Navigating complex regulations, mitigating ever-present risks, to ensuring ethical operations — all are paramount to an organisation’s sustainable success. This is where Governance, Risk, and Compliance (GRC) comes in. While it’s not a fairly new framework, GRC continues to be a significant tool for building trust and resilience.

In this guide, we will explore the GRC meaning, its benefits, and how you can incorporate it into your ESG strategies.

What is GRC?

In general, GRC is the set of processes organisations use to manage their overall governance, enterprise risk management, and regulation compliance efforts. This operational strategy also enables organisations to align activities to business goals. The concept was originally introduced by the Open Compliance and Ethics Group (OCEG) in 2002, referring to the critical capabilities necessary to achieve “Principled Performance”.

GRC, which acts as a crucial operational strategy, is used to guide businesses in a risk-aware environment. It primarily aligns a company’s governance, risk, and compliance endeavours to its goals and objectives.

What are the core GRC principles?

GRC combines three critical principles in one coordinated model, helping companies achieve their goals in a sustainable, ethical manner. These include:

- Governance: A set of policies and frameworks evolving around the ethical management of an organisation. Good governance includes transparency and accountability, ethical conduct, equity and inclusiveness, and resource management.

- Risk Management: Involves identifying potential threats and vulnerabilities, such as security, financial, strategic, and legal risks. Risk management also includes strategies to assess the impact of such risks and implement controls to mitigate them.

- Compliance: The act of adhering to all relevant laws, regulations, and industry standards mandated by governing bodies. It also includes implementing processes to meet such requirements and align with internal corporate policies.

What is Principled Performance?

Developed by the OCEG, Principled Performance is a concept that acts as a guiding philosophy for ethical excellence. This concept represents the desired outcome achieved through the effective implementation of GRC practices. Its three pillars include:

- Principled Purpose, or setting a clear, ethical mission and values guiding all organisational actions.

- Principled People, refers to the leadership and employees with strong character who consistently work towards the principled purpose.

- Principled Pathway, means breaking down silos and leveraging all systems to ensure the organisation stays on track.

What is the GRC Capability Model?

The OCEG also provides an open-source standard to integrate the GRC disciplines into a unified approach, as well as achieve Principled Performance. This is called the GRC Capability Model, which includes four components:

- LEARN: Understand the organisation’s context and culture needed to inform goals and strategies.

- ALIGN: Bridge the gap between objectives and actions with effective decision-making.

- PERFORM: Implement necessary controls and processes, and promote ethical behaviour to achieve objectives.

- REVIEW: Assess and refine the GRC program for ongoing effectiveness.

What is a GRC framework?

A GRC framework is a structured model used to manage various aspects of governance, compliance, and risk. It involves policies for attaining company objectives. At its core, it aims to promote adherence to business best practices throughout daily operations. A GRC framework also facilitates preemptive risk mitigation, informed decision-making, and adherence to legal mandates.

Some examples of GRC frameworks that cater to specific industry needs are:

- Control Objectives for Service and Information Technology (COBIT) — Developed by the ISACA, COBIT focuses on information technology (IT) governance and management. The framework offers a comprehensive set of best practices and control objectives that organisations can utilise to manage IT risks effectively, comply with regulations, and ensure IT operations are aligned with business goals.

- COSO Enterprise Risk Management (ERM) Framework — Created by the Committee of Sponsoring Organisations of the Treadway Commission (COSO), this framework provides an extensive approach to enterprise risk management. It outlines a structured process for identifying, assessing, and monitoring risks across the entire organisation, not only IT-related risks.

Checklist for GRC Implementation: A Step-by-Step Guide

Implementing a successful GRC program requires careful planning and approach. Here’s a step-by-step guide on how to properly do it:

1. Define your GRC scope and objectives

The initial step is to analyse the current areas in the organisation linked to GRC. Such mechanisms may be siloed depending on how the company operates. These areas may include:

- ESG initiatives (e.g. sustainability practices, social responsibility)

- Legal and regulatory compliance

- Internal policies and procedures

- Operational risks (e.g. IT security, business continuity)

- Financial risks (e.g. fraud, market fluctuations)

- Strategic risks (e.g. M&A, competition)

- Corporate governance (e.g. board oversight, ethical conduct)

- Information security governance (e.g., data access controls, incident response)

- Project management governance

Also, make sure to define the objectives of your GRC implementation, which also aligns with the organisation’s goals.

