As the urgency to address the impacts of climate change grows, Singapore is taking a significant step forward to strengthen corporate responsibility. Starting in 2025, the city-state will mandate climate reporting for listed companies to improve transparency, accountability, and sustainability practices across Singapore businesses – making them the first in Asia to do so.

If you want to learn more about this initiative and its impact on the corporate landscape and the broader community, this article provides a detailed overview.

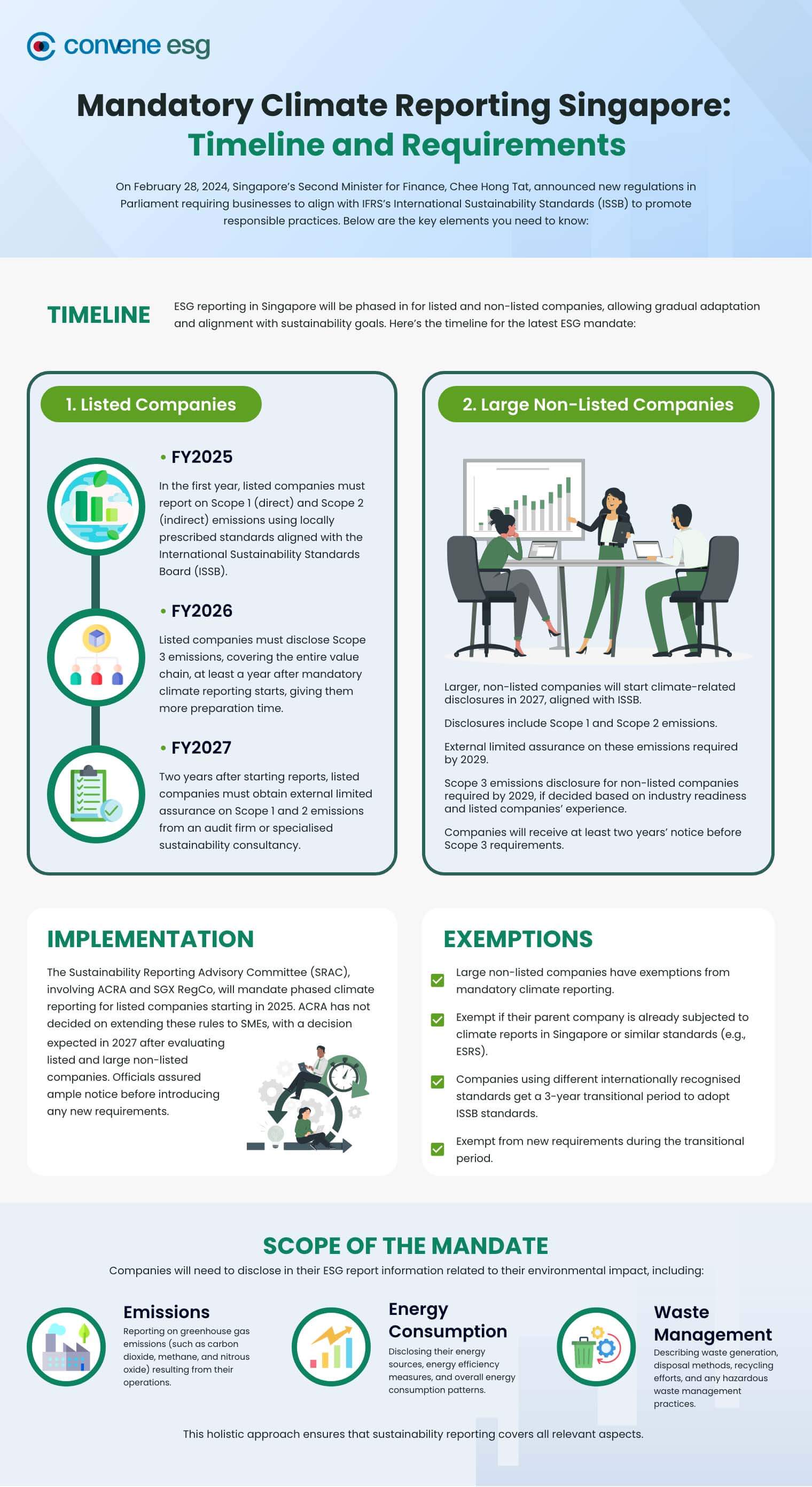

Mandatory Climate Reporting Singapore: Timeline and Requirements

On February 28, 2024, the Second Minister for Finance, Chee Hong Tat, announced the new rules in the Parliament of Singapore. In his talk, he detailed the regulations’ requirements for aligning businesses with IFRS’s International Sustainability Standards (ISSB) and promoting responsible practices.

