Achieving net-zero emissions by 2050 and limiting the rise in the global average temperature have become critical priorities for directors and boards. Ergo, climate change is now getting its way to the top of the boardroom agenda, calling directors to assess risks and devise schemes to address the issue. Open discussions were held among businesses, investors, government, and other stakeholders to align policy settings and strategies.

As long-term advocates of a sustainable future for Australian organisations, the Australian Institute of Company Directors (AICD) recognises the need to support directors in driving their organisations toward net-zero. Through the Climate Governance Initiative (CGI) Australia, AICD has offered tailored resources and events to support Australian boards in this area of modern governance.

In collaboration with Pollination, AICD released a joint publication of the Climate Governance Study 2024, surveying 1,057 AICD members on their perspectives and actions on climate governance. Explore the findings and implications of the study in the following sections.

Key Findings from the Climate Governance Study 2024

The 2024 Climate Governance Study builds on the insights from the inaugural 2021 study, highlighting the ongoing efforts to lift climate capability, establish clear policies on climate governance, and invest in climate resilience.

1. Australian directors continue to prioritise climate governance

In the face of geopolitical and economic challenges, climate change remains one of the most critical issues on the board’s agenda. Out of all the participants in the study, 80 per cent of directors expressed concern about climate change as a material risk. Specific climate-related risks that pose the highest concerns include:

- policy changes,

- physical climate impact,

- regulatory or political uncertainty,

- and increased insurance costs or lack of insurance availability.

Despite the concern about climate risks, 70% of directors also see opportunities in the transition to a net-zero economy. Directors from both listed and unlisted entities anticipate benefits such as enhanced brand recognition and reputation, product innovation, and positive environmental impacts.

Additionally, with the growing prioritisation of climate governance comes the emerging focus on nature and biodiversity. Half of the directors surveyed consider nature and biodiversity to be material financial risks to businesses due to the maturity of nature reporting and extensive environmental management requirements. The finalisation of the Taskforce for Nature-related Financial Disclosures (TNFD) framework may lead to mandatory reporting, adding complexity to the reporting obligations for directors.

2. Moving from climate ambition to execution is a growing challenge

Notwithstanding the increasing focus on climate change, board activities don’t seem to align well. The findings present a mixed picture: while some climate-related board activities are being practised, others have been neglected. Notably, only 43 per cent of listed directors are on boards with climate targets and transition plans.

Some board activities that have positive developments include reporting on climate and sustainability metrics, board training, and board climate competence assessment. Conversely, the study showed a decline in activities such as embedding climate change in risk management frameworks and integrating climate risk metrics – a significant drop from the 2021 survey.

On a more positive note, 32% of the directors have reconsidered their organisational strategy to incorporate climate risk and opportunity. Some directors have shifted their focus from governance arrangements to implementing organisational responses. This involves ingraining climate commitments across the business rather than creating new commitments. Such findings suggest that boards are revisiting their views of board capability to meet stakeholder demands on climate governance.

3. Stakeholders are pulling in different directions

Stakeholder dynamics are a significant factor influencing climate action. While most companies reported decreased pressure from civil society (activist groups, media, and individuals) compared to the 2021 study, the listed and government sectors are experiencing heightened scrutiny from Australian regulators (from 37% to 53%).