2. Assemble your GRC team

Next is to build a dedicated internal team in charge of the GRC implementation. You can consider internal talent and offer them training opportunities to bridge skill gaps. Implement cross-departmental collaboration to foster a culture of risk awareness and compliance throughout the organisation. You can also consider recruiting external members for specific expertise you lack internally.

Make sure to also secure leadership buy-in so the program will have executive-level support and resources. Some key members are:

- Executive Leadership: Champions the GRC program, secures resources, and oversees program performance.

- Chief Risk Officer (CRO): Leads the risk management function, assesses risks, develops mitigation strategies, and monitors the risk landscape.

- Compliance Officers: Interprets and translates regulations, conducts compliance audits, and manages compliance training.

- Internal Audit Team: Independently reviews and evaluates the effectiveness of the GRC program, such as determining control weaknesses and areas for improvement.

- IT Department: Implements the GRC technology platform, maintains data security and access controls, and manages system integration.

- Business Unit Representatives: Contribute departmental risk knowledge, implement GRC processes within their department, and report on departmental GRC activities.

As for the skills and expertise of the team, you need members with the following:

- Understanding of regulatory frameworks and standards

- Familiarity with compliance practices and principles

- Expertise in risk management concepts and methodologies

- IT and cybersecurity knowledge (e.g. information security, data protection)

- Ethical and professional integrity

If you’re looking to hire an external GRC expert, opt for those who possess certifications such as:

- GRC Professional (GRCP) certification by OCEG

- Certified Information Systems Security Professional (CISSP) by (ISC)²

- Certified in Risk and Information Systems Control (CRISC) by ISACA

- Certified Information Systems Auditor (CISA) by ISACA

3. Select the ideal GRC tools

Choosing the right GRC management tools is vital to ensure a smooth implementation. A good one can streamline pain points in your GRC program, and allow you to focus on higher-level tasks. A few key factors to evaluate are:

- Scalability: Can the solution adapt to your organisation’s evolving needs?

- Functionality: Does it offer the necessary features to address your GRC objectives?

- Integration: Can it integrate seamlessly with your existing IT infrastructure?

- User-friendliness: Is the platform easy to learn and use for all stakeholders involved?

- Vendor support: Does the vendor offer reliable customer support and ongoing software updates?

In addition, the tools should support common GRC projects, including:

- Enterprise Risk Management (ERM): To identify, assess, and mitigate organisational risks.

- Compliance Management: To track regulations, generate reports, and manage compliance processes.

- Internal Audit Management: To streamline internal audit workflows, track remediation efforts, and manage audit findings.

- Incident Management: To facilitate efficient incident response, track investigations, and implement corrective actions.

- Policy Management: To create, centralise, and manage corporate policies and procedures effectively.

- Centralised Repository: To store and manage all GRC-related data in a single location for easy access and analysis.

4. Continuously monitor and improve

A GRC program is not a one-time implementation; it requires ongoing monitoring and improvement. In general, you should conduct:

- Test the program: Conduct periodic tests of the program’s controls and procedures through testing incident response protocols and simulating risk scenarios.

- Regular reporting: Generate reports to identify areas for improvement and track GRC metrics.

- Internal audits: Perform periodic audits to assess the effectiveness of the GRC program.

- User feedback: Get feedback from stakeholders to know which areas can be enhanced.

- Stay updated: Keep your GRC program up-to-date with evolving regulations and best practices.

