Sustainability is now at the heart of every business decision-making, and companies need to know which sustainability issues are worth focusing on. Consumers, employees, investors, and regulators expect organisations to act on what’s crucial to society and future generations. Questions can come up such as, what matters to the people today? What will impact the company’s reputation and success? And with so many issues from climate change to social justice, it can be quite overwhelming.

This growing need for alignment with societal values is where a materiality assessment comes in.

What is a Materiality Assessment?

A materiality assessment is a process that helps companies identify and prioritise key sustainability issues based on their environmental, social, and governance (ESG) impact. It comes from the concept of material issues — topics that are significant enough to affect a company’s corporate sustainability. It evaluates both the potential risks to a company’s financial performance and the effects its operations have on society and the environment.

This assessment involves engaging stakeholders to address the most relevant topics in sustainability strategies and reporting. By considering these critical issues, companies can make more informed decisions that align with both business goals and societal expectations.

The Corporate Sustainability Reporting Directive (CSRD) expands sustainability reporting to 49,000 companies, a jump from the 11,700 under the previous Non-Financial Reporting Directive (NFRD) that mandates companies to report both how sustainability issues affect their finances and how their actions impact the environment and society. With 68% of public feedback advocating for the inclusion of materiality assessments, the CSRD emphasises the need for companies to improve their disclosure and transparency with this process.

What is a materiality matrix?

A materiality matrix is a graphical representation used to assess and prioritise issues based on their importance to both the company and its stakeholders.

The materiality matrix is, in essence, the visual outcome of a materiality assessment. While the materiality assessment is the process of identifying and evaluating the most significant ESG issues for a company, the materiality matrix maps those issues based on their importance to both stakeholders and the company itself.

It typically displays these issues on a graph, with one axis representing the significance to stakeholders and the other showing the impact on the company’s success. By gathering stakeholder input through surveys or questionnaires, companies can compare their views with external expectations to identify key ESG factors to focus on. This helps guide strategies and makes sure that a company’s actions align with the most pressing social, environmental, and governance concerns.