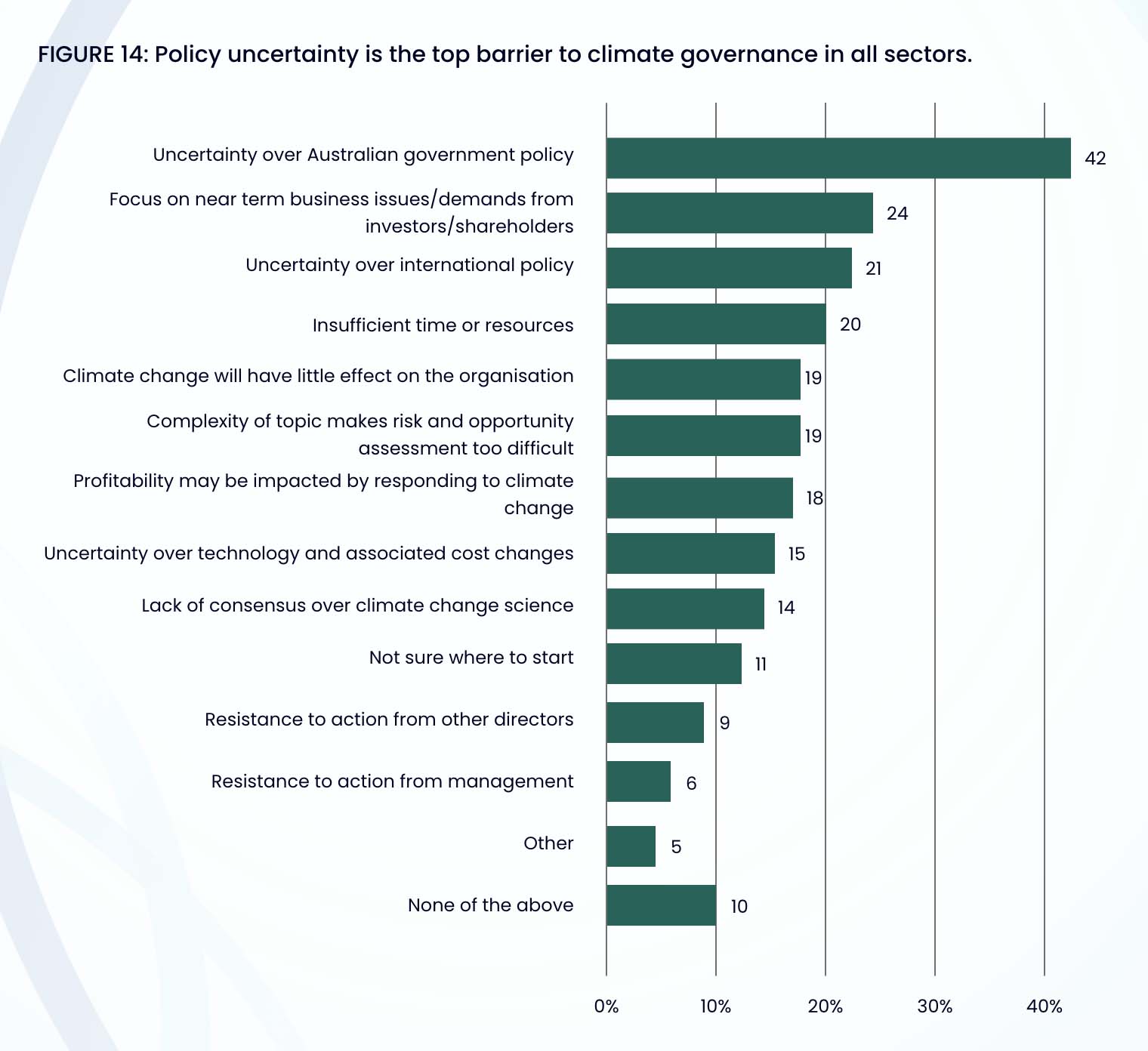

Directors also reported the challenge of striking the balance between the mixed expectations from stakeholders – immediate returns versus long-term sustainable value. 24 per cent of directors stated investor and shareholder demands as the biggest barrier next to policy uncertainty. Some directors also noted that due to shareholder expectations, sustainability becomes a second-order objective only once financial goals are met. The differing expectations raise a challenge for directors to commit to supporting the transition to net-zero initiatives, even when investment may affect short-term financial results.

4. Policy and regulation act as both a driver and drag on transition plans

While regulatory pressure is the main driver of climate action for many boards, 42% of directors cited uncertainty over Australian climate change policy as the biggest barrier to effective climate governance. The lack of clear policies and regulations insinuates risks for misalignment in transition decision-making and long-term investments.