Benefits of an Effective GRC Implementation

If done correctly, GRC can lead a company to success. Turning it into a strategic asset can unlock several benefits for any organisation. Some of these benefits are:

1. Enhanced efficiency and cost savings

A good GRC strategy demolishes the siloed operations of governance, risk, and compliance. It can even create a seamless workflow and eliminate duplicate efforts that lead to wasted time and money. Establishing a GRC framework can result in:

- Automated data collection and streamlined reporting that frees up employees’ time for analysis or strategic tasks, and also minimises the risk of missed deadlines and errors.

- Automated alerts for compliance deadlines to ensure timely filings and prevent penalties.

- Continuous monitoring of internal controls that allows for timely corrective actions and prevents potential financial losses due to control failures.

2. Stronger reputation and stakeholder trust

Modern businesses know that a strong reputation is paramount, particularly when consumers are increasingly discerning. Implementing an effective GRC framework demonstrates a commitment to ethical practices and responsible risk management. Hence, fostering trust with stakeholders, including:

- Investors — Reduced risk exposure translates to a more attractive investment proposition.

- Customers — Robust data security and ethical practices attract and retain loyal customers.

- Partners — Strong GRC also strengthens the foundation of credible business partnerships.

3. Improved decision-making and transparency

Another benefit GRC offers is a hub where risk data, compliance reports, and performance metrics are centralised. Therefore, empowering businesses to make informed decisions based on a holistic view and foster transparency. Data-driven insights extracted from a GRC framework can be utilised for:

- Strategic resource allocation, referring to prioritising resources towards mitigating high-impact risks.

- Proactive opportunity identification, including defining emerging markets and proactively addressing risks.

- Transparent data access, wherein department heads, project managers, and employees can access relevant data within their roles.

How to Align GRC Strategies with Your ESG Goals

Governance, the foundation of both GRC and ESG, establishes a framework for accountability and transparency within an organisation. It defines ethical behaviour, ensures resources are used responsibly, and sets the overall direction for the organisation.

By leveraging the strong governance principles within GRC, you can effectively integrate ESG considerations into your operations. Here’s how you can achieve this:

1. Assess current GRC and ESG processes

Before anything else, it’s important to conduct a thorough review of existing GRC frameworks. These may include internal controls, risk management protocols, and compliance procedures. Then, evaluate ESG strategy by examining your current sustainability initiatives and reporting mechanisms. Determining these can help you identify synergies between GRC and ESG goals.

2. Integrate ESG criteria into risk assessment processes

The next step is to enhance your risk assessment methodologies by incorporating relevant ESG metrics. Some ESG aspects to consider are climate change impact, labour practices and community relations, and board diversity and transparency. For proactive risk management, you can use a scenario analysis to model potential ESG risks and their financial implications.

3. Align compliance efforts with ESG standards

Last but not least, tailor your GRC program to address ESG-related regulations and reporting requirements. Ideally, pertinent to your company’s industry and geographic location. Collaborate with industry peers, sustainability experts, or even regulatory bodies to ensure compliance with evolving ESG guidelines.

While meeting legal requirements is critical, look for opportunities to exceed compliance minimums. Identify relevant ESG frameworks (e.g. GRI Standards) and incorporate their best practices into your compliance programs. This ensures your GRC program is also tailored to address high-priority ESG risks.

