex data and juggling multiple sustainability reporting standards is also a time-consuming task to tackle. But with the right ESG software, companies can automate data consolidation and reporting generation. Firms can conveniently access their sustainability portfolio while navigating through different reporting requirements.

To speed up your reporting timeline, opt for ESG reporting software that is purpose-built to comply with major frameworks such as SASB, GRI, TCFD, and CDP. It should also let you review actionable insights from peers and automate scenario analysis.

3. Encourage investment and employee retention

At COP26, a call for heightened climate pledges has been highlighted. Campaign demands and substantial investments like impactful mitigation are deemed essential. Also, innovative commitments such as cutting plastic in the supply chain and transitioning to green energy are brought up.

With over $51.1 billion of contributed sustainable funds in 2020, it’s profitable for companies to set ESG priorities to attract such investing interest. Doing so is not just appealing to investors but also a deciding factor for employees.

Sustainability is one of the top values many modern employees place high importance on. If they feel like they’re contributing to something bigger, they are more likely to be loyal and enthusiastic about the company they work for.

4. Better compliance and environmental response

Remember that the primary purpose of ESG reporting is to encourage and evaluate sustainable actions and practices among industries. However, manual processes not only impede progress but also exacerbate the global environmental crisis.

Adopting well-designed ESG software can cut off risks of human error and waste management. These platforms often feature customisable templates, whether for generating air emission reports or obtaining ISO 14001 certification.

Notably, they can seamlessly calibrate report structures in adherence to global standards and frameworks. This not only facilitates smoother reporting but also empowers the organisation to craft insightful ESG policies and practices.

5. Compare ESG performance with industry averages

ESG reporting software allows companies to compare their sustainability performance with industry averages. This benchmarking offers valuable insights into how your company stacks up against peers. Such platforms often integrate data from external sources, allowing you to gauge your ESG efforts against broader industry trends.

For instance, you can analyse your carbon emissions reduction in comparison to the industry average. This way, you can identify areas where you excel and areas that need improvement.

6. Enhanced data security

Data security is paramount, especially when dealing with sensitive ESG information. Adopting ESG reporting software comes with the perk of enhanced data security. It offers strong security measures to safeguard ESG data, which include data encryption, access controls, and regular audits. On top of that, the software can also guarantee the secure archival and retrieval of data over the years.

Robust data security measures prevent unauthorised access, data breaches, and potential reputation damage. This not only ensures compliance with data protection regulations but also fosters trust among stakeholders — from investors to customers.

Five Factors to Consider Before Choosing ESG Reporting Software

Selecting the best ESG reporting software requires careful consideration of several pivotal factors is imperative. Ensure the software seamlessly aligns with your organisation’s needs by considering these five factors:

1. Alignment with organisational profile and offerings

Before opting for ESG reporting software, it’s essential to assess your organisation’s size, structure, and the nature of the products or services you provide. Different software might cater to varying business scales and industries. For instance, a large manufacturing company’s requirements will differ from those of small startups. Ensure the software can accommodate your organisational nuances effectively.

2. Targeted audience and reporting scope

Determine who your key stakeholders are and the scope of your ESG reports. Are you reporting to investors, customers, regulatory bodies, or a combination? The software must offer comprehensive customisation options, allowing you to finely tune the metrics and disclosures that directly resonate with your audience. This ensures the ESG reports effectively communicate your sustainability initiatives and performance, aligning with stakeholders’ interests and expectations.

3. ESG reporting objectives and metrics

Clearly define your ESG reporting objectives, goals, and priorities. Are you aiming to improve certain environmental metrics? Are social impact metrics more critical for your organisation? The software should be able to help collect or track the ESG metrics and data that you need to report on. With this, you can ensure that the reporting software effectively supports your sustainability journey

4. Technical support and organisational resources

Next, evaluate the technical support provided by the software vendor. Consider the ease of implementation, training, and ongoing assistance. It’s crucial that your team can effectively navigate and utilise the software’s features in the shortest time possible. For example, if your organisation lacks dedicated IT support, opt for one that comes with a user-friendly interface and reliable technical support.

5. Enabling strategies and seizing opportunities

The chosen ESG reporting software should not be limited to compliance but should also enable strategic decision-making and identify growth opportunities. Look for features that provide data insights and trend analysis. For instance, a renewable energy company might want software that not only tracks its emissions but also identifies potential areas for expanding its clean energy portfolio.

What to Look for When Selecting the Best ESG Reporting Software

Adopting reporting software can completely transform how your organisation tracks and improves its ESG performance. To guide you in selecting the best ESG reporting software, below are the qualities and features that you should look for.