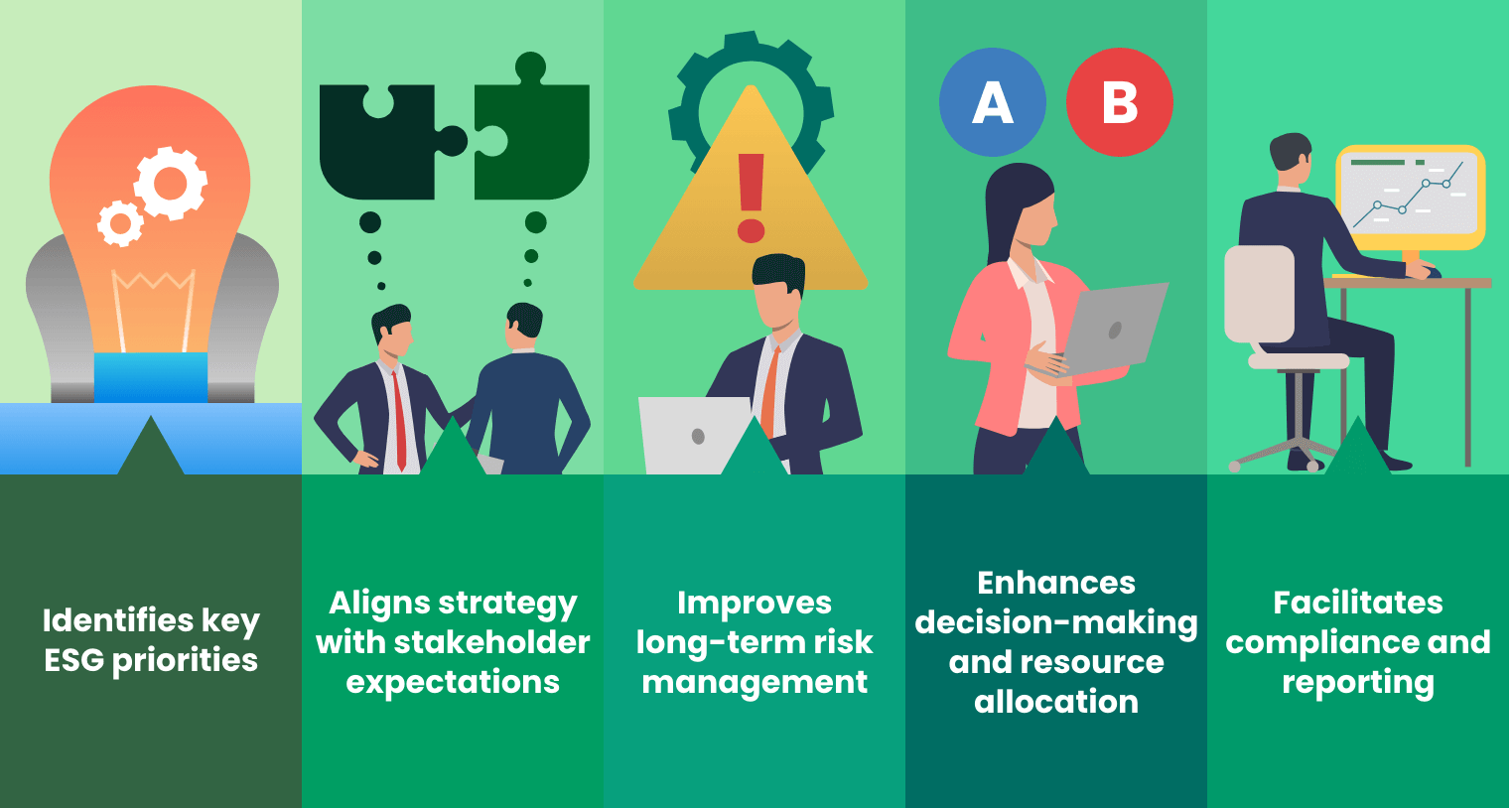

Why is a materiality assessment important in ESG?

A materiality assessment is necessary for aligning a company’s ESG strategy with its core business goals, helping businesses prioritise the most impactful sustainability issues. It pushes the companies to focus on what matters most to stakeholders and their long-term success.

- Identifies key ESG priorities: The materiality assessment helps identify the most critical ESG factors that affect the business and stakeholders. This allows the company to direct its resources and efforts toward the issues that will have the most significant impact on its operations and reputation.

- Aligns strategy with stakeholder expectations: It helps understand what stakeholders — such as investors, employees, and customers — value most. By addressing these concerns, a company strengthens relationships and boosts stakeholder engagement, leading to better support for its initiatives.

- Improves long-term risk management: Through this process, companies can anticipate and prepare for future risks, such as regulatory changes or climate impacts. Recognising these risks early allows organisations to be proactive rather than reactive, safeguarding their long-term sustainability.

- Enhances decision-making and resource allocation A materiality assessment helps businesses make informed decisions about where to invest, reducing the chance of wasted resources on less important issues. This focused approach maximises the impact of ESG initiatives, contributing to more effective strategies.

- Facilitates compliance and reporting: With growing regulatory demands and requirements, a materiality assessment allows companies to disclose and address the most relevant and significant topics in their sustainability reports while staying ahead of compliance needs. It provides the data needed to meet regulatory frameworks, putting transparency and accountability into focus.

How to Conduct a Materiality Assessment: Step-by-Step

To conduct an effective materiality assessment, businesses must identify the most critical ESG topics that impact their strategy and stakeholders. This will involve systematically gathering insights, prioritising issues, and aligning the results with business goals. Below are the key steps in the process:

Define Purpose and Scope

Begin by setting clear objectives for the assessment. Understand what “materiality” means for your organisation — whether it is to identify risks, improve sustainability strategy, or inform corporate reporting. Additionally, outline the scope of your assessment, including which business units, regions, or stakeholders will be involved.

Identify Potential Material Topics

Compile a list of potential ESG topics from a variety of sources such as media, reports from industry leaders and competitors, and internal data. Engage with key internal departments and external experts to secure a comprehensive list and include topics for these areas, like:

Environmental

- Carbon emissions

- Biodiversity conservation

- Waste reduction

Social

- Human rights

- Labor rights

- Employee health and safety

Governance

- Data privacy

- Risk management

- Organisational diversity

Engage Stakeholders

Identify which stakeholders should be consulted to gather diverse perspectives. Employees? Investors? Customers? Their input will highlight issues that might otherwise be overlooked. Prioritise stakeholders based on their influence or the significance of their concerns to your business and its long-term sustainability.

Analyse and Rank Topics

Gather feedback from stakeholders and analyse each topic’s relevance and potential impact on the business. Assess the social, environmental, and economic significance of each issue and align them with the company’s strategic goals. Rank topics based on their importance, considering both stakeholder input and business priorities.

