Over the past two years, Singapore has been introducing new regulations that guide companies in managing the welfare of boards and shareholders for annual general meetings to facilitate businesses and organisations in making alternative arrangements in light of safe distancing measures brought about by the COVID-19 pandemic.

This article will tackle the implications of the guidelines on AGMs set by the Monetary Authority of Singapore (MAS) the Accounting and Corporate Regulatory Authority (ACRA), and the Singapore Stock Exchange (SGX) on boards and shareholders.

Authorities Regulating Annual General Meetings

In regulating annual general meetings of listed companies, MAS, ACRA, and SGX have set policies and practice guidance for companies on the conduct of annual general meetings for SGX issuers. ACRA’s enforcement of the statutory obligations of directors, as stated in the Companies Act, focuses on holding AGMs and filing annual returns. MAS, on the other hand, has created the Practice Guidance to complement the Companies Act in conducting AGMs. SGX has established guidance in conducting annual general meetings amid the COVID-19 pandemic. By adopting both the statutory obligations and the Practice Guidance, best practices in annual general meetings can be set and achieved.

The next section talks about the annual general meeting guidelines and their implications on the boards and shareholders. We also discuss the best practices in conducting physical, virtual, or hybrid AGMs based on MAS’s, ACRA’s, and SGX’s guidelines.

On Holding Annual General Meetings

Listed companies in Singapore must conduct their AGMs 4 months after the financial year end (FYE), whereas other companies need to hold their AGMs 6 months after FYE.

Failure to comply with the policies may result in penalties. Company directors may compound by paying a composition sum per breach. But for instances that ACRA does not impose a composition sum, or the directors did not accept the composition offer, directors will then be summoned to be prosecuted in court. Once convicted for an offence, the company or directors will be fined up to $5,000 per charge.

On Remuneration Report and Annual Returns

Apart from the usual information included in the director’s reports, MAS is strongly encouraging board members to have a commentary on the company’s risk management, financial statements, and internal audit functions. They need to review, at least annually, the effectiveness of the actions of the company.

ACRA, in parallel, has been strictly implementing Section 197 of the Companies Act which states that listed companies are mandated to file Annual Returns (AR) within a month after the AGM. Companies that will fail to comply with lodging annual returns are subject to criminal liability. ACRA issues summons against the company and imposes a fee as a penalty for late lodgement that amounts to $300 per breach.

Read more about holding annual general meetings in this article and learn about the meeting flow and requirements in AGMs.

On Shareholder Rights and Engagement

In upholding the rights and involvement of shareholders in annual general meetings, MAS is encouraging companies to consider other AGM avenues, such as town hall meetings and webcasting meetings. While virtual meetings are not leaving the AGM picture soon, companies are now slowly adopting the hybrid setup, a blend of physical and virtual engagement and best practices in general meetings.

Annual General Meetings in Hybrid Setup

Hybrid AGM is considered to be the ‘best of both physical and virtual setups’ in conducting annual general meetings as it allows for the implementation of governance best practices in physical meetings and the flexibility of virtual setups. Listed companies who may opt for this kind of setup need to consider catering to both shareholders joining in-person and remotely.

The physical component in hybrid AGMs is similar to how in-person meetings are usually held pre-pandemic, however subject to headcount and health safety measures. Companies must consider procedures for in-person attendance, social distancing, and logistical arrangements. On-site protocols, such as registration counters and temperature scanners, should also be in place. For instance, registration can be done contactless through administering QR codes for user scanning after verification of identities at the registration counters. Most importantly, a good venue must be selected based on best practice criteria to support the hybrid format. Otherwise, additional costs may be incurred.