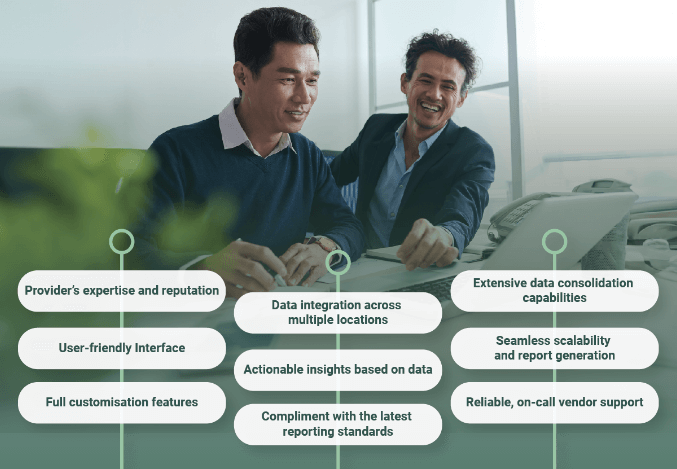

1. Provider’s expertise and reputation

A provider with a solid track record in the ESG software space understands the nuances of various reporting frameworks and regulations. Look for established players with a consistent record of delivering accurate and compliant reporting solutions.

Furthermore, check if the provider has experience with the specific reporting frameworks your organisation follows (such as GRI, SASB, and CDP). Their familiarity will ensure the platform aligns seamlessly with your reporting needs.

It’s also best to seek testimonials or case studies from organisations similar to yours that have benefited from the provider’s software. Positive feedback indicates a provider’s capability to meet client expectations.

2. User-friendly interface

A user-friendly interface is crucial for encouraging widespread adoption and engagement within your organisation. This minimises the learning curve and empowers users of all levels to actively participate in ESG reporting. Look for the following ESG reporting tools and features:

- Intuitive Navigation — The software should have a clear and organised menu structure, allowing users to easily find and access different sections and functions.

- Interactive Visualisations — Visual representations of data, such as charts, graphs, and maps, should be interactive and easily comprehensible. Users should be able to interact with these visuals to explore data trends and insights.

- Drag-and-Drop Functionality — This feature allows you to simplify the data entry process and smoothly navigate uploaded data, reducing the time and effort required to input information.

- Customisable Dashboards — The reporting platform should allow you to customise dashboards, displaying specific data and metrics relevant to the roles and responsibilities of the users.

- Responsive Design — The software should be responsive across various devices and screen sizes, ensuring usability on desktops, tablets, and smartphones.

- Search and Filter Options — Robust search and filter functionalities enable users to quickly locate specific data points or reports, enhancing efficiency when working with large datasets.

3. Full customisation features

In terms of ESG reporting tools, one key thing to look for is the ability to customise. Every organisation has its distinct ESG goals, reporting needs, and industry context. To ensure the software can adapt seamlessly, focus on the following aspects:

- Customisable templates — A good reporting platform should allow you to tailor reporting templates to precisely match your industry’s requirements and organisation’s unique objectives. You should be able to create, adjust, or modify templates to include data that matters most to your sustainability efforts.

- Scalability — Scalability means that the platform won’t become a limiting factor as you strive to enhance your sustainability performance. It must be able to handle increased data volumes, additional reporting dimensions, and evolving ESG metrics — all crucial as you expand your sustainability efforts.

- Localisation — This means the software can be customised to adhere to diverse regulatory standards in various regions where your organisation operates. This ensures that your ESG reports remain accurate and compliant, regardless of local variations in reporting rules.

4. Data integration across multiple locations

Another aspect to look for is the capability to consolidate data from multiple sources and locations. In the context of ESG reporting, data often resides in various silos across different departments, locations, and systems. Having data integration capabilities means the software can seamlessly pull together data from disparate sources.

This gives you an overview of relevant metrics such as energy consumption, water usage, employee diversity, and so on. With a data-integrated platform, you gain a more holistic understanding of your sustainability performance and drive meaningful improvements to your ESG strategy.

5. Actionable insights based on data

The true value of a platform lies in its ability to translate data into actionable insights, not just data compilation. Through advanced analytics, the platform identifies significant trends and correlations within your ESG data.

For instance, if energy consumption across facilities decreases consistently, the platform’s analysis might unveil specific operational changes or equipment upgrades responsible for the reduction. Access to such information allows you to replicate successful practices across the organisation, fostering energy efficiency.

6. Compliant with the latest reporting standards

The best reporting software should not just support one reporting requirement — but all the major ones. Enter the data once yet be able to report multiple times. Ideally, the report must be configured from a single tool and a single data set. This prevents the need to do separate calculations for different frameworks or jurisdictions.

The software should be able to handle state and federal regulations and allow you to report to both voluntary and regulatory bodies. Some of the major reporting frameworks include the CDP, CDSB, GRI, IIRC, and SASB. A reporting solution that readily supports these can save you time and money, which you can use on other important business ventures.

7. Extensive data consolidation capabilities

As previously mentioned, collecting data is a key task in successful EGS reporting. Pick the software with tools that can analyse, integrate, and verify essential data for you. Ideally, it should guide you in all aspects of decision-making using the available data. Check how extensive its set of tools, is and if its features can offer credible insight resources.

Look for ESG software with in-depth capabilities that don’t just let your update the report automatically, but also, make data measurable and accessible.

- Does it let you submit and review current ESG data with ease?

- Will all source data and final values be traceable and visible?