Prioritise and Integrate Findings

Use a materiality matrix to plot the identified topics, categorising them based on their importance to both stakeholders and the business. This helps in visualising the issues that require immediate attention. Integrate the prioritised topics into your organisation’s ESG strategy, ensuring they guide decision-making and resource allocation moving forward.

Integrate Assessment into the Report

Once the impactful issues and findings are integrated into the ESG strategy, this can be moved forward into the sustainability report, addressing the priorities and integrating the assessment into the sustainability frameworks for compliance.

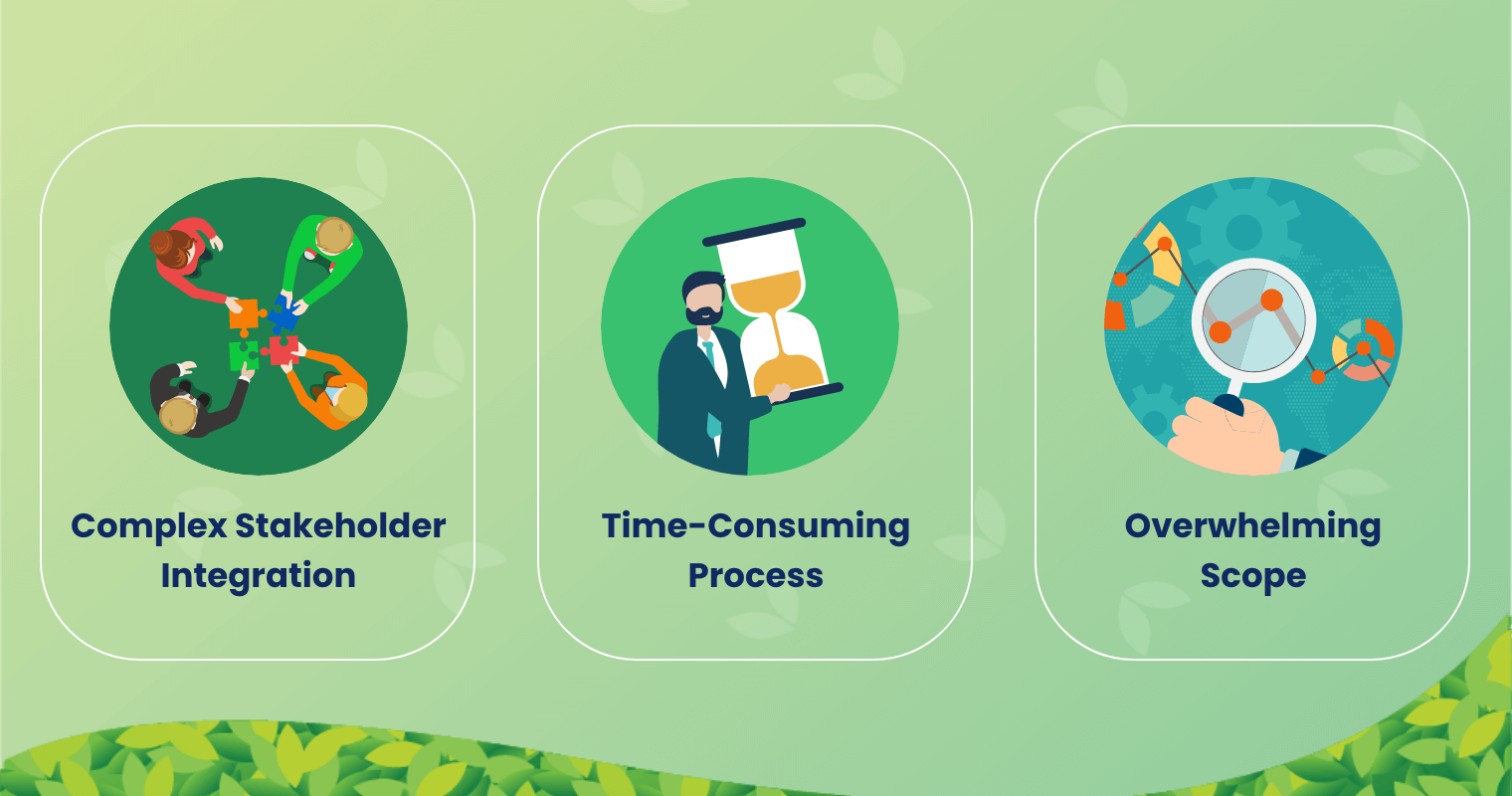

What are the challenges of materiality assessment?

A materiality assessment can provide companies with valuable insights into their most critical issues. But while it has many benefits, conducting one also comes with its own set of challenges, which require strategic planning to overcome.