With Australia’s forthcoming mandatory climate reporting, 72 per cent of the directors expressed feeling ‘well’ or ‘somewhat’ prepared for the heightened requirements. They emphasised that the complex quantitative climate data requirements, assessment of climate-related risks, and application of methodologies would prompt better board focus and engagement towards climate governance.

However, the increasing reporting requirements may also lead to ambitious climate targets and potential greenwashing risks. Directors noted that the absence of reasonable assurance could result in unqualified signoffs on disclosures, particularly regarding forward-looking or aspirational statements. This calls on Australian directors to keep climate-related disclosures verified, balanced, and accountable.

5. Board approaches to climate change continue to evolve

Boards are becoming increasingly engaged with climate change issues, driven by both physical and regulatory risks. In the 2024 study, more directors reported to have undertaken training on climate governance issues, from 18 per cent in 2021 to 26 per cent. Building director capability through training and upskilling is pronounced particularly for listed companies that are regulated by climate disclosure standards.

However, contrary to the growing capability development, only 45 per cent of surveyed directors believe their board has the adequate skills and experience to address organisational climate issues. This lack of confidence may be attributed to the complexity of new regulations and heightened scrutiny from stakeholders.

On top of director capability, integrating climate into board committees remains a vital approach to climate governance. However, 58 per cent indicated not having a board committee for sustainability issues. Among those with a dedicated climate committee, Risk and ESG or Sustainability committees were equally used. Companies joining various committees to integrate sustainability reported deflecting organisational silos and incoordination. This connectivity is also seen to increase with the implementation of the new reporting requirements.

Leveraging ESG for Effective Climate Governance

Climate governance is evolving beyond sustainability issues, with boards increasingly focusing on ESG principles. What was once primarily a reputational concern is now recognized as a strategic and commercial imperative. This shift implies that material climate work is integrated across various governance structures – including Board, Audit and Risk Committee, Sustainability Committee, Remuneration Committee, and Operations Management – rather than being confined to a single committee.

The latest study suggests a deeper integration of ESG principles and sustainability within corporate governance structures. Aside from climate change, nature and biodiversity are also gaining prominence on board agendas. This trend calls for companies to embed climate change and ESG considerations into the company’s strategy, risk management, and governance structures, and to develop climate transition plans and policies at an organisational level.

Furthermore, the fast-moving changes in regulations and policies greatly influence such a shift of focus. With the recent draft legislation on mandatory climate-related reporting, boards are pivoting towards better ESG oversight and reporting. Under the new requirements, large and medium-sized companies must report on material climate-related risks and opportunities, metrics and targets, and related governance processes. These disclosures are based on the International Sustainability Standards Board (ISSB)’s climate standard, and IFRS S2, which builds on the framework of the Taskforce for Climate-related Financial Disclosures (TCFD).

Australian companies must actively understand and comply with the evolving policy and regulatory changes, as well as explore assurance options to provide confidence in their sustainability and ESG reporting. Moreover, directors should be able to work towards ESG and climate governance to remain relevant and competitive rather than for compliance’s sake.

Effective ESG reporting and strategy development are as challenging as other corporate governance aspects. With heightened stakeholder scrutiny and an intensified focus on climate governance, boards need to have well-crafted ESG performance plans and reports on their agendas.

To enhance your ESG governance, digital board tools can be invaluable partners. Convene ESG, the top-tier ESG reporting software, streamlines the reporting process to ensure accurate climate-related and sustainability disclosures compliant with Australian regulations and sustainability frameworks.

Convene ESG offers a pool of ESG reporting features to achieve your climate objectives while guaranteeing regulatory compliance, including:

- Automated ESG data and report workflows — Simplify data collection, risk assessments, and report generation.

- ESG dashboards — Gain full visibility and oversight of the reporting process, goals progress, and internal reviews in a single space.

- Flexible reporting templates — Customise ESG reports to meet mandatory requirements and frameworks, with best-practice recommendations from our team of ESG experts.

Chart a sustainable path towards ESG and climate governance with Convene ESG. Talk to us today to have a walkthrough of our solution and take the first step towards streamlined and effective ESG reporting!