With more consumers and stakeholders prioritising sustainability for their purchase behaviours, ESG reporting and compliance are no longer optional for most organisations. Companies are now expected to report on their environmental, social, and governance initiatives, as ESG undoubtedly has become a competitive differentiator.

Despite its growing importance, ESG reporting is still not a cakewalk. Most organisations struggle to identify which information is relevant for their stakeholders. This is unfortunate because, after all, the value of a report lies in its clarity, comprehension, and relevance.

Thankfully, tools and frameworks are available to help navigate this issue. Materiality matrices can help determine which issues matter most to stakeholders and have the greatest impact on operations. This guide breaks down what a materiality matrix is, how to build one, and why it plays a crucial role in ESG reporting.

What is a materiality matrix?

Before broaching the topic of assessments and matrices, it is important to define what materiality is. Materiality refers to the relevance of the information in influencing stakeholders’ decisions. In terms of ESG, materiality refers to the key environmental, social, and governance issues that an organisation should prioritise.

There are different approaches to materiality, including financial materiality, which focuses on ESG factors that impact a company’s financial performance, and impact materiality, which considers the organisation’s effect on society and the environment. Double materiality, a concept gaining traction in global ESG reporting standards, incorporates both perspectives. It assesses not only how ESG factors affect the company but also how the company’s operations influence the wider world.

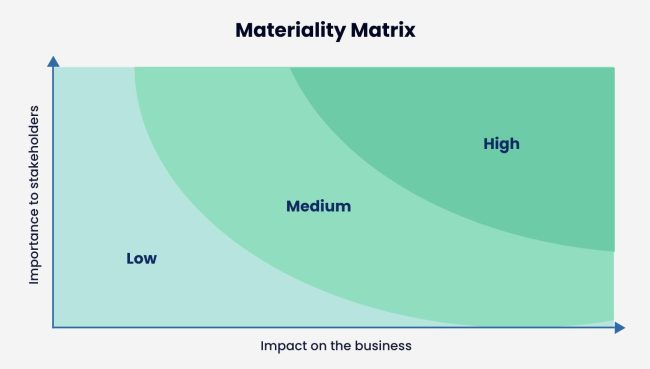

That said, a materiality matrix is a visual tool that presents the findings of a materiality assessment. It maps ESG topics on a two-axis chart, illustrating their importance to stakeholders (Y-axis) and their impact on business success (X-axis).

Materiality Matrix vs. Materiality Assessment

While the terms materiality matrix and materiality assessment are closely related, they refer to distinct aspects of the materiality analysis process.

A materiality assessment is the process of identifying and evaluating ESG materiality issues that are most relevant to a company and its stakeholders. It involves gathering input from internal and external stakeholders, analysing industry trends, and assessing regulatory requirements. This materiality process helps organisations determine which ESG factors have the greatest impact on their business operations and long-term strategy.

Essentially, a materiality matrix is the visual outcome of a materiality assessment.

Once an organisation identifies key ESG issues, these factors are plotted on a two-axis chart to illustrate their significance to stakeholders and their impact on business success.

By plotting ESG issues on a matrix, companies can categorise them into different priority levels. Issues that rank high on both axes demand immediate attention, while those with lower rankings may still require monitoring but are not considered pressing concerns. The matrix provides a structured way to communicate sustainability priorities to leadership teams, investors, and regulatory bodies.

Why are materiality matrices and assessments important?

Building a well-structured materiality matrix is a good, solid step to take a business from a traditional framework to a sustainable operational model. Aside from creating a foundation for ESG efforts and reporting, several other benefits come with materiality assessments and matrices:

Sharper ESG Focus

A materiality matrix and assessment offer comprehensive visibility into the ESG goals of an organisation. By pinpointing the most relevant issues, companies can allocate resources more effectively and focus on initiatives that drive meaningful impact. They can streamline their efforts and ensure that sustainability projects align with both corporate strategy and stakeholder expectations. This targeted approach not only enhances ESG performance but also prevents wasted investments in initiatives with minimal business or stakeholder relevance.

Stronger Stakeholder Trust

Investors, customers, employees, and regulatory bodies increasingly demand transparency and accountability in ESG efforts. A materiality matrix provides a clear, structured approach to identifying and addressing corporate sustainability concerns, demonstrating that a company is proactive in managing ESG issues. By aligning corporate priorities with stakeholder materiality, organisations can build stronger relationships, enhance credibility, and foster long-term trust. This, in turn, can lead to increased investor confidence, improved brand reputation, and greater customer loyalty.

Regulatory Alignment

Even with its current importance, ESG is still in its relative infancy. ESG regulations and reporting requirements are still constantly evolving. Despite all the changes, companies must ensure that their sustainability disclosures remain compliant with global standards. Many ESG frameworks, including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Corporate Sustainability Reporting Directive (CSRD), require businesses to disclose material ESG issues. A materiality matrix simplifies compliance by clearly illustrating how a company’s ESG priorities align with these frameworks.