Below are the key elements you need to know:

Timeline

ESG reporting in Singapore will be done in phases for listed and non-listed companies. This allows companies and authorities to assess risks, adapt gradually, build capacity, and align their processes with sustainability goals. Here is the timeline for the latest ESG reporting mandate:

1. Listed Companies

- FY2025

In the first year, listed companies must prepare climate reporting based on locally prescribed standards aligned with the International Sustainability Standards Board (ISSB). This involves reporting on Scope 1 and Scope 2 emissions. Scope 1 emissions refer to direct greenhouse gas (GHG) emissions from sources owned or controlled by the company, such as emissions from the combustion of fossil fuels. Scope 2 emissions encompass indirect emissions associated with purchased electricity, heat, or steam. - FY2026

To give listed companies more time to prepare, they are required to disclose Scope 3 emissions at least a year after the mandatory climate reporting. These emissions represent the entire value chain, including those from suppliers, customers, and other stakeholders. - FY2027

Two years after they start reporting, listed companies must then obtain external limited assurance on Scope 1 and 2 emissions. This process comprises choosing an external assurance provider, often an audit firm or a specialised sustainability consultancy, to conduct several testing procedures, ensuring that the companies’ environmental data is aligned with established standards.

2. Large Non-Listed Companies

Larger, non-listed companies will follow a similar timeline. Starting in 2027, they must prepare and provide ISSB-aligned climate-related disclosure, including Scope 1 and Scope 2 emissions. This will precede obtaining external limited assurance on Scope 1 and Scope 2 emissions by two years, beginning in 2029.

Non-listed companies might require more time to build capabilities for handling Scope 3 emissions than listed ones. For this reason, ACRA will not require them to disclose Scope 3 emissions until 2029. However, if the decision to proceed is made based on the industry’s readiness and the listed companies’ implementation experience, companies will be given at least two years’ notice.

Implementation

Based on the guidance provided by the Sustainability Reporting Advisory Committee (SRAC), a collaborative effort between the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) aimed at enhancing sustainability reporting in Singapore, mandatory climate reporting will be implemented in a phased approach starting in 2025 for listed companies. On the other hand, large non-listed companies, or companies with at least $1 billion in revenue and $500 million in assets, will follow suit in 2027.

ACRA has yet to decide whether to extend climate reporting rules to small and medium-sized enterprises (SMEs). According to the statement, the decision will be based on their assessment of the experiences of listed and large non-listed companies in 2027. The officials guaranteed that they would give sufficient notice before introducing any requirements.

Exemptions

There are, however, several exemptions and transitional provisions from mandatory climate reporting in large non-listed companies.

Firstly, they are relieved of the mandatory reporting if its parent company, whether immediate or intermediate, is already subjected to climate reports in Singapore or similar standards, such as the European Sustainability Reporting Standards (ESRS).

Secondly, recognising that some companies may have started climate reporting using different internationally recognised standards and frameworks, there will be a 3-year transitional period to ISSB standards during which they will be exempt from the new requirements.

Scope of the Mandate

Companies will need to disclose in their ESG report information related to their environmental impact, including:

- Emissions — Reporting on greenhouse gas emissions (such as carbon dioxide, methane, and nitrous oxide) resulting from their operations.

- Energy Consumption — Disclosing their energy sources, energy efficiency measures, and overall energy consumption patterns.

- Waste Management — Describing waste generation, disposal methods, recycling efforts, and any hazardous waste management practices.

This holistic approach ensures that sustainability reporting covers all relevant aspects.