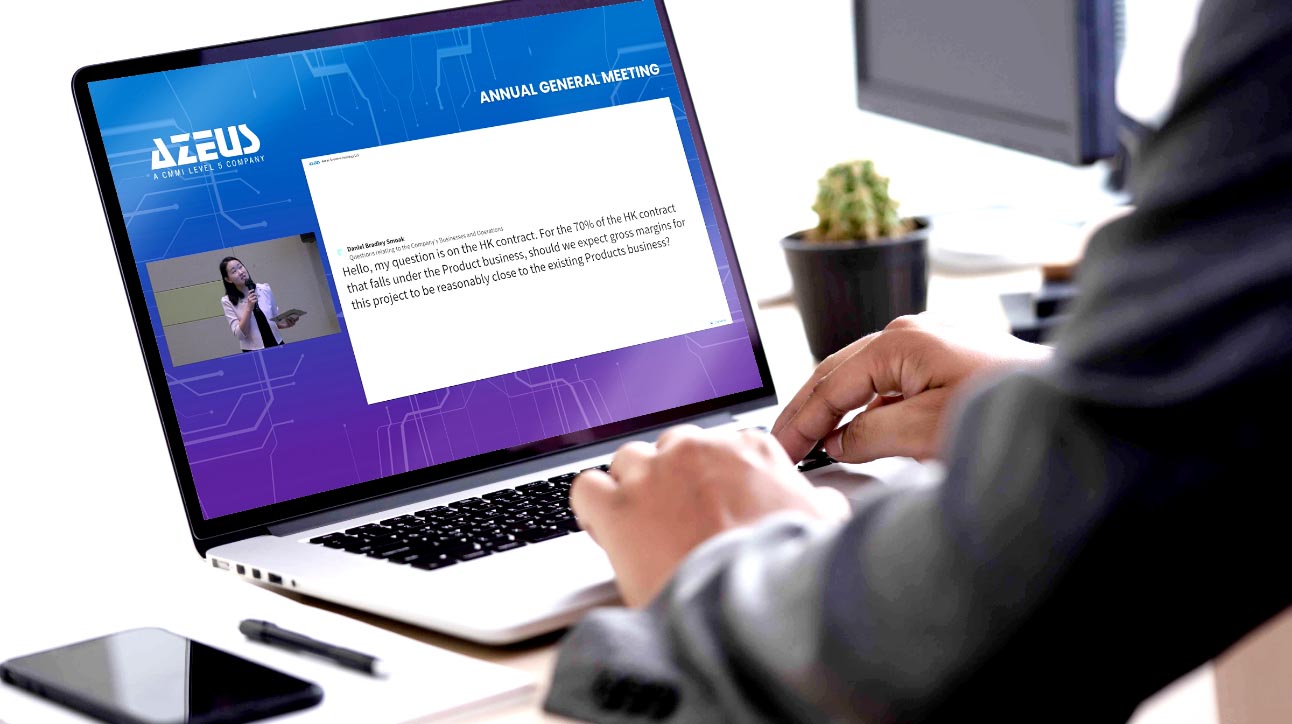

Companies conducting hybrid AGMs are expected to invest in a platform that can support virtual AGMs broadcast in real-time. Providing an avenue for shareholders, even those who joined remotely, to interact live with the Chairman and board directors in the physical venue would signal the board’s initiative to accommodate the preferences of shareholders in attending onsite or online.

One of the concerns hybrid AGMs must address is fairness and equality for both the physical and virtual audiences. Boards must ensure that the same information and capabilities are available for all shareholders — opening a larger space for information and engagement. ConveneAGM is an end-to-end AGM solution that provides compliant and interactive features, such as real-time webcast, live voting, and live Q&A. Globally and in Singapore, ConveneAGM is the only provider in the market offering sub-second latency, ensuring that the presentation of reports are concurrent with minimal delay and facilitating healthy discussions between the company’s management team and their shareholders.

Live Voting

In fostering a coherent annual general meeting, MAS also guides boards to make resolutions not inter-conditional with each other. This will allow a better understanding of each resolution that will be translated to informed voting. The board of directors must supply correct and enough information to shareholders for them to vote with premises. To ensure that shareholders may express their views on every part of the AGM, companies must be able to facilitate a process for discussion on every resolution or agenda item.

SGX and MAS have set guidelines for listed companies and their option to conduct real-time electronic voting in hybrid AGMs. In fact, MAS’ Corporate Governance Advisory Committee (CGAC) expects Singapore companies to explore and implement live remote voting to replicate the interaction of in-person meetings for remote participants. It is necessary to facilitate robust shareholder participation akin to physical meetings. Since voting has been the essential channel for shareholders and boards to uphold transparency and accountability, an electronic voting system should be capable of carrying out votes both from the physical and remote attendees. Moreover, it should accurately validate and count votes submitted by all the shareholders.

The live voting feature of the AGM solution must allow for transparent voting. Once resolutions have been laid out, shareholders can vote on all resolutions. ConveneAGM allows shareholders to change their votes within a slated voting period after considering the company’s responses. Once votes are finalised, the results are instantly tabulated and shown to the shareholders in the system.

Live Q&A

The annual general meeting, whether conducted in virtual or hybrid format, must be able to value its essence — an open and transparent two-way discussion of boards and shareholders about the company matters, resolutions, and decisions. Allowing live questions in hybrid AGMs brings spontaneity, and mimics the engagement and governance in physical meetings.

A digital AGM solution helps in facilitating constructive dialogues among shareholders, board directors, and management using its live Q&A function. ConveneAGM offers two setups for shareholders to ask questions — either through textual questions or video calls.

For larger companies, questions from shareholders may come in batches of tens or hundreds of questions. That is why the best practice is to assign a moderator who will manage the flow and number of questions for the board. The moderator can filter the questions coming in via text by setting question types. For instance, a shareholder can ask a question about a specific resolution only. Moreover, the moderator can also answer textual questions by replying to the query of the shareholder. Video questions are also welcomed wherein the moderator can queue in shareholders to join the webcast of the panellists or the board. In facilitating live discussion, ConveneAGM is implementing the best practice of preoccupying one person at a time for better communication.

SGX has also made it a requirement for companies to hold a virtual information session (VIS) for certain corporate actions, so that the board and management can take live questions from shareholders before they vote or submit their proxy forms. This is akin to a physical general meeting where the Q&A session occurs prior to voting. Aside from that, there are additional prescriptions on the timeline to post answers to SGXNet on the questions they receive before the deadline (48-72 hours prior, depending on the notice period) for shareholders to submit their proxy votes to ensure that shareholders can sufficiently review the answers before making a decision.

Separately, companies must also provide means for investor relations contact, which MAS specify as online submission forms, contact number, or email address which shareholders can reach the companies with — enabling them to ask questions and receive responses promptly. MAS is highly encouraging companies who will hold virtual AGMs to utilise a virtual event platform that can cater to no-delay and organised discussions.

Read: Ensuring Shareholder Engagement in Virtual AGMs

ConveneAGM is a seamless digital AGM solution that can help Singapore companies and organisations adhere to the guidelines set by the Monetary Authority of Singapore, the Accounting and Corporate Regulatory Authority, and the Singapore Stock Exchange. It provides features for meetings that comply with the authorities while embodying the best practices for AGMs — Singpass integration, live webcast, live Q&A, live voting, third-party proxy and many more.

Are you preparing for your next annual general meeting? ConveneAGM is currently the only provider in Singapore that have successfully helped SGX issuers with live Q&A (video/textual) and live voting in a hybrid or virtual format. Talk to us today.

Nina is a Digital Marketing Manager of the global marketing team at Convene. She has profound knowledge of the growing trends within the board management software market. With her ample experience in marketing and corporate solutions, she authors in-depth articles that teach companies about the features and benefits of board portals.