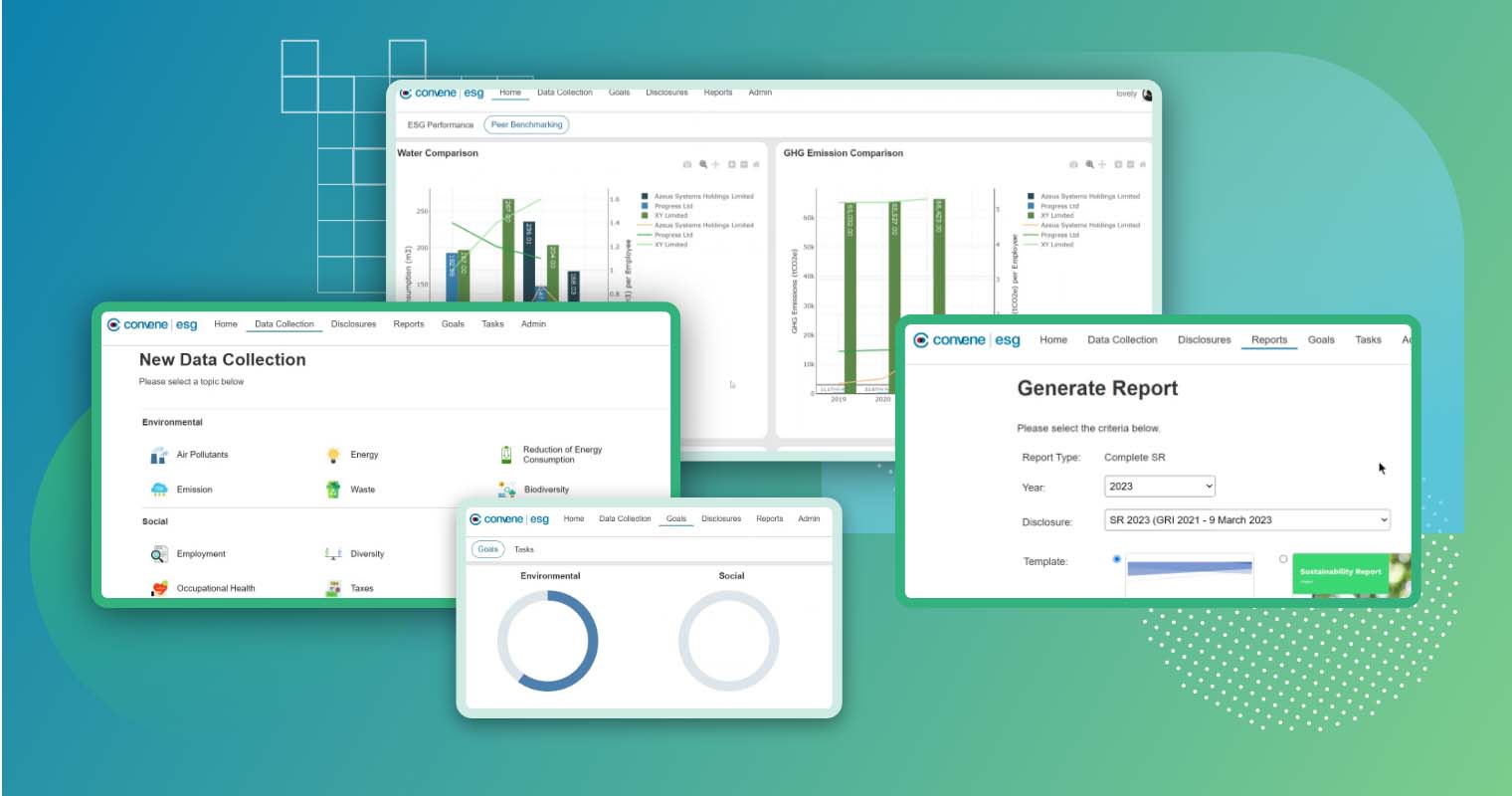

Convene ESG: Seamlessly Integrate Your ESG Reporting With Your GRC Program

While managing a GRC program is essential for good governance, integrating ESG initiatives can add another layer of complexity. Our ESG reporting software, Convene ESG, is designed to streamline the implementation of your ESG strategy, and seamlessly integrate it with your existing GRC program.

Convene ESG offers a suite of features to achieve sustainability goals while maintaining compliance practices. Find out below how our reporting software can help integrate ESG with your existing GRC program:

- Centralised data management: Eliminate data silos and have data risks (e.g. environmental or governance) in a single repository.

- Automated workflows: Streamline your risk assessments, data collection, and reporting with Convene ESG.

- Enhanced reporting and transparency: Easily generate comprehensive sustainability reports encompassing both GRC and ESG performance metrics.

Bridge the gap between ESG and GRC with Convene ESG. Talk to our team and request a demo now!