Here is a quick infographic that highlights all the key points:

Benefits of the New Mandate to Singapore Businesses

Preparing for the new ESG reporting regulation may be challenging or burdensome for some companies, but the pros outweigh these initial difficulties. In the statement announcing the new rules, Singapore companies who are able to provide climate disclosures will benefit from:

Improved access to new markets in Singapore

Companies that disclose climate-related information transparently gain a competitive edge because stakeholders now prioritise sustainability. Recent SGX-listed companies have shown an increasing trend of valuing eco-friendly practices. By prioritising environmental responsibility, firms can tap into these emerging markets that are heavily focused on renewable energy, sustainable supply chains, and green technologies.

Enhanced customer engagement

Climate-conscious consumers seek products and services from companies aligned with their values. Therefore, companies that actively address climate risks and opportunities appeal to these customers, who are more inclined to support and advocate for such businesses.

Better financing opportunities through ESG investing

Investors increasingly integrate environmental, social, and governance factors into their decision-making. In this sense, Singapore businesses with robust climate disclosures are more attractive to investors seeking sustainable investments. This increased appeal gives these companies easier access to capital markets and offers them more financing options.

Singapore Government’s Sustainability Reporting Grant

The government’s push for better sustainability reporting shows its dedication to a greener economy. But, along with this commitment comes the rising cost obligations. A study by the SustainAbility Institute by ERM reveals that corporate issuers spend over $675,000 annually on climate-related disclosures. In comparison, institutional investors spend nearly $1.4 million on average to gather, analyse, and report climate data.

To aid large companies in getting ready for the new regulation, Singapore will offer funding to cover almost one-third of the cost of producing their initial ESG reports. Qualifying expenses may include data collection, analysis, and seeking external assurance for the report.

This initiative was administered by the Singapore Economic Development Board (EDB) and Enterprise Singapore (EnterpriseSG) to support large companies with annual revenues of $100 million and above. The guidelines state that these companies can avail of financial aid for up to 30% of their expenses, which will be capped at $112,000.

While SMEs are not mandated to report, the government has announced its plans to provide funding support covering up to 70% of the costs incurred from their first sustainability reports. This program, specific to SMEs, will commence later this year and offer additional support, covering up to 50% of sustainability reporting costs for the following two years through EnterpriseSG.

Additionally, due to skill gaps in sustainability reporting, EDB and EnterpriseSG are collaborating with the National University of Singapore and Nanyang Technological University to create training programs focused on carbon management, services, and trading. These courses enable workers and interns to seize opportunities in this area.

Future of Climate Reporting in Singapore

Despite its limited land area, Singapore has emerged as a beacon of environmental consciousness. The city-state seamlessly integrates green spaces into its urban landscape, promotes smart infrastructure, and actively embraces circular economy principles through initiatives like the Closing the Waste Loop campaign, among other initiatives.

As Singapore continues to lead by example in environmental stewardship, the introduction of mandatory climate reporting further solidifies the country’s commitment to sustainability. It sets a precedent for corporate responsibility on a global scale. This new mandate will allow companies to:

Promote more accountability and transparency in the companies’ environmental practices.

Specify metrics to measure climate risks and set up quantitative targets to ensure companies actively work toward reducing their environmental impact.

Help them understand the financial implications of climate-related risks and opportunities and allow them to make informed decisions that align with their financial goals.

In the coming years, smaller companies may eventually be included in the reporting obligations, and technology will play a bigger role in streamlining the process.