- Complex Stakeholder Integration: Balancing the views and expectations of various stakeholders can be challenging, as there may be conflicting priorities that require careful consideration and prioritisation.

- Time-Consuming Process: A thorough materiality assessment, especially one that involves a company’s entire value chain, can be resource-intensive and time-consuming.

- Overwhelming Scope: For large organisations with complex operations, determining the most material topics from a large number of ESG issues can be overwhelming, often leading to a lack of focus.

Strategies to Overcome These Cons:

- Streamline Stakeholder Engagement: Focus on engaging the most influential stakeholder groups and use existing feedback channels such as surveys and interviews) to efficiently gather input without overburdening the process.

- Segment the Assessment Process: Break the assessment into manageable phases, starting with key operations or geographic areas, and gradually expand to include the broader value chain to help with the focus and effectiveness.

- Simplify Prioritisation: Use clear, simple ranking systems to prioritise material topics, distinguishing between those that have the greatest potential to impact business value and those that are less urgent. This keeps the focus on what matters most.

- Utilise ESG Software: These processes can all be simplified with the use of sustainability software that has tools for automation, collation, and collaboration.

Double Materiality vs. Single Materiality

Single and double materiality are two approaches for evaluating sustainability issues, with a distinct focus on financial and broader societal impacts. The key difference lies in whether a company considers only how sustainability issues affect its financial performance or also includes the wider effects its operations have on the environment and society.

- Financial Materiality (Outside-In): Single materiality only focuses on how external sustainability issues, like climate change or resource scarcity, directly impact a company’s financial performance, such as costs, revenues, or asset value. This perspective is essential for investors looking to assess risk to the company’s profitability and future growth.

- Impact Materiality (Inside-Out): Double materiality adds another perspective by also considering the broader impact of the internal company activities and operations towards the external environment and society. It evaluates how a company’s operations contribute to issues like climate change or social inequality, affecting stakeholders beyond the organisation.

Is materiality assessment a requirement for companies?

Conducting a materiality assessment is becoming a requirement, especially for companies under the EU’s Corporate Sustainability Reporting Directive (CSRD). Starting in 2025, these companies will need to identify and report on material ESG topics that affect both their business operations and the wider society. The CSRD mandates the use of double materiality, meaning companies must assess both the financial impacts of sustainability issues on their business and the effects of their activities on people and the planet. These reports must also undergo independent audits, guaranteeing compliance and transparency.

Conducting a materiality assessment is advisable as it not only helps guarantee compliance but also allows the business to identify and prioritise the ESG topics that matter most to its stakeholders and long-term success. By doing so, companies can develop a clear sustainability strategy, mitigate risks, and strengthen their reputation among investors, customers, and employees.

Case Studies: Businesses that Conducted Materiality Assessments

Companies have used sustainability materiality assessments to effectively identify and prioritise key issues and approaches that impact a company’s performance, stakeholder interests, and long-term sustainability. Here are three materiality assessment examples from companies:

Amazon’s materiality assessment identified 26 sustainability topics using external research and internal analysis, including data from reports, regulations, and social media. The company prioritised issues like climate change, sustainable packaging, and responsible supply chain management, while also focusing on employee well-being, ethics, and innovation for long-term strategy.

Unilever’s materiality process involved identifying sustainability issues that were considered risks or opportunities for their business, as well as those deemed important to key stakeholders. The company used extensive stakeholder research, including surveys from consumers, suppliers, and business partners, to assess and prioritise 11 material issues, including climate change, health and wellbeing, and sustainable sourcing. This process was aligned with their risk management framework and communicated through their annual reports.

Samsung’s 2024 materiality assessment followed a Double Materiality Approach (DMA), considering the company’s impact on the environment and the external risks to their business. They identified 11 key material topics, such as climate change, water resource management, and product safety, based on an in-depth analysis of their value chain and stakeholder feedback. This holistic approach was designed to align with their corporate strategy and global sustainability goals.