- Do you have access to complete audit trails?

- Does it allow real-time monitoring and extensive benchmarking?

Ensuring comparable and consistent data can make your investors’ jobs easier, especially when creating their index-fund portfolios. This further allows your company to come up with ESG disclosures that cleverly match your financial disclosures.

Lastly, the software should offer a centralised location to store information coming from hand-written field logs or the external database. No more searching for missing documentation or data from disparate facilities, no more hunting down the technician for the field log. Also, look for built-in workflows and notifications that can prevent missed deadlines. A worthy investment can solve the most infuriating issue in sustainability reporting: searching for the right data.

8. Seamless scalability and report generation

Every company has its own ocean of data and sustainability initiatives to deal with. Look for a tool that lets you create tailored reporting templates to suit your disclosure needs, from collection forms to escalation plans. It should also accommodate larger volumes of data and files while still ensuring data entries are valid.

Future visualisation and reporting needs are also worth considering, especially for reviewing data summaries. Are the software’s dashboards customisable? Does it come with tools to easily configure new data charts, visualisations, or reports? Is there a way to track and personalise your ESG goals?

Also, the software should include exports to MS Word or PDF, making your life easier during the reporting season. Such auto-generation capabilities let you report to multiple regulatory bodies with ease while implementing quality assurance review and data source tracking.

9. Reliable, on-call vendor support

To truly leverage your investment, it’s crucial to choose a vendor who can efficiently implement and optimise the reporting software within a short timeframe. The ideal vendor goes beyond the initial setup, offering around-the-clock helpdesk support and keeping data security measures up to date.

Some vendors also have in-house ESG experts who facilitate reporting, analysis, and training. This vendor-provided training eliminates the need for costly outsourcing or exhaustive internal training, and gives access to certified specialists and training content.

It is also better if they can guarantee an annual trend analysis. This ensures you’re updated with the latest ESG trends and helps improve your reporting and performance over time.

Ready to Make A Decision?

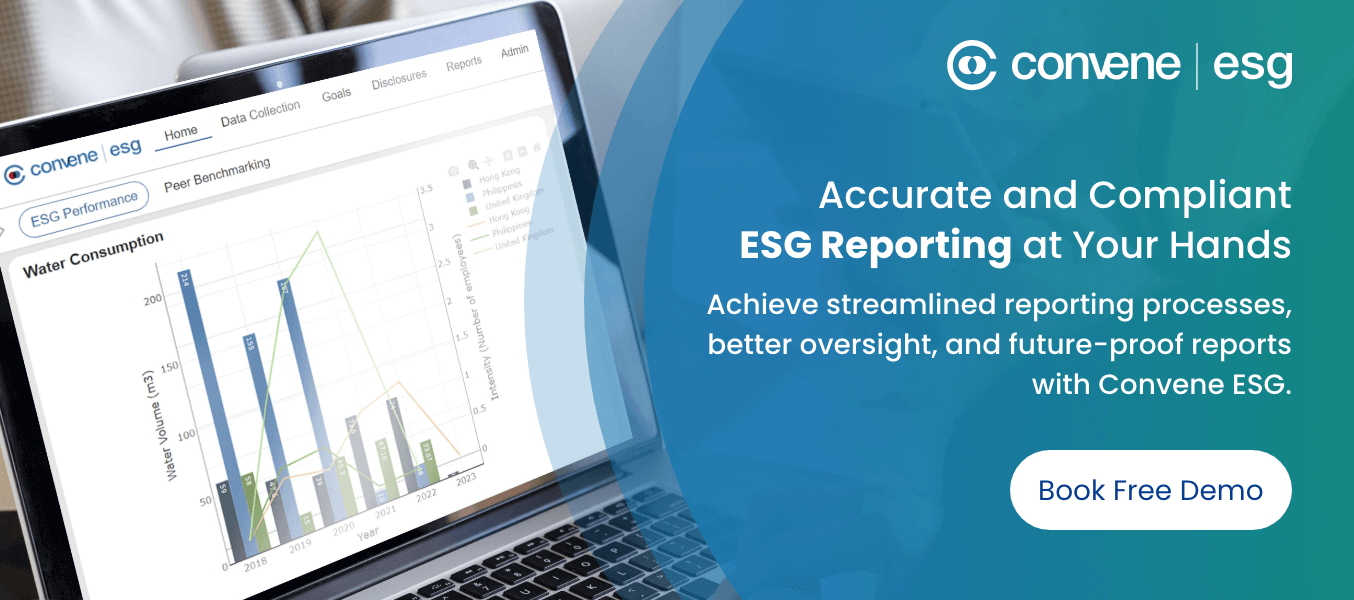

Here at Convene ESG, we do not confuse what you look for with what you need — we deliver both right to your doorstep. Whether you need a centralised system to consolidate your data or you require continuous software support, you can get both by availing of Convene ESG.

The software is designed to adapt to the ever-changing disclosure requirements and standards. Peer comparison and ESG goals tracking are other unique features no other software to date have. Request a demo now and learn more about Convene ESG’s features!