Future-Proof Your ESG Reporting with Convene ESG

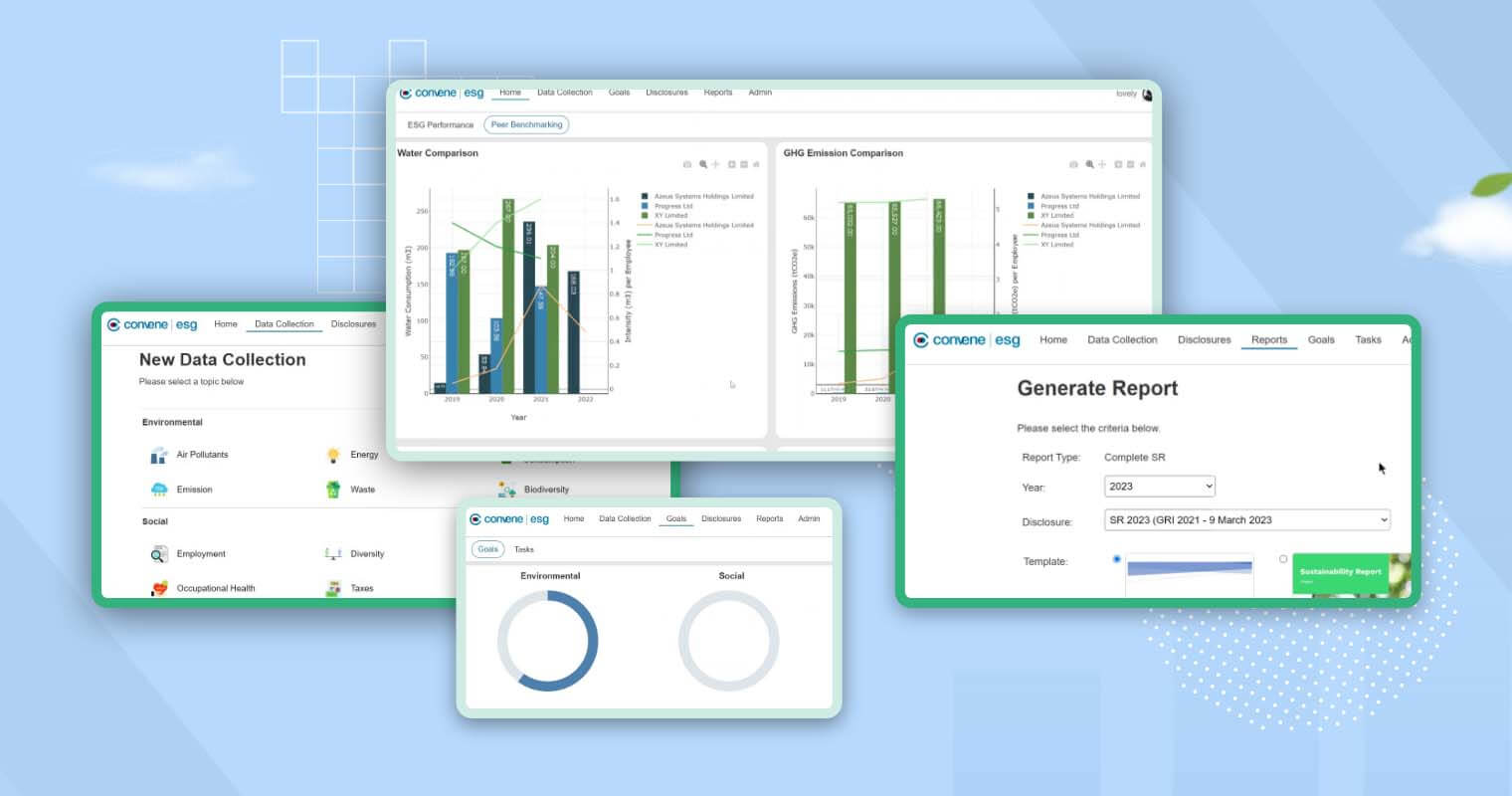

Singapore’s mandatory climate reporting initiative is a bold stride towards a more sustainable and resilient future. By integrating environmental considerations into business practices, companies can contribute to a greener economy. Businesses can utilise tools like Convene ESG to navigate this course effectively.

Convene ESG is a reliable ESG reporting software that simplifies data management from collection to analysis and stores them in one centralised space to ensure accuracy. Because it streamlines the entire process, the tool allows for easier report generation, eliminating tedious manual work. There is also an option to use pre-built and customisable templates for qualitative inputs, all of which follow local provisions such as SGX and 27 Core Metrics, and global frameworks including GRI, ISSB, and TCFD.

Among other features, Convene ESG offers expert insights through consultations, assurance, and integrations, guaranteeing full compliance with the ever-evolving requirements.

Learn how Convene ESG can future-proof your ESG reporting journey by booking a demo with us today.

Jess is a Content Marketing Writer at Convene who commits herself to creating relevant, easy-to-digest, and SEO-friendly content. Before writing articles on governance and board management, she worked as a creative copywriter for a paint company, where she developed a keen eye for detail and a passion for making complex information accessible and enjoyable for readers. In her free time, she’s absorbed in the most random things. Her recent obsession is watching gardening videos for hours and dreaming of someday having her own kitchen garden.