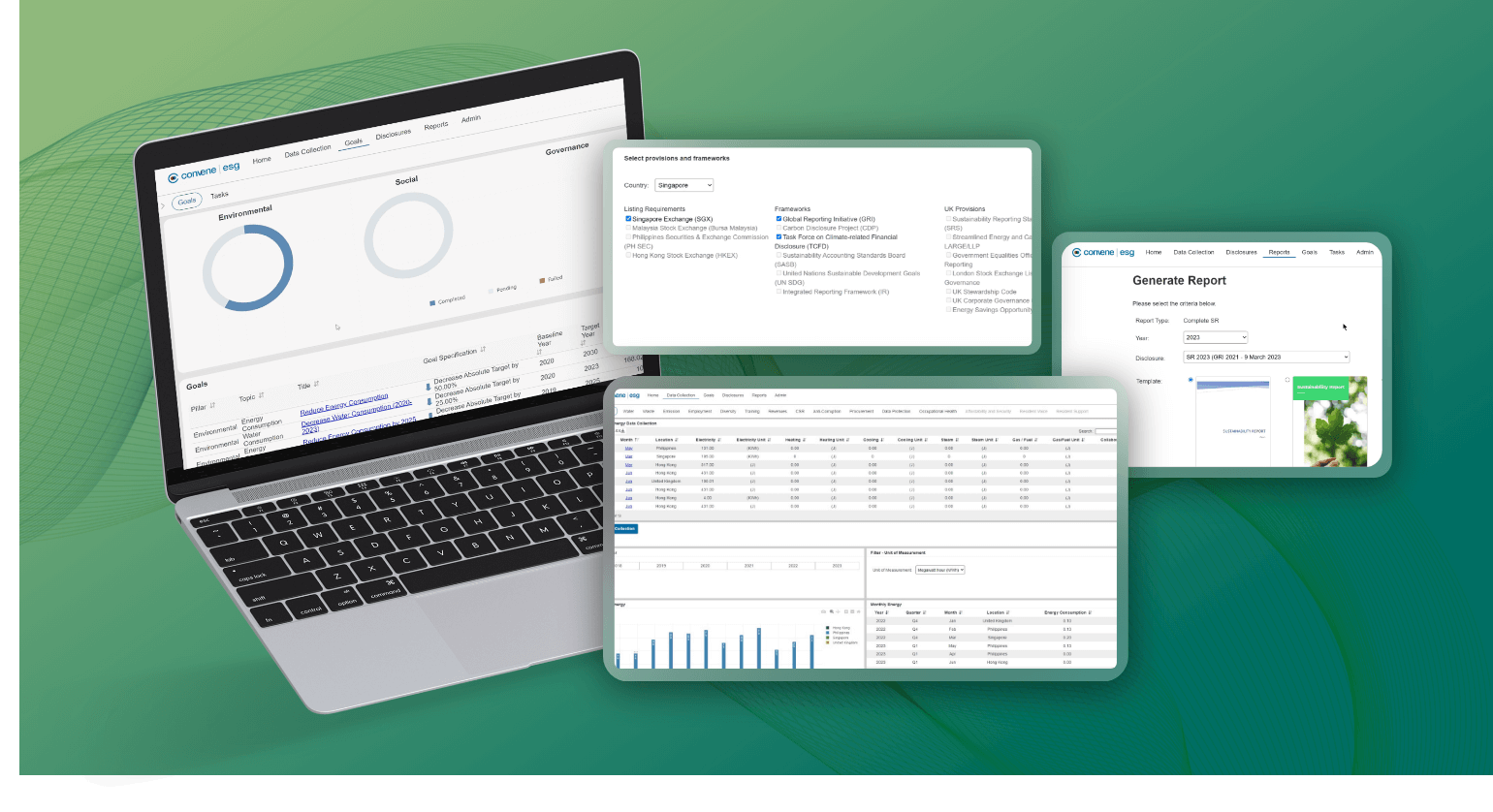

Accurate ESG Materiality Assessments with Convene ESG

A materiality assessment lets a business highlight the most important ESG issues that align its strategies with stakeholder expectations for long-term sustainability. However, it can be challenging, requiring considerable stakeholder consultation, data analysis, and adherence to emerging regulations.

Using ESG reporting software streamlines the process for a more efficient and compliant assessment and reporting process.

Convene ESG is an ESG platform that can simplify ESG materiality assessments for ESG reporting. With its interactive dashboards and visualisation and its automated tools, such as Optical Character Recognition (OCR) and granular access controls, the company can benefit in:

- Being guided in materiality analysis and assessments

- Collating data into a centralised location

- Automating data collection workflow

- Aligning with global frameworks like GRI, SASB, and CSRD

- Collaborating seamlessly among internal teams, external experts, and stakeholders

- Providing a clear overview of progress towards ESG goals

By taking advantage of these features for materiality assessment, companies can elevate their sustainability performance and sustainability reporting.

Ready to simplify your ESG reporting? Request a demo of Convene ESG today.