Risk & Opportunity Management

A well-developed ESG materiality matrix is a valuable tool for identifying both risks and opportunities within the ESG landscape. It highlights potential ESG-related risks, such as climate change vulnerabilities, regulatory non-compliance, supply chain disruptions, and human rights concerns. At the same time, it helps organisations uncover opportunities for sustainability-driven innovation, cost savings, and competitive differentiation.

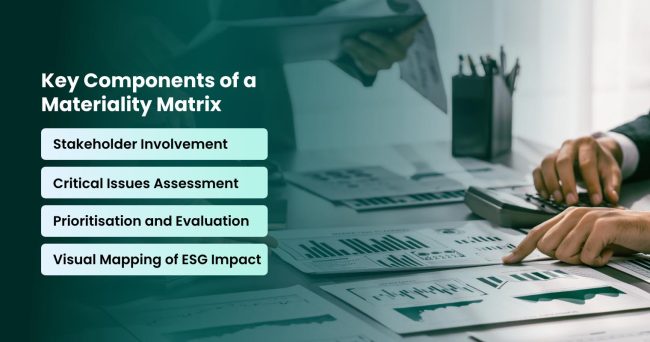

Key Components of a Materiality Matrix

Stakeholder Involvement

Stakeholders — from investors to employees — play a critical role in defining ESG materiality priorities. After all, the materiality matrix should reflect the priorities of the stakeholders that influence and are influenced by the organisation.

Engaging with key players can come in different forms, including surveys, interviews, and focus groups, to gauge which issues are most pressing. It is important to remember that in communicating with these decision-makers, each group may have different ESG concerns, so gathering a broad range of insights ensures that the matrix accurately reflects business realities and external expectationsCritical Issues Assessment

Identifying relevant ESG issues requires assessing industry trends, competitor benchmarks, and sustainability reporting standards. Common topics include:

- Environmental: Carbon emissions, resource efficiency, biodiversity impact

- Social: Employee well-being, human rights, diversity, and inclusion

- Governance: Ethical business practices, transparency, board diversityBusinesses must ensure that the ESG issues selected align with both regulatory requirements and long-term sustainability objectives.

Prioritisation and Evaluation

Once ESG issues are identified, companies must evaluate their significance using criteria such as:

- Financial and operational impact: How does this issue affect revenue, costs, and efficiency?

- Reputational and brand risk: Could this issue damage the company’s public image?

- Regulatory and legal obligations: Are there current or upcoming regulations addressing this issue?

- Long-term sustainability trends: Will this issue grow in importance over time?

Visual Mapping of ESG Impact

Materiality matrices typically use a scatter plot or heatmap to highlight key ESG concerns. These concerns are mapped across two axes: the X-axis (horizontal) represents the impact of an issue on the organisation’s business success or operations, while the Y-axis (vertical) reflects the level of concern or importance the issue holds for stakeholders. The most critical issues — those with both high business impact and high stakeholder concern — appear in the upper-right quadrant, while lower-priority items are placed elsewhere. Regardless of the visual format used, the matrix should be clear and effectively communicated.

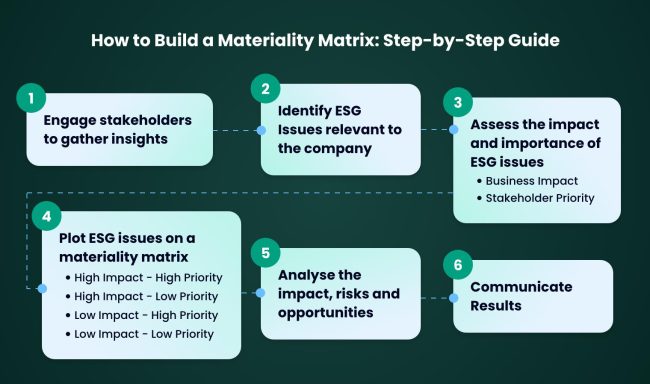

How to Build a Materiality Matrix: Step-by-Step Guide

The process of building a materiality matrix may differ from organisation to organisation, but there are a few general steps to follow:

1. Engage stakeholders to gather insights

To ensure the matrix reflects a broad range of concerns, it is crucial to engage both internal and external stakeholders. This group can include executives, employees, investors, customers, suppliers, and local communities. Collecting feedback from these groups ensures that the assessment made reflects the priorities and perspectives of the key players.

2. Identify ESG Issues relevant to the company

After engaging stakeholders, research and identify the key ESG issues that could impact your business, as well as those that matter most to your stakeholders. Review industry benchmarks and sustainability standards (e.g., GRI, SASB, TCFD) to help determine which issues are most relevant for your business and sector. Explore ESG trends, regulations, and the best practices of your industry, and be sure to consider upcoming challenges, such as climate change regulations or changes in social expectations, that may affect the business in the near future.

3. Assess the impact and importance of ESG issues

To determine the relative importance of each ESG issue, assess its potential business impact and the priority of stakeholders. Rank each issue by considering both:

- Business Impact: Evaluate how significant each issue is to your company’s financial performance, reputation, operations, or legal compliance.

- Stakeholder Priority: Assess the level of importance stakeholders place on each issue, based on the feedback gathered.

This ranking helps you understand which ESG factors have the greatest impact on your business and which ones are most pressing for those you engage with.

4. Plot ESG issues on a materiality matrix

Next, plot the ESG issues on the materiality matrix. Typically, the X-axis represents stakeholder priority, while the Y-axis reflects business impact. The matrix helps visualise where each issue stands in relation to the other:

- High Impact/High Priority: Issues that are both critical to business success and highly prioritised by stakeholders. These should be your top focus areas.

- High Impact/Low Priority: Issues that could significantly affect the business but are less prioritised by stakeholders. These may require monitoring or action to address potential risks.

- Low Impact/High Priority: Issues that stakeholders care about but have less direct impact on the company. These may require communication and engagement but may not need immediate action.

- Low Impact/Low Priority: Issues that have little business impact and are less important to stakeholders. These may be of lower focus unless circumstances change.

5. Analyse the impact, risks and opportunities

Before finalising the materiality matrix, conduct a thorough internal review to ensure it accurately reflects the organisation’s priorities and strategic direction. Double-check with key internal stakeholders whether the identified ESG issues align with business objectives and expectations. Seek input from governance, legal, and sustainability experts to validate the rankings and ensure the assessment is both comprehensive and credible. This internal validation process helps refine the matrix before it is shared which ensures it serves as a reliable foundation for ESG strategy and reporting.

6. Communicate Results

Once validated, share the results of the materiality matrix with both internal and external stakeholders. This helps demonstrate transparency and reinforces the company’s commitment to ESG priorities. Include the materiality matrix in annual sustainability or ESG reports, showing how the company plans to address key issues. Regularly update the materiality matrix as new issues arise or existing priorities change. This ensures the assessment remains relevant over time.

How Different ESG Frameworks Use Materiality Matrices

Different ESG frameworks, such as GRI, SASB, and CSRD use materiality matrices to address varying stakeholder concerns and regulatory demands. These matrices differ in their focus areas and the methodology used to evaluate and rank ESG issues:

GRI (Global Reporting Initiative)

GRI is one of the most widely recognised ESG reporting standards. Its materiality matrix emphasises a broader stakeholder approach that places significant importance on engaging both internal and external stakeholders in identifying material issues. GRI encourages companies to disclose not only those ESG issues that affect their operations but also those that are of significant concern to their stakeholders.

SASB (Sustainability Accounting Standards Board)

SASB focuses primarily on financially material ESG issues that are most relevant to investors and the financial community. The SASB framework is designed to help businesses disclose sustainability information that directly impacts financial performance and investment decisions. As such, its materiality matrix prioritises ESG topics that significantly affect the company’s ability to generate long-term shareholder value.

A SASB materiality matrix generally prioritises issues such as climate-related risks, labour practices, water management, and corporate governance, all of which can directly impact a company’s financial health. The matrix is structured to identify industry-specific risks and is based on financial materiality rather than stakeholder priorities.

CSRD (Corporate Sustainability Reporting Directive)

CSRD, part of the European Union’s broader effort to improve ESG reporting, introduced the concept of double materiality. Under the CSRD framework, companies are required to evaluate ESG issues from two perspectives: financial materiality (how ESG factors affect financial performance) and impact materiality (how the company’s operations and activities affect the environment and society).

The CSRD framework’s matrix allows companies to assess and disclose ESG topics such as greenhouse gas emissions, labour rights, social inclusion, and diversity, clearly understanding their impact on business performance and the broader world.

Ensuring Accurate Materiality Assessments with Convene ESG

A materiality matrix is a crucial tool for organisations navigating ESG reporting, enabling them to identify and prioritise the most significant environmental, social, and governance issues. It ensures that companies focus on what matters most, meeting regulatory standards and enhancing transparency.

Convene ESG is a comprehensive ESG software that helps organisations manage and analyse key ESG data with greater accuracy and efficiency. With automated data workflows, digital repositories, and advanced tracking features, our solution ensures that critical ESG information is accurate, up-to-date, and fully compliant. By consolidating data in one location and offering insights to streamline reporting, Convene ESG supports organisations in identifying and prioritising the ESG factors that matter most.

This ESG reporting software also supports robust stakeholder engagement, allowing you to capture diverse perspectives and monitor stakeholder concerns effectively. With fully customisable templates and real-time reporting, Convene ESG empowers organisations to create actionable insights that evolve alongside shifting regulatory requirements.

Book a demo today to see how Convene ESG can simplify your materiality assessment and optimise your ESG